KLX Inc/KLX Energy Services Spinoff

Member Write-up by Yuvraj Jatania

Spinoff Background

In May 2018, KLX Inc. (KLXI) announced an agreement to sell their Aerospace Solutions Group (ASG) to Boeing for $63/share in an all cash deal.

The deal was based on a successful spinoff of KLXI’s Energy Services Group (KLXE) because Boeing had no interest in buying this part of KLX’s business.

The management team led by founder, Chairman and CEO, Amin Khoury, initially tried to market the energy business for sale to trade and financial buyers. Bids were received from a mixture of competitors and PE houses in the range of $250-$400m but management felt very strongly that these valuations undervalued the potential of the business based on the rapidly improving market conditions, the higher market value of comparable companies and strong forecasted financial performance of the business.

Instead they decided to initiate a spin off which would allow them to run the energy business as a standalone, publicly traded entity.

Our investment opportunity lies in the spinoff of the energy business which will trade on the NYSE under ‘KLXE’.

The spinoff is expected to take place before the end of Q3 2018. Not long.

KLX Inc

KLXI is a US listed company which used to be part of BE Aerospace (BEAV).

BE Aerospace was founded by Amin Khoury in 1987 through an acquisition of an aerospace interiors parts manufacturing and services business with only $3m in revenue at the time. Khoury grew the business and sold the manufacturing side to Rockwell Collins in April 2017 for $8.6bn and retained and managed the services business which became known as ‘KLX Inc’.

KLXI operates through two distinct and unrelated businesses:

1. KLX ASG – Aerospace after-market services and parts/consumables for commercial and private aircrafts

2. KLXE – Onshore oil and gas field services – focused only on serving North American onshore Exploration and Production (E&P) companies

KLX Energy Services Group

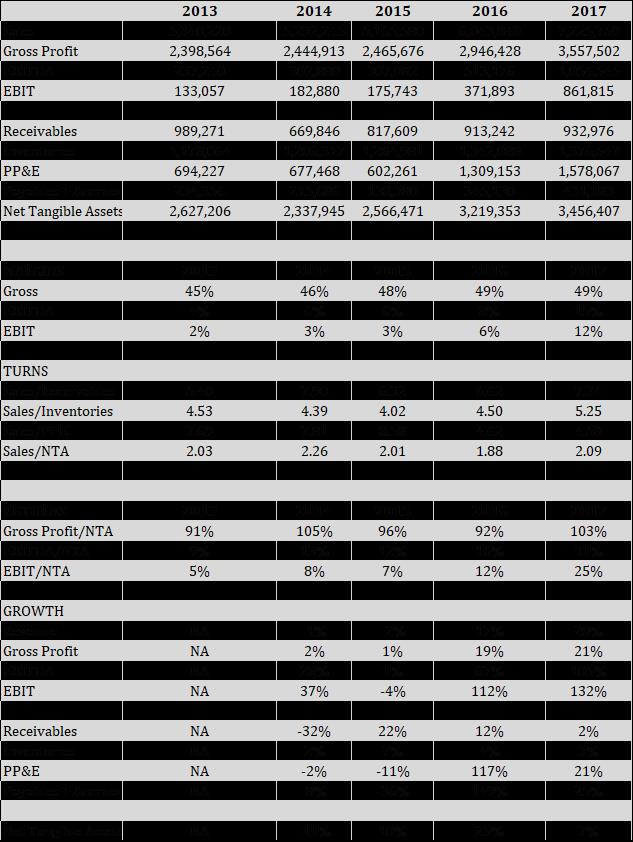

The energy business was founded through a quick succession of acquisitions in 2013-14 of seven regional oilfield services companies which each operated in the major shale basins in North America – the Southwest, Rocky Mountains and the Northeast. The execution and integration of the acquisitions was managed by Khoury and his executive team.

The business provides well completion, intervention and production services and equipment to major oil and gas E&P companies. Their customers include Conco Phillips, Chesapeake Energy and Great Western amongst others. These companies drill and create wells in the shale basins looking for oil and natural gas. When they have a pump issue, equipment gets stuck or loss, a valve becomes faulty or loose, or any other well-related issues they call in technicians or equipment and tools from a company like KLXE. Historically, some of these players would resolve these issues by having an in-house team but now a majority of them outsource the support services to companies like KLXE as the work is considered non-core to their daily activities.

One of the very attractive features of this type of business is …

Read more