Auto Dealership Groups

Thesis

- Auto dealership groups with scale are attractive businesses with good profitability and attractive growth opportunities driven by industry consolidation.

- Dealership franchises are protected from competition by regional exclusivity. They earn high margins on vehicle parts & servicing by acting as the warranty arms and parts distributors for their major automaker partners.

- Despite similar economics and growth opportunities, U.K. auto dealerships look cheap relative to their global counterparts. Vertu Motors plc (LSE:VTU) looks particularly cheap despite less debt / risk, better past growth, improving margins & profitability, much better cash flow generation, and better growth opportunities.

- Vertu Motors has a great management team including a young founder / CEO with skin in the game, a sound strategy / track record of execution, and excellent capital allocation.

- The largest dealership groups have the unique ability to thrive in both good times in bad. Profitability is better during downturns in the economy that you’d expect while offering significant opportunities for further industry consolidation at attractive prices.

- Key industry risks sound worse than they probably are. Threats to the dealership model are likely overblown because OEMs are unlikely to abolish it and online retailers like Amazon have numerous hurdles to overcome to compete directly with dealerships (eg. Distribution & servicing outlets). It is unclear whether ride sharing is a threat or a boon to dealership sales & profitability and the impacts of autonomous vehicles is farther off than valuations suggest.

- OVERALL: Vertu Motors is an above average business, with excellent management, a reasonable risk profile, trading at a very attractive price.

Industry Overview

- How do auto dealerships make money?

- Most automotive dealers sell new & used vehicles and automotive services (including maintenance & repair).

- They also often help arrange automotive finance and insurance products for their customers. Many sell parts & accessories as well.

- Ultimately, car dealers have four key goals: sell you a car; sell you a car loan (or get you to lease the car); sell you insurance; and get you back to the dealership for service and eventually a trade in.

- What geographic regions did I study?

- I looked at four regions of the world with established auto dealership groups: North America, Europe, Oceania, and the U.K.

- What are the business economics like?

- Dealerships get more than half of their revenues from new-vehicle sales, but most of car dealership profits come from the sale of used cars, parts and service, from acting as a middleman in securing loans and leases, and from the sale of so-called Finance & Insurance products like extended-service contracts. The key to the business is less about making huge profits on the sale of new cars and more about the repeat business from servicing those vehicles.

- While there is small need for capital (dealers ‘floorplan’ their operations, with auto finance companies and other lenders owning the cars that have been sold), the initial capital outlay to build a dealership can be immense (in the U.S., a larger auto dealership can cost $20-$30MM to build), and due to business complexity and slim gross margins on new car sales, dealerships must be run very efficiently with minimal overhead to offer attractive returns.

- It is a very fragmented and competitive industry with slim margins. The top 10 largest U.S. dealership groups account for roughly 6% of total vehicle sales. A similar story exists in the U.K. with the 10 largest dealerships representing ~13% of total new and used vehicle sales. Gross margins on new cars can range from as low as 2% for fleet and commercial vehicles. Thus, economies of scale are increasingly important in separating the winners from the losers.

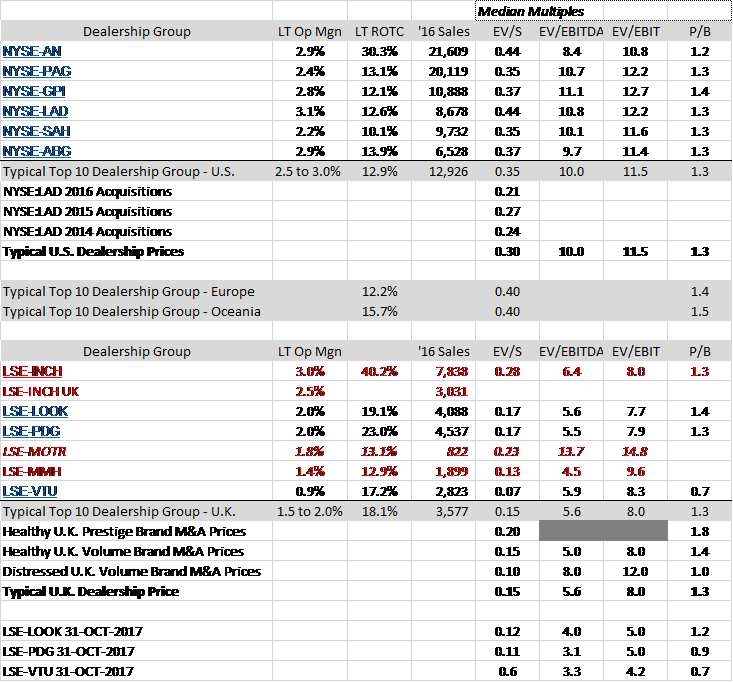

- Scale comes in the form of buying power and spreading overhead costs across a larger revenue base. As a result, larger groups enjoy better economics. Autonation, the largest dealership group in the U.S., has a long-term return on tangible capital (ROTC) of 30.3% versus 12.9% for a typical top 10 dealership group. In the U.K., top 5 dealership groups by size like Lookers plc, Pendragon plc, and Vertu Motors have achieved long-term ROTC’s of approximately 17-23% versus 13% for dealership groups in positions 6 to 10.

