FFD Financial (FFDF): A Conservative Community Bank with a High ROE Trading at Less than 10x Net Income

by REID HUDSON

FFD Financial Corp. (FFDF) is a small Ohio bank holding company that owns all the outstanding shares of First Federal Community Bank. It is headquartered in the town of Dover, Ohio, where it also has its two largest branches. The bank has a market cap of just under $54 million and is listed on the OTC Pink Sheets. It is extremely illiquid, with average daily volume over the past year at 173 shares, representing around .02% of shares outstanding (although that daily average has jumped to 232 shares in the last three months). The bank delisted from the NASDAQ stock exchange in 2012, pursuant to relaxed reporting requirements put in place by the JOBS Act for companies with less than 1200 shareholders. This allowed FFD to save money by avoiding periodic filings with the SEC as well as NASDAQ compliance. The company does, however, still file annual reports with the SEC and posts them on its website.

FFD is an interesting potential investment because of the way it has been able to vastly outperform almost all community banks and most large commercial banks when it comes to return on average equity (ROAE) and return on average assets (ROAA). The bank has also decreased the cost of its deposit base since the financial crisis, with CDs as a percentage of total deposits going from 54% in 2008 to around 30% in the third quarter of FFD’s fiscal year 2019.

FFD just released its unaudited financial statements for the fiscal year-end 2019. Its total assets stood at just under $414 million, its loans at about $336 million, its deposits at around $371 million, and its shareholders’ equity at just over $39 million. Also, FFD’s borrowings are down significantly, standing at just $257,000 compared to over $13 million at year-end 2018. This financial data, however, is unaudited.

The bank’s fiscal reporting year ends on June 30 each year, and its audited financial statements, as of June 30, 2018, show total assets at $382 million, total loans at around $306 million, deposits at about $332 million, and shareholders’ equity at about $34 million. FFD’s audited financial results only go back to 2004, so that is the earliest year I will be able to reference in this report. From 2004 to 2018, FFD’s assets grew at a CAGR of 7.66%, its loans grew at 7.28%, its deposits at 8.5%, and its shareholders’ equity at 5.1%. These results have increased in recent years because of the company’s higher returns which it is able to retain to fuel deposit and loan growth. In the last five years, FFD’s deposits have grown at a rate of 9.3%.

FFD’s 2018 year-end ROAE was at 15.3% and its ROAA was 1.35%, and its unaudited year-end 2019 ROAE was at 17.4% and its ROAA at 1.59%. Obviously, as a small bank this is very impressive, especially considering FFD has been able to achieve this by utilizing only a traditional banking business model. Most small banks you find that generate high returns on equity are doing so through the use of a large mortgage origination operation or some other kind of non-interest income revenue source. I consider banks relying primarily on mortgage origination income or SBA loan origination income to be much riskier than a bank like FFD.

Mortgage origination is not necessarily a repeatable income source. To bring in this kind of income, a bank must continuously source new customers to sell mortgages to. A bank must also incur a lot of leverage to fund the origination before it is sold off or securitized. While this business model results in operating leverage at the normal banking branch level, it does not result in the same operating leverage that can be achieved by organic deposit and loan growth. A bank usually compensates mortgage origination personnel in a way that incentivizes them to generate more business. This usually means that compensation costs increase as income increases. You can see this by looking at the American Banker top 200 community bank list. Most of the small banks on that list generate a lot of non-interest income, and most banks are increasing non-interest expense at a rate over 10%. You may have to discount these results, however, because the list also shows FFD’s non-interest expense growth as 12.69%. In reality, FFD’s non-interest expense growth was at around 10% from 2017 to 2018, but in the years preceding that, it has ranged from 3-6%. Regardless, even the publication notes that the growth in non-interest expense is a troubling statistic.

