Maui Land & Pineapple (MLP): 900 Acres of Hawaiian Resort Land for $250,000 an Acre

Maui Land & Pineapple (MLP) owns real estate on the island of Maui (which is in Hawaii). The company has 22,800 acres of land carried on its books at prices dating back to the 1911 to 1932 period. So, book value is meaningless here. The total size of the land holdings is also meaningless here. Of the 22,800 acres, 9,000 acres are conservation land. That leaves only 13,800 acres of potentially productive land. Almost all of that (12,900 acres) is zoned for agriculture.

That leaves 900 acres zoned for residential use.

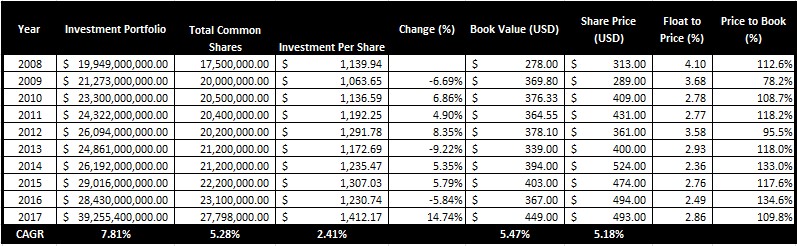

Let’s compare those 900 acres of land to the company’s enterprise value to get a sense of just how expensive this stock is on a price per acre basis. The company has 19.18 million shares outstanding. As I write this, the stock price is $11.40 a share.

Since we’re talking shares outstanding, I’m going to pause to discuss liquidity. I may run managed accounts focused on the most illiquid stocks out there (because I believe stocks with wide bid/ask prices tend to be less efficiently priced than stocks that trade constantly at almost no spread), but I know some members of Focused Compounding prefer more liquid investments. MLP should be liquid enough for everyone. The stock trades about $300,000 worth of shares per a day. It’s listed on the New York Stock Exchange.

Now, a bonus aside for those interested in ultra-illiquid stocks: if you’re interested in Maui Land & Pineapple after reading this write-up, you should definitely check out is closest “peer” of sorts – Kaanapali Land LLC (KANP). KANP is an illiquid (it trades about $2,000 worth of stock on an average day) over-the-counter stock. I’m not going to discuss KANP here. However, what land it owns – which I think is much more speculative and possibly worth much less than the land I’m about to discuss owned by MLP – is only something like 4 miles from the land we’ll be talking about here.

Now back to the enterprise value calculation. MLP stock is at $11.40 a share and there are 19.18 million shares outstanding. So, that’s $11.40 times 19.18 million equals $219 million. You can find the company’s 10-Q on EDGAR and decide how much net cash or net debt to add to that $219 million to get the correct enterprise value. There’s a tiny bit of cash, a tiny bit of debt, some retirement benefit obligations, etc. For our purposes, all balance sheet items excluding the 900 acres of residential zoned land are a rounding error. So, I’m going to round the market cap up from $219 million to $220 million and call that the enterprise value.

Now, we can calculate the price ratio that matters most here. It’s not price-to-book (meaningless because the land is carried at at 1911 to 1932 values) or price-to-earnings (also meaningless because it includes land sales which are very lumpy from year-to-year). It’s enterprise value per acre. So, that’s $220 million in EV divided by 900 acres of …

Read more