Your Greatest Advantage as an Investor in 2020: FOCUS

For this week’s post, I decided to talk to the camera. Be sure to watch if you haven’t here.…

Read moreFor this week’s post, I decided to talk to the camera. Be sure to watch if you haven’t here.…

Read moreTo Focused Compounding Members,

I hope everyone had a great holiday! Let me start by saying I am not one for New Year’s resolutions. I genuinely believe you should start today instead of tomorrow – and that an arbitrary date should not dictate when you should work to become the better version of yourself.

That said, one of the things I wanted Geoff and myself to do before the new year was to write down 5 goals that we would be proud of if we accomplish by this time next year. We had professional and personal goals. I decided on 5 because this was right out of Warren Buffett’s 5/25 strategy for focus. You can learn about that below from James Clear’s blog post below. (Hopefully James won’t mind me stealing his story if I link to his great book, Atomic Habits: https://www.amazon.com/Atomic-Habits-Proven-Build-Break/dp/0735211299/ref=tmm_hrd_swatch_0?_encoding=UTF8&qid=1578004386&sr=8-1

/

https://jamesclear.com/buffett-focus

“The Story of Mike Flint

Mike Flint was Buffett’s personal airplane pilot for 10 years. (Flint has also flown four US Presidents, so I think we can safely say he is good at his job.) According to Flint, he was talking about his career priorities with Buffett when his boss asked the pilot to go through a 3-step exercise.

Here’s how it works…

STEP 1: Buffett started by asking Flint to write down his top 25 career goals. So, Flint took some time and wrote them down. (Note: you could also complete this exercise with goals for a shorter timeline. For example, write down the top 25 things you want to accomplish this week.)

STEP 2: Then, Buffett asked Flint to review his list and circle his top 5 goals. Again, Flint took some time, made his way through the list, and eventually decided on his 5 most important goals.

Note: If you’re following along at home, pause right now and do these first two steps before moving on to Step 3.

STEP 3: At this point, Flint had two lists. The 5 items he had circled were List A and the 20 items he had not circled were List B.

Flint confirmed that he would start working on his top 5 goals right away. And that’s when Buffett asked him about the second list, “And what about the ones you didn’t circle?”

Flint replied, “Well, the top 5 are my primary focus, but the other 20 come in a close second. They are still important so I’ll work on those intermittently as I see fit. They are not as urgent, but I still plan to give them a dedicated effort.”

To which Buffett replied, “No. You’ve got it wrong, Mike. Everything you didn’t circle just became your Avoid-At-All-Cost list. No matter what, these things get no attention from you until you’ve succeeded with your top 5.”

/

One of my goals for 2020 is to write a lot more. To quantify this, I’m committing to one post a …

Read more

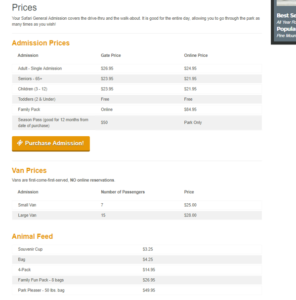

Parks! America

Price: $0.14

Shares: 74.8m

MC: $10.4m

Cash: $3.2m

Debt: $2.4m

EV: $9.6m

Geoff and I use a checklist that we go through before investing in any company. Let’s go over it here before jumping into the actual business.

Boxes that need to be checked for us to invest:

One of the first initial checklist items we do is look at a long-term stock chart to see how the business has performed over time. We want to roll with the tide.

Compound Annual Returns

YTD: -12%

1 Yr: -11.95%

2 Yr: +18%

3 Yr: +40%

4 Yr: 46%

5 Yr: 47%

6 Yr: 29%

Current

P/E: 8x

EV/EBIT: 6x

FCF Yield: 15%

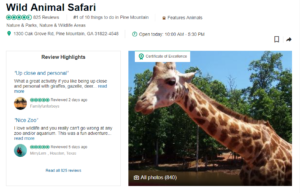

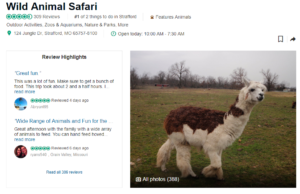

Parks! America is the perfect example of a stock that is overlooked and operates in a niche market. Since 1991, the business has owned and operated drive and walk through wild animal safaris. Combined, the company owns two parks – one in Pine Mountain, Georgia and the other in Stafford, Missouri. The Missouri park was acquired in 2008. Both parks are named Wild Animal Safari. Here are a few videos to get a visual tour from people who have vlogged the experience and uploaded it to YouTube:

https://www.youtube.com/results?search_query=wild+animal+safari+pine+mountain+ga+

Both parks combined have over 100 different species and over 900 animals. Together, the uniqueness of having a true animal safari in Georgia and Missouri with affordable admission prices makes Parks a business that people genuinely enjoy attending.

The trip advisor reviews for both parks are 4.5 stars with over 1,000 reviews.

Although people seem to love both parks equally, the economics of the two could not be more different. In 2018, the Georgia park did $5.1m in revenue with a 47% EBIT margin while the Missouri park only booked $923k with a -15.6% EBIT Margin. This is not anything new as the Missouri park has pretty much …

Read more

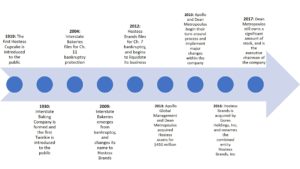

For the past few weeks I have been studying and doing research on Hostess Brands, the maker of the classic chocolate cupcake with the squiggly white frosting line and of course the iconic, golden, cream-filled Twinkie. At first glance, the company passed almost all my filters on my investment checklist for a company I would want to be involved with. They claim to have a 90% brand awareness among people in the United States, they benefit and profit on the nostalgia that their products create within people, they are growing internally at a decent rate and they are run by a very capable management team. Before we can dive into the investment case, let’s go back through the history of the company to better understand how we got to the present.

Hostess 1.0

The first Hostess cupcake was introduced to the public in 1919, followed by the formation of Interstate Baking company and the introduction of Twinkie in 1930. The company progressed with their normal course of business only to later file for Chapter 11 bankruptcy protection in 2004. For those who don’t know, Chapter 11 bankruptcy gives a company time to re-organize their debts and pay them off without having to “go out of business”. Chapter 7 bankruptcy on the other hand, is when a company or individual must sell off their assets to repay debts; in other words, liquidate. In most events the shareholders get wiped out, but I just wanted everyone to know the difference. Although that sounds terrible at first glance, Interstate Bakeries filing for bankruptcy protection was never due to failure of their brand. It was the result of union issues, zero efficiency within the company (stay with me here, I will go into more detail in a bit), high fixed costs and an excessive amount of debt…. A true recipe for disaster within any company. During this time, the company employed a Direct to Store Distribution Model which meant they needed a high number of employees (more than 33,000), tons of trucks to deliver their products frequently due to a 28-day self-life and 57 bakeries around the country to produce fresh products close enough to the stores that they deliver to. All of this compounded together created a company that, although had great products that people loved, had a structure that economically did not make sense. Their operating and labor costs where through the roof which led them to begin the bankruptcy process.

Hostess 2.0

Interstate Bakeries emerged from bankruptcy in 2009 and changes its name to Hostess Brands. The company gets back to its normal course of business to only again file for bankruptcy in 2012. This time, the company files for Chapter 7 and begins of the process of liquidation. Yet again, the result of them filing for bankruptcy was never due to lack of consumer consumption of their products, but more …

Read more