Andrew Kuhn wrote a new post 5 years, 6 months ago

By Geoff Gannon

06/07/2012

For understanding a business rather than a corporate structure – EV/EBITDA is probably my favorite price ratio.

Why EV/EBITDA Is the Worst Price Ratio Except For All […]

Andrew Kuhn wrote a new post 5 years, 7 months ago

Recommendation: Buy

Burford Capital is complicated to value; and so vulnerable to opportunistic short sellers, but this weakness offers opportunities to long term investors.

Stephen Gamble, writer and […]

Andrew Kuhn wrote a new post 5 years, 8 months ago

Originally posted at http://www.Gannononinvesting.com on June 01, 2011

by Geoff Gannon

Someone who reads the blog sent me this email:

Dear Geoff,

in your article “Should you Buy Microsoft?” on GuruFocus, you […]

Andrew Kuhn wrote a new post 5 years, 9 months ago

Some readers have emailed me with questions about exactly how to calculate free cash flow, including: Do you include changes in working capital? Do you really have to use SEC reports instead of finance w […]

Andrew Kuhn wrote a new post 5 years, 9 months ago

“In lieu of (earnings per share), Malone emphasized cash flow…and in the process, invented a new vocabulary…EBITDA in particular was a radically new concept, going further up the income statement than anyone had g […]

Andrew Kuhn wrote a new post 5 years, 9 months ago

By GEOFF GANNON

09/05/2019

A Focused Compounding member asked me this question:

“Have you any thoughts on why U.S. banks are so profitable (the better ones at least)? I’ve looked at banks in other cou […]

Andrew Kuhn wrote a new post 5 years, 9 months ago

By Geoff Gannon

December 8, 2017

Someone emailed me this question about tracking portfolio performance:

“All investors are comparing their portfolio performance with the S&P 500 or DAX (de […]

Andrew Kuhn wrote a new post 5 years, 10 months ago

March 26, 2011

Someone who reads the blog sent me this email.

Geoff,

In a previous email to me you explained how Warren Buffett values a company. The text that your wrote was:

“He wants his i […]

Andrew Kuhn wrote a new post 5 years, 10 months ago

April 24, 2016

By Geoff Gannon

Moat is sometimes considered synonymous with “barrier to entry”. Economists like to talk about barriers to entry. Warren Buffett likes to talk about moat. When it comes to inv […]

Andrew Kuhn wrote a new post 5 years, 10 months ago

December 17, 2017

by Geoff Gannon

A blog reader sent me this email:

“Do you ever pay attention to insider transactions when analyzing a company?”

I do read through lists of insi […]

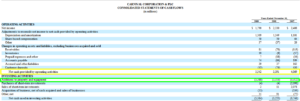

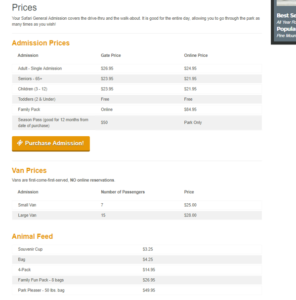

Andrew Kuhn wrote a new post 5 years, 10 months ago

by ANDREW KUHN

Parks! America

Price: $0.14

Shares: 74.8m

MC: $10.4m

Cash: $3.2m

Debt: $2.4m

EV: $9.6m

Geo […]

Andrew Kuhn wrote a new post 5 years, 10 months ago

December 14, 2017

by Geoff Gannon

A blog reader emailed me this question about why I appraise stocks using a pure enterprise value approach – as if debt and equity had the same “c […]

Andrew Kuhn wrote a new post 5 years, 10 months ago

December 23, 2017

by Geoff Gannon

Richard Beddard recently wrote a blog post about company strategy. And Nate Tobik recently wrote one about how you – as a stock picker – have no edg […]

Andrew Kuhn wrote a new post 6 years, 9 months ago

To Focused Compounding members:

This week, a Focused Compounding member sent me a link to a blog post about Brighthouse Financial (BHF). Brighthouse Financial is the spun-off retail business of MetLife. […]

Andrew Kuhn wrote a new post 6 years, 9 months ago

To Focused Compounding members:

I spend a surprising amount of time talking with members about other investors – investors who are doing better than them. The truth is: returns much beyond 20% a year aren’t eve […]

Andrew Kuhn wrote a new post 6 years, 9 months ago

Member Write-up by Yuvraj Jatania

Spinoff Background

In May 2018, KLX Inc. (KLXI) announced an agreement to sell their Aerospace Solutions Group (ASG) to Boeing for $63/share in an all cash deal.

The d […]

Andrew Kuhn wrote a new post 6 years, 10 months ago

Member write-up by VETLE FORSLAND

I wrote up BUKS on the website earlier this month. After discussions with Geoff, we agreed that a follow-up article was relevant, as there were important parts of the thesis that […]

Andrew Kuhn wrote a new post 6 years, 11 months ago

Member Write-up by VETLE FORSLAND

Investing in companies with big upsides (and big downsides) with LEAPS, instead of common stock, to up your return (and minimize risk)

If you believe that a stock is […]

Andrew Kuhn wrote a new post 6 years, 11 months ago

To Focused Compounding members:

This week, Vetle Forsland was our guest for two podcast episodes. One was about GameStop (GME). The other was about Entercom (ETM). You should listen to them both. What stood […]

Andrew Kuhn wrote a new post 6 years, 12 months ago

To Focused Compounding members:

One of the most difficult things for investors to deal with is to watch other get richer faster than you. In the stock market, the same choices are available to everyone. So, if […]