Monro (MNRO): A Durable Automotive Service Chain Executing a Roll-Up

Article by DAVE ROTTMAN

Introduction and Overview

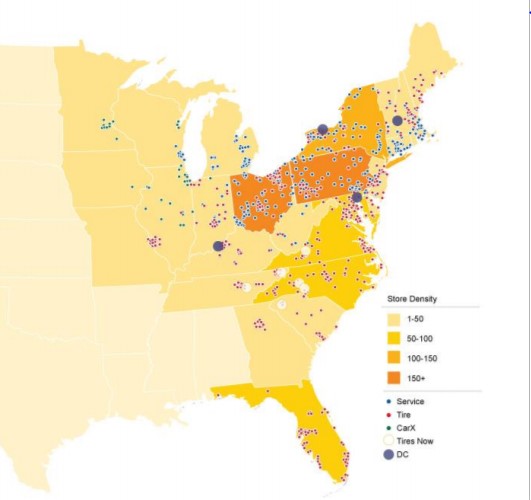

Monro (MNRO) is a large chain of auto shops providing a wide range of automotive service and repair work in the United States with company-operated stores servicing 6.2 million cars in the fiscal 2018 year ending 03/31/2018. While originally based out of the Northeast, Monro has been executing a roll-up strategy for decades, slowly widening their coverage as they expand both south and west. As of the end of fiscal year 2018, Monro had 1,150 company-operated stores, 102 franchised locations, 5 wholesale locations, 2 retread facilities, and 2 dealer-operated stores. These locations are spread across 27 states and operate under the following brands: Monro Muffler Brake & Service, Car-X, Tread Quarters Discount Tire, Mr. Tire, Autotire Car Care Center, Tire Warehouse, Tire Barn Warehouse, Ken Towery’s Tire & Auto Care, and The Tire Choice.

One of the largest operators of automotive repair and service shops in the US, Monro has used a roll-up strategy to become one of the lowest-cost operators by building an increasingly dense network of auto shops that result in improved economics through the sharing of distribution, marketing, and management costs. Further, as a large purchaser of aftermarket auto parts, Monro enjoys relatively more bargaining power than most of its competitors. These factors have resulted in increasingly superior margins, decent economics, and consistently competitive prices for its customers. While this acquisition-based strategy has been in the works for decades, the industry is still incredibly fragmented and offers a long runway of growth for Monro to continue to deploy capital in acquiring and developing new shops. This will serve to further improve operating efficiencies, and thus economics, and allow Monro to continue to offer its work at very competitive prices.

In addition to the long runway of growth, Monro is a durable business with strong and stable cash generation. This is because people must continue to service their vehicles in all economic climates. Historically, Monro has held sales, margins, and cash flow strong during downturns. In fact, Monro is somewhat countercyclical in that when new car purchases are halted, repairs are increased. This allows Monro to do especially well in a downturn. As we approach a decade-old bull market, the new cars sales cycle begins its descent, the average age of vehicles on the road increases, the number of vehicles on the road increases, the shift away from DIY auto work continues, and the number of service bays decreases, there are a confluence of factors that bode well for Monro’s future earnings power.

The Business

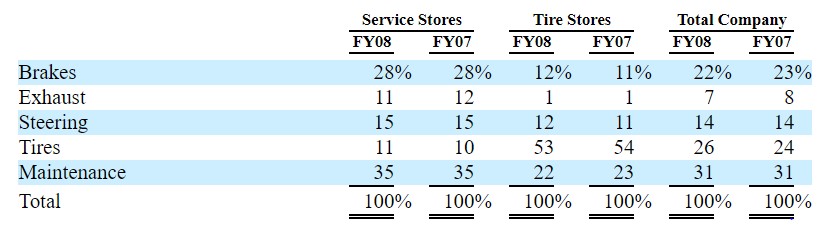

Monro’s business is broken into two main categories: undercar service and repair and tire sales and service. Monro categorizes its shops as either service stores or tire stores. In reality, there is a large degree of overlap in these locations where you see the service stores doing tire work and the tire stores doing non-tire service work. For example, in 2018 23% of service stores’ revenues were related to tires, and 40% of tire stores’ revenues were related to non-tire activities. In total, in 2018 Monro generated 50% of its revenues from non-tire work and 50% of its revenue from tire work. The composition of the non-tire revenue was 13% brakes, 2% exhaust, 8% steering, and 27% maintenance.

