RLI Corp (NYSE:RLI) – Just Wait for the Price

Introduction

Founded in 1965, RLI Corp. is a specialty insurance company with a niche focus. Initially, the company was called Replacement Lens Inc.*, as the company started out as an insurer for contact lens. They were once the largest insurer of this product in the world. In 1976, RLI expanded beyond contact lens insurance into property and casualty insurance.

Fast forward to the present, they now offer insurance coverages in both the specialty admitted and excess and surplus markets. Through 3 subsidiaries, they operate their insurance business nationwide in the US.

Coverages in the specialty admitted market, such as their energy surety bonds, are for risks that are unique or hard-to-place in the standard market, but must remain with an admitted insurance company for regulatory or marketing reasons. In addition, their coverages in the specialty admitted market may be designed to meet specific insurance needs of targeted insured groups, such as professional liability and package coverages for design professionals and stand-alone personal umbrella policy.

The excess and surplus market, unlike the standard admitted market, is less regulated and more flexible in terms of policy forms and premium rates. This market provides an alternative for customers with risks or loss exposures that generally cannot be written in the standard admitted market. This typically results in coverages that are more restrictive and more expensive than coverages in the standard admitted market. Often, the development of these coverages within the excess and surplus market is generated through proposals brought to them by an agent or broker seeking coverage for a specific group of clients or loss exposures.

RLI distributes their insurance products through their own branch offices that market to wholesale and retail producers. The top 3 states for RLI are California (16% of total direct premiums earned in 2016), New York (14.1%) and Florida (10.4%).

Description

To understand an insurance company, it’s important to look at both its insurance operation and investments.

Let’s begin with a more detailed look at its insurance operation.

In terms of market segment, RLI categorizes them into 1) Specialty Admitted Insurance Market, 2) Excess and Surplus Insurance Market and 3) Specialty Property and Casualty Reinsurance Markets.

As mentioned, in the Specialty Admitted Insurance Market, most of the risks they underwrite are unique and hard to place in the standard admitted market, but for marketing and regulatory reasons, they must remain with an admitted insurance company. This market is more regulated than the other two markets RLI are in, particularly regarding rate and form filing requirements, as well as restrictions on the ability to exit lines of business. In 2016, this is the biggest market for RLI, representing about 67% of their total gross premiums written.

Excess and Surplus Insurance Market is the second biggest market for them, contributing 30% of the gross premiums written in 2016. This market focuses on hard-to-place risks, with more flexible policy forms and unregulated premium rates. For the overall property and casualty industry, this excess and surplus market represents about 5% of the total market.

The rest of RLI’s business come from policies written in the specialty property and casualty reinsurance markets. This business is typically more volatile because of unique underlying exposures and excess and aggregate attachments.

On a business segment basis, RLI categorizes its business into 1) Casualty, 2) Property and 3) Surety.

Casualty has been the biggest segment for RLI. In 2016, Casualty was 62% of net premium written. Major products within this segment include commercial and personal umbrella, commercial transportation, general liability and professional services. The combined ratios of this segment were 92 in 2016, 88.8 in 2015 and 88 in 2014.

Property is the second biggest segment despite recent decline. In 2016, it was 21% of net premium written. Major products here include commercial property, marine and specialty personal. Given the worsening business environment in recent years, they have been willing to write less business in this segment. The combined ratios of this segment were 91.6 in 2016, 83.1 in 2015 and 83.4 in 2014.

The last segment is Surety. In 2016, this constitutes 17% of total net premiums. Miscellaneous, commercial, contract and energy are the business lines within this segment. Underwriting margin is higher in this segment than the other two, with combined ratios being 77.8 in 2016, 71.5 in 2015 and 73.8 in 2014.

On their asset/investment side, RLI maintains an 80% fixed income and 20% equity target. As of the end of 2016, their investment portfolio has a fair value of more than $2 billion.

Fixed income represented 79% of the 2016 portfolio, consisting of 35 percent AAA-rated securities, 30 percent AA-rated securities, 18 percent A-rated securities, 11 percent BBB-rated securities and 6 percent non-investment grade or non-rated securities. RLI mainly manages its ultimate payout patterns of their reserves through matching it with the duration of its fixed income investments. In other words, their float is invested in fixed income securities. The fixed income portfolio had a duration of 4.8 years as of the end of 2016.