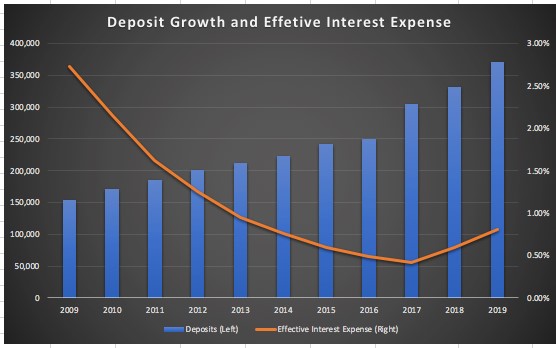

While FFD has been able to keep non-interest expenses relatively steady, what has been really impressive is the way it has been able to dramatically decrease interest expense while substantially increasing its deposits. In 2008, the bank’s deposits stood at about $141 million and its interest expense was over $5 million. At the end of 2018, its deposits were about $332 million and its interest expense was just under $2 million. If you want a rough estimation of interest costs at these two points in time, dividing the interest expense number by total deposits should give you a general picture of the cost of funds. This calculation translates to a rough interest expense rate of about 3.5% in 2008 versus an expense of about 0.6% in 2018. I know that interest rates have decreased over this time period, but FFD’s total deposits have grown at a rate of 135% over a decade while its total interest expense shrunk by almost 62%. This is very indicative of a new and lower source of funds for the bank. FFD’s unaudited interest expense as of fiscal year-end 2019 has risen to just over $3 million. This may seem like a lot, but with deposits growing to over $370 million, the effective interest expense only increased to about 0.8%.

Business Model & Competition

FFD Financial Corp.’s business model is the epitome of a well-run community bank. It has seven branches as of fiscal year-end 2019, and it is concentrated in small towns in the two Ohio counties of Tuscarawas and Holmes. Tuscarawas County, Ohio, is the bank’s original place of business, and it has five branches there. FFD is the second largest bank by deposit market share in Tuscarawas County with deposits of $283.7 million. It has 19.72% of the market, and the leader, Huntington Bancshares, Inc., has 22.93% with $329.9 million in deposits. In Dover, its original market, FFD has two branches with $210.3 million of deposits and 43.71% of the market. In second place is J.P. Morgan Chase with $100.1 million and 20.81% of the market. FFD’s deposit market share in Dover increased to 43.71% in 2018 from 40.51% in 2017, while J.P. Morgan’s stayed relatively consistent at 20% and the third-place bank – Huntington Bancshares – decreased from 25% to 20%.

FFD is not as established in Holmes County, Ohio. In terms of deposit market share, it is in third place with only 5.69% of the market. The top two banks hold around 40% of the deposits each. FFD is relatively new to Holmes County, with its first entrance occurring in 2009 when it constructed a branch in Berlin, Ohio. FFD then purchased a Holmes County branch in Mt. Hope from CSB Bancorp in 2017. While FFD is a distant third in the deposit market in Holmes County, it did experience the fastest growth in deposits out of any bank in the county in 2018 – over 23%.

FFD Financial is a conservative bank, with its net charge-off ratio averaging 0.11% since 2005 (furthest back I have data from) and 0.004% in the last five years. The nonperforming loan to total loan ratio has averaged 1.29% since 2004. Keep in mind the long-term averages of both of these ratios include the financial crisis. FFD’s highest net charge-off ratio was 0.36% and occurred in 2011. During 2008, 2009, and 2010, its net charge off ratio never exceeding 0.20%, showing that the bank was almost completely insulated from the chaos that was decimating much of the banking sector. FFD has never been a bank that has targeted a specific growth rate, yet it has been able to grow while remaining conservative in its lending. Trent Troyer has been the president of FFD since 2000 and has overseen the bank through the financial crisis as well as recent years of growth.

In my opinion, to analyze a bank you have to look at it the opposite way you would look at any other kind of business. Obviously, banks are very highly leveraged institutions. This could be construed as an indication of their relative riskiness compared to other kinds of businesses, and is one reason why they are so highly regulated (besides the fact that they hold the funds and savings of almost all the citizens in a given country). Because of this, a bank’s liabilities should be viewed as assets and its assets should be viewed as liabilities. This primarily means that commercial banks are usually able to differentiate themselves, and therefore earn higher returns, because of the quality of their deposits, not their loans.

Bank loans are essentially commodities. It is very difficult for a bank to earn a higher return on its loan book than other banks without taking on more risk. Obviously, this analysis is not taking into account any fee-generating revenue sources a bank may have access to, but for now let’s just stick to general commercial banking operations. Most banks, especially community banks, are going to be competing with each other on loans and earning the market rate of return on those loans. Therefore, it is essential that these loans bring in the market-level interest rate consistently, and that they do not cease to bring in this interest income because of default. Because of this, I think that a bank’s loan book should be assessed primarily on its sustainability and riskiness, not its ability to generate above-average rates of return.