- The demand on scale within the industry has led to considerable consolidation with the number of U.S. dealerships shrinking by 1.9% per year over the last 11 years and the number of U.K. dealerships shrinking by 2.6% per year over the same time period.

- “UK consolidation started in 2002, with block exemption rule changes,” says Daksh Gupta, chief executive of Marshall, referring to EU regulations which eased manufacturers’ chokehold on who could handle their products. “Since then it’s been phenomenal.” “It’s a scale game,” he added. “To get into top 100 of car sales you need sales of £137m. There’s a big gap between the handful of the biggest listed dealers and the remainder. Effectively there’s more than 90 private dealers out there to be bought in the top 100.”

- James Baggott, editor in chief of Car Dealer magazine, says car dealers need scale to take advantage of manufacturers’ offers. Scale and cash availability also allows the larger groups to take advantage of the way manufacturers are doing business. At short notice car companies can offer large packages of cars to dealers at a discounted price so they can hit targets. “These bulk deals can be seven-figure sums – we’re talking offers of dozens £60,000 prestige cars as long as the dealer can take them tomorrow,” says Baggott. “You need cash to be able to take advantage of that of those deals.”

- How big is the industry? Who are the key players?

- In the U.S., approximately 16MM new vehicles are sold each year, and roughly 38MM used vehicles are sold. The U.S. population is ~ 323MM, so roughly 1 in 6 persons change out their vehicle each year (1 in 20 buy new, 1 in 9 buy used).

- Top U.S. dealership groups include:

- Autonation (NYSE:AN)- 1st largest automotive dealer in the U.S. Operates ~260 dealerships in 16 states (primarily in Sunbelt metropolitan areas). Annual sales > $21B. Estimated U.S. Market Share of 1.2%. Investing mostly in building their brand & digitizing the customer experience.

- Penske Automotive (NYSE:PAG)- 2nd largest automotive dealer in the U.S. Operates 164 U.S. franchises in 20 states + 191 franchises overseas (primarily in the UK). Annual sales > $20B. Includes > 40 brands. Estimated U.S. Market Share of 1.0%. Investing in expanding through commercial truck dealerships, international car dealerships, and buying up more ownership in Penske Truck Leasing.

- Group 1 Automotive (NYSE:GPI)- 3rd largest automotive dealer in the U.S. Operates about 160 automotive dealerships, 210 franchises, and 38 collision service centers in the U.S., U.K., and Brazil. S. locations concentrated in 15 states in the Northeast, Southeast, Midwest, and California. Annual sales > $10B. Includes 31 brands. Estimated U.S. Market Share of 0.6%.

- Lithia Motors (NYSE:LAD)- 4th largest automotive dealer in the U.S. Annual sales > $8B. Includes 30 brands. Estimated U.S. Market Share of 0.5%. Lithia Automotive is the only big dealership of the bunch that is hyper focused on growth through acquisition of other dealerships.

- Van Tuyl / Berkshire Automotive Group (Berkshire Hathaway Subsidiary)- 5th largest automotive dealer in the U.S. Has 85 independently operated dealerships and over 100 franchises in 10 states (CA 5; AZ 28; NM 2; TX 34; NE 7; MI 15; IL 3; IN 4; GA 4; FL 7). Annual sales > $9B. Estimated U.S. Market Share of 0.5%. The Van Tuyl Group ownership structure is set up so that each individual dealership is its own legal entity in which the managers hold a minority stake described by Jeff Rachor, CEO-to-be of Berkshire Hathaway Automotive, as “meaningful.”

- Sonic Automotive(NYSE:SAH) – 6th largest automotive dealer in the U.S. Annual sales > $9B. Estimated U.S. Market Share of 0.5%. Sonic Automotive is venturing into a CarMax-like independent used car dealership business. Its EchoPark business has an interesting private seller program where EchoPark facilitates a private car sale transaction: Buyer and seller meet at an EchoPark location, EchoPark technician inspects car and provides feedback, then EchoPark helps with paperwork. EchoPark even offers financing to the buyer. It’s an inventory-free strategy.