Monro does not do every type of automotive service work, but it does quite a bit. Specifically it focuses on services for passenger cars, light trucks, and vans, including work on brakes, mufflers and exhaust systems, steering, drive train, suspension and wheel alignment, tires, and assorted routine maintenance work. This work is generally not covered by new car warranties. Monro generally does not do under-the-hood repair work with the exception of oil change service, flush and fill services, and some minor tune-ups. The balance of Monro’s revenues comes from tire sales and related services such as alignments.

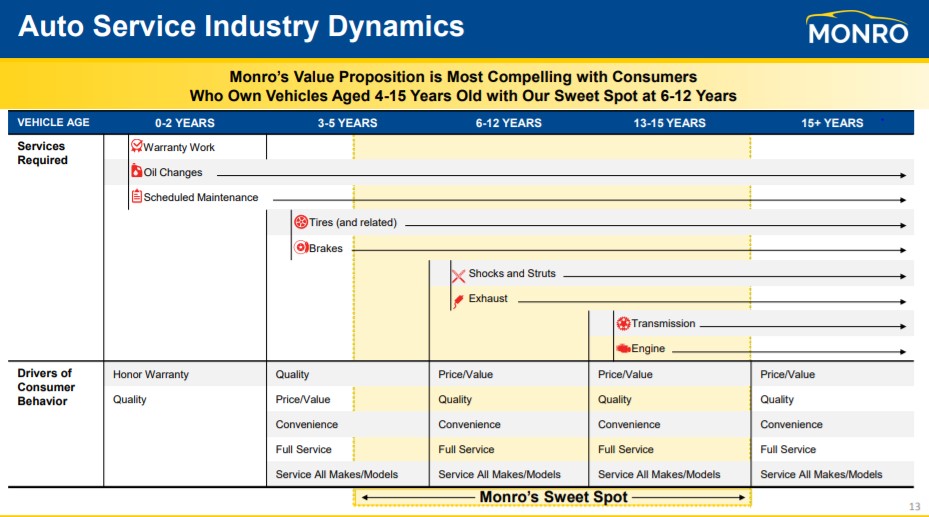

As noted above, the work Monro does is generally not covered by new car warranties. If you think about the life cycle of a new automobile, an individual purchases the car from the dealer, often uses the dealer for service work for a period, and then as the vehicle’s value declines, the owner shifts towards various other auto shops to take over maintaining the vehicle during its remaining life. Monro steps in during the period after the individual stops using the dealer for service work. Monro says their sweet spot is the 6-12 year period of a vehicle’s life. The following graphic generated by Monro presents the automotive service lifecycle:

The inventory needed to perform the sales, service, and replacement work is purchased from about 120 vendors. Although the largest vendor supplied 26% of stocking purchases in 2018, there are many alternative sources of supply if needed. Brake rotors and pads, filters, steering and suspension parts, wipers, and belts are generally sourced from China, and secondary parts are purchased from Advance Auto Parts and AutoZone. Tires are purchased from a wide range of vendors including Goodyear, Michelin, Continental, Yokohama, Kelly Tires, Hankook, Cooper Tires, BF Goodrich, Bridgestone, Achilles Tire, Blacklion, and Pantera Tire.

One of Monro’s strengths relative to many other automotive service shops, especially smaller ones, is the distribution system it has built. Monro has a few large distribution centers and several smaller warehouses spread out throughout its service areas to allow for continuous stocking of inventory in shop locations. This prevents shops from running out of inventory and either making customers wait a few days for inventory delivery or purchasing parts at full retail prices from local suppliers. As a supplement to the warehouse system, Monro has setup many of its stores as “key” stores which carry about double the inventory of a typical store and serve as mini-distribution centers. Most of Monro’s locations are within 25 miles of at least one of these “key” stores. This creates a more seamless flow of inventory between store locations in order to optimize inventory levels across the network.