Deposits, on the other hand, are the primary way that a commercial bank may be able to differentiate itself and earn high returns on its equity. If a bank is borrowing or issuing bonds to fund its lending, then it is probably paying a higher rate than it would on deposits, if it could bring them in. Deposits are, for the most part, a cheaper way to raise capital than most other forms. At one end of the spectrum are time deposits (CDs, brokered deposits, etc.), which pay out the highest rate of any form of deposits and are not very sticky at all. Banks must compete for these kinds of deposits, and therefore, must offer higher interest rates to attract them. This means that these deposits are actively seeking the highest rate, and are likely to leave as soon as the deposit period ends. On the other end of the spectrum, you have demand deposits and even savings accounts that are much stickier and usually pay lower or no interest. Banks that have and develop deposits based on relationships with customers are usually the banks with the best kind of deposits and the best competitive advantage.

I don’t know if FFD has the strongest possible relationships with its customers, or if it develops deposits based on relationships with businesses or other kinds of depositors. What I do know, however, is that FFD is based in small towns. Primarily, small towns where it is the leading or one of the leading banks based on deposit market share. This indicates to me that FFD likely has sticky, long-term deposits that are probably cheaper than deposits acquired through a CD offering or a deposit broker. Think about it, if you live in a small town where one bank serves almost half or 20% of the people living in that community, and you and your family have been depositing your money in that bank for as long as you can remember, you are probably going to keep depositing your money there.

Like I said, I don’t know what kind of relationships FFD has with its customers, but I’m pretty sure they are better relationships than the relationships a national bank would be able to form if it came to town. There isn’t much a new bank is going to be able to do that will make a lifelong depositor in one bank switch to a new one. Sure, it could offer higher rates, but that’s only sustainable if the bank (1) can originate higher yielding loans, (2) is able to keep its operational expenses much lower than FFD, or (3) is comfortable earning much less on its capital than FFD. In Dover, OH (a town of 12,755 people as of 2019), where FFD has about half of its deposits, it is unlikely that a new competitor is going to come in and make about half of the population switch to a new bank. In other cities where FFD has just established a presence, these relationships will probably not be as strong, but with the fastest deposit growth in these areas, it seems as though the bank is doing something right.

FFD’s loan to deposit ratio stood at around 92% in 2018 and is at 90% in 2019, indicating that the bank is primarily engaged in lending out its deposits and does not have a lot of excess capital sitting on its balance sheet. The bank’s equity to assets ratio stood at 8.78% in 2018 and 9.44% in 2019. Again, another indication that the bank is not overly-capitalized, but also not an indication of risky behavior. You can see that the bank is primarily engaged in safe lending by looking at its net charge off and non-performing loan ratios.

FFD’s loan book appears pretty typical from a community bank perspective. As of June 30, 2018, the majority of its loans consisted of Nonresidential Real Estate and Land and One-to-Four Family Residential Real Estate.

Valuation

At its current $54.00 stock price, with about 995,000 shares outstanding, FFD Financial Corp. is trading at a market cap of $53.7 million. With an unaudited, diluted 2019 EPS of $6.35, FFD appears to be trading at about 8.5x its 2019 earnings and about 11x its 2018 earnings. This is too cheap a price for this company to be trading at. With a current earnings yield of 11.8%, and a five year EPS growth rate of about 20% per year as well as a 10-year EPS CAGR of about 20%, this is a company that has exhibited earnings growth as well as growth in book value. To account for the tax cut, FFD’s five-year pre-tax EPS growth rate is 16.2%, and its 10-year CAGR for the same metric is 17.3%.

This growth will most likely not be at the same pace over the next ten years. FFD has grown its book value at 8.13% over the 10 years from 2009 to 2019 and 12% over the last five. Its EPS has grown at a faster rate because of the operating leverage it has been able to achieve by growing from a tiny bank to a small bank with almost $500 million in total assets. As most of the readers know, small community banks usually have the worst efficiency ratios and the highest fixed costs as a percentage of assets. However, these costs are relatively fixed, meaning that as banks grow, those costs usually grow at a rate much slower than the bank’s interest income and assets, resulting in earnings that grow faster than assets and interest income.

FFD has been paying out about 25% of its earnings in dividends over the past two years. This leaves us with a current dividend yield of just under 3%. FFD has been retaining the majority of its earnings for growth, and it has been growing its deposits and loans roughly in line with its book value, which is what you would expect from a bank that is adequately capitalized. To determine if the current price is the correct price to be paying for FFD, you have to determine what the current stock price is pricing in.

