CountPlus (CUP)

CountPlus Investment Thesis

Market data

Ticker: ASX:CUP

Price: $0.66

Net debt: ~$0m

Market cap: AU$74m

Elevator pitch

After years of poor performance, a revolving door at the C suite and ongoing restructuring charges/impairments, recent insider buying gives us confidence that CountPlus has reached an inflection point in its turnaround. Looking through the one-off charges to cash profitability and assuming no improvement in operating margins (~10% vs. peers >20%) we believe the shares are selling for a pre-tax free cash flow yield of 14%. As the turnaround begins to show up in the reported financials and the company re-instates a dividend policy, we believe the market will wake up to this emerging growth story.

Investment thesis

- New CEO who co-founded one of the best performing groups within the network, and who has a non-monetary vested interest in the success of the business due to relationships with many of the employees he mentored, is implementing a strategy he successfully employed while managing Hood Sweeney and recently acquired ~$400k of stock on market

- Sticky, diversified, annuity like revenues provide downside protection. Operating margins of 10% due to a loss-making division and poor incentivisation under old model vs. peer group margins 20%+. Every 1% improvement in profitability adds $0.08 in value per share (if capitalised at 8x)

- Increased regulatory pressure on the back of a Royal Commission should drive consolidation as sub-scale firms look to partner with a well-capitalised competitor to scale fixed compliance overheads, providing an attractive backdrop in a highly fragmented industry

- Current valuation implies extremely low expectations. Assuming no improvement, it should currently be generating $10-12m in pre-tax owner earnings (14%+ earnings yield). Given the low capital requirements of the business, the majority of this cash flow can be used to pay dividends or make acquisitions. As the CEO has a track record of finding and executing value accretive acquisitions, combined with a board rich in M&A experience, and a consolidating industry backdrop, we believe CUP is in a prime position to increase value for shareholders

- The convergence of cash profits and reported financials, together with the dividend returning, should provide a hard catalyst for the Aussie small cap community to take another look at the business

History

CountPlus (CUP) was born within Count Financial (Count), one of Australia’s largest network of advisory firms. Count, which is now owned by The Commonwealth Bank of Australia (ASX:CBA) spun CUP off into its own publicly traded entity in 2010 and still retains a 36% shareholding. CUP generates revenues through a network of ~17 firms (wholly and partially owned) with a fairly even split between accounting and financial advice fees.

After an initially successful IPO, CUP began to get into trouble when Count Financial went from a stand-alone public entity, to being acquired by CBA. While this had little impact on the underlying operations of CUP member firms, because of the unique relationship between CUP and Count, CBA began making “loyalty payments” to CUP which offset declining operational performance. Once these payments ceased in 2015, underlying and reported financials converged, resulting in a 21% fall in EBITDA. At this point things went from bad to worse – the dividend was cut from 12 – 8c p.a. (before being completely removed in 2017), a rogue trader incident materially impacted the profitability of the financial advice division, a new CEO was appointed and removed within two years and finally the stock was removed from the ASX All Ordinaries Index.

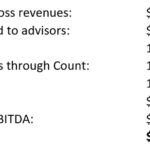

The divergence in underlying performance and reported financials, due to the loyalty payments, caused a “shock” dividend cut once they ceased. By excluding the payments and calculating a true EBITDA figure, we can see the situation unfold:

Once the market realised the loyalty payments were going to be removed (when the dividend was cut) the stock re-based its valuation to the new level of profitability.

In early 2017, Matthew Rowe was appointed CEO and immediately implemented a strategic review focussed on reducing debt, improving working capital and getting the business back in to a position from which it could grow. Rowe co-founded Hood Sweeney, an accounting & advisory firm in which CUP acquired a 25% stake in 2012 – at the time, the company was generating $16m+ in revenues. Since his appointment, Rowe has returned the business to a net-cash position, improved lock-up (debtors + WIP) from 107 to 97 days, settled the rogue trader incident with ASIC, sold off several businesses for $8m that contributed an aggregate loss of $250k in FY17 and introduced a new business plan where CUP will only seek minority investments in underlying firms. Rowe has acquired ~700k shares on market since his appointment and after speaking with him you get a sense that he has more than a pure monetary motivation to see the business succeed as he mentored many of the senior employees within the network.

New Strategy

A key part of Rowe’s strategic review was a shift in strategy away from owning 100% of the equity of the underlying firms to one where CUP owns 30-50%. This is the same strategy he successfully implemented at Hood Sweeney and encourages the managing partners to maintain a tight control on cost while also chasing new business as they share in the upside. This lack of alignment has been a key reason for the underperformance in recent years and going forward the plan is to sell-back a portion of the equity in all existing firms to the senior employees (once the business performance has improved).

