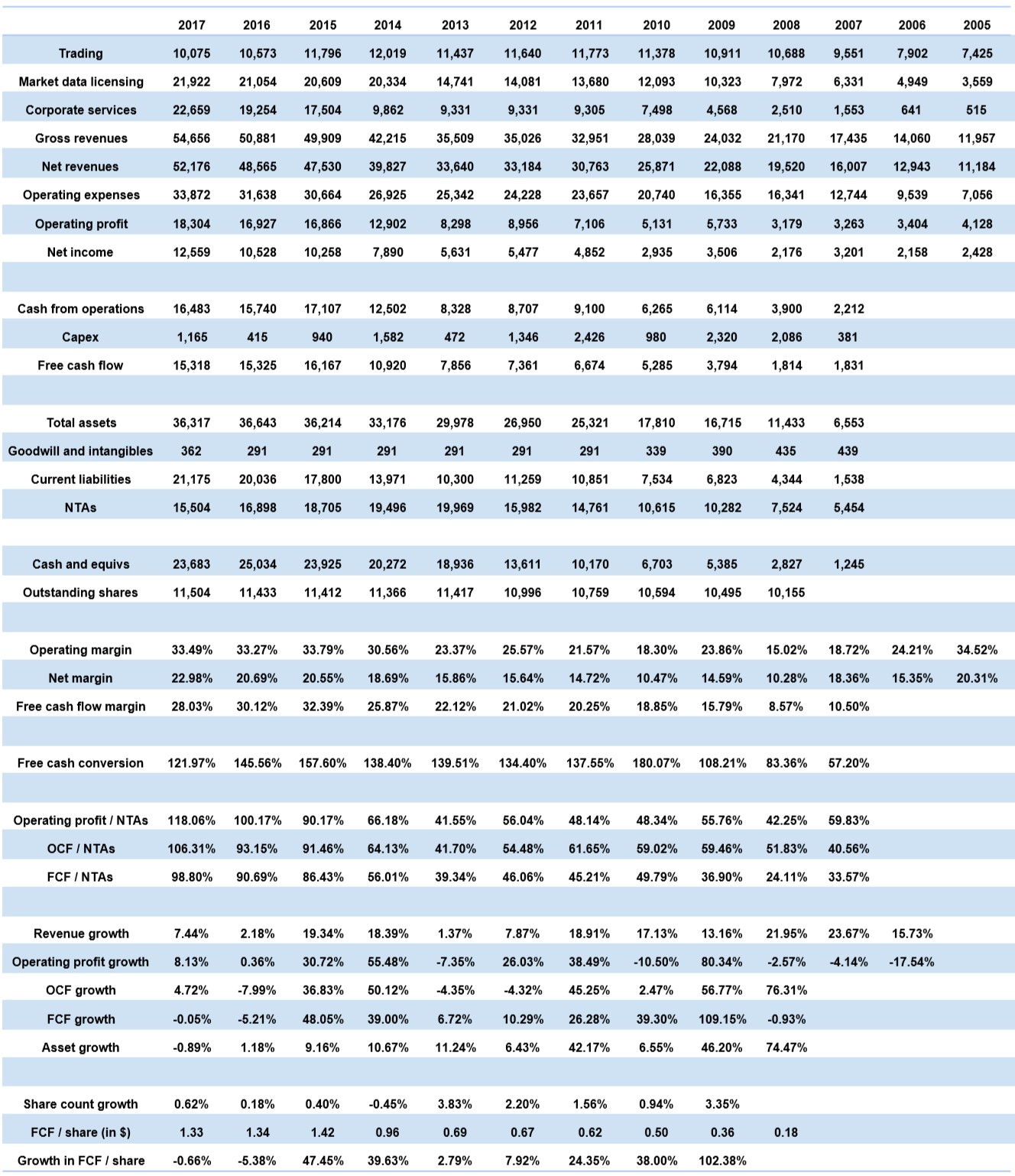

Revisiting Keweenaw Land Association (KEWL): The Annual Report and the Once Every 3-Year Appraisal of its Timberland Are Out

Accounts I manage hold shares of Keweenaw Land Association (KEWL). I’ve written about it twice before:

Keweenaw Land Association: Buy Timberland at Appraisal Value – Get a Proxy Battle for Free

And

Why I’ve Passed on Keweenaw Land Association – So Far

I didn’t continue to pass on Keweenaw Land Association. Like I said, the stock is now in accounts I manage.

