AutoNation (AN): A Cheap Cannibal with Minimal Downside

Member write-up by Dave Rottman

Introduction and Overview

AutoNation (AN) is the largest automotive retailer of new and used vehicles in the United States. As of the end of 2017, they owned and operated 360 new vehicle franchises with 33 different new vehicle brands through 253 dealership locations concentrated in major metropolitan areas primarily in the southern Sunbelt region. AutoNation also owned and operated 76 collision centers scattered throughout the continental US.

Prior to 1999, AutoNation was named Republic Industries and was involved in waste management and then later electronic security services, vehicle rentals, and automotive retailing. Since the turn of the century, AutoNation has been focused exclusively on the automotive retail business.

Despite changing conditions in the coming years with the advent of online automotive retailers, autonomous vehicles, increased ride sharing, and electric vehicles, AutoNation offers investors several attractive characteristics.

First, as the largest automotive retailer in the United States, AutoNation enjoys benefits of scale both in terms of lower general and administrative overhead and in volume discounts when purchasing parts for the repair business and even inventory from manufacturers. As the automotive retail industry continues to undergo consolidation into a less fragmented market, these benefits are likely to amplify and strengthen the competition position of those players with scale, like AutoNation.

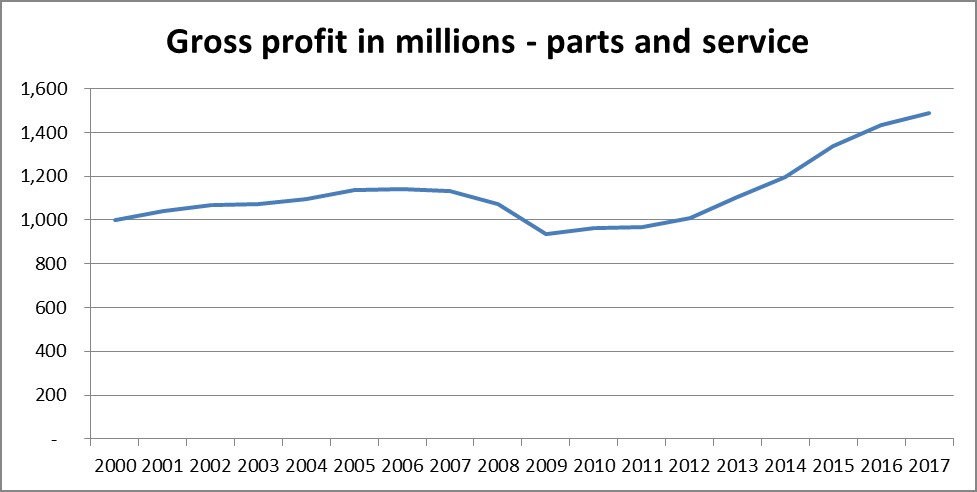

Next, the business generates a large and noncyclical stream of cash flow related to its parts and service business that has increasingly become a larger portion of earnings. While new and used car sales and the associated finance and insurance revenues are cyclical, parts and service earnings have provided a stable base of cash flow. In addition to stabilizing the cash flow of the overall business, this has also allowed AutoNation to consistently funnel cash into stock buybacks when shares prices are attractive, leading to a 5, 10, and 15 year growth rates of approximately 10% in earnings per share. This is impressive considering that the sales volume of actual new and used vehicles has essentially been flat over the course of the cycle.

Further, AutoNation holds a large amount of attractive real estate that provides a meaningful asset-based value that can be sold as a next-best use that supports valuations if earnings power were to become impaired or if/when AutoNation decides to decrease its physical presence.

Finally, and more speculatively, in late 2017 AutoNation announced a partnership with Waymo – Google’s autonomous vehicle company – where AutoNation will maintain and repair Waymo’s autonomous fleets. While the actual value this will provide to AutoNation is extremely uncertain at this point, it does serve as an offsetting factor to the risks posed by increased use of autonomous vehicles and ride sharing by hitching AutoNation up to the dominant player in autonomous vehicles in the nascent stages of this development.

The Business

There are four parts to AutoNation’s business: new vehicle sales, used vehicle sales, parts and service (P&S), and finance and insurance (F&I).

New and used vehicle sales are straightforward: generally speaking AutoNation purchases new vehicles from manufacturers and used vehicles from customers via trade-ins and a few other sources.