Securities within the equity portfolio are diversified and are primarily invested in large-cap issues with a focus on dividend income. RLI claims to employ a value oriented strategy, with security selection taking precedence over market timing. By the end of 2016, they also had 33.5% of their equity portfolio invested in 3 ETFs, tracking Russell 1000, S&P 500 and S&P 500 Utilities Indexes respectively.

Furthermore, RLI has equity interests in 2 investees. Through their legacy business (contact lens insurance, contact lens wholesale and services), RLI owns a 40% stake in Maui Jim, a manufacturer of high-quality sunglasses. In 2016, they recorded $9.7 million in earnings from Maui Jim. The other investment is a 27% in Prime Holdings Insurance Services. In 2016, their share of Prime’s earning was $1.1 million. Additionally, they also have a 25% quota share reinsurance treaty with Prime, which contributed $11.4 million of net premiums to RLI.

Durability, Quality and Moat

Insurance is one of the most durable businesses. With the exception of auto insurance, the possibility of demand disappearing is very low. The techniques to price the risks involved may change and surely the technology to collect data and distribute products will improve. Nevertheless, the need to buy insurance will in all likelihood always exist.

The problem with property and casualty insurance is more on the supply side. This market can be very cyclical with excess capital in the market when losses have been minimal. The market can turn rapidly once a major catastrophe hit, creating significant losses that eliminate less prudent players.

The key to navigating such cycles for an insurance company is underwriting discipline, i.e. putting profitability above maintaining or growing market share. This is exactly RLI’s underwriting approach. For instance, given the current soft condition in the property market, RLI has been willing to accept lower revenue in this segment, as shown by the rapid decline in premiums written in recent years. (11% decline in 2016 and 21% decline in 2015)

Another stronger piece of evidence comes from the track record of their combined ratio. In 2016, RLI posted an 89.5 GAAP combined ratio. This marked their 12th consecutive year of achieving a combined ratio of below 90 and their 21st conservative year below 100. From 2007 to 2016, their average combined ratio was 83.1. During the same period, the average combined ratio for the P&C industry was 100.6.

RLI is also conservatively managed. They tend to write less than 1x their statutory surplus in net premiums. They do so both because they can earn a decent underwriting margin, but also to prepare for the occasional year where combined ratio gets out of hand. Throughout the past two decades, RLI has ceded less and less premiums written to reinsurers. However, the ratio between net premiums written to statutory capital has not increased meaningfully in the same period. This is due to lower gross premiums written to statutory surplus in recent years.

Looking at their combined ratio track record, I would argue that they could increase their underwriting leverage. The worst combined ratio they endured was 116.9 in 1994, with the second worst being 107.5 in 1995. Since then, their combined has always been below 100.

