A Few Thoughts on Hostess Brands

“Your premium brand had better be delivering something special, or it’s not going to get the business”

-Warren Buffett

For the past few weeks I have been studying and doing research on Hostess Brands, the maker of the classic chocolate cupcake with the squiggly white frosting line and of course the iconic, golden, cream-filled Twinkie. At first glance, the company passed almost all my filters on my investment checklist for a company I would want to be involved with. They claim to have a 90% brand awareness among people in the United States, they benefit and profit on the nostalgia that their products create within people, they are growing internally at a decent rate and they are run by a very capable management team. Before we can dive into the investment case, let’s go back through the history of the company to better understand how we got to the present.

Hostess 1.0

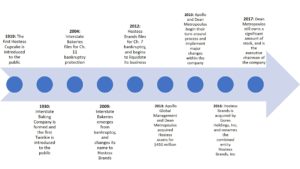

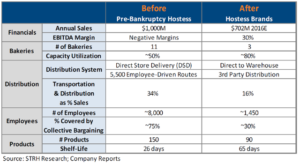

The first Hostess cupcake was introduced to the public in 1919, followed by the formation of Interstate Baking company and the introduction of Twinkie in 1930. The company progressed with their normal course of business only to later file for Chapter 11 bankruptcy protection in 2004. For those who don’t know, Chapter 11 bankruptcy gives a company time to re-organize their debts and pay them off without having to “go out of business”. Chapter 7 bankruptcy on the other hand, is when a company or individual must sell off their assets to repay debts; in other words, liquidate. In most events the shareholders get wiped out, but I just wanted everyone to know the difference. Although that sounds terrible at first glance, Interstate Bakeries filing for bankruptcy protection was never due to failure of their brand. It was the result of union issues, zero efficiency within the company (stay with me here, I will go into more detail in a bit), high fixed costs and an excessive amount of debt…. A true recipe for disaster within any company. During this time, the company employed a Direct to Store Distribution Model which meant they needed a high number of employees (more than 33,000), tons of trucks to deliver their products frequently due to a 28-day self-life and 57 bakeries around the country to produce fresh products close enough to the stores that they deliver to. All of this compounded together created a company that, although had great products that people loved, had a structure that economically did not make sense. Their operating and labor costs where through the roof which led them to begin the bankruptcy process.

Hostess 2.0

Interstate Bakeries emerged from bankruptcy in 2009 and changes its name to Hostess Brands. The company gets back to its normal course of business to only again file for bankruptcy in 2012. This time, the company files for Chapter 7 and begins of the process of liquidation. Yet again, the result of them filing for bankruptcy was never due to lack of consumer consumption of their products, but more so the overall structure of the company. The company during this time still employed the Direct to Stores Distribution Model, which we now know balloons an astronomical amount of costs to the company, employed 19,000 people, of which 92% were unionized, had a lot of debt and was paying over $100 million a year to its unfunded pension fund. At this time, Hostess had a net loss of $1.1 billion, on revenues of $2.5 billion. After a run-in with the union, they ultimately proceeded with the process of liquidation.

Hostess 3.0

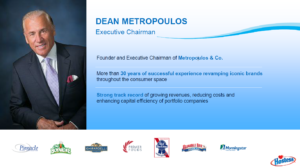

Hopefully the 3rd time around really is a charm. In 2013 during liquidation, Hostess assets are acquired for $410 million from Apollo Global Management and billionaire Dean Metropoulos. Due to their bankruptcy, this new company emerged without any legacy issues from the prior company. Dean Metropoulos is nicknamed “Mr. Shelf Space”, and is known for buying into well-known consumer food brands that are going through temporary or structural issues, making changes, revamping them and then flipping them for a profit. Here is a summary about him:

Let’s go over a few past investments made by Dean. He acquired Pabst Brewing company for $250 million in 2010. At the time, Pabst was viewed as a lower quality type of beer and it was not popular by any sort of measure. Dean implemented new marketing campaigns, made some structural changes within the company and ended up selling Pabst for $700 million 4 years later.

Another success was when he bought Aurora foods out of bankruptcy in 2004 and merged it with Pinnacle foods (their products were Aunt Jemima, Duncan Hines, Log Cabin etc.). They did their work in revamping and changing things within the company and eventually sold it to Blackstone Group for $2.2 billion in 2007.

In 1996, he formed a company called International Home Foods to revamp Chef Boyardee pasta products, Pam cooking spray and Bumble Bee seafood. In 2000, he sold International Home Foods to ConAgra foods for $2.9B. It is safe to say him buying into Hostess is within his circle of competence.

Due to new management, Hostess is a completely different company now. They switched their distribution model from Direct to Stores (DSD) to a new Direct to Warehouse model (DTW). Why DTW is important is because instead of having to deliver to each individual store that Hostess products sells in, which required the old company to employ thousands of unionized workers and all the costs associated with Direct to Store Distribution (labor, trucking, gas, etc.), now they just need to deliver their products to third-party distribution centers. The third-party distribution centers then fill customer orders and send the product to customer warehouses, and the customer take it from there. They could implement this change because they also extended their product shelf lives from 28 days to 65 days, all of which means lower costs that directly benefit to the bottom line. Hostess has said this new distribution method allowed them to get rid of 36 factories, 5,600 delivery routes and thousands of employees, which allowed costs to be down 16%. The old company had a negative operating margin, but due to all the implementations within the new company, they are now in the normalized area of 25% and operate as a much leaner company.