AutoNation then sells these vehicles through its dealership locations and digital storefront. In the last few years, AutoNation has made large investments in its online presence, which now includes listing its entire used inventory online for purchase at a “no-haggle” single price, what they call AutoNation One Price. AutoNation has dedicated meaningful effort at evolving with the times, pivoting its marketing strategy to include a major online presence in addition to the legacy dealership model.

P&S represents a wide range of work including vehicle maintenance, general repair, collision repair, manufacturer recall repair, other warranty work, reconditioning of used vehicles for sale, and a variety of wholesale parts operations.

F&I income is connected with new and used vehicle sales and represents the variety of automotive finance and insurance products related to automotive sales. The financing arrangements, like installment loans or leases, are arranged by AN, who is paid a commission, and go through an external provider. AutoNation does not directly finance purchases or leases. The insurance piece of business is related to various vehicle protection products including extended service contracts, maintenance programs, guaranteed auto protection, and other types of protection. For the most part, these protection products are underwritten and administered by independent third parties, and AutoNation is paid strictly on a commission basis.

New and Used Vehicle Sales

The sale of new and used automobiles is not an especially attractive business by itself. Margins on used automobiles are slightly higher than on new automobiles, but in neither case are the product economics especially attractive due to the combination of thin margins and non-rapid inventory turnover. The terms dictated by manufacturers have effectively turned the sales of new vehicles into a commodity business. The poor economics on inventory sales are partially offset by the inventory floorplan financing program provided by the manufacturer at very low rates of net interest. The ability to acquire inventory for sale at low interest rates serves to leverage poor product economics on the sale of automobiles for slightly better overall economics.