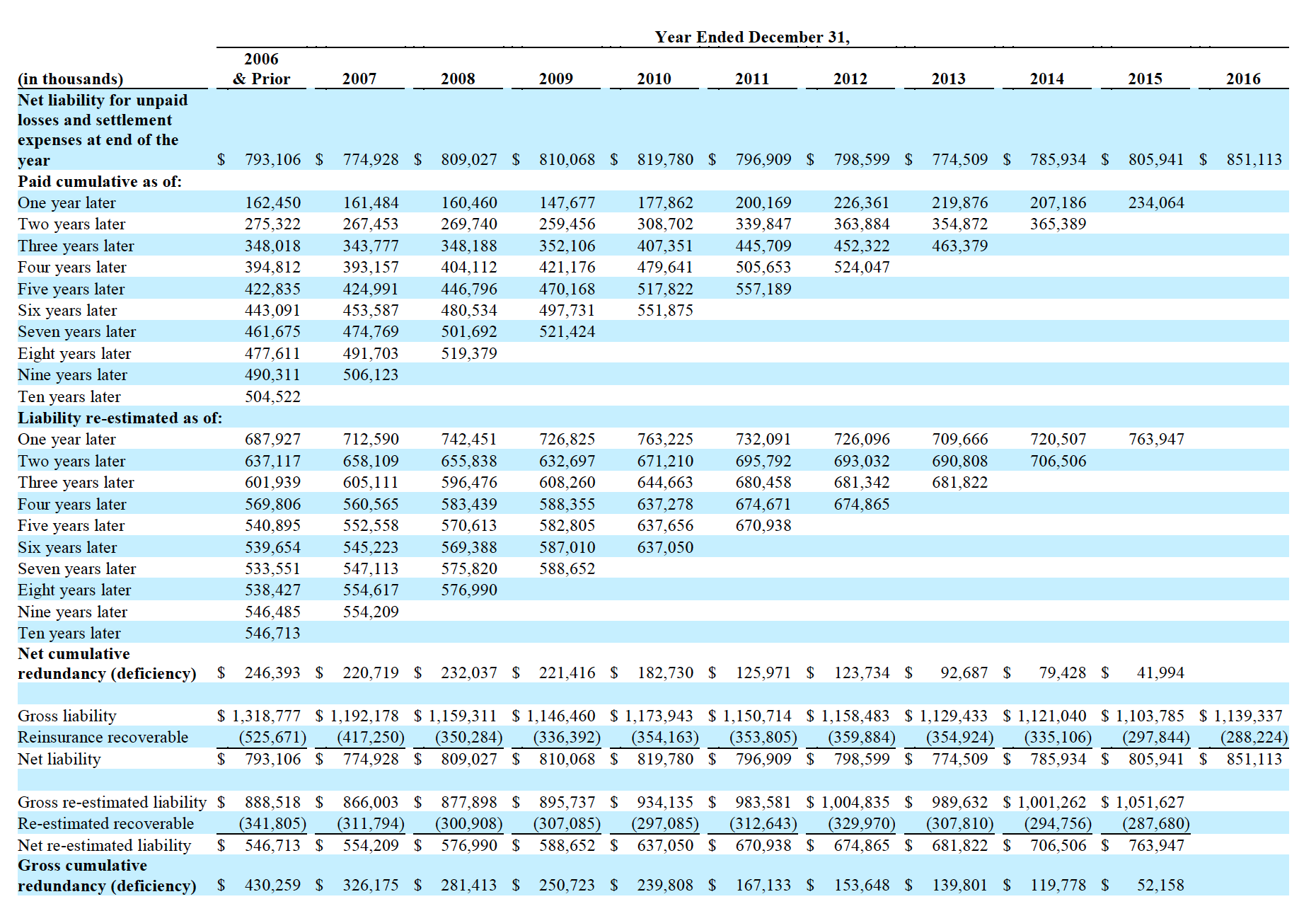

The reserving practice of RLI is another display of conservatism. Below is a table that presents the development of RLI’s balance sheet reserve from 2006 to 2016. As seen in the last row, there has been a gross cumulative redundancy in each of the last ten years.

Last but not least, A.M. Best has a rating of A+ for RLI, suggesting RLI has superior financial strength.

All this makes RLI a high-quality insurance company.

In terms of moat, my impression is this comes from RLI doing several things well all at the same time.

Here is what RLI refers to when they discuss competition in the 10k:

“The combination of coverages, service, pricing and other methods of competition vary from line to line. Our principal methods of meeting this competition are innovative coverages, marketing structure and quality service to the agents and policyholders at a fair price. We compete favorably, in part, because of our sound financial base and reputation, as well as our broad, geographic penetration in all 50 states, the District of Columbia, Puerto Rico, the Virgin Islands and Guam. In the casualty, property and surety areas, we have experienced underwriting specialists in our branch and home offices. We continue to maintain our underwriting and marketing standards by not seeking market share at the expense of earnings. We have a track record of withdrawing from markets when conditions become overly adverse, and we offer new coverages and programs where the opportunity exists to provide needed insurance coverage with exceptional service on a profitable basis.”

First, RLI is a niche insurance underwriter. It focuses on areas where the risks are less standardized and harder to place. Generally, these are areas where the overall market is not big enough for multiline industry giants to participate. Moreover, these are risks with lower price transparency. As such, RLI’s principal method for meeting competition is by providing quality services at a fair price, instead of the lowest price, through insurance brokers and independent agents. Extended relationships with such intermediaries aid RLI in better distributing their products. Since RLI has been in business for more than 50 years, through experience and data collection, they should have also built up the pricing expertise in most of the risks they focus on. For independent agents and insurance brokers, all these, coupled with the financial strength, reputation and wide geographical coverage of RLI, make RLI one of the preferred insurers to recommend.