- Hendrick Automotive (Privately Held) – 7th largest automotive dealer in the U.S. Annual sales > $8B. Estimated U.S. Market Share of 0.4%.

- Asbury Automotive (NYSE:ABG) – 8th largest automotive dealer in the U.S. Annual sales > $6B. Estimated U.S. Market Share of 0.3%. Asbury Automotive is exploring the online world by expanding into an independent used car dealership business similar to CarMax (NYSE:KMX).

-

- In the U.K., around 2.5MM new vehicles are sold each year, while approximately 7.5MM used vehicles are sold. The U.K. population is ~ 65MM, so roughly 1 in 6.5 persons change out their vehicle each year (1 in 26 buy new, 1 in 8 buy used).

- Top U.K. dealership groups include:

- Pendragon plc (LSE:PDG)- 1st largest automotive dealer in the U.K. 218 retail points. Annual sales > 4.5B GBP. Estimated U.K. Market Share of 2.7%. Have a number of complimentary businesses within the Group which include: ‘Pinewood’ for dealership management systems, ‘Leasing’ for fleet and contract hire vehicles and ‘Quickco’ for wholesale vehicle parts.

- Sytner Group (wholly owned by Penske Automotive)- 2nd largest automotive dealer in the U.K. 191 franchises overseas (primarily in the UK). Annual sales > 4.2B GBP. Estimated U.K. Market Share of 2.0%.

- Lookers plc (LSE:LOOK)- 3rd largest automotive dealer in the U.K. Annual sales > 4.0B GBP. Estimated U.K. Market Share of 1.8%. Lookers’ strategy is based on the “Best Brands, Best Locations, Excellent Execution”.

-

-

- Arnold Clark Automobiles (Privately Held)- 4rd largest automotive dealer in the U.K. Began in Glasgow and expanded into other parts of Scotland & then England. Has 200 dealerships + 24 franchises. Annual sales > 3.3B GBP.

- Inchcape plc (LSE:INCH)- 5th largest automotive dealer in the U.K. Annual sales > 2.6B GBP.

-

- Vertu Motors plc (LSE:VTU)- 6th largest automotive dealer in the U.K. Estimated U.K. Annual Sales > 2.8MM GBP. Includes 30 brands. Market Share of 1.3%.

- What are the industry trends?

- As mentioned previously, industry consolidation is a major theme.

- Another major theme is digitization with most dealerships trying to take a bigger share of their leads from the internet. Building their brand and improving their websites is a big part of this strategy. Dealerships want to make it possible for consumers to start the car-shopping process at whatever point they want, and offer them the ability to search inventory and hold a vehicle.

- Most dealerships are also making an effort to streamline the auto sales process – trying to get the customer in and out of the store in 30 minutes, haggle-free. This effort is driven by studies showing how much most consumers dislike the car buying process and the need to simplify the process.

- Many dealerships are also moving away from high-pressure sales tactics and more towards informing their customers about features. This theme is being driven by increased pricing transparency and product knowledge prior to dealership visits (customers in recent years are much more likely to visit a dealership with an idea of what they want and what it should cost due to research they’ve conducted on the internet prior to visiting the dealership).

- Some dealerships, like Autonation, are expanding their collision repair businesses in an effort to grab a larger portion of the high margin parts & servicing sales.

- What does industry growth look like?

- In the U.K., the historical long-term trend of new car unit sales has tracked population and GDP growth; however, future growth may be impacted by disruptions such as ride sharing & autonomous vehicles (see Key Risks for more).

Safe- Moat?

- Dealerships, even though many are now owned by big dealer conglomerates, are still local businesses. Buffett has shown with his newspaper acquisitions that he likes local when there are compelling business reasons to invest in the idea. A well-run car dealership selling the right vehicles in a community can develop something of a monopoly that’s analogous to what local papers can do with local advertisers — a process that’s supported by carmakers, who restrict the number of franchised dealers that can sell their cars in a particular region.

- High margin parts & servicing sales grew in the U.K. during the financial crisis, offsetting the slowdown in new and used car sales. Good operators were able to sell down inventory quickly and ride out the storm and maintain positive earnings.

- Dealerships are the warranty arms, part distributors for the OEMs. Parts & service is a dealerships most profitable work and there is currently no good competitive alternative.

- Buffett: “It’s always a great time to be in this business. Automobiles are central to every family and will always be around. It’s a very, very fundamental business. It will be a fundamental business 50 years from now, and 100 years from now, and we’ll still be in the business then and I hope we’re a whole lot larger.”