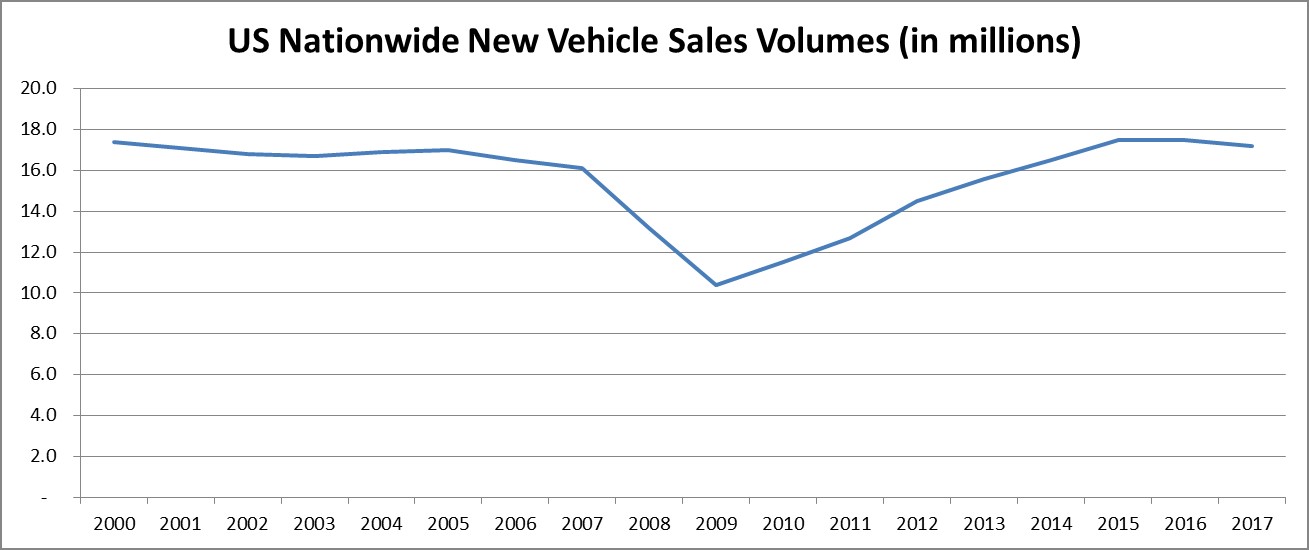

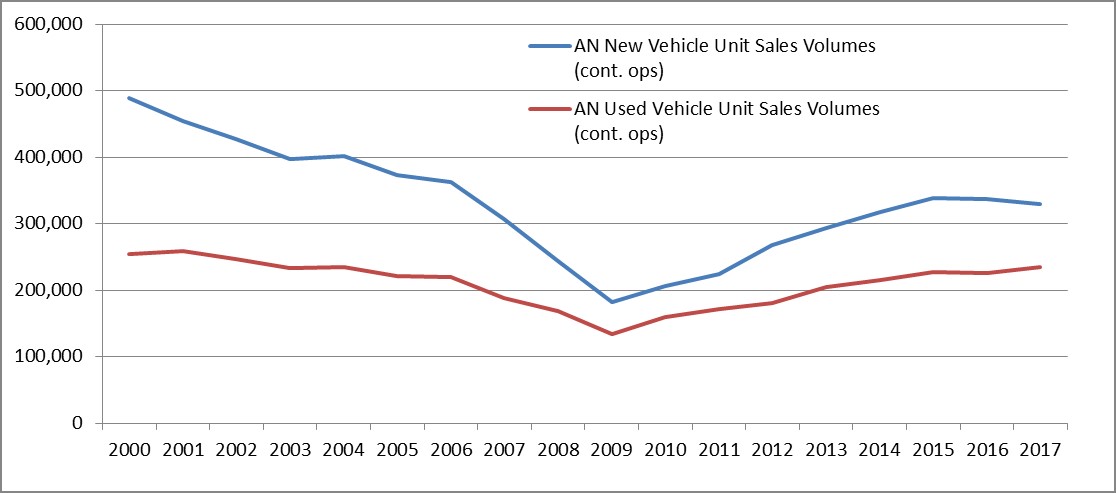

Additionally, the market for automotive vehicles is cyclical, with cycles lasting approximately 10-15 years. AutoNation’s sales volumes have roughly tracked the cycle, with new vehicle sales being more affected than used vehicle sales.

Despite the mediocre economics and challenges of selling vehicles, these sales are essential in that they allow AutoNation to participate in the P&S and F&I businesses that are much more lucrative.

Parts and Service

It is important to emphasize out that while P&S was only 16% of 2017 revenues, it was 44% of gross profits. While P&S is noncyclical (with only a modest dip in a severe recession), the other three segments ebb and flow with the overall level of auto sales. However, P&S is a large chunk of gross profits and has been increasing in recent years as part of a dedicated effort by management to focus on this business, part of which includes adding more collision centers. The cash flow of the P&S business is durable and provides a solid foundation for AutoNation to be able to service debt, repurchase shares, make acquisitions, and maintain their physical and online presence even in an economic downturn.

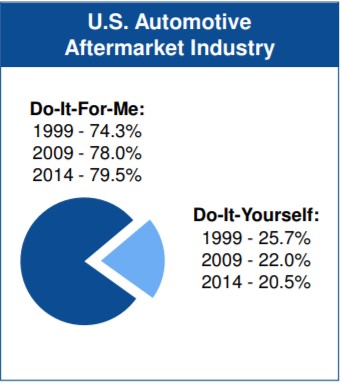

A minor point is that Do It Yourself (DIY) has become a smaller percent of aftermarket automotive work over the past couple of decades. According to Monro Inc., an automotive service company, “DIFM” (do it for me”) has increased from 74.3% in 1999 to 79.5% in 2014. This is a trend likely to continue, especially considering the ever-increasing complexity of automobiles.

Finance and Insurance

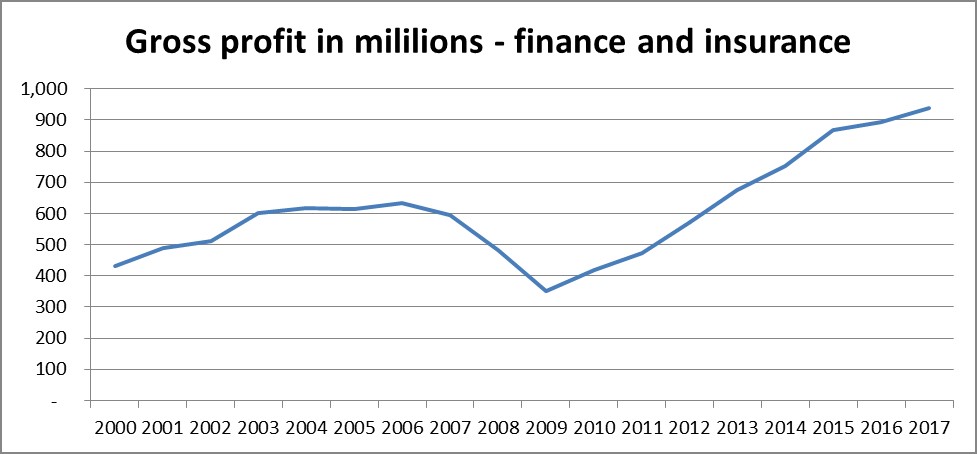

The F&I business, while tied to the overall level of vehicle sales as these revenues are earned on a commission basis, has been growing between 5% and 10% annually over the past 10 and 5 years. As the level of car sales has stayed relatively flat, this has resulted in F&I representing an increasing portion of AutoNation’s overall revenues. Since there are basically no direct costs associated with this revenue, F&I’s impact on gross profit has become even more pronounced and is likely to continue doing so. This highly profitable segment represented 4% of revenue and 28% of gross profit in 2017.