Valuation

There are a couple of ways to think about valuation of an insurance company. Here we will focus on the return to net premium approach, with the other being price to book.

Net premiums written is roughly equivalent to net sales generated for most other businesses. Calculating the average combined ratio of an insurance company, depending on how stable that figure is, will give you an estimation of the normalized margin for this business. For RLI, since 1993, their average GAAP combined ratio is 89.4, and the median is 87.8. Since 2000, the numbers are 86.5 and 84.5 respectively. In the last 10 years from 2007, the figures further decrease to 82.9 and 83.7 respectively. In addition, the variability, as measured by coefficient of variance, decreases as the period get shorter and more recent. Let’s use 85 as our estimation of normalized combined ratio for RLI. This gives us an operating margin from underwriting of 15%. Applying 15% to net premium written in 2016 gives us normalized underwriting profits of $109 million.

Insurance companies also generate float, which provides another source of value when invested. It’s important to only consider the investments supported by float, and not all the investments an insurance company holds. This is because all companies can decide to invest its equity in non-core businesses. Only float supported investments are truly value-adding. For RLI, it mainly invests its float into fixed income securities. Equity holdings are mostly supported by debt and equity. By the end of 2016, RLI’s fixed income portfolio amounted to $1.6 billion, and had a duration of 4.8 years. RLI’s fixed income portfolio is diversified. To simplify the return estimation, we will assume the total return RLI can generate from its float will approximate the return of the 10-year treasury. Recent 10-year treasury rate is at around 2.4%. Yet this figure comes in the context of historically low rates in recent years. If we normalize the rates environment the return on float may be closer to 5% pretax, or $80 million.

There is also general corporate expense. In the past three years, it averaged at roughly $10 million. This roughly equates to the profits RLI generates through its two unconsolidated investees. For simplicity, we will assume they cancel out each other.

As a result, our normalized pre-tax earnings estimation for RLI is $189 million. A regular multiple of EV/EBIT at 10x will give RLI a fair enterprise value of $1.89 billion. It now has around $120 million in net cash. Adding that to the EV and dividing the resulting sum by the 44 million shares outstanding will give us a share price of $45.7.

The share now trades at $57 a share, or 25% above our valuation estimation. If the stock price drops to $35 to $40, I will consider that an attractive entry point to invest in a high-quality insurer.

Misjudgment

The main value driver for RLI is its underwriting discipline. As it is impossible for investors to analyze each of the insurance contract held by RLI nor each of the investment RLI has made, the only relevant data points for us is to study its track record. Then we must decide whether its record is replicable and trust the management can continue to achieve similar results in the future.

In other words, to bet on RLI is to bet on its management team and its culture. Herein lies the potential and most consequential misjudgment, a deterioration in the culture of underwriting discipline and conservative investing.

The current compensation model for the top executives are highly geared to valuation creation as measured by return on capital above cost of capital, or what they refer to Market Valuation Potential Program. By way of example, in 2016, Chairman and CEO Mr. Jonathan Michael earned a total compensation of close to $4 million, $2.7 million of which is related to the MVP Program. As long as the current compensation structure stays in place, it’s reasonable to expect management to remain focused on profitability in lieu of market share.

The bigger concern is the age of Mr. Michael. At 63, Michael who first joined RLI in 1982 is approaching the usual retirement age. It’s understandable that when the founder Gerald Stephens retired from the board of RLI in 2011 he would have chosen to pass the chairmanship to Michael, who has actually been the CEO since 2001. With the benefit of hindsight, that was clearly a successful transition. But would a similar situation happen in the near future? It will be important to monitor the company’s current succession plan to answer that question.

Conclusion

RLI, as a niche insurance provider, has proved with its track record spanning decades that it’s a high-quality insurance company. Since 2007, it has compounded its book value by around 10% annually (including total dividends paid during this period). It is worth putting RLI on your monitor list. If its stock price drops to the range of $35 to $40, that would be a very good entry point.

*RLI’s corporate history can be found in more detail from this interview with CEO Jonathan Michael back in August 2001 (http://www.peoriamagazines.com/ibi/2001/aug/interview-jonathan-michael)