Computer Services Inc. (CSVI): An Unlisted, But Super Predictable Company Trading at an Unleveraged P/E of 15 times Next Year’s Earnings

Member write-up by Jayden Preston

Introduction

Computer Services Inc (often called “CSI”, the ticker is CSVI) is an unlisted stock in the US. It does not file with the SEC. But it does trade over the counter. The Company also publishes annual reports and quarterly earnings reports. You can find more information about the Company on OTCmarket.com.

As you would expect from an unlisted company, their annual report is not as extensive as you would find in a 10K. However, there are financial figures of the Company going back to 1996. There are also three main comparable companies that are listed. So, you can gather enough information to make an educated judgement on the Company.

CSI provides service and information technology solutions to meet the business needs of financial institutions and corporate entities. Their main clients include community banks, regional banks, multi-bank holding companies and a variety of other enterprises. They emphasize that their services are tailor-made to the clients’ needs.

The Company categories their revenue sources into two major parts: 1) core processing and 2) integrated banking solutions. Below I quote from the annual report on the range of services they offer:

“We derive our revenues from processing services, maintenance, and support fees; software licensing and installation fees; professional services; and equipment and supply sales. In addition to core processing, our integrated banking solutions include digital banking; check imaging; cash management; branch and merchant capture; print and mail, and electronic document delivery services; corporate intranets; secure web hosting; e-messaging; teller and platform services; ATM and debit card services and support; payments solutions; risk assessment; network management; cloud-based managed services; and compliance software and services for regulatory compliance, homeland security, anti-money laundering, and fraud prevention.”

As you can see, their solutions cover a very wide range of operational needs of financial institutions. They are almost like an outsourced IT department for financial institutions, with many functions they provide being highly critical.