Recent Shift in Sales Mix

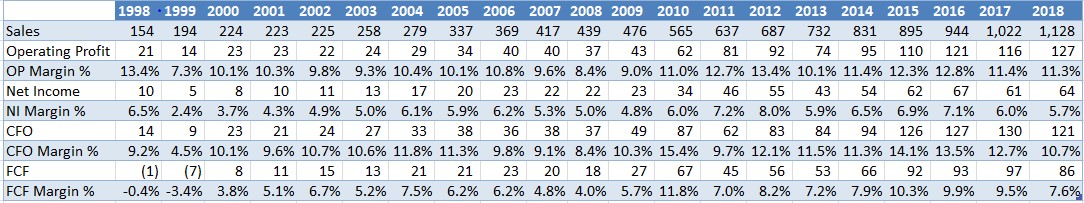

It is important to have a sense of how Monro has evolved over the years. The biggest change is that Monro has done proportionally more tire work over the last decade as a result of more tire store acquisitions than service store acquisitions. The following tables from Monro’s 2008 and 2018 10-Ks reflect Monro’s sales mix shift:

From 2008 to 2018 Monro went from earning 26% of its revenues from tire work to 50% in 2018. This is a large shift with a major implication: lower margins. Tire work, taken in the whole, tends to be lower margin work than the other categories of work Monro does. So, even as Monro has gained scale from its growing base of locations, the increased shift towards tire work has dampened margins in the last few years. It is difficult to tease out the specific amounts of this impact because in addition to the two effects above Monro has seen declining same-store sales that corresponds to the end of the new-car sales cycle. Nonetheless, it is important to understand that as tires become a larger part of Monro’s business that margins will be impacted.

Durability

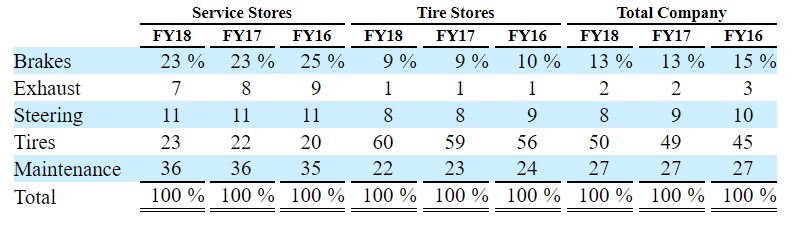

Monro’s business is durable in that is consistently generates sales, earnings, and cash flow. The table below illustrates several key metrics:

This table illustrates impressive stability of earnings power and margins over time. In fact, there are no years with negative operating profit, net income, or cash flow from operations. Margins have held steady throughout the 20 year period. There are only see two years with small amounts of negative free cash flow, and that is because of elevated levels of capital expenditure in those years.

The Roll-Up

As noted above, Monro has been executing a roll-up strategy for decades. The following image demonstrates where Monro is at today:

As noted above, Monro had 1,150 company-operated stores, 102 franchised locations, 5 wholesale locations, 2 retread facilities, and 2 dealer-operated stores as of the end of fiscal 2018. As of the end of fiscal 1998, Monro had around 350 total locations. Over these 20 years, Monro has almost quadrupled its locations, or increased them a compound annual growth rate of 6.6%.

Another way to consider Monro’s roll-up is to analyze the growth in the numbers vehicles serviced by company-operated stores. In 1998, Monro serviced 1,568,000 vehicles. In 2018, Monro serviced 6,200,000 vehicles. This is a compound annual growth rate of 7.1% and is an interesting proxy for the growth in the intrinsic value of the business without the distortions of pricing effects.

The majority of these store additions have been driven by acquisitions as opposed to greenfield growth, although there has been meaningful greenfield growth, too.

Looking forward, Monro should be able to continue its expansion for a long time to come. While it may appear from the graphic above that Monro has tapped out its present geographies, a quick drive around any suburban or urban area will show that there are countless auto shops that are one-offs or part of small chains. The National Oil and Lube News confirms this, estimating that the top 10 national chains of auto shops only have 14% of market share. As the owners of small shops look to retire or cash out on their business, Monro will be there.

Industry Trends

There are numerous trends affecting the automotive service industry going forward with implications for Monro.