In my mind, there are a few ways to look at how FFD may be performing in five years. The current stock price is most likely pricing in interest rate cuts by the federal reserve, which, overall, usually causes commercial banks to earn less. Increases in rates (that are reasonable) usually allow banks to perform better, overall, than when rates are low. This has proven, recently, to be the case for FFD. From 2011 to 2016, when interest rates were extremely and consistently low, FFD brought in an average of $10.5 million in total interest income over those five years. When rates started to rise in 2017, FFD’s interest income jumped 10%, 20%, and 20% in 2017, 2018, and 2019 respectively.

Like I said earlier, over the same time period, FFD’s interest expense was decreasing significantly. Obviously, FFD’s interest expense has increased over the past three years, but the effective interest rate it pays on its deposits is still below 1%. If FFD continues to increase its loans and deposits at a constant rate, it will also continue to achieve economies of scale and decrease its efficiency ratio and overall cost of deposits.

Take a base case scenario where FFD grows its shareholders’ equity at the rate of its retained earnings growth. This means that its shareholders’ equity grows at a rate of earnings growth minus dividends. If earnings are growing at the rate of equity growth, then this means that FFD’s actual growth is its ROAE minus its dividends, which is really the rate that a bank can reasonably grow its deposits, equity, and earnings if you’re not taking into account economies of scale and fee-based income. Also assume that loans and deposits grow at the same rate as equity, because FFD can’t meaningfully increase its loans faster than its equity over a long period of time without running afoul of regulatory capital requirements. If you are skeptical about rates staying where they are or FFD continuing to increase its returns, assume that they earn an ROAE of 13% over the next five years. This is still a good return and is FFD’s average ROAE for the five years ending in 2018. If you carry this “model” to its logical conclusion in 2024, then you end up with earnings of $8.1 million and a dividend yield that has risen from just under 3% in 2019 to about 3.8% in 2024. If FFD is trading at 12x earnings in 2024, not an unreasonable assumption and still below the general market P/E, this would result in an annualized return of around 15% including dividends. While I said this is a base case, this is actually pretty conservative, with a growth rate and ROAE below what FFD is currently achieving. But, this is taking into account possible rate cuts and normalizes earnings growth to what FFD has accomplished over the last fifteen years. If you don’t think FFD can grow this fast, then you can account for this by assuming a larger dividend payout ratio in future years. If FFD doesn’t grow at all in the future and pays out all of its earnings in dividends, you would at least be stuck with around a 12% dividend yield if the ROAE stays the same. If ROAE drops to and stays at 15%, then you would have around a 10% dividend yield. I doubt this 100% payout will happen, but if it does, this would be one of the safest cash flow streams you could have access to.

Lastly, this is a safe bank that has a demonstrated history of conservative lending. Community banks like FFD aren’t usually risky lenders that lever their balance sheets to the extreme and target high growth rates. In fact, FFD has borrowings of less than half a million as of June 30, 2019, and has not experienced significant loan default rates, even in the financial crisis. Think back to what I said about bank assets being, in reality, liabilities. FFD’s assets (or liabilities) are some of the safest out there. So, if you are investing in FFD, you are not taking a large risk that the bank will become insolvent or go to zero. What you are taking a risk of is a decrease in deposit and loan growth or a huge rate cut. These are risks that I will address in the risk portion of the article.

Risk

FFD benefits from its position as a community bank that has huge portions of the deposit market share in small towns. This, however, can be the primary source of its risk as well. Without expanding to new areas or taking a larger percentage of the already outsized deposit market share it has in several towns, FFD cannot grow much faster than the underlying GDP of the small communities it is in. This may not be good news for the bank because the population growth in these areas, for one thing, is not very impressive.

FFD’s largest market – Dover – has declined in population at a rate of about -0.6% since 2010. According to the St. Louis Fed FRED website, the GDP of the state of Ohio has grown at a CAGR of 3.15% from 2008 to 2018. This may not be very indicative of the kind of growth that towns where FFD has a presence have experienced. According to an Ohio Research Office (state affiliate of the U.S. Census Bureau), in 2017 the GDP from Ohio’s metropolitan areas (of which there were 13) made up about 90% of Ohio’s total GDP. So, it is possible that the majority of the GDP growth could have come from these cities, with cities like Dover and Berlin not contributing anything at all. I don’t know what the GDP of each individual city is, but we can look at population growth to get an idea of what growth could look like. The more the population increases, the more people there are to deposit in a bank and get loans from a bank.

According to World Population Review, Tuscarawas County, Ohio, has 92,176 residents as of 2019 and has experienced a population decline of -0.41% since 2010. Holmes County has 43,892 residents and has experienced population growth of 3.34% since 2010.

