Gaia (GAIA): A Strange Value Investment in a Strange Streaming Service

Gaia operates a streaming service like Netflix, but for yoga, meditation, and weird conspiracy videos. They have many great titles, like “The Baltic Sea Anomaly; A Crashed UFO Or Natural Rock Formation?” or “Cannabis Spirituality: Using Plant Medicine as a Sacred Tool”. The company is run by its founder, Jirka Rysavy, who owns over 32% of the company’s stock. Rysavy is an experienced entrepreneur who founded Corporate Express, which became a Fortune 500 company before merging into Staples. Gaia is growing extremely fast, but has been losing money along the way. I believe the net losses are a result of investments for growth that will dramatically decrease over the next few years.

At first glance, Gaia is exactly the kind of business that value investors would avoid. The company is selling for $160 million, and produced just $42 million of streaming revenues in 2018. This gives the stock a price to sales ratio of 3.8. The company’s losses have been growing, with a net loss of $33.8 million in 2018 and $23.3 million in 2017. At this point, most value investors would have lost interest and moved on to the next idea. However, there are some very interesting aspects of this business that deserve a closer look.

Gaia has a low amount of operating expenses, while most of their net loss comes from investments for growth. This provides the business the potential to earn very high returns on capital as the investment in growth spending slows. In the 2018 Q4 earnings call, management expressed that their plan was to reduce subscriber acquisition spend throughout 2019 as they attempt to head toward profitability.

What really excites me about Gaia is the low cost of content. This can be seen within the company’s gross margin. As the company grows, the gross margin continues to rise as well, from 80.7% in 2015 to the 87.2% Gaia had in the 4th quarter of 2018. Netflix, for comparison, has a gross margin of 36.9%. In addition, the gross margin doesn’t tell the whole story for Netflix, as their amortization of streaming content leads to cash flow being much worse than net income. The opposite is true for Gaia, as they reports better cash flow than net income. However, cash flow is still negative for Gaia for the time being. This low cost of content is achieved even considering that the vast majority of Gaia’s titles are either created by or exclusively for Gaia. About 90% of Gaia’s content is exclusively available for Gaia subscribers. For companies like Netflix or Gaia, the sole product is content. With such low costs of content, there is potential for abnormal profits eventually.

The net loss for Gaia can be attributed to the ‘Selling and Operating’ line on the Income Statement, as this is currently 156% of revenue. In 2018, this value was $68.3 million. Management discloses in the earnings calls the breakdown of what they consider operating expenses compared to subscriber acquisition costs. $52 million was spent on subscriber …