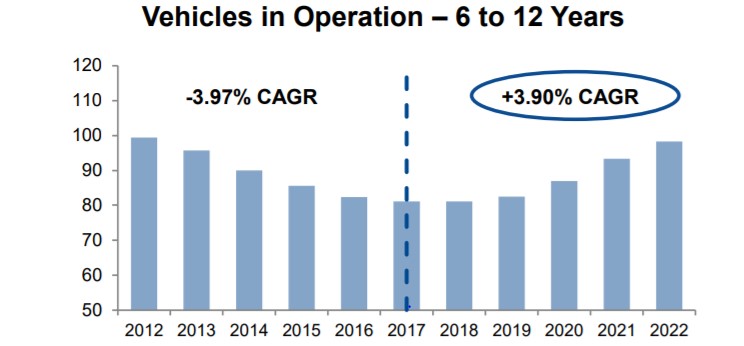

First, and perhaps most importantly, the average age of vehicles on the road is increasing as a result of the turn of the new car sales cycle with sales of new light vehicles peaking between 2015 and 2017. The following graphic, compiled with historical and projected data, illustrates the past and future trends of the number of vehicles in the 6-12 age cohort, which is Monro’s sweet spot. The implication is that as a percentage of vehicles on the road, more vehicles will be going to Monro’s shops for service work.

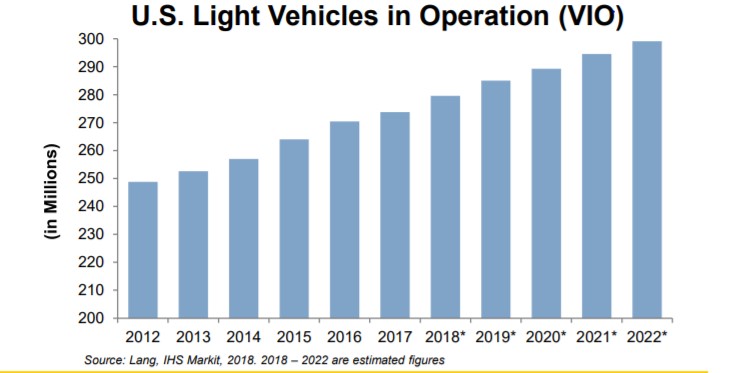

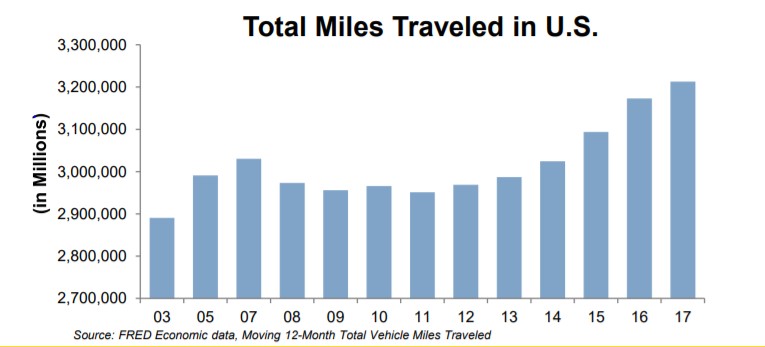

Even beyond this, there are simply more vehicles on the road than there have been and more miles are being driven, which are trends likely to continue.

Next, there has been a decades-long shift away from DIY work to the DIFM (“Do it for me”). This makes sense given the increasing complexity of automobiles. According to Monro, DIFM was 74.3% of all work in 1999. In the last couple of years, The Autocare Association Factbook estimates that DIFM represented about 81% of work. This trend is likely to continue going forward.

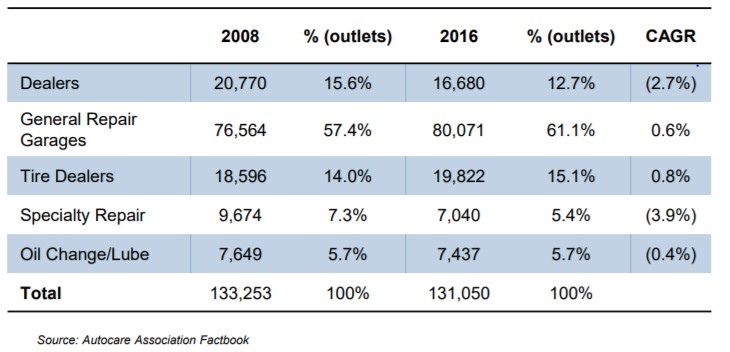

Finally, according to the Autocare Association Factbook, there has been a moderate decline in the number of automotive service outlets over the past decade. Given the increasing number of vehicles of the road, this means fewer outlets/bays to work on more vehicles in operation. Further, the composition of these bays has shifted away from dealers, specialty repair, and oil change shops, towards general repair garages and tire dealers.