Overall Business Composition

To put it all together, the relative role of these segments has evolved over time. The noncyclical P&S becomes an increasingly large portion of business over time, F&I has become an increasingly large portion that still varies somewhat with the cycle. Meanwhile, new and used vehicle sales ebb and flow with the cycle, but has become less important to AutoNation’s earnings as time has gone on, as a result of a concerted management effort. All in all, this results in a surprising stability of cash flow for a business that is tied to a cyclical factor like overall automotive sales. Since 2000, AutoNation has had zero years with negative cash flow from operations or free cash flow, and only one year with negative income which resulted from a large Goodwill impairment write-down in 2008.

Economics

AutoNation’s overall economics are good with returns on capital (average pre-tax operating profit to tangible capital) of around 25%. This may be surprising, but these levels are obtained due to the floorplan financing programs coupled with strong returns on P&S and F&I businesses. With that said, limited areas for reinvestment limit the usefulness of these economics as AutoNation is unlikely to be able to deploy large amounts of incremental capital that earns such returns. They may acquire new dealerships, but in these cases the purchase price will determine returns.

Growth

As discussed above, AutoNation has limited opportunities for organic growth in sales and earnings. State laws and manufacturer franchise restrictions limit the number of new vehicle dealerships that can be in place, which limits the growth in vehicle sales. Growth will be limited to the expansion in the P&S business (currently occurring with the addition of more collision centers), growth in F&I revenues, acquisitions of existing dealerships, and general pricing increases. It is difficult to estimate exactly how much AutoNation will be able to grow overall earnings as there are several different components to the business and the industry is undergoing change, but I think it’s reasonable to estimate that over the cycle AutoNation will grow its earnings and cash flows around the rate of population growth plus inflation, so roughly 3% to 5% annually.

Capital Allocation

Capital allocation at AutoNation consists of maintaining existing dealerships, building and acquiring new dealerships, developing a digital storefront and marketing strategy, and buying back stock.

The first three of those categories of capital allocation are critical but represent the minority of where capital has historically been allocated. It is worth noting that AutoNation has changed the number of dealership locations it has had over the years. After the recession, they trimmed their physical presence. And, since then, they have built it back up to some degree. More recently, they have allocated a meaningful amount of capital to developing their online presence. It is worth reiterating that although building out a new dealership is capital intensive, ongoing operations are not nearly as capital-intensive as the inventory is financed through dealer floorplan financing programs. This is what allows AutoNation to funnel most of its earnings towards uses other than simply maintaining dealerships.

But, as I mentioned above, the majority of capital allocation has been dedicated to share buybacks. In fact, over 5, 10, and 15 year periods AutoNation has repurchased its own stock in amounts exceeding its net income and free cash flow by taking on long-term debt at low interest rates. This has allowed AutoNation to lower its share count from 337M in 2000 to 149M in 2010 to 92M in 2017, making it a true cannibal. This is a 73% reduction in its share count over the last 17 years, or about 7% annually.

It is important to discuss the safety of this debt. AutoNation’s debt to total asset ratio has grown from around 10% to 25% over the past two decades and the ratio of total debt to earnings before interest and taxes (EBIT) has climbed from 1 to around 3.2 currently. The ratio of debt to EBIT generally stayed under 3.0, but in recent years has slightly exceeded 3 to fund large share buybacks. Given the maturity dates of the debt and the stability of AutoNation’s cash flow, I believe this is not excessive.

I believe capital allocation, via share repurchases, is an area where AutoNation has added significant value to its shareholders. Management has taken a business with good economics but slow growth and through the intelligent buyback of their own stock has generated reasonably strong growth in per-share value. Over the last 5, 10, and 15 year periods, management has growth earnings per share and free cash flow per share by a little over 10% annually. This growth in per-share value substantially outpaces the rate of growth in the underlying businesses because buybacks were done at prices below intrinsic value. For example, share purchases have been made at an average P/E ratio of 13 and at a price to trailing 3 year high ratio of around 80%. This, and the fact that AutoNation historically traded around 15 times earnings, indicates that management paid attractive prices for the shares. Further, the large increases in debt generally corresponded with particularly attractive share prices throughout the years. So, not only did management pay reasonable prices when buying back shares, but it also took out larger amounts of debt during those times when shares were especially cheap to amplify the effects of its cannibalism.