Read more

You can

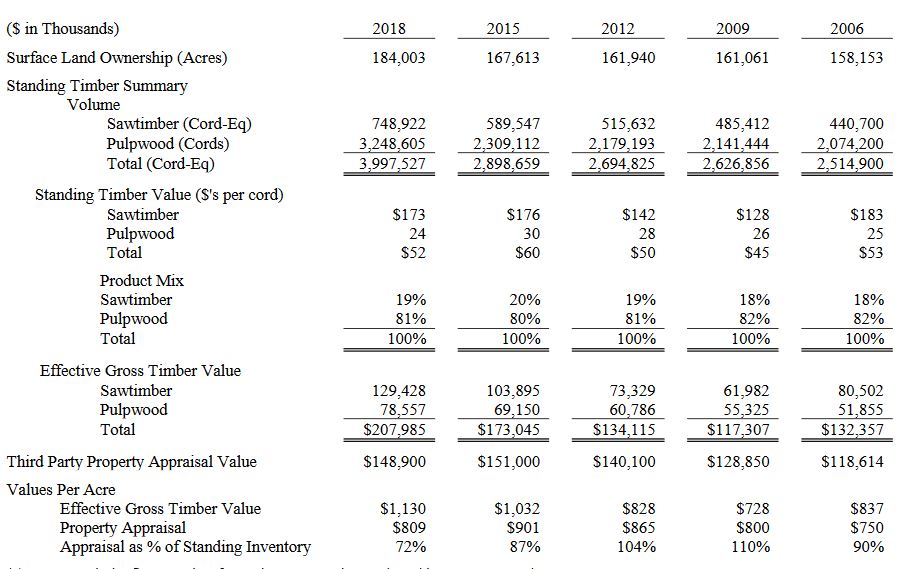

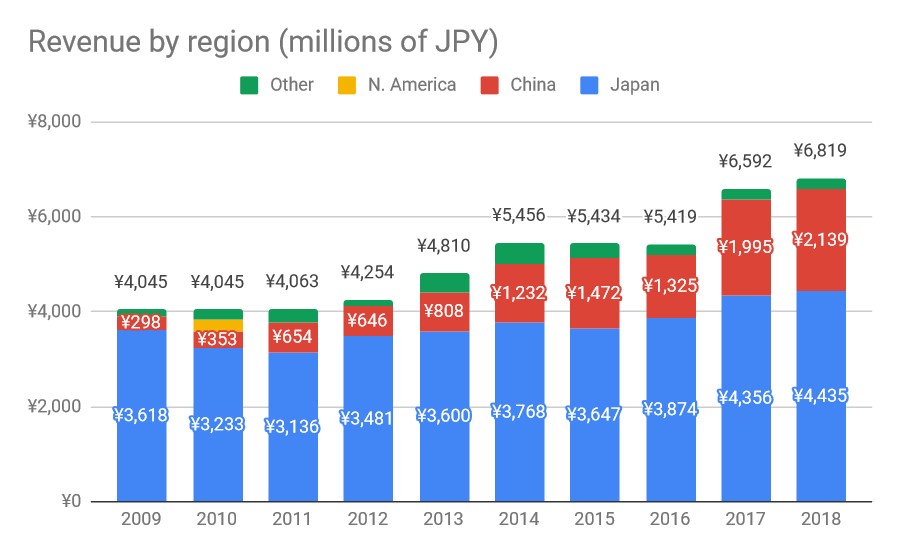

You can  Source: Company filings

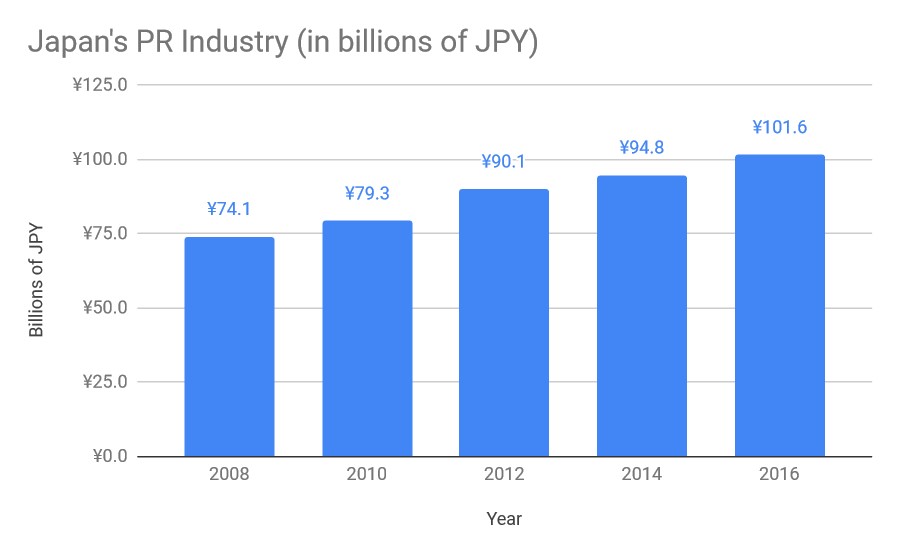

Source: Company filings Source: Public Relations Society of Japan

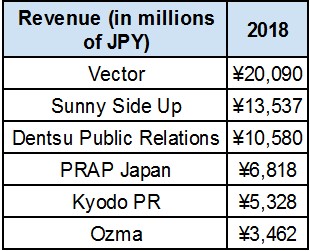

Source: Public Relations Society of Japan Source: Company websites

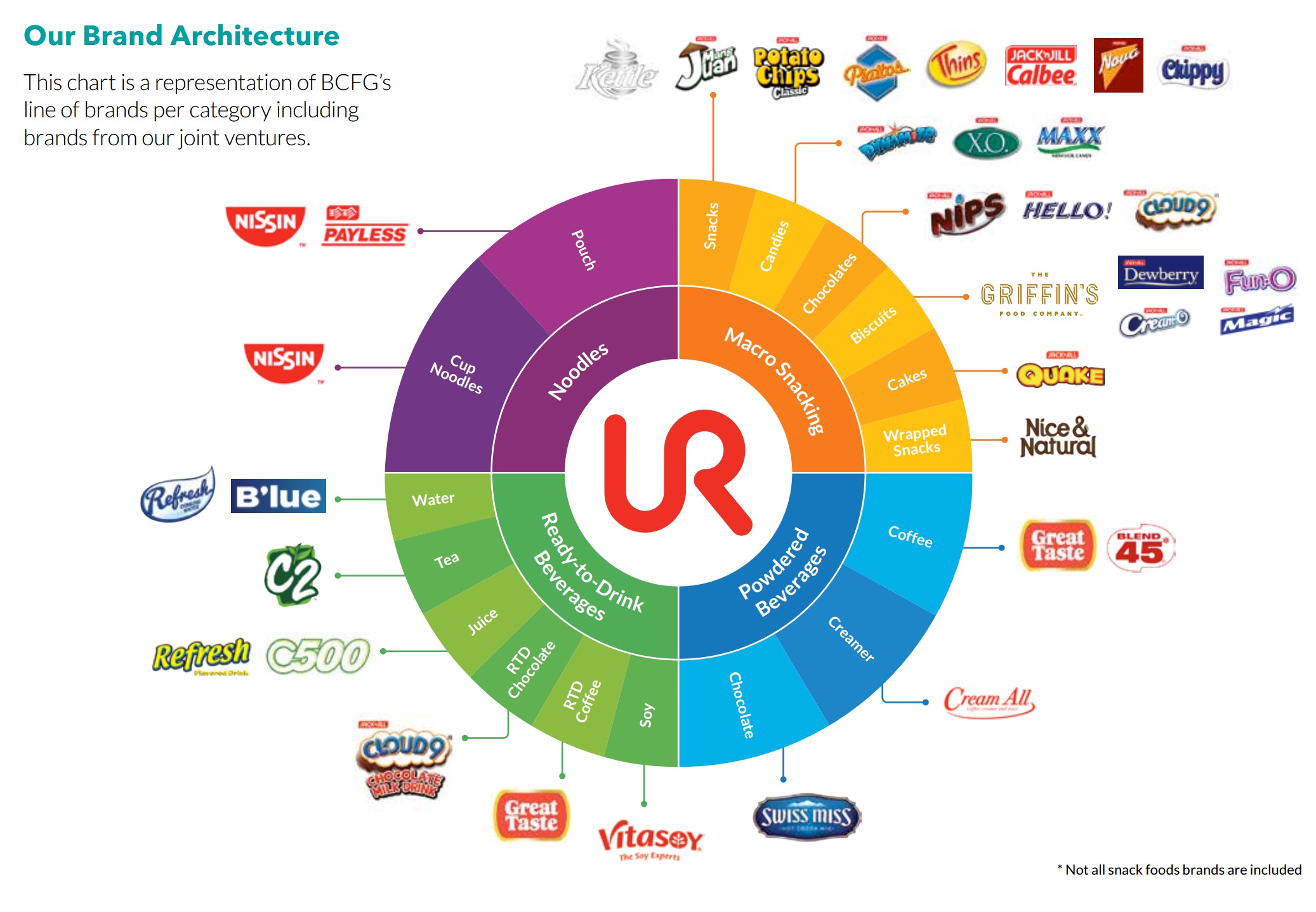

Source: Company websites In addition to its home market, URC also has presence in 12 other countries in Southeast Asia and Oceania. Its major international markets include Vietnam, Thailand, Indonesia, Australia and New Zealand.

In addition to its home market, URC also has presence in 12 other countries in Southeast Asia and Oceania. Its major international markets include Vietnam, Thailand, Indonesia, Australia and New Zealand.