This chart speaks to the competitive environment in the automotive service industry. To simplify things, general repair garages and tire dealers are gaining market share from other establishments, while the overall supply (number of outlets) relative to demand (number of light vehicles in operation) has shrunk. This is a positive indicator for those firms in the categories gaining share.

Finally, as discussed above, the industry is still incredibly fragmented with the vast majority of its participants much smaller than Monro and other national chains. There are several other large chains, including TBC Corp, Firestone Complete Auto Care, Midas, The Pep Boys, Meineke, and others. As each of these chains focus on slightly different segments, it is difficult to compare and contrast their operating efficiencies, and many of these chains are not public. From the information available, Monro’s operating margins and customer ratings seem very competitive. Additionally, Monro’s prices seem very competitive, with a generic 5% off any competitor’s coupon offer available on their website. The takeaway is that within its fragmented industry, Monro is a large player with scale that offers quality work and good prices for its customers.

All in all, the backdrop of the existing industry bodes well for Monro’s earnings power. That is not to say there are not challenges facing the industry – as with many other industries, automotive service faces technological disruption in the offing. These will be discussed in the Risks section.

Economics

Monro’s firm-wide economics are decent with pre-tax returns on tangible capital around 30% in recent years. While these returns are strong, it is important to remember that for a company executing a roll-up strategy, the price paid for acquisitions will have a huge impact on returns on capital going forward. It is difficult to calculate with publicly available information exactly what Monro’s returns on acquisitions have been, but pre-tax returns on total capital, including Goodwill, have been around 15%. It is clear that returns on tangible capital materially exceed returns on total capital, as a result of paying premiums to tangible capital for acquisitions. Putting this together, Monro earns strong returns on its existing asset base, and decent but not great returns on its acquisitions.

Monro provides useful data in assessing the economics of its individual locations. There are several ways that Monro arranges financing for new builds: a lease for both the land and building, a land lease with Monro constructing the building, or a land purchase with Monro constructing the building. In any of the three financing cases, a service store requires about $225,000 for equipment and $55,000 for inventory. Total capital required to build a new build service store ranges from $360,000 to $990,000, depending on the location and which financing option Monro utilizes.

Tire stores, in general, are larger and have more service bays and tend to be at the higher end of the range. And, of course, in either event, if Monro acquires the location, it generally pays for intangible assets like customer lists, non-compete covenants, trade names, and goodwill, although in acquisitions they generally pay less for the tangible capital.

As of 03/31/2018, Monro leased the land and/or the building at 71% of its locations, and owned the land and building at the remaining locations.

Service and tire stores have average sales of approximately $600,000 and $1,200,000, respectively. Since the sales mix is 50/50 non-tires and tires and the store split is roughly 50/50, on average there are sales of $900,000. With firm-wide operating margins of around 12%, that is $108,000 of operating profit. Assuming again the 50/50 blend, and average required capital of $675,000 (the mid-point of capital outlay for a new site, which is conservative given the percentage of locations that lease), that is a pre-tax return on capital of 16%.

This amount roughly corresponds to Monro’s overall pre-tax return on total capital of 15% and gives us a rough glimpse at the return on incremental capital deployed in new shop construction.

Growth

Monro’s growth has been and will continue to be primarily acquisition driven, although greenfield construction contributes meaningfully, too.

Given the degree of fragmentation in the industry, Monro is likely to increase their store base by 7% for at least a decade into the future. This seems reasonable given the historical record and management’s guidance that acquisitions represent the opportunity for 10% annual sales growth going forward.

The other category of growth for Monro comes from same-store sales growth. Comparable store sales fluctuate with what is going on with the industry, but management’s guidance of 2-4% growth seems reasonable for many years to come given the industry backdrop discussed above.

Putting together store growth with same-store sales growth, Monro should be able to generate 10% in revenue growth for a long time into the future.

Capital Allocation

Over the years, Monro has allocated the majority of earnings and free cash flow towards acquisitions, followed by capital expenditures (building new shops and maintaining the existing store base), and then finally to dividends.

When analyzing portion of earnings and free cash flow that has gone to each of these categories, it becomes clear that Monro has been using debt to supplement its earnings power to provide the capital to meet its needs.

With that said, it is important to note that this debt has never been especially high. Over the last 20 years, the average debt to equity (book values for each) ratio has been about 50%, or 63% at the end of 2018. Additionally, the average debt to EBIT ratio over this period is about 2.4, or 3.1 at the end of 2018.