It is worth noting that management has specifically stated they are not interested in expanding outside of the United States. Management believes, and I agree, that AutoNation has meaningful benefits of scale (both in fixed cost leverage and in volume purchase discounts on vehicles and parts) that they would not be able to take advantage of to the same extent outside of the United States. This is especially true of the parts business, as AutoNation’s CEO, Mike Jackson, recently said his company has the best purchasing power on parts and supplies of any dealership in the United States. I find this attitude to be attractive as AutoNation will restrict themselves to allocating capital in areas where I know they have competence: growing the P&S and F&I businesses, acquiring new dealerships, and buying back stock.

All in all, I believe management demonstrates an ability to add value to shareholders through its capital allocation policies. While they allocate enough capital to maintain and grow the underlying businesses as much as it makes sense to do so, they dedicate most of their earnings to share buybacks at attractive prices. This allows them to turn AutoNation stock into a vehicle that outperforms growth in the underlying business. This is a key driver of growth in AutoNation’s per share value, and I believe this is one of management’s core strengths.

Risks

Like businesses in many other industries, AutoNation faces the risk of technological disruption. For car dealerships, this manifests as online competitors, (e.g. Carvana), a shift to autonomous vehicles, ride sharing, and electric vehicles. It is easy to see how these trends may damage traditional dealerships at some point, but it is not clear as to how everything will shake out exactly and even when these trends will take hold on a meaningful level.

In fact, it seems speculative to assume that these trends will radically shift the business model of automobile dealerships in the next few years given the issues with technological feasibility and economic viability of some of these changes. To be clear, there are major changes on the horizon, but I think the role of dealerships will evolve to adapt to the changes (e.g. a reduced physical footprint, fleet servicing stations, etc.) rather than go extinct. Further, AutoNation is as well-positioned as a dealership could be to manage these challenges. They have a solid online presence, they partnered with the leading autonomous company (Waymo) early on, and they have shifted their business to focus on the more stable P&S business. While things could go much worse than I expect for car dealerships, I do believe AutoNation is positioned to handle these challenges better than many of its competitors. Management’s attitude toward the changes is encouraging with Mike Jackson saying that they “want to be at the absolute intersection of autonomy, sharing, and electrification.” This is exactly where AutoNation needs to be to stay relevant and maintain its earnings during a time of change.

To discuss one example, if autonomous vehicles coupled with ride-sharing are technologically feasible and economically viable at a large scale in 15 years, this could materially change the way cars are sold and serviced. However, it is probable that large fleets of autonomous vehicles are going to be serviced by high-end reliable auto shops as opposed to small one-off shops, so a company with a strong reputation and national scale like AutoNation is extremely-well positioned to acquire this sort of business.

The increased use of plug-in electric vehicles (PEV) is also a threat to the current dealer model since P&S is such a large component of profits. Compared to vehicles with internal combustion engines (ICEs) PEVs are thought to require less maintenance because the battery/motor/associated electronics require little-to-no regular maintenance, there are fewer fluids to change, brake wear is reduced due to regenerate braking, and in a general sense there are fewer moving parts. As offsetting factors, replacing batteries is quite expensive for PEVs and to-date many PEVs require more frequent tire changes. Nevertheless, I think it is reasonable to assume that the increased use of PEVs will reduce the amount of work for auto shops. But it’s important to keep things in perspective. Currently, PEVs represent only 1.13% of new vehicle sales in the United States. The growth rate in recent years has been rapid and is likely to continue, but if we assume 25% growth in the percent of new vehicle sales for 10 years, 15% growth for the next 10 years, and 5% growth for the final 10 years, PEVs will represent 11% of vehicle sales in 2027, 43% by 2037, and 69% of vehicle sales in 2047. Since vehicles operate well in excess of 10 years with the average age of a vehicle around 11.5 years and total life being closer to 15 years, the actual percent of plug-in vehicles on the road will be lower than 69% even as long as 30 years from now. These assumptions may prove to be very inaccurate – I simply do not know. But the point remains that even with high rates of growth in the adoption of PEVs, given its currently low penetration rate and the relatively long life of vehicles, ICE vehicles will remain a large portion of vehicles on the road for several decades to come. Taking that into consideration and considering that PEVs will also need some, if less, P&S work, I do not consider this a game-changing risk.

