GAN Plc – A Player Account Management Software providers for Casinos and Sports Gaming

GAN PLC

GAN is a supplier of internet gambling solutions to the US land-based casino industry. GAN has developed an internet gambling enterprise software system, which it licenses to land-based US casino operators as a turnkey technology solution to launch an online and mobile presence.

GAN has developed a Player Account Management (PAM) system where highly sensitive customer and player activity is stored and processed. A PAM, among other things houses all customer data within the state, bears responsibility for identity verification, processing payments, determining that the user is located in a place where gambling is legal, produces regulatory reports and is licensed by each states regulators, provides a dashboard to operators for monitoring purposes and integrates with third party online casino games and sports book, effectively serving as the accounting platform for the casino operator. In a way, the Player Account Management system is to an online casino what the core

processor is to a bank: An operating and accounting system that keeps track of all transactions. In addition to the PAM, GAN also sometimes develops the front-end interface for Online Casino, Sports Betting and Simulated Gaming websites and apps.

Other add-on elements of a platform can include a sportsbook transaction engine, gaming content, payment services, marketing services, trading services and other activities. Outside of the sportsbook, GAN supplies some of these services to some of its customers.

GAN primarily supplies this software in the US where an increasing number of states are legalizing online sports betting due to the Supreme Court of the United States issuing a ruling that struck down the Professional and Amateur Sports Protection Act (PASPA), the 1992 federal law that had prevented states from regulating sports betting. The passage of PASPA in 2018 left it to states to legalize online gambling activity, rather than gambling being regulated federally. After the passage New Jersey quickly legalized online gambling, followed by Pennsylvania, Indiana and Michigan. Other states are expected to follow suite.

GAN received a patent in 2014 for linking a US casino clients’ loyalty account to an online gambling account. The patent covers integration of both social casino gaming and real money gambling with casino loyalty programs and has licensed this patent to FanDuel for a five-year term in return for a Patent license fee.

GAN has several distinct revenue streams:

- Real Money Gaming Revenue Share (38% of revenues). This consists mainly of revenue share agreements with local casinos for running their online platform. This segment grew 103% YoY.

- License Revenue (27% of revenues). One-off licensing revenue mostly for licensing to Flutter plc. This licensing revenue derives from GAN plc’s technology and patents integrating loyalty programs with online gambling. Instead of subscribing to the entire GAN platform, these customers just license this specific part. While it is one off revenue , there are large casino groups that could benefit from licensing GAN plc’s technologies and patent.

- Platform development revenue (8% of revenues). These are one-off software development revenues that GAN receives for developing its online platform. They have, however, been fairly stable over GAN plc’s history. YoY growth in this segment was 213%.

- Simulated Gaming (23% of revenues). Online simulated gaming, just not for money. This grew 8% YoY.

- Sportsbook Revenue (5% of revenues). Revenue share from the Flutter plc / FanDuel collaboration. This is a fairly new revenue stream, but may fall away over the next few months and only restart in the second half of 2020 as sports events are interrupted due to the coronavirus.

GAN shares in its clients revenues through a take rate that ranges between 5-10%. Its technology powers Fanduel, Betfair in New Jersey, Parx Casino in Pennsylvania, JACK in Ohio and large tribal Casinos in Washington and California. Though there is no clear disclosure on revenue share, GAN is rumoured to be getting roughly a 5% of FanDuel revenues in the state that FanDuel uses their platform.

Unfortunately, GAN’s future revenue is extremely difficult to forecast and model. Broadly speaking it is a function of:

- New casinos signing onto the GAN platform or licensing GAN’s technology

- Further legalization of online gambling in new states

- Growth of Sports betting, regulated Gaming and Simulated Gaming in existing states with existing clients

According to the latest numbers, growth in Pennsylvania and New Jersey, GAN plc’s biggest contributors, has been running between 50-60% YoY. Adaptation has definitely been rapid.

At least 10 states have now passed sports betting legislation. Many more are working on it.

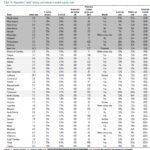

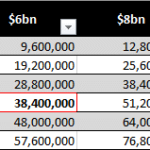

GVC Holdings, a British sports betting and gambling company, expect the US market to be worth “at least” $6bn in GGR terms by 2023, although they expect the pace of regulation to be “gradual”. There are several other estimates out there ranging between $4bn and $15bn. I think somewhere between $4bn to $6bn is realistic.

Assuming GAN can take about 15-20% market share through its PAM offering doesn’t seem like stretching it too far either, given that they have the premier offering in the space.

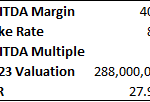

As about 65-75% of incremental revenue gets converted into EBITDA assuming a 40% EBITDA margin by 2023 seems justifiable as well. The take rate of 8% is roughly in line with existing contracts. Finally, a high quality software platform such as GAN should be able to fetch a 15x EBITDA multiple. Assuming a $4bn 2023 GGR market and a 15% market share would get you to a 27.9% IRR. A $6bn 2023 GGR and 20% market share would lead to a 53.5% IRR. Clearly these are high IRRs, but GAN is also a risky stock. Large customers could stop using them, build their own in-house solutions or a better competitor could emerge.

Achieving the GGR numbers outlined above may also take longer than expected as the coronavirus has led to most sports events being cancelled. Sports betting has been one of the main drivers of cash gaming, so a delay or temporary shutdown in sports betting could impact GAN’s revenue. On the other hand, it doesn’t take into account license revenue, simulated gaming or platform development revenue.

Overall, the largest threat to these estimates is the treat of Flutter and other large casinos developing an inhouse PAM platform and phasing GAN plc’s platform out in 2024 when their contract ends. It looks like Flutter / Fanduel have experimented with rolling out sportsbook in West Virginia, a smaller state where regulation is lighter. GAN’s patent and the years of development time they have spent building out their PAM platform should act as a moat for a while.

A coronavirus-induced recession may be another risk. Casino-going clearly drops in a recession, but do online gambling and sports betting? I think that will depend on the steepness and duration of the recession. Running at -1% GDP growth for a quarter or two may not impact online gambling month. Numbers that GAN just released on its Italian operations also seem to indicate that online gambling and sports betting have increased ever since mass quarantines have set in. At least if we have a short-term recession one might expect that gamblers not being able to access their favorite venues might lead to them hitting up the app-store.