The takeaway with capital allocation is that Monro has historically had a simple policy: pay out about 25% of its earnings or free cash flow as dividends and reinvest the rest in the business via acquisitions, growth capex, or maintenance capex. Any shortfalls in cash to achieve these needs were met by taking on debt, but that debt never reached unreasonable levels. Given the historical record and management communication, there is no reason to expect this to change.

One of the attractive elements of analyzing Monro is the unusual degree of clarity shareholders have into their capital allocation policy and its likely results. As noted above, investors know what to expect with Monro’s capital allocation policy and the likely results of that policy: 25% of the earnings will be paid out to shareholders and the other 75% will be invested in the business for after-tax rates of return in the low to mid-teens. Further, Monro has a long history of sticking to what it does best: purchasing, developing, and operating automotive repair shops in a specific geography. This provides peace of mind that management is unlikely to allocate capital to areas where they have not demonstrated competency. This gives investors a relatively clear view into what Monro looks like 5 and 10 years out in the future.

Risks

There are several risks facing Monro going forward: overpaying on acquisitions, margin compression related to the tire business, the shift towards electric vehicles, and the trend towards autonomous vehicles.

Acquisitions

Overpaying on acquisitions is one of the risks facing Monro going forward. Given the continuation of the roll-up strategy as the primary use of capital, it is crucial that Monro applies a disciplined approach and pays an appropriate price for the auto shops and chains it acquires. It is not possible with publicly-available information to evaluate the prices paid on acquisitions and the resulting returns, but returns on total capital have drifted downward somewhat in recent years. It is unclear whether this is simply because of the shift towards more tire sales and the general slowdown of automotive work, or whether it is because of expensive acquisitions. However, given the portion of earnings that are dedicated to acquisitions, it is important that Monro is successful in this area. To the extent possible, this is an area for investors to monitor.

Margins

The pressure put on Monro’s margins, as a result of the increased importance of the tire business, is another area for investors to monitor. The shift towards more tire work has both positive and negative implications. On the one hand, the sale and service of tire work tends to be lower margin than that of non-tire automotive work. Therefore, a bigger focus on tires will lower overall margins. This is likely to be slightly offset due to improving economies of scale. On the other hand, the shift towards more tire work serves as an offset to the risk that electric vehicles pose to certain other categories of service work Monro performs, as electric vehicles need tires just as much as internal combustion vehicles. In fact, it is suggested by some that electric vehicles have more tire needs (more frequent rotation, replacement, etc.), but it is early to have a definitive conclusion.

One subset of this concern is that of online tire retailers entering the market, including Amazon, and the impact they will have on companies such as Monro as margin pressure follows. The market was clearly worried about this as Monro’s stock price sold off sharply after the Sears-Amazon partnership was announced for Sears to install Amazon’s tires. With that said, Monro does not appear to be overly worried by this as they actually are a preferred installer for several online retailers and they receive an attractive service fee for the installation of tires. Just as interesting, half of the customers that come to Monro through these tires sales are first-time Monro customers and this offers Monro a chance to build a new customer relationship. Further, the after-market auto services industry is somewhat insulated from online sellers since customers in many situations need timely service and do not have the ability to wait for parts to ship, and even if they did many customers do not have the skill and tools to handle such work themselves.

Electric Vehicles

The risk of electric vehicles on auto dealerships was discussed in the Focused Compounding article on AutoNation (“AutoNation (AN): A Cheap Cannibal with Minimal Downside”). The discussion on the effects of electric vehicles on auto dealerships is relevant to automotive repair shops:

“The increased use of plug-in electric vehicles (PEV) is also a threat to the current dealer model since P&S is such a large component of profits. Compared to vehicles with internal combustion engines (ICEs) PEVs are thought to require less maintenance because the battery/motor/associated electronics require little-to-no regular maintenance, there are fewer fluids to change, brake wear is reduced due to regenerate braking, and in a general sense there are fewer moving parts. As offsetting factors, replacing batteries is quite expensive for PEVs and to-date many PEVs require more frequent tire changes. Nevertheless, I think it is reasonable to assume that the increased use of PEVs will reduce the amount of work for auto shops. But it’s important to keep things in perspective. Currently, PEVs represent only 1.13% of new vehicle sales in the United States. The growth rate in recent years has been rapid and is likely to continue, but if we assume 25% growth in the percent of new vehicle sales for 10 years, 15% growth for the next 10 years, and 5% growth for the final 10 years, PEVs will represent 11% of vehicle sales in 2027, 43% by 2037, and 69% of vehicle sales in 2047. Since vehicles operate well in excess of 10 years with the average age of a vehicle around 11.5 years and total life being closer to 15 years, the actual percent of vehicles on the road will be lower than 69%. These assumptions may prove to be very inaccurate – I simply do not know. But the point remains that even with high rates of growth in the adoption of PEVs, given its currently low penetration rate and the relatively long life of vehicles, ICE vehicles will remain a large portion of vehicles on the road for several decades to come. Taking that into consideration and considering that PEVs will also need some, if less, P&S work, I do not consider this a game-changing risk.”