It is worth discussing the risk of obsolescence of the traditional dealer model in even distributing vehicles at all. There has certainly been a push in recent years to selling cars online. Tesla goes even a step further with direct to consumer sales. Historically vehicle manufacturers have been legally required to rely exclusively on dealerships to sell vehicles as opposed to direct selling. Tesla is attempting to challenge this, but its reasons for doing so may not be simply to “cut out the middleman”. Tesla has stated that it does not want to sell through dealerships due to their conflict of interest in prioritizing traditional vehicles with internal combustion engines that lead to more parts and services work over electric vehicles. Regardless of the Tesla issue, the major automotive manufacturers (who are also developing PEVs) have made no indication of lobbying for law changes and side-stepping dealerships, so I believe this issue is overstated.

In fact, I think it is implausible to think that dealerships will disappear anytime soon. It is not as if vehicle manufacturers have not considered whether it makes sense to cut out the distributor. It is that there are substantial costs in managing large and heavy physical inventory over a huge geographic area (an issue for online automotive retailers), the business of managing real estate to house the assets, and the necessity to have service centers spread out and available for vehicle owners in all geographies to maintain vehicles through warranty and other work. In fact, this last issue has been an issue for Tesla customers as customers in some locations have had to drive for hours to reach the nearest Tesla service center. As a result of this issue, Tesla has had to increase the number of service centers, in effect simulating part of the dealership model.

Finally, in recent years there have been more online retailers of vehicles including companies like Carvana. But as I have discussed above, AutoNation has already listed its inventory online and has dedicated meaningful resources to its digital storefront. Because of inventory distribution issues and the necessity of warranty work, there will always need to be local, physical retailers. But there has been, and will continue to be a shift towards more an omni-channel marketing strategy with digital and physical sales complementing each other. This is not altogether a negative for dealerships, though, as this change is a chance to streamline operations by reducing redundant infrastructure, thereby freeing up capital for redeployment, and focusing more on higher-margin activities like service work.

Stepping back and thinking about the risks that face automobile dealerships – autonomous, ride sharing, electrification, direct selling, and online retailers – there are a lot of challenges in the future. But, some of these challenges are overstated, some are a couple decades away from being dominant factors, and some are issues AutoNation is already taking control of to the best of their ability. It is hard to predict how all of these factors will affect AutoNation, but we do know that AutoNation is facing these challenges head-on and has the benefits of scale to help it maneuver through these challenges.

Management and Ownership

I believe AutoNation’s management team, especially Mike Jackson (chairman & CEO), to be above-average. The reasons have been somewhat discussed above: long-term skillful maneuvering of the business in a time of many changes and excellent capital allocation. Mike Jackson owns 1.6% of the company, or approximately $71M at $47 per share. The remaining management team and directors own approximately 1.2% of the company, or approximately $54M at $47 per share.

AutoNation’s management is a large part of the investment thesis. They have proven to be superior operators, honest, and skilled at capital allocation. Monitoring the management team for any major changes, especially with regard to Mike Jackson, is important. As Mike Jackson is 69, he is at a potential retirement age. However, after reviewing shareholder information and dealings with the press, I see no indication that he has any plans for soon retirement. In fact, he has said that he plans to stay with the company indefinitely. Given his continued involvement with the automotive and business community, this is believable.

AutoNation’s non-executive and board ownership is concentrated in two large investors.

Bill Gates, through his investment in Cascade Investment and the Bill & Melinda Gates Foundation, owns 22.1% of AutoNation’s stock, or 20M shares. They have maintained roughly the same number of shares since their initial investment around 2008, but the ownership percentage has increased as the share count has fallen.

Eddie Lampert, through his investment vehicle ESL Investments and its related entities, owns 16.7% of AutoNation’s stock, or 15M shares. Lampert made his investment around 2000 and at the time owned 45M shares. In 2009 Lampert owned approximately 80M shares. Over the past 10 years the size of Lampert’s investment has decreased substantially. I speculate that this has been partially to free up capital to support Lampert’s investments in the various Sears entities.

Taken together, these two long-term shareholders currently own about 39% of AutoNation’s stock. Coupled with strong management, I believe that the management and ownership of AutoNation are conductive to efficient long-term operating performance and intelligent capital allocation.

Valuation

There are two ways to think about AutoNation’s intrinsic value: the value of its earnings and the value of its assets.