Value Opportunity

- The U.K. market always seems to trade at a considerable discount (cheaper on a price-to-sales and price-to-earnings basis) to other regions despite as attractive profitability and growth opportunities.

- The largest dealership groups in the U.K. look very cheap relative to their historical prices.

- Simplified Sum-of the parts for Vertu Motors: 127x healthy franchises at EV/S valuations of 0.10x to 0.15, results in a discount to EV of 156.9MM GBP on 8-NOV-2017 of between 44% and 63%.

- Vertu Motors’ P/B of 0.68x on 8-NOV-2017 represents a discount of 47% to the industry’s typical P/B of 1.3x. The company’s EV of 156.9MM GBP is 20% less than the book value of the company’s freehold & long leasehold land that is on its books.

- Current FCF / EV yield is 23%; normalized FCF / EV yield likely to be 9-11%.

- Vertu Motors looks particularly attractive, trading at a discount to competitors in the U.K. despite less debt / risk, better past growth, improving margins & profitability, much better cash flow generation, and better growth opportunities.

- Vertu Motors EV/Mkt Cap = 88% versus 115% for Lookers and 139% for Pendragon.

- 2008 to 2016 revenue CAGR 17.8%. Lookers 10.9%. Pendragon 10.8%.

- 2008 to 2016 operating profits CAGR 40.5%. Lookers 12.3%. Pendragon 9.5%.

- 2008 to 2016 net income CAGR 51.7%. Lookers 14.3%. Pendragon 9.9%.

- Operating margins expanded from 0.2% in 2007 to 1.1% in 2016.

- Net margins expanded from 0.01% in 2007 to 0.9% in 2016.

- Return on Tangible Capital grew from 4% in 2007 to 19% in 2016. Lookers in 2016 was 26%. Pendragon was also 26% in 2016.

- 2008 to 2016 CFFO CAGR 13.4%. Vertu converted 199% of EBIT into CFFO over this time frame. Lookers 71%. Pendragon 85%. Typical industry player is 70%.

- Vertu due to its low debt levels and smaller size, has better growth opportunities than its larger, more indebted competitors. The company has done particularly well with respect to growing aftersales (the highest margin business for auto dealers).

Vertu Motors Management

- Shareholder friendly: Founder / CEO with skin in the game (as of 7-AUG-2017, CEO Robert Forrester owned 6,929,868 shares of common stock, valued at ~ 3.118MM GBP, representing 1.77% of the shares outstanding).

- Excellent strategy & execution: 1) Grow through acquisitions at attractive prices, then improve the efficiency of the acquired dealerships (drastically improve cash flow generation), 2) Customer service focus / focusing on high margin aftersales, 3) Focused on building strong relationships with OEMs. 4) Business remained profitable through financial crisis.

- Excellent capital allocation: 1) Price discipline in acquisitions. 2) Looks for freehold property and long leases as part of acquisitions. 3) Recent buybacks at very attractive prices.

- Maintains an incredibly strong balance sheet; could be very helpful if another financial crisis arrives and acquisition targets become extremely cheap again.

- Huge runway for growth through acquisition with highly fragmented industry, attractive valuation target prices in the U.K.

- Essentially, the business is run the way I think I it should be run.

Mis-Pricing / Mis-Judgement

- The largest dealership groups should thrive in both good times and bad:

- If the industry remains strong, most dealerships should continue to thrive.

- Dealerships have multiple lines of business, each contributing to a healthy bottom line when times are good, and often even when times are bad because people tend to need transportation no matter what the economy is doing.

- The biggest dealer groups due to scale have the best chance of long-term success in the industry and are the best positioned to take advantage of an industry downturn. Industry consolidation will continue.

- Gross margins were stable through the financial crisis for most of the large auto dealer groups in the U.S. and the U.K. Autonation, Penske, Group 1 Automotive, Lithia, Sonic, Inchcape plc, Lookers plc, Pendragon plc, and Vertu Motors all achieved higher gross margins in 2008 & 2009 than the years leading up to the financial crisis.

- Large dealer groups who were able to react quickly to dropping demand by slashing inventory and reducing operating costs during the financial crisis were able to maintain positive earnings during 2008 and 2009. Van Tuyl / Berkshire Hathaway Automotive, Inchcape plc, and Vertu Motors were all able to achieve positive net margins during 2008 and 2009.

Key Risks

- Economic slowdown (slowdown in vehicle sales, increased loan risk):

- In took nearly 5 years for most of the largest U.S. auto dealer groups to start growing revenues beyond 2007 levels (profits recovered within 4 years); however, aided by industry consolidation and increased aftersales, players like Lookers plc and Vertu Motors actually grew their revenues (though moderately) right through the downturn. It took two years for Lookers’ net income to surpass that from 2008, while Vertu (whose business was in its infancy), grew its 2008 net income above its 2007 level.