Industry

The Australian accounting industry is highly fragmented with over 35,000 firms turning over a total of $20bn in revenues per annum. According to the Australian Financial Review, which produces a list of the top 100 firms each year1:

- Less than 20 firms’ turnover in excess of $100m p.a.

- Less than 50 firms’ turnover in excess of $10m p.a.

- Top 10 firms control ~40% of the market – with the majority concentrated in the “Big 4” (PWC, Deloitte, EY & KPMG)

The financial advice industry contains around 25,000 individual advisors operating under 4,168 Australian Financial Services Licensee’s authorised to provide personal advice and turns over roughly $4.6bn per annum2. This industry has undergone major change in the last few years which started with the introduction of FOFA (Future of Financial Advice) reforms in 2014. These reforms banned conflicted renumeration structures (such as trail commissions) and force advisors to renew their fee agreements with clients every two years, among other things. Given the Big 4 Banks + AMP controlled around 48% of the industry and 85% of advisors were associated with a product provider (in 2009) this obviously had a dramatic impact on the industry.

Since the introduction of the reforms, we have seen the large banks begin to divest their wealth management arms to remove any conflict of interest and the recent Royal Commission into the Banking industry looks to have expeditated this process with calls for the Big 4 Banks, AMP and Macquarie to separate the advice businesses from the product or investment management side. These reforms have already started to claim some scalps with CBA splitting off their wealth management arm into a separate entity, Westpac selling off further stakes in BT Financial and advisors leaving AMP in droves.

The final regulatory factor driving change and opening up consolidation opportunities are the new education reforms which require existing advisors to have a finance degree by 2024. Discussions with industry participants suggest that this alone will result in up to 8,000 advisors retiring between now and 2024 – creating substantial opportunities to acquire books of business.

All of this change puts well-funded, independent players with sufficient scale (such as CUP) in an interesting position to grow through acquisitions and organic means, for the foreseeable future. As mentioned earlier, less than 20 firms are operating with sufficient scale to be a meaningful consolidator, which means it could potentially be a “buyers market.” Further anecdotal evidence from those within the industry suggest that for every 8 financial services firms for sale, there is only 1 buyer – this compares to 15 buyers for every 1 seller just a few years ago.

Relationship with Count Financial

Count Financial, as per the Relationship Deed3, granted CountPlus “most favoured nation status” which essentially provides them with the best prices available for Counts’ services. In return, the two parties must “use their best endeavours to work together in good faith for their mutual benefit in relation to their business objectives3.” The document also states that the term for the initial agreement is “the period from the date of its execution until the date that is 10 years from the date that the Shares are initially traded on ASX.” Given CUP listed on the market in December 2010, this implies the deed could be ceased from early 2021.

Based on Count Financials last available annual report (2011, before being taken over by CBA) we estimate that CountPlus advisors account for around 20% of the Count Network. Therefore, CountPlus is an extremely important partner for Count and represents an enormous risk given they are currently providing the same services that CountPlus provides under their TFS brand. This goes a long way in explaining why CBA paid CUP over $7m in “loyalty payments” following the acquisition of Count in 2011.

While the agreement may continue on as it has for the last 10 years post the initial term, it obviously presents an interesting opportunity for CUP to try and squeeze some extra profit out of the arrangement (through further loyalty payments) or in-house the entire operation all together. There were rumours that CBA was looking to sell Count Financial earlier this year, however, they have recently announced plans to spin the wealth management division off into a separate entity in 2019.

The economics

These are decent businesses – despite all the issues CUP has faced, they’ve still managed to generate a lot of shareholder value since the 2011 IPO. I define per share value as book value + cumulative dividends paid out:

While barriers to entry are optically low – all you need is a computer, some software and a telephone – the regulatory burden leads to sub-scale firms having difficulty reaching a level of profitability that ensures long-run viability. Countplus also provides an attractive home that reduces the impetus to leave and “start your own shop” through their equity plans. These programs ensure a fair equity valuation (independently valued) as well as access to cheap financing through their relationship with Westpac that would not be available without the credibility a publicly listed firm provides. For younger employees on a ‘partner track’ we believe this offers an attractive alternative to starting your own practice.

Why does the opportunity exist?