This growth in Holmes County is very interesting because this Ohio county is unique in its population make-up. Holmes County is home to a very large Amish population, with estimates putting the size at about 40% of the population of Holmes County. Now, I am not from Ohio, and I do not know much about the Amish people, but my assumption is that they do not utilize the banking system as much as other citizens, which could be a significant hindrance on FFD’s growth in that county. The upside to this is that there may not be much competition. According to FFD’s deposit market share statistics on its website, there are only seven banks with deposits in Holmes County. As noted above, FFD is in a distant third place, but has grown faster than any other bank in the county from 2017 to 2018. The two banks ahead of FFD in terms of deposit market share are Killbuck Bancshares and CSB Bancorp Inc. Both banks have about 40% of the market each, but it seems as though no new competitors have entered the market in a while. It’s possible FFD is starting to shake things up in a county that has not attracted a lot of competition in the past. The good thing is that FFD is a community bank that has had branches in the neighboring county for decades; it’s not an out-of-state bank that no one is familiar with.

Both CSB and Killbuck are slightly larger than FFD, with loan books of over $500 million. Both banks have experienced similar growth as FFD, although slightly less, which makes sense considering the three are primarily based in the same counties. FFD has generated higher ROAE and ROAA over the past several years, however. Both banks also trade at around 11x their 2018 net income, which is actually about the same as FFD’s current price to 2018 earnings. Maybe the market thinks FFD won’t be able to gain market share on these banks in Holmes County, or maybe it thinks that all three will suffer from low population growth in these areas. Whatever the case, the market is discounting FFD’s extremely high ROAE and reasonably fast growth in deposits combined with economies of scale.

None of the cities that FFD is in have increased or decreased population at a meaningful rate over the last ten or so years. This is to be expected. It is very unlikely for towns ranging in size from 2,000 to 12,000 people to attract large amounts of outside people to these small areas. The good news is that none of the locations where FFD has branches are experiencing meaningful declines in population. Despite this, FFD has experienced meaningful organic growth in deposits over the last ten years as well as loan demand. This has not been aided by acquisitions. FFD acquired a branch in 2017, but the branch had around $8 million in deposits. The growth in deposits from 2016 to 2017 was over $50 million. I’m not sure how FFD’s expansions into such unincorporated areas such as Mt. Hope and Berlin will play out. Obviously, there is less competition, but much of the competition is deeply entrenched. Also, it is very unlikely that these areas will grow at an overall rate that will allow FFD to meaningfully grow its deposits without having to take market share from other banks.

These communities also do not appear to be situated in a bad part of Ohio. Most of the towns where FFD has branches are less than an hour away from Canton and Akron. Maybe FFD has a plan of expanding into and taking over these small communities in the areas around Dover and New Philadelphia. The bank did announce, in 2018, a planned branch opening in Uhrichsville, Ohio, which is in Tuscarawas County. This branch currently has a non-existent or negligible amount of deposits, but it is possible an expansionary strategy such as this could provide FFD with alternative avenues of growth. Uhrichsville is a small town of around 5,000 people, and a cursory internet search only turned up four banks, excluding FFD, located within the city. There is a possible opportunity for FFD to expand to small communities, around its main areas of operation, that do not have many local banking options.

Tuscarawas County is where the heart of FFD’s operations lie. Tuscarawas County is a county where the population has slightly decreased over the last ten years, and therefore, is not necessarily a place that attracts a ton of competition. FFD’s largest competitor in this county is Huntington Bancshares. This is a bank with over $100 billion in assets and just under $100 billion in deposits, that is headquartered in Columbus, Ohio. It has a vast amount of resources to deploy, and can surely offer many more services than a small community bank such as FFD. However, the Dover-New Philadelphia MSA has total deposits of $1.4 billion according to FFD’s website. Of this, Huntington owns about $330 million, slightly more than FFD. This $1.4 billion, in reality, makes up all of the deposits in the entire county, meaning whoever controls the deposits in the Dover-New Philadelphia MSA will have the lion’s share of the deposits in the county. Huntington Bancshares’ market share decreased from around 24% to 22% from 2017 to 2018 while FFD’s increased from 18% to over 19%.

This small market opportunity of gaining a few more hundred million in deposits, if Huntington is successful in taking market share from FFD, will not really move the needle on their balance sheet or income statement. A bank the size of Huntington is focusing the majority of its resources in much larger cities and metropolitan areas. On the other hand, the Dover-New Philadelphia area is the heart of FFD’s operations. They are committed to building relationships here and throughout the county. I’m not saying that Huntington is not committed to this same goal, but I can imagine their focus being drawn to other areas. Who knows, maybe one day they will be willing to sell branches to FFD. Only time will tell, but for now it seems that FFD is holding its own against Huntington.