The new management also invested in “state of the art baking technology” that has allowed them to increase production, volume and operating efficiencies. They are more focused on automation which allows them to keep labor costs down. Here is a picture of an old factory compared to a new, upgraded one.

A new factory using automation and robots with 500 people produces 1 million Twinkies per day, which would have required 14 plants and 9,000 employees with the old Hostess structure.

Here is a good summary of the before and after effect:

The investment Case

Now that we went over the history of the company, let’s walk through the potential investment case in the new entity. The main reason I was so drawn to learning about this business and doing the work to get caught up to date on everything was because of their products and brand. Hostess claims they have a 90% brand awareness among individuals, and that is something you cannot put a price on. Hostess products are: Twinkies, Donettes, Cupcakes, Ding Dongs, Fruit Pies, Mini Muffins, Ho Hos (my favorite), Suzy Qs, Danish, Iced cookies, Madeleines, Zingers, Coffee Cakes, Cinnamon Rolls, Honey Bunds, Sno Balls, Chocodiles, Brownies, Bread and buns, Jumbo Muffins and Eclairs. They sell these products through mass merchandisers, supermarkets, convenience stores and drug and dollar stores. Their bread and butter (no pun attended) is getting consumers to purchase their items due to impulsion. Since becoming a new entity again, Hostess has also added new products to their line such as bread, Deep-Fried Twinkies, Ice cream and in-store bakery products. The reviews on these products are top notch. They believe continuing to expand their product base will increase their share in the Sweet Baked Goods market.

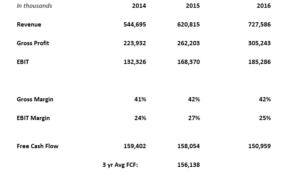

Past 3 years financials since under new management:

My investment case is based on them returning to their pre-bankruptcy market share while, this time around, being a more efficient company with a shareholder oriented management team. The total Sweet Baked Goods market is $6.5 billion, and them returning to their old share of 22% would yield $1.43 billion in revenue for the company. If the company can keep their operating margins in the neighborhood of 20% (extremely conservative on my part considering the average operating margin has been 26% the past 3 years) and trade at a multiple of 10x’s operating income, we would come to a market value of $2.8B (10’x operating income is conservative in my opinion considering most comparable companies that are not growing as much as Hostess are trading 13-15x’s operating income).

To get to our total enterprise value, we can add back net debt of $714m (this debt figure includes the cash they will receive from the warrants they have outstanding when they are exercised) to get a total enterprise value of $2.1 billion, or $15.87 per share (there are 135 million diluted shares outstanding). The company’s average free cash flow the past 3 years has been $156 million so, assuming for the next 5 years they’ll earn $100m in free cash flow per year (again, we are being conservative here), they will have $500 million in free cash which comes out to 3.70 per share. So, accounting for that, Hostess could be worth around $19.57 per share or 41% higher. I think these projections are extremely conservative and could offer us a margin of safety if we are wrong. If we did the same math on 25% operating margins, which is probably more realistic, the share price comes out to $24.86 per share which is 79% higher. If any of these values can trade at anything more than 10x’s operating income, then the value per share is even more. But let’s be conservative and say $19.57- $24.86.

As always, no investment comes without risk. The first major risk is their debt. Currently the company has $934m in variable rate net debt without accounting for the cash they will receive from the exercise of their warrants. If we account for the warrants, assuming they do not pay any major amount down, they will have $714M of debt in 5 years. As I said in my valuation, during this time they will accumulate over $500m in free cash flow that can go directly to debt. So, assuming the company continues to operate and there are no operating problems within the business, I think the high debt will not be an issue.

The other risk, and my main concern, is how durable is the overall Sweet Baked Goods market? If it is durable, how long until they reach old market share? This is the tough one. Society is more concerned about living healthier lives in 2017 than they ever have been before, and that could directly hurt their business. That said, Hostess really thinks about themselves as an indulgence, instead of a “have a Twinkie 3 times a day” type of business. Managements goal is to gain 50 basis points (half a percent) of market share per year, which they have been exceeding (their market share grew over 1 percent this past year). Part of me thinks indulging in sweet foods is more like people who smoke cigarettes; everyone knows they are not good for you, but they will consume them anyways. This thought process aside, declining revenues due to lack of consumer preference and consumption would have a grave effect on the company due to the debt it is carrying. It is something I will continue to think about and continue to follow. This all said, it is easier to have confidence in the business when management and the Chairman Dean Metropoulos have so much of their own capital at risk, which properly aligns their incentives with shareholders.

One last thought, and this opinion may be totally out in left field, but it would not surprise me if within 5 years the current management does what it has done best and sells the company to a bigger food company. Hostess’ current CEO, Bill Toller, was the CEO Dean Metropoulos hired to fix the balance sheet issues at Pinnacle foods, which they both went on to sell.

As for me laying out capital right now, I have no definitive conclusion yet but it is definitely really interesting and I could pull the trigger on at any time. Also, the warrants are certainly interesting as well. I may go over them in another post here soon…. In any event, I will continue to update all of you..