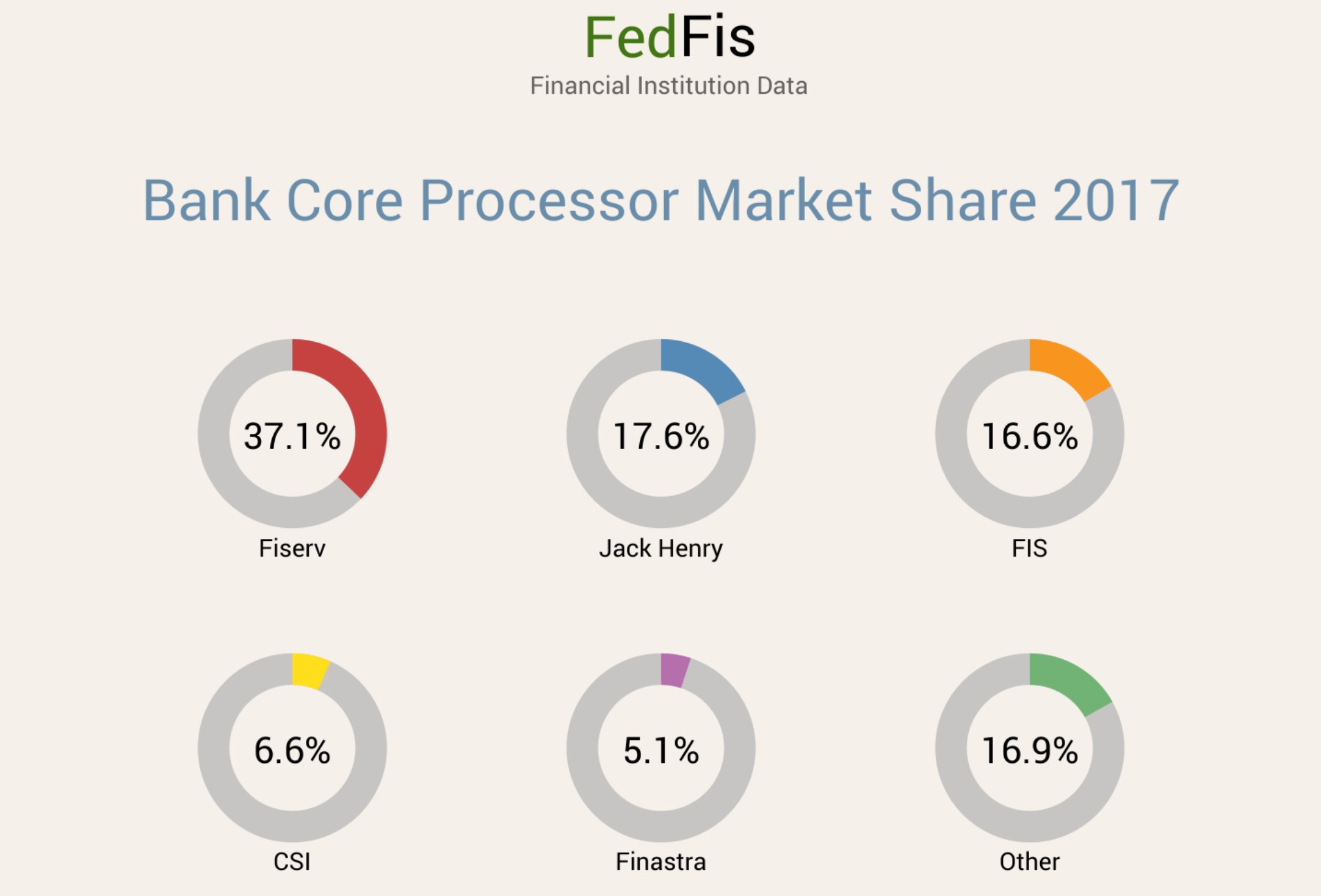

Within the bank core processing industry, CSI is a distant fourth player, with a market share of 6.6% in 2017. The biggest player is Fiserv, with 37.1% of the market. The next two players are Jack Henry and FIS, with market share at 17.6% and 16.6% respectively.

Durability

For the business of core processing and other bank IT services to be durable, two key conditions are needed: 1) Financial institutions, such as banks and credit unions, remain durable and 2) Outsourced solutions continue to be an option.

Historically, banks are some of the most durable businesses. Now, with cryptocurrencies being all the rage, there are people who will question whether banks will remain durable. That is too big a topic to discuss in full here. But in short, my personal thought is it is too speculative to believe bitcoins will take over the whole banking industry. A more reasonable scenario to me is the blockchain technology will be incorporated within the current banking system instead.

As for outsourcing, there are clear benefits to it, especially for small to medium banks. It is simply uneconomical for them to develop their own solutions. In fact, Fiserv claims to be observing a trend of financial institutions moving from in-house technology to outsourced solutions, with the reason being the desire to remain current on technology changes in an evolving marketplace. Core processors whose focus is on developing IT solutions to financial institutions are usually in better positions than the banks themselves to developing the next technology. The expertise these financial software providers have garnered through decades of operation, alongside tens and hundreds of millions of R&D investments, have thus made potential clients more dependent on them as the changes in technological needs becomes more dynamic. Finally, extra incentives to get outsourced solutions could also come from the continued pressure to cut costs.

Moat and Quality

In terms of moat, CSI mainly enjoys an advantage based on switching costs. Research conducted by CEB highlights what banks think of replacing core bank systems. 46% indicate that core banking system replacement is high risk or very high risk. For virtually all large banks in the survey, it is very high risk. Due to the nature of solutions they provide to clients, CSI has very sticky sales. First, these are potentially very long-term contracts, ranging from one to ten years in length. Moreover, the business enjoys high renewal rates for contracts, with the average renewal period for their contracts being 8 years in length. If a customer terminates the contract early, there is also a termination penalty fee. This typically happens when the customer is acquired by another financial institution, which uses another core processing provider.

The above enviable nature of the business makes CSI a high-quality business, despite being a distant fourth player in the market. This is reflected in the stability of growth and margins of CSI in the past 20 plus years. Since 1996, the Company has only failed to increase revenue in 2 years. In fact, the Company still managed to grow during the Financial Crisis. Operating margins have been on a gradual upward trend. The average operating margin is 19.8%, with the median at 20.5%. Coefficient of variation is at the low level of 0.13.

As a software provider, CSI has low tangible asset needs. The Company capitalizes certain software development costs. But even after including the capitalized software development expenses, the average invested capital of CSI in 2017 does not exceed $120 million. During that same year, the Company generated $49 million in operating income and $36 million in free cash flow. CSI clearly has a high return on capital no matter how you look at it.

Another testament to the high business quality of CSI is the high free cash flow conversion the Company enjoys. The average FCF conversion is around 100% of net income, going as far back as 2000.

Growth

Growth for CSI will mainly come from 3 areas: 1) Adding new customers, 2) Cross-selling to existing customers; and 3) increases in transaction volumes from existing customers.

Given the sticky nature of the business, the rate of adding new customers will likely remain slow. Cross-selling to existing customers and increase in transaction volumes would be more dependable. The latter will almost certainly happen due to the continued shift from offline to electronic means in banking transactions.

Historically, since 1996, revenue has grown 8.7% annually. However, the growth weighed heavily toward the late 90s. Growth has been much more muted since the financial crisis. From FY2008 to FY2017, revenue only grew by 4.5% a year. Nevertheless, the last ten years were tough for the financial industry, with low inflation and low interest rates. Thus, one could argue the next ten years for Computer Services may look brighter than the last.