In addressing the risk of a rate cut, you have to look at how FFD has performed during the periods when the fed funds rate was near zero. FFD’s net interest margin has not meaningfully improved when rates increased, and its non-interest paying deposits are around 20% of total deposits. This is a larger portion than it was when Fed Fund Rates were around zero, so the bank has benefited from a small amount of rate leverage, as I call it, during the recent period of increasing rates (i.e., it has been able to increase its rates on new loans, re-financings, and variable rate loans while a larger portion of deposits have not increased in cost because they have no cost). FFD’s net interest margin was 3.55% in 2010 and 3.68% in 2018, and didn’t really fluctuate much in the intervening years. This is a result of FFD loaning out almost all of its deposits and paying an interest rate on most of its deposits. If rates decrease, its net interest margin is not going to experience a material decrease. To determine how much of an impact rate cuts could have, you can run a simple “model” utilizing FFD’s past results.

Right now, using FFD’s total interest income divided by its loans, FFD is earning an effective interest rate of 5.21%. From 2012 to 2016, a time when interest rates were extremely low, FFD earned an average effective interest rate on its loans of 4.83%. Let’s say that after rate cuts, FFD earns this again and that it pays a rate of 0.5% on its deposits, considering the deposit rate will decrease as well. This means that FFD will bring in about $14.5 million in net interest income if you assume FFD’s loan book doesn’t grow or shrink. Provisions for loan losses have averaged 1.31% of total interest income over the past five years so this would drop net interest income to about $14.3 million. Non-interest expense has decreased to about 2.10% of total assets in 2019, so I will assume this will stay the same if assets are not growing. This would result in non-interest expenses of $7.6 million. Subtract this from the net interest income and account for taxes using the tax rate of 21% and you get about $5.3 million in net income. At this rate, FFD would still be achieving an ROAE of around 13% and would be trading at an earnings yield of about 10% using the current stock price. A rate cut doesn’t seem as bad if you look at how FFD performed during a period of sustained near-zero fed funds rates, and if that is the worst-case scenario, you can still feel pretty good about earning the market rate of return or above, even in a decreasing rate environment.

I know the fed funds rate was near zero throughout 2009, 2010, and 2011 as well, but using these years would actually distort our average higher than it should be. FFD’s effective interest income rate ranged from 5.7% to over 7% in these years because loans made when interest rates were much higher were still on the books at this time. The effective interest income rate didn’t start to get depressed until 2012 when, I assume, more new loans started to be originated at the new lower interest rates. With this in mind, it seems that the most significant risk is the lack of growth that could be the result of the demographics in the areas FFD operates in. The two risks paired together could definitely decrease future returns, but that’s essentially the scenario I played out in the paragraph above. It involved FFD not growing and earning a lower rate on its loans. I know there are many other subtleties involved in rate cuts and the changing composition of bank loan books. I do not know how exactly the future could play out, but these are my best estimates considering past results.

Conclusion

Most of this analysis hinges on the continuing safety of FFD’s loan book. If I am wrong about that, then the whole thesis could fall apart. If I am right about that, then this could be a chance to earn one of the safest double-digit returns you can find. The President, Trent Troyer, owns almost 3% of the bank’s outstanding stock and the Employee Stock Ownership Plan (ESOP) owns about 12.5%, which lends a little confidence to the aligned incentives of the executive and employees.

Since FFD is concentrated in two specific counties in Ohio, it is possible that it may grow at a rate less than the overall GDP growth rate of the U.S. or Ohio. That is part of the risk you take when you invest in a community bank. However, I think the benefits of a high return on equity and assets, a sustained historic growth rate, and future economies of scale outweigh these risks, and the stock price does not reflect this. The bank appears to have local barriers to entry, such as sticky deposits and a small market that does not offer a chance for rapid growth outside of direct competition with local banks over deposit market share.

The reasons for mispricing appear to stem from the bank’s extremely small size, relative illiquidity, and boring market. I can’t find a recent write-up on Seeking Alpha, Value Investors Club, or anywhere else on the internet for that matter. Besides a few mentions in Seeking Alpha articles back in 2012, there isn’t any analysis of this bank that I can find. A cursory glance at the bank will not excite most people, but what is underneath is a safe, quality bank that is earning high returns, growing, and is operating in a market with limited competition.