Points International (PCOM): A 10%+ Growth Business That’s 100% Funded by the Float from Simultaneously Buying and Selling Airline Miles

Points International (PCOM) is a stock Andrew brought to me a couple weeks ago. It always looked like a potentially interesting stock – I’ll discuss why when I get to management’s guidance for what it hopes to achieve by 2022 – but, I wasn’t sure it’s a business model I could understand. After some more research into the business, I feel like I can at least guess at what this company is really doing and at how this helps airlines. My interpretation of what the company is doing is sometimes a bit different than what I’ve read about in write-ups of this stock on Value Investor’s Club, Seeking Alpha, etc. The company’s own investor presentation doesn’t lay things out quite the way I will here. So, everything you read in this initial interest post should be consumed with the understanding that it’s my best guess of how this business works – and that guess could be far off the mark.

Points International has 3 segments. One of these is “Loyalty Currency Retailing”. That segment produces more than 100% of the company’s economic profit because the other 2 segments together add up to a slight loss, break even result, etc. depending on the exact year or quarter. At this point, I see no reason to assign any value – positive or negative – to the other two business segments. Points International also says it serves a lot of different clients. It mentions a total of 60 clients who it does some work for. However, only 30 use even one of the company’s “Loyalty Currency Retailing” functions. As a side note: in a YouTube video I saw, the company’s President seems to mention the number 36 in reference to Loyalty Currency Retailing – so, when I say “30” going by the company’s reports to regulators and so on, the actual number may now be 36 but I’m not 100% sure that’s what the President was referencing. So, I’m going to keep saying they have about 30 out of 60 clients actually allowing them to do any Loyalty Currency Retailing. Loyalty Currency Retailing is the only business that produces value here. So, all profits are from only 30 (or so) “partners”. Customer concentration seems extreme here if you read the note that 70-75% of revenue comes from 3 partners. However, gross profit is the more meaningful measure here. I would just cross out revenue and replace it with gross profit for most discussions of this company. The one exception would be “float”. I’ll discuss that later. It’s possibly best to treat gross profit as this company’s top line revenue and to treat the reported revenue as a form of “billings” as other marketing companies might put it. So, gross profit concentration is such that 80% of gross profits comes from 12 partners. Based on other things the company says, I would assume these partners are airlines based in the U.S. and Europe. I think the concentration here is really that almost all profits …

Read more

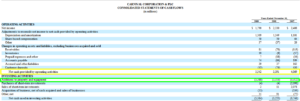

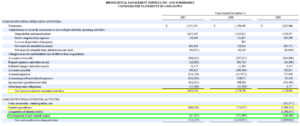

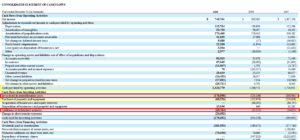

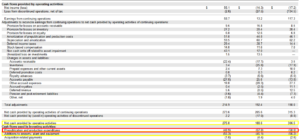

These are both publishers. And like most publishers they include a line called “prepublication and production expenditures” or “investment in prepublication cost”. Despite the fact that these expenses aren’t called “capital expenditures”, you absolutely must deduct them from operating cash flow to get your free cash flow number. In fact, these are really cash operating expenses.

These are both publishers. And like most publishers they include a line called “prepublication and production expenditures” or “investment in prepublication cost”. Despite the fact that these expenses aren’t called “capital expenditures”, you absolutely must deduct them from operating cash flow to get your free cash flow number. In fact, these are really cash operating expenses.