Earnings

The first way is an earnings or cash flow based valuation. Valuing AutoNation based off its earnings is a little difficult due to cyclicality and changes in the business mix. AutoNation’s sales are cyclical based on the ebb and flow of automobile purchases, so we will consider a normalized level of earnings. With that said, its earnings are less cyclical than its revenues due to the stability of the P&S business. Further, I believe even the business’s revenues will be less cyclical in the future than they had been in the past due to the increased impact of P&S on the overall business. So while the business is cyclical, its earnings fluctuations might not be as pronounced as in the past.

The business has recently experienced slightly declining operating margins due to the commoditization of new vehicle sales, but I expect the business to recover to historical margins as a result of a general reversion and a shifting of focus of the business more towards P&S and F&I.

Considering the above, I think it makes sense to take the 5 year average of revenues of $20.1B and apply the 5 year average operating margin of 4.1% which results in an operating profit of $835M.

Next, floorplan financing costs of $68M (the 5 year average, since inventory levels with float with sales levels) needs to be deducted, resulting in $767M.

Before considering what this amount of pre-tax operating income is worth, we need to recognize that car dealerships are the type of business where the accounting for depreciation understates true capital expenditure requirements. Over the last 15 years, AutoNation has averaged capex 65% higher than its depreciation. AutoNation has increased its physical and digital presence, so some of this capex went towards growing the business. To keep things simple, I will assume that about half of the excess of capex over depreciation went towards growth and half went towards maintaining the asset base. Therefore, we need to reduce our adjusted operating profit by 33% of the depreciation charge, or $53M, to bring implied maintenance depreciation to $211M. This is conservative as management has guided for maintenance capex of $150M, but I do not believe that $150M is sufficient for maintaining AutoNation’s market share. After making this adjustment, there is $714M of adjusted operating income.

Finally, we need to consider the impact of taxes in determining normalized earnings. AutoNation historically paid tax rates around 38%, but after the recent tax reform I estimate they will pay 25%. This is in line with management guidance. Applying this tax rate to $714M, we are left with $536M of after-tax earnings available to equity and debt investors.

Therefore, from an enterprise value based approach, at $47 per share AutoNation is trading at 13 times normalized after-tax earnings.

This approach may penalize the valuation somewhat as the business maintains a reasonable level of debt at attractive rates of interest. From a simple price per share to earnings per share available to stockholders perspective, we need to consider the effects of interest expense. Taking the adjusted operating income of $714M and subtracting out interest expense of $120M, there is $594 of pre-tax income. Applying the 25% tax rate leaves equity investors with $446M, which is a price to earnings ratio of 10 at $47 per share.

AutoNation has historically traded around 15 times its reported earnings, which at $47 per share would imply the stock is trading around 2/3 of its historical valuation level. It would be dangerous to assume this without further thought, though, as vehicle sales appear to have peaked in 2015 and 2016 and therefore we are likely at the higher end of a cycle. This explains why AutoNation may be trading at such a large discount to historical levels. The offsetting factor, as discussed above, is that AutoNation is now less cyclical of a business than it used to be, so I would expect the earnings to be more stable than they were in the past.

In thinking about the type of multiple AutoNation deserves, it is worth considering that the economics of AutoNation’s business are strong (approximately 25% pre-tax returns on tangible capital), the limited opportunities for organic growth, the technological disruption it faces, its industry-leading position and scale, and management’s operational and capital allocation skill. When I put all of this together, I believe that it is reasonable to value AutoNation as a business worth 15 times normalized earnings, in line with what average businesses have traded at in the past.

Using the simple price to earnings ratio approach, this implies a per-share value of $73 per share, which at $47 per share represents a margin of safety of 35%.

Under the more conservative enterprise value based approach, AutoNation would be valued at $58 per share, which at $47 per share represents a margin of safety of 19%.

Another way to think about buying AutoNation at 15 times earnings is that you will receive a 3% growth in the value of the business per year and you will receive 5% of your purchase price back in share buybacks (1/15 earnings ratio times 75% earnings payout ratio). For investors paying 15 times earnings, this comes out to an 8% return, likely in line with the overall level of returns from the overall S&P 500 over an extended period.

To be clear, this is not a business with significant growth on the horizon in sales or earnings, but you will own a larger share of the business as time goes on. In the event of a languishing stock price, management has proven it will repurchase shares at attractive prices, adding significantly to the per-share value of holding stockholders. Further, there is additional protection in the asset value backing each share of AutoNation stock.