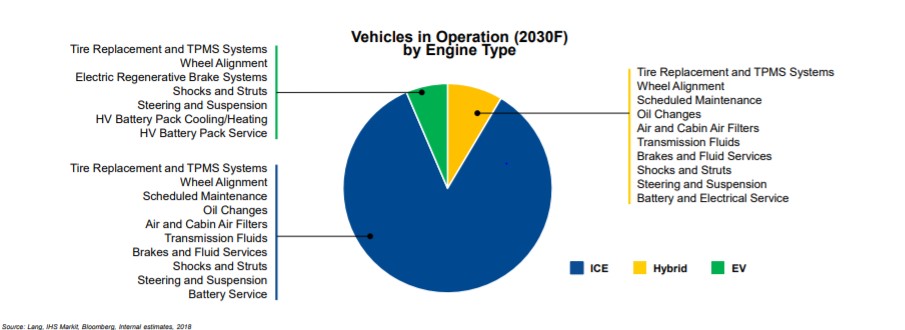

The following graphic from IHS Markit provides another perspective on relative numbers of vehicles in operation in 2030.

To tie this into how electric vehicles affect Monro’s business, it is important to remember that America is a long way from seeing the majority of vehicles on the road being electric, even when a majority of the vehicles are electric these vehicles will still require service work, and Monro’s tire business will be unaffected by electrification.

Autonomous Vehicles

The trend towards autonomous vehicles is another potential risk to Monro’s business model. If the majority of the cars on the road are part of fleets of autonomous, ride-sharing vehicles, would Monro have a place in the automotive ecosystem? Also discussed in the AutoNation article, even in this scenario that may be decades away, these fleets of cars would need to be serviced by high-end auto shops with the reputation, scale, and quality control to do this sort of work. Other than large car dealerships, Monro is one of the few businesses with the characteristics needed to perform this sort of work. The truth is it is very difficult to evaluate the timing of when this technology will become feasible and economically viable on a large scale, but it seems premature to assign too much of a discount to Monro today based off this risk.

Management and Ownership

There has been some turnover in the management team in the recent past, but nothing stands out as especially troubling.

Monro’s new CEO, Brett Ponton, has a deep background in the automotive industry including working at Goodyear Tire Company, a group of Jiffy Lube franchises, and more recently as the CEO of AAMCO’s parent company. In several of these roles, Brett was involved in the successful recovery or turnaround of the business. Given the slump in the last few years at Monro, there is reason to think that Mr. Ponton’s background will be helpful.

As of the last filed proxy statement measurement date on 05/26/2017, Monro’s management team and board, as a group, owned 6.2% of the common stock, and 100% of the Class C preferred stock.

The Class C preferred stock is a little unusual. The economic interest of this stock is immaterial, but the voting interest of this stock gives its holders the power to veto votes put forth by common shareholders. The following text is from the 2017 proxy statement:

“…Therefore, such preferred shareholders have an effective veto over all matters put to a vote of common shareholders…”

In effect, this gives Class C control over the business. The Class C preferred stock is 100% held by Peter Solomon, a director of Monro since 1984. This unusual arrangement came about from an investment group led by Mr. Solomon purchasing a controlling interest in Monro in 1984. Historically there have not been any issues related to this control situation, but it is noteworthy.

Beyond the executive management team and the board, Monro has recently adjusted its store-level incentives in a manner that should be conducive to positive performance. Previously, store-level management received additional compensation based strictly off store profitability. Now, store managers and assistant managers “may receive other compensation based on their store’s customer relations, store profit, sales volume and other factors via a monthly or quarterly bonus based on performance in these areas”. This broadened array of incentives should incentivize the on-the-ground managers to run their shops with a more long-term orientation rather than simplify maximizing this period’s profitability.