There are really two things worth updating you on. One is the annual report. The other is the appraisal. The appraisal is something the old management team – the one that lost last year’s proxy vote to Cornwall Capital – always did as well.

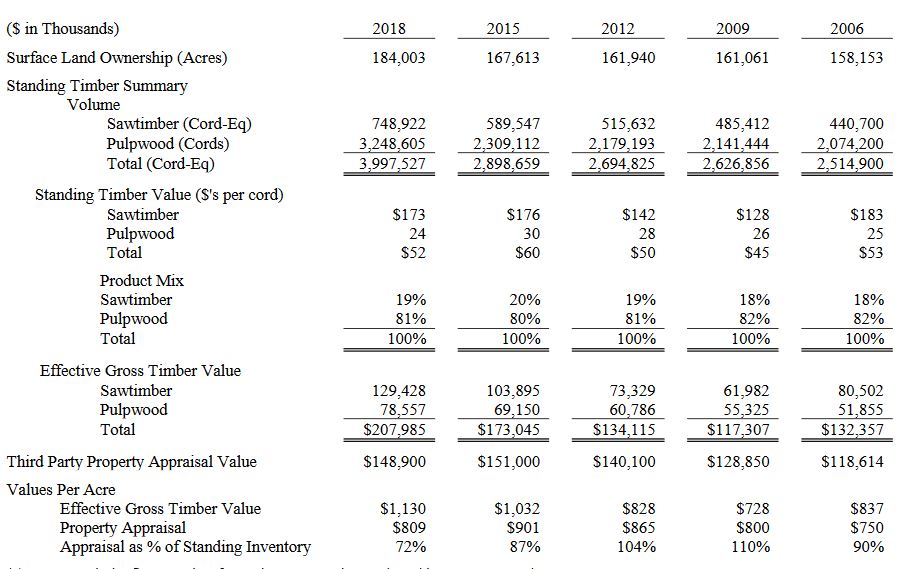

So, I can show you a summary of every appraisal from 2006 through 2018. The company includes this in its annual report:

You can read the entire annual report here.

You can read the entire annual report here.

A full summary of this year’s appraisal and methods used by the appraiser can be found here.

In today’s article: I’ll focus on the appraisal, because valuation of the stock seems to be the thing readers are most interested in. The annual report is also quite interesting though. The company’s new management is disclosing far more than the previous management. Although Keweenaw stock is “dark” (it doesn’t file with the SEC) – this latest annual report reads like a typical 10-K filed with the SEC. The company also changed its auditor to a better known firm (Grant Thornton) that audits plenty of other public companies.

As you can see in the table above, the value per acre of KEWL’s timberland was appraised at $809 this year versus $901 in 2015. That’s a decline of 10% versus 3 years ago. It’s also basically flat with an appraisal done in 2009 (so nearly 10 years ago). These are also nominal numbers. So, that means that the real value of KEWL has declined on a per acre basis over the last decade.

What’s tricky about this though is the last row you see “appraisal as a percent of standing inventory”. As you can see, the effective gross timber value – this is the value of all of the wood on Keweenaw’s land less the estimated gross costs of cutting and trucking that timber away – has risen pretty consistently. It went from $728 an acre in 2009 to $1,130 an acre today. But, the appraisal as a percent of that standing inventory went from 110% in 2009 – meaning the appraiser was then valuing the timberland above the gross value of the timber itself – down to just 72% this year. You can also see that the physical volume of timber – measured in cord equivalents – has compounded at something like 4% a year over the last 12 years. So, physically there is more timber on Keweenaw’s land every 3 years – and at least in the 2012, 2015, and 2018 appraisals this timber’s value has also increased per acre every time. However, the property’s appraisal has not. In fact, it declined by …

Read more