To better understand the historical growth of Computer Services, let’s look at the real growth rate the Company has achieved.

Adjusting historical operating earnings with the consumer price index, I collected the following statistics:

From FY1996 to FY2017, the annualized real growth rate was 7.6%. This rate will drop to 4.3% for the period from FY2008 to FY2017. The compound rate will further decline to 2.8% from FY2010 to FY2017.

In any case, what is obvious about the Company is that it does have pricing power and has been able to grow earnings in real terms. Should they only be able to grow earnings in real terms by 3% a year in the future, adding inflation of 2% will lead to a 5% annual growth.

Valuation and Capital Allocation

Is Computer Services now trading at an attractive valuation?

We will try to answer this question from three different angles.

First, let’s compare CSI against the three major publicly listed comparable companies. Fiserv, Jack Henry and FIS currently trade at P/E multiples of 24.8x, 27.4x and 24.6x respectively. CSI trades at a discount to the major competitors at 19.8x. On the one hand, this might be due to better future prospect for the three bigger competitors. On the other hand, this meaningful gap of 25% to 40% could be attributed to CSI being a smaller, unlisted and much less liquid company. But as Geoff recently wrote in his latest memo, forgoing liquidity can be a major source of outperformance.

Second, with the consistency in the Company’s margins and growth, CSI is clearly a superior business than the average. Nevertheless, despite its higher quality, the Company sports a lower P/E multiple than the S&P 500, which is now estimated to be 24x. This makes Computer Services a better bet than the general market.

Last but not least, we should not neglect an upcoming one-off earnings boost. With operations mainly in the US, Computer Services has historically paid a fairly high tax rate of close to 40%. After the corporate tax cut, the effective tax rate will go down dramatically. I would suggest a 25% rate to be reasonable going forward for CSI. This equates to an earnings boost of 25%.

Last twelve-month operating income was $53.7 million. Using the new tax rate of 25% gives us a net income estimate of $40.3 million. (CSI has net cash) This suggests Computer Services is currently trading at a multiple of 15.5x.

CSI can convert close to 100% of net income into free cash flow. At a multiple of 15.5x, this translates into a yield of 6.5%. If earnings can grow at 5% as suggested, then investors can expect an 11.5% total return while holding the stock of Computer Services.

In terms of capital allocation, CSI has recently increased its payout ratio to nearly 50%. Historically, they have reduced share count by close to 1% per year. At the current share price, you can expect a dividend yield of 3%, and an EPS boost of around 1% from share buyback. The rest of the cash will be used for acquisitions occasionally. And if too much cash is piled up, the Company might pay it out as special dividends as they did in FY2013.

Misjudgment

My biggest concern is the relative competitive positioning of CSI compared to the 3 leader players.

During the past 25 years, the number of financial institutions in the US has declined at a relatively steady rate of approximately 3% per year, primarily as a result of voluntary mergers and acquisitions. Bigger financial institutions may tend to have more complex needs. And the bigger players would have more resources for research and development than Computer Services. For instance, the market leader in core processing, Fiserv, spent around 8% of revenue in R&D in 2017. This means a spending of $455 million, which is nearly double the revenue of Computer Services. FIS also spends close to $400 million on R&D. (But FIS has recently expanded its business into providing solutions to asset managers) And as you can expect, there is an advantage in being able to provide integrated solutions with multiple applications to each client. This is partly driven by regulatory reasons, where many requirements in terms of vendor management exist. There is also driven by the fact that ancillary technologies once considered optional, such as internet and banking are now considered mission critical, maybe even more so than the core offering itself. With more programs and more capabilities needed, it is natural for banks to select providers who can offer all sorts of solutions, both for better reliability and integration. In other words, there is a tendency now for banks to consolidate their service providers.

However, the current market share structure has been in existence for many years. And this has not hindered CSI from enjoying good economics while still growing quite nicely. Moreover, again given the sticky nature of customer relationship, it will be easier for one of the market leaders to acquire CSI to further consolidate the market than trying to take customers away from CSI.

Conclusion

Despite being a small player in the industry, Computer Services is a high-quality business with low tangible asset needs and high customer retention. It is going to be a big beneficiary of the recent US corporate tax cut. With only an average earnings multiple, this makes it an attractive investment in the current market environment.

https://www.americanbanker.com/news/temenos-is-ready-to-make-waves-in-us-core-processing

https://www.americanbanker.com/news/can-big-four-core-banking-vendors-oligopoly-be-broken

https://www.bloomberg.com/professional/blog/banks-too-slow-to-modernize-core-systems/