Finally, Monro has experienced a low level of stock dilution over the years, averaging approximately 1% after considering stock splits. It is reasonable to expect 1% dilution going forward.

All things considered, there is nothing to suggest that Monro’s management, board, and ownership structure are abnormally good or bad.

Valuation

Owning Monro is best thought of as owning a durable stream of cash that will grow at a moderate clip for a long time into the future. In valuing Monro, it is helpful to think about what level of normalized earnings you will be earning going forward, and then consider what that stream of earnings is worth.

Although sales have been relatively depressed in the last 5 years due to being in the tail end of the new car sales cycle, I will use management’s estimate of fiscal year 2019 sales of $1,185M as a starting point. As discussed above, Monro has had some level of declining margins in the last few years due to the increasing portion of tires in the business and same-store sales decreases, but given improving sales and operating efficiencies I think management’s 3 year estimate of 12% operating margins is reasonable. This brings us to $142.2M of operating profit.

Next, we need to consider the effect of taxes. Monro is a large beneficiary of the tax changes, as they historically paid a tax rate of 35%-40%. Management has guided, and I agree, that the tax rate going forward will be around 24%. This leaves $108.1M of after-tax operating profit.

Over a 20 period, depreciation has exceeded capital expenditures by about 10%. That is even more interesting considering that Monro has steadily added stores, adding capital expenditures beyond what a steady-state would be like. I estimate maintenance capex to be $30M, which seems to likely be on the high end considering 2018 capex was $35M. Given projected 2019 depreciation of $54M, we need to make an adjustment up of $24M. After making this adjustment, we are left with adjusted after-tax operating profit of $132.1M.

Taking into account current debt of $394M and its market capitalization at $56 per share, Monro is trading at 17 times after-tax operating profit on an enterprise-value basis.

Given its ability to grow sales at 10% for a long time to come while paying out 25% of its earnings as dividends, proven economics on its existing asset base and its successful acquisition history, and the durability of its earnings and cash flow, I believe Monro is worth 22 times earnings.

If Monro’s business is worth 22 times earnings, and we back off the debt of the business, that implies equity value of $76 per share. At prices of $56, that is a margin of safety of 27%.

Another way to approach investing at Monro at an EV/NOPAT level of 22 is that you will receive 1% in dividends (based off a 25% historical dividend payout rate, so .25 of 1/22. is around 1%). As discussed above, I believe Monro will be able to generate sales growth of 10% that should translate into earnings growth of at least 10% for at least a decade into the future. As an offset, an investor would expect approximately 1% of stock dilution. This would bring an investor who pays 22 times earnings to a total annual return of nearly 10% for a long time. I believe a buy and hold investor buying Monro at 22 times earnings and earning nearly 10% total return is very likely to outperform the S&P 500 over the same time period.

The final way to think about Monro is to consider what the business will look like in 5 years. The big difference between Monro today and Monro in 5 years is the number of locations, the increased level of sales at those locations from industry tailwinds, and the efficiencies gained through an increasingly dense network of locations. In five years, I think it is reasonable to expect Monro to have sales of $1,735M sales driven by 7% annual expansion of stores and 3% annual growth in same-store sales. Further, if margins expand out to 12%, Monro will have $158M of after-tax operating profit. I will ignore a depreciation-capex adjustment to keep things simple and conservative. To simplify the capital allocation, I will assume that instead of paying out some of its earnings as dividends, they will pay off the debt. If we assume that Monro’s growth prospects are somewhat less in 5 years than it is today, and that it is only worth a multiple of 20 times after-tax profit, then the value of the business would be $3,165M. Taking into account 1% annual dilution in the share count, this would imply per-share value of $92. From the current price of $56, this implies a 10% annual return going forward. From $45 per share, this implies a 15% annual return going forward.

Conclusion

Monro is a durable business that is able to weather both strong and weak economic environments with ease. While the business enjoys decent economics, a long runway of growth to continue its roll-up strategy, and several strong industry tailwinds, the current market price reflects some of these attractive qualities, and buying at prices around $56 only offers a margin of safety of around 27%.

At prices around $45, however, I believe Monro to be materially undervalued and highly likely to outperform the S&P 500.