- Most new car sales (~83%) and many used car sales (~47%) in the U.K. are sold using personal contract purchases (PCP). The U.K. subprime PCP market is negligible, and the OEM takes all the credit and residual value risk. OEM loss ratios run around 0.2%.

- Dealership model will vanish in favour of online sales (either direct from OEMs or via online retailers like Amazon):

- Part of the problem would be that neither the OEMs or Amazon currently have the density of distribution centres to make it convenient for customers to pick up their vehicles. For example, Volvo and mobile app maker Fair both require online purchases to be picked up at the nearest physical dealership. Even a company like Tesla, who is actively pursuing the direct to consumer model concedes that it is likely to head down the road of adding franchised “showrooms”.

- Another key challenge is the lack of service centres to offer customers servicing support. Dealerships are the warranty arm and parts distributors for the OEMs and that is unlikely to change in the near-to-medium term.

- In the U.S., there are also state regulations that prevent OEMs from competing directly with their franchise partners (ie. the franchise law).

- While the dealership model has weaknesses (most notably that they are independent businesses that affect the brand, steal profitability, and lead to sales experience inconsistency), they also enable the OEMs to focus on their core business, reduce capital needs / enable fast growth, offer nearly guaranteed cash flow, and offer local market expertise.

- Autonation CEO Mike Jackson: Do you see a day when there aren’t AutoNation storefronts, just digital orders? “No, absolutely not. Customers—and I’m talking about 90% of customers—want a brand they can trust, they want a great price, of course, and they want to be in control. But it is a big purchase. They want the ability to come in, test-drive, compare and confirm they made the right decision. That happens at a physical location. Now, the equation is changing somewhat, and what happens within the brick-and-mortar storefront is changing dramatically. Consumers come into stores with more information and expect help, not a hard sell, from salespeople. But brick and mortar still has a role. I think in automotive retail with a price point on new vehicles of $35,000 and preowned vehicles of $20,000, I don’t see that changing.”

- Buffett on Tesla and threat of an online sales model: “I do not see it as a threat. They are challenging the dealer system, but the dealer system works well for the manufacturer, works well for the dealer, works well for the consumer, and it’s been around now for a very long time. And usually, when a distribution system becomes that firmly established, there’s a reason for it and I just don’t see that changing.”

-

- A more likely scenario for an online retailer like Amazon might be a tweak of the current model whereby they generate and are compensated for sales leads provided to dealers.

- A more likely scenario overall is a tweak of the dealership business model with smaller showrooms, example models you can test drive before customizing and ordering your model, all enhanced by online information, price transparency, and showroom reps who provide info rather than high-pressure sales tactics.

- Ride sharing & autonomous vehicles impacting dealership sales growth:

- Today’s marketplace is 70% personal use and 30% shared (which includes rental cars, taxis, buses, etc.).

- Studies show conflicting data on the impact of ride sharing / self-driving cars on vehicle sales. What is likely, however, is that ride sharing growth will continue, particularly in larger metropolitan centres (populations > 500,000). Thus, due to larger urban driving populations, Europe and Asia are the most likely regions to be affected.

- The real game changer is likely to be autonomous vehicles. Self-driving cars would enable mobility players to reposition vehicles optimally, allowing smaller fleets to provide adequate coverage and reducing the fixed cost base. Autonomy would also let companies target different user segments via smaller differentiated fleets of vehicles. Vehicle self-parking capabilities could reduce inner-city congestion (for instance, by self-parking in less densely populated areas). These inherent benefits could make car sharing more acceptable to local governments and would likely also increase customer use of the service.

-

- The most pessimistic report (ie. Barclay’s) shows auto sales dropping by 40% in the next 25 years (2% per annum) while the most optimistic report (McKinsey) suggests new auto sale growth rates dropping from 3.6% per annum from 2010 to 2015 down to 2.4% per annum from 2015 to 2030.

- Autonation CEO Mike Jackson believes that autonomous vehicles will be very disruptive to the 30% that’s shared in the relatively near future (5 to 10-year horizon), but due to their high cost and limitations, will take longer to impact personal use.

- What is likely more relevant for auto dealerships is how ride sharing & autonomous vehicles will affect parts & servicing sales. Reports disagree on whether an increase in ride sharing will mean more total vehicle mileage (expanding mobility) or decrease it (consumers making fewer daily trips). More mileage would obviously mean more servicing sales and vice versa.

Disclosure

- I am long shares of LSE:VTU.

Share: