VieMed Healthcare (VMD): A Founder Led Canadian Listed U.S. Ventilator Company Faces the Risk of Competitive Bidding for its Medicare Patients Starting in 2021

Write-up by REID HUDSON

(Geoff’s note: VieMed trades under the symbol “VMD” in Canada and over-the-counter in the U.S. under the symbol “VIEMF”. The stock is a lot more liquid in Canada than in the U.S. However, the price difference between the shares in Canada and the U.S. doesn’t always perfectly reflect the U.S. Dollar to Canadian Dollar exchange rate.)

VieMed Healthcare Inc. operates in the home health space and provides services and equipment to a variety of respiratory patients. Its main market consists of stage 4 COPD patients who are in need of non-invasive ventilation (NIV) therapy to continue living without excessive time spent in a hospital. VieMed also offers a range of sleep apnea, oxygen, and other respiratory solutions to patients. VieMed employs Respiratory Therapists (RTs) to assist patients with the set-up of machines, education, continued monitoring, and other services included in respiratory treatment. The company states that NIV treatment makes up roughly 90% of its business. VieMed is a Canadian listed company that operates in the United States. Its corporate structure consists of a Canadian parent company listed on the TSX called VieMed Healthcare Inc. This parent company is the sole owner of a Delaware incorporated U.S. subsidiary called VieMed Inc. that owns two subsidiaries of its own. The company operates through these two Louisiana based subsidiaries: one called Sleep Management, LLC and the other called Home Sleep Delivered, LLC.

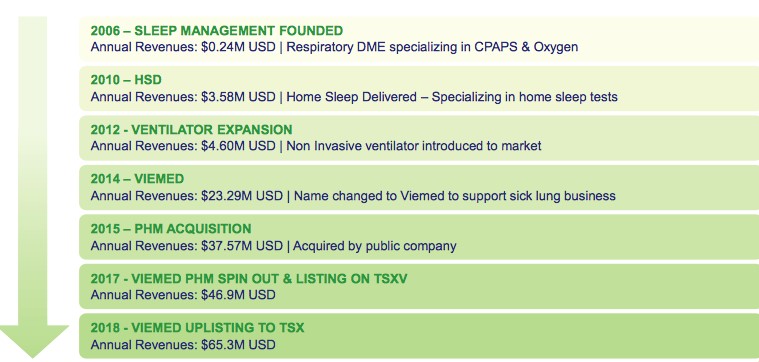

As the graphic above shows, Sleep Management was founded in 2006 by its current CEO Casey Hoyt. It got into the Non-Invasive Ventilator (NIV) market in 2012 and began to focus on COPD, changing its name to VieMed shortly thereafter. After being acquired by PHM, VieMed completed a spin-out in 2017. It was listed on the TSX Venture Exchange mainly because the company that it spun-off from was listed there.

VieMed claims that it cares for more patients with non-invasive ventilators than any other company in the United States. NIVs are non-invasive machines that are used to lessen the effort required to breath. They are primarily used by patients with late-stage COPD and neuromuscular diseases that both make it very difficult to breathe without assistance. These machines are non-invasive as opposed to invasive ventilators that require insertion through the mouth, nose, or directly to the trachea by way of a tracheostomy tube.

Since entering the NIV market, VieMed has grown revenue and active vent patients at a fantastic rate. Its revenue has grown at a CAGR 44% since 2010 and around 29% since its name change in 2014. However, this number is weighed down by a negative year in 2016, when Medicare slashed reimbursement rates for NIVs. Most recently, VieMed grew its top line number 39% in 2018 and around 50% in 2017. The number of active ventilation patients that it serves grew to about 5,905 in 2018, representing a growth rate of about 35% for the year. Active vent patients grew at almost 43% in 2017. While this growth has been impressive, what …

Read more