Universal Robina: A Good, Growing Filipino Branded Food and Drink Business – That’s Not Quite Cheap Enough for Value Investors

Write-up by Jayden Preston

Overview

