Argan (AGX): A Cheap, Cyclical Construction Company With a Ton of Cash and No Debt

MEMBER WRITE-UP BY JACOB McDONOUGH

Argan is a holding company that owns a few different businesses, but the most important by far is Gemma Power Systems (GPS). GPS is an engineering, procurement, and construction contractor and consultant. The company mostly provides services related to the construction of natural gas power plants, but also has worked on wind and solar projects in recent years. Argan acquired GPS in December 2006 for $33 million, and since then it has produced over $607 million in cumulative EBITDA. Argan has a ton of cash with no debt, and is selling at a very cheap price based on historical earnings. Also, the company doesn’t require any capital to operate. However, there is a lag time in between projects, which will lead to poor results over the next few quarters.

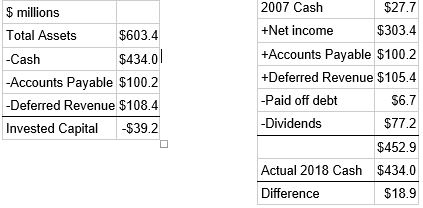

Invested Capital

In most cases, Argan can operate with negative invested capital. When projects are in process, the business is funded through accounts payable and deferred revenue. In the most recent 10-K from January 2018, the company had total assets of $603.4 million, and cash of $434 million. As long as the company has new business coming in, this cash is not needed for operations. Accounts payable was $100.2 million, and deferred revenue was $108.4 million. If we subtract these items from total assets, this comes to a negative figure of -$39.2 million. If you include the accrued expenses and long term deferred taxes, the invested capital figure becomes even more negative. This is important because the profits Argan generates becomes cash for owners, even when the business is growing rapidly. In 2007, Argan had cash of $27.7 million with $6.7 million in debt. Since then, the company has produced net income of $303.4 million. If you add up the cumulative net income, the 2018 accounts payable and deferred revenue, then subtract the cumulative dividends paid and reduction of debt, this gets us within $18.9 million of the actual ending cash balance in 2018, which is pretty close. The remainder can mostly be explained by acquisitions over the years.

In most businesses, owners must invest money in order to grow. Argan’s cash was able to build up on the balance sheet even during a period of rapid growth. Sales in 2008 were $206.8 million compared to $892.8 million in 2018, which is a compound annual growth rate of 15.8%. The company had a net loss of $3.2 million in 2008, compared to net income of $72 million in 2018. The accumulation of cash during a period of such growth is proof of the low capital requirements of the business.

High Uncertainty and Volatility Ahead

With so much cash on the balance sheet and zero debt, the risk of the business failing is very low. However, the company’s near-term future is uncertain. GPS finished some large projects this year, and will have a lag time before new projects begin in 2019. This lag time will cause the company to have a few rough quarters coming up. The company will burn through some of the cash on the balance sheet due to the temporary decrease in revenue, and the deferred revenue line on the balance sheet has disappeared. This means that the cash on the balance sheet is needed in the short term, and can’t be totally excluded from invested capital in this scenario. However, once the company weathers the storm over the next few quarters, the cash will build up and go back to being unnecessary for operations.

Valuation

At close on 10/29/2018, Argan is selling for $43.82 per share, or $682.2 million. Cash has declined to $361.7 million over the first 6 months of the year. If you back out the cash, the business is selling for $320.5 million. This valuation would provide an initial yield to owners of 14.4% based on trailing twelve month earnings, or 22.5% based on full year profits reported in the 10-K from January 2018. For a business with a history of rapid growth and low capital requirements, this looks very attractive. However, investors should be cautious of looking in the rear-view mirror, especially in this case.

Construction is a cyclical industry, and Argan has enjoyed rapid growth over the past decade. Valuations of cyclical businesses may look artificially cheap after a period of growth. I have no idea where we are in the cycle, but it is something to keep in mind after experiencing so much growth. Also, the lag time over the next few quarters will make sales and profit figures look very poor. Net income has already dropped to $46.1 million over the trailing twelve months, down from $72 million in January 2018. As I said before, the net income figures will look even worse over the next few quarters. However, if the company can earn $20 million on a regular basis, which was close to the earnings 5 years ago, this would yield investors over 6% based on the current valuation. In this scenario, net income would have to decrease by over 50% and never recover. The current stock price implies low market expectations, so there is some real upside if Argan can recover to the heights of the last few years.

Argan reported a project backlog of $474 million as of July 31, 2018. The company also has a contract to build a 1,600 MW natural gas plant in Virginia. This hasn’t been included in the backlog yet because the project won’t begin until 2019. The project backlog from this project, as well as others they have received contracts for, could be potentially as high as $1.5 billion according to the company. The last time the backlog was over $1 billion the stock price was over $65, or 48.3% above the current price of $43.82 per share. Even though there is near-term uncertainty, the project backlog should comfort investors of its medium-term future.

Additional Risk Factor

There is another factor to consider in Argan’s business, but I can’t decide if it is a major risk, or a slight competitive advantage. On page 4 of the most recent 10-K, Argan discloses information regarding its project development participation. In the past, Argan has provided financing for certain projects when they were in the early stages of development. This is risky because it is unclear at the time of financing whether or not the project will happen. However, it helps Argan secure contracts if the projects are successful, and the company can earn interest and success fees if it all works out. This looks like a risky venture capital type investment, but maybe this is a competitive advantage due to Argan’s strong balance sheet. Argan earned fees of $31.3 million in fiscal 2017, which was 44.7% of net income that year. If these success fees are non-recurring, then net income could be inflated for fiscal 2017.