Our edge in CUP is analytical and based on the following factors:

- No analyst coverage and optically expensive on trailing earnings

- CUP does not screen well with earnings per share down 64% in the last five years and a trailing PE ratio of 20x

- No sell-side analyst coverage and a sub-$100m market cap leave little reason for investors to dig below the surface and uncover the opportunity

- However, by taking more than a superficial look, the company is trading on a cash PE ratio of 10-12x at a point when margins are materially lower than normal

- Formerly profitable business currently losing money/breaking even resulting in operating margins materially below peer averages

- The largest contributor to the financial services division, TFS, is currently trading around break-even as the company implements new compliance protocol and has removed all grandfathered trail commissions to be on the offensive should they become outlawed (looking more likely by the day)

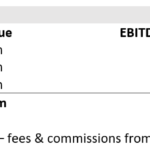

- The contribution from TFS is not explicitly broken out in the accounts, however, if we reduce total financial services revenues by the fees CUP receive from Count Financial (which are generated by non-TFS advisors) we can get a rough idea of its contribution:

- FY17 total financial services revenues: $48m

- FY17 fees and commissions from Count: $15m

- Estimated TFS contribution: $33m

- If TFS can return to a 10% operating margin, this would add $3.3m in incremental profits, or $0.25 in value per share (if capitalised at 8x)

- Potential in-housing of the services currently outsourced to Count Financial

- As explained earlier, Count Financial provides licensee (AFSL) and compliance services to CUP financial advisors outside the TFS group. However, in the company’s admission documents from the 2011 IPO, it states that this service agreement is due to expire in 2020/21

- This is a big “what if” but Count Financial doesn’t provide anything that TFS isn’t already doing for its own advisors. Therefore, CUP could potentially “cut out” Count in 2020/21 by bringing the other advisors under the TFS banner and re-capturing the margin

- Based on the margin CUP currently takes from its TFS advisors, we believe this could add $2m+ of incremental EBITDA:

The company could also be mispriced due to the ongoing uncertainty surrounding the industry and specifically, the range of potential roads CUP could take. At the moment, even if one were to have a deeper look into CUP, they would probably see a boring, GDP style grower, trading on 10x cash PE – not much to get excited about. However, we believe this perception could change as Rowe begins to deliver on his strategy – expanding margins to be more in-line with peers, freeing up capital previously held by debtors/working in progress and making value accretive acquisitions. While this could take some time, in the interim we are likely to receive a dividend yield of >5% to reward our patience.

We believe the key thesis for incremental buyers to buy the stock at a higher valuation will be the extrapolation of M&A activity, resulting in a justification for a higher multiple of current earnings, combined with operational improvements delivering a higher earnings figure – i.e. a higher multiple of higher earnings.

Valuation

The following are my assumptions around business units and are not explicitly stated this way in the financial accounts:

Ongoing maintenance capital expenditure is minimal, assume around $1m p.a.

This implies, with two currently underperforming business units (accounting and TFS earning sub 20% margins) the business is selling for a pre-tax free cash flow yield of 14% ($11.1 – $1m = $10.1m divided by $74m EV)

Therefore, even assuming no recovery in operational performance, the business is being offered for an extremely undemanding valuation. However, the investment begins to look extremely interesting if one assumes the new management team can return the group to EBITDA margins in excess of 20% – which is still below both peers and what CUP was achieving in 2010 – 2013.

Therefore, assuming a normalisation in margins to around 20% implies the business would be trading on a pre-tax free cash flow yield in excess of 25%

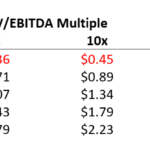

Valuation Matrix

The key variables are sales, margins and multiple. To be conservative, I’ll assume $100m in sustainable sales as my constant, with EBITDA margins and EV/EBITDA multiples as my two variables:

For the investment to result in a material loss, margins would have to decline from current levels (which are already well below normal) and the stock would have to trade for a multiple lower than where private transactions have occurred. The best example is Crowe Horwarth, which was acquired by Findex for 13x EBITDA when it was earning ~4% margins. If we apply the same logic to CUP (i.e. assume 4% margins and a 13x take-out multiple) it would result in a loss of ~30% – this forms my “bear case” scenario.

On the flip side, if the management team can return the group to 20% margins and the business trades for an 8x multiple, the investment would return >100% – providing an attractive reward/risk ratio of >3:1

Risks

Having worked in the accounting and financial advice industries, and still being in contact with partners in private practices, I feel that these businesses are extremely difficult to screw up. If you provide good service to your clients and they enjoy dealing with you, they will return year-after-year for their annual reviews/audits/financial statements etc. and create an annuity like revenue stream. Despite the issues that CUP has faced, the resilience of the business model can be seen in the stability in year-on-year revenues:

Even in 2015/16 when the company experienced a “rogue trader” incident that required the largest contributor to the financial planning division to essentially re-build the entire compliance function (and inform clients of what happened), the revenues barely moved. Despite relatively low switching costs and low (but arguably growing) barriers to entry, accounting/financial services businesses generate extremely sticky revenues and when managed optimally, should produce large amounts of free cash flow and high returns on invested capital.