Assets

The business of selling cars at dealerships requires large amounts of space to physically store the cars. This real estate is generally positioned in valuable metropolitan areas.

Determining the exact value of AutoNation’s assets is difficult as there are 253 dealerships locations and we do not have perfect clarity into how long some of the assets have been held due to the purchase and sale of dealerships over time. I tried to keep this simple and look at it big picture and in a general sense, as it is not necessary to be precise to realize there is significant asset value backing each share of AutoNation stock.

Currently, AutoNation’s book value per share is $26. A large portion of the book value per share, $23, is related to Goodwill and intangible franchise rights. This leads only $3 of tangible book value per share. However, I think it is unreasonable to assume that these intangible assets are worthless: AutoNation can and has sold its dealership locations and recaptured a large portion of this intangible value. It is important to mention that if the value of vehicle dealerships drops quickly, much of this value could evaporate. However, as discussed above in the risk section, I see this as an unlikely occurrence.

Further, AutoNation has owned a lot of its dealerships for over two decades. For instance, in 2000 AutoNation had about $596M of land and $942M of buildings and equipment (net of depreciation) on its books. At the end of 2017, AutoNation had about $1,333M of land and $1,630M of buildings and equipment (net of depreciation). Between these periods, AutoNation has been through periods of acquisitions and dispositions, so not all of the assets on the books in 2000 are still owned by AutoNation. However, it is clear that there is a large amount of property that has been on the books for a couple of decades that is likely severely understated by historical cost accounting.

The consumer price index (CPI) has gone up about 42% during this time period. So, for example, any land and buildings that were on the books in 2000 that have not been sold has gone up 42% in value if it tracked changes in the CPI. It’s unlikely that the value of land and buildings exactly tracked the CPI, but it helps understand in a general sense what sort of understatements may be present on the balance sheet. So, if we assume that all of the land and just the value of buildings (at cost, not net) held in 2000 went up 42%, then the current balance sheet undervalues land and buildings by about $598M, or about $7 per share, simply related to historical cost accounting distortion of assets held from 2000. This effect, to a lesser degree, applies to asset additions every year since then.

Really, though, this is not the main way I think about the asset value of AutoNation. While the current tangible book value per share is well below the stock price, the asset value serves as a next-best use if and when AutoNation decides to decrease its physical presence, a process that will play out over time and not all at once. So instead of considering the current tangible value per share, I think it makes sense to make an assumption that the earnings engine of AutoNation will more than be able to sustain and pay off its debt (with total debt to EBIT of 3.2 this seems reasonable), and that if that earnings engine becomes impaired over time, AutoNation will be able to pare down its physical capital base accordingly and at fair prices.

From this perspective, AutoNation has $2,963M of land, buildings, and equipment at net book value. As discussed above, I believe some of these assets are understated substantially due to historically cost accounting. This is a very simplistic approach (and certainly inaccurate as depreciation may understate the actual value of an asset like a building), but if we assume that this amount is understated by 15%, that implies there is $3,407M, or $37 per share of land, buildings, and equipment backing each share of AutoNation stock.

I am not saying that AutoNation could liquidate and receive this much per share net of all liabilities, but I am simply showing that AutoNation could scale down its physical presence while still capturing a meaningful amount of value per share. And, this amount ignores the value of any franchise agreements or Goodwill embedded in a specific location. Also, these real assets will naturally provide protection from inflation. These factors combine to create a backstop of value.

To summarize, while I do not consider the asset value to be the best and highest use of the real estate currently, the asset value does serve as a backstop if the earnings of the business become impaired. In other words, the asset value provides the protection of limited downside to investors as the value of the land and buildings should be stable regardless of what is going on with the dealership business model. The asset value also provides the ability of management to downsize the physical presence of the company if they pivot the business towards more online sales and fewer physical locations. And, as share buybacks continue, the asset value per share, backed by valuable real estate, will continue to increase and buttress the value of the stock.

Conclusion

The way I think about owning AutoNation is you own an increasingly large share of a slow-growing but fairly durable stream of cash, the investment has downside protection due to significant real estate value behind each share, and more speculatively the investment has some optional upside in the event that AutoNation participates in servicing autonomous or ride-sharing companies (like Waymo) in a major way.

Although the share price has climbed slightly in the last few weeks, I think it is moderately attractive at $47 per share, representing a 19-35% margin of safety from its intrinsic value depending on valuation methodology. At prices around $40 per share, I believe AutoNation to be materially undervalued and highly likely to outperform the S&P 500.

Disclosure: I own shares of AutoNation