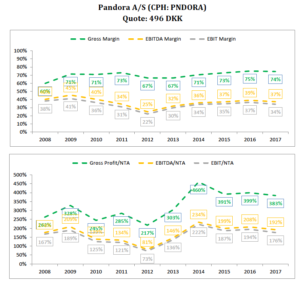

Pandora A/S (CPH: PNDORA)

Member Write-up by Luke Elliot

Note: Sponsored ¼ share ADRs also trade under “PANDY” in U.S. Dollars

Pandora A/S is the largest jewelry maker in the world

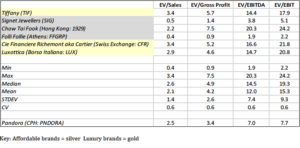

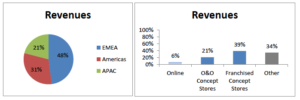

Overview Pandora is a vertically integrated jewelry maker that has rapidly grown from a local Danish Jeweler’s shop to the world’s largest jewelry manufacturer, producing more than 100 million pieces of jewelry in 2017. The original jeweler’s shop in Copenhagen, Denmark, was opened by goldsmith Per Enevoldsen and his wife Winnie in 1982. The company quickly transformed from a local shop, to a wholesale retailer, to a fully integrated global behemoth that designs, manufactures, directly distributes (in most markets), and retails its own jewelry. The company now sells in more than 100 countries through 7,800 points of sale. If you’ve ever been to a grade-A mall during Christmas or Valentine’s Day, you’ve probably witnessed the crazy lines snaking out of their small glass stores. Jewelry makers are segmented by price: Affordable (less than 1,500 USD), Luxury (1,500-10,000 USD) and High-End (greater than 10,000 USD). Pandora is in the affordable category by price but claims to have an ‘affordable-luxury’ brand. The company gets a little less than half (48%) its sales from EMEA (with 71% coming from UK, Italy, France, and Germany), about one-third (31%) from Americas (with 74% from US) and one-fifth (21%) from APAC (with 43% from Australia and 28% from China). The company’s sales are geographically diverse and in mature markets. To make it easy, let’s break down Pandora’s business model into two main retail formats:

Pandora is the world leader in charms and charm bracelets. It’s their bread and butter. It’s estimated they own about 30% of the charm market and 75% of their revenues are generated from this category. Estimates are that charms and charm bracelets make up only 6% of the total jewelry market. In essence, Pandora sells you a bracelet for somewhere between $80-150 and then you fill the bracelet up with charms that are $50-150 each. Pandora sells 73 million charms per year (200,000 per day) and 14.5 million bracelets per year (40,000 per day). Pandora’s brand and leadership position in the charm niche is by far its most important asset.