With that being said, the main risks that I see with the business and investment case are:

- Regulatory risk

- As with any financial institution, potential changes to regulation create an ongoing risk. However, as explain earlier, we believe the regulatory focus on reducing conflicts of interest present an opportunity more than a threat to CUP

- No revenues come from grand-fathered trail commissions. The management team took the proactive step to remove this source of revenues as it has a high chance of regulatory pressure

- Hit by a bus risk

- Much of the growth and operational improvement thesis hinges on the track record of Matthew Rowe. This introduces a key person risk, but in our opinion is not enough to prevent investment given the attractive yield available even on the current level of profitability.

- People business risk

- As with all “people businesses” a key risk is that each night, all of your assets walk out the door and go home

- We believe the new “minority shareholder” business model, combined with the access to financial resources (both personal and at a business level) create an extremely attractive home for smaller financial services firms – thereby reducing the risk of poaching or leaving to start their own practice

- Rogue trader risk

- As CUP have already experience, a “rogue trading” incident can materially impact business. However, as they have shown, it is not a business killer

- By having gone through this issue already, we believe the introduction of new compliance procedures reduces the risk of this occurring again in the future (although it is always a reasonable possibility)

- Technological risk

- A recent survey by Minerva revealed that only one in five UK investors would trust software to make their investments decisions, one in ten would trust a robo advisor, but 72% trust a traditional financial advisor. Therefore, at this stage, we do not believe robo-advisors provide an immediate threat to the industry. If anything, it may provide an operational cost opportunity.

What would cause me to change my mind?

A material deviation in strategy or something that changes my view that these businesses generate annuity like revenues.

Appendix 1 – sources

- https://www.afr.com/business/accounting/financial-review-top-100-accounting-firms-2017-20171113-gzk50e

- https://financialservices.royalcommission.gov.au/publications/Documents/features-of-the-australian-financial-planning-industry-paper-6.pdf

- https://stocknessmonster.com/announcements/cup.asx-XX618362/

- https://www.asx.com.au/asxpdf/20110829/pdf/420ppp2tbbd2t0.pdf

Appendix 2 – peer analysis

| Ticker | Name | EV/Sales | EV/EBITDA | EBITDA Margin |

| ASX:KPG | Kelly Partners | 2x | 6x | 28% |

| AIM:AFHP | AFH Financial | 2.3x | 10x | 22% |

| NYSE:HRB | H&R Block | 1.5x | 6x | 30% |

| NYSE:ACN | Accenture | 2.5x | 14x | 16% |

| AIM:HW. | Harwood Wealth | 2.6x | 16x | 17% |

| Taken private | Crowe Horwarth | 0.5x | 13x | 4% |

| Median: | 2.1x | 11.5x | 17% | |

| ASX:CUP | Countplus | 0.7x | 7x | 11% |

Private market transactions

The UK financial services market is further along in the consolidation theme then Australia and the two publicly traded peers (AFH Financial & Harwood Wealth) provide further inside into what multiples are being paid in the private markets:

| Target | Date | Price | Revenue | Revenue Multiple |

| Omega consulting: | May-14 | £ 116,500.00 | £ 39,000.00 | 2.99 |

| Finlay Gow: | Jul-14 | £ 675,000.00 | £ 175,000.00 | 3.86 |

| KL Plester: | Feb-15 | £ 1,717,200.00 | £ 600,000.00 | 2.86 |

| Independent financial services: | May-15 | £ 4,100,000.00 | £ 3,090,000.00 | 1.33 |

| Quest Financial & Phoneix: | Jul-15 | £ 1,074,345.00 | £ 320,000.00 | 3.36 |

| Parker Sage: | Jun-17 | £ 5,600,000.00 | £ 2,200,000.00 | 2.55 |

| Eunisure: | Jun-17 | £ 4,500,000.00 | £ 5,600,000.00 | 0.80 |

| Granville, G-Force & Johnson: | Jul-17 | £ 1,900,000.00 | £ 500,000.00 | 3.80 |

| Martin Cooper: | Jul-17 | £ 408,100.00 | £ 430,000.00 | 0.95 |

| Arden & Martin Cooper: | Aug-17 | £ 1,400,000.00 | £ 430,000.00 | 3.26 |

| J W Wealthcare: | Dec-17 | £ 1,100,000.00 | £ 300,000.00 | 3.67 |

| Monopoly: | Jan-18 | £ 631,000.00 | £ 170,000.00 | 3.71 |

| Harrison White: | Feb-18 | £ 738,000.00 | £ 410,000.00 | 1.80 |

| Mark Hughes: | Apr-18 | £ 1,400,000.00 | £ 600,000.00 | 2.33 |

| Meritor: | May-18 | £ 530,000.00 | £ 330,000.00 | 1.61 |

Median multiple: 2.9x

Range: 0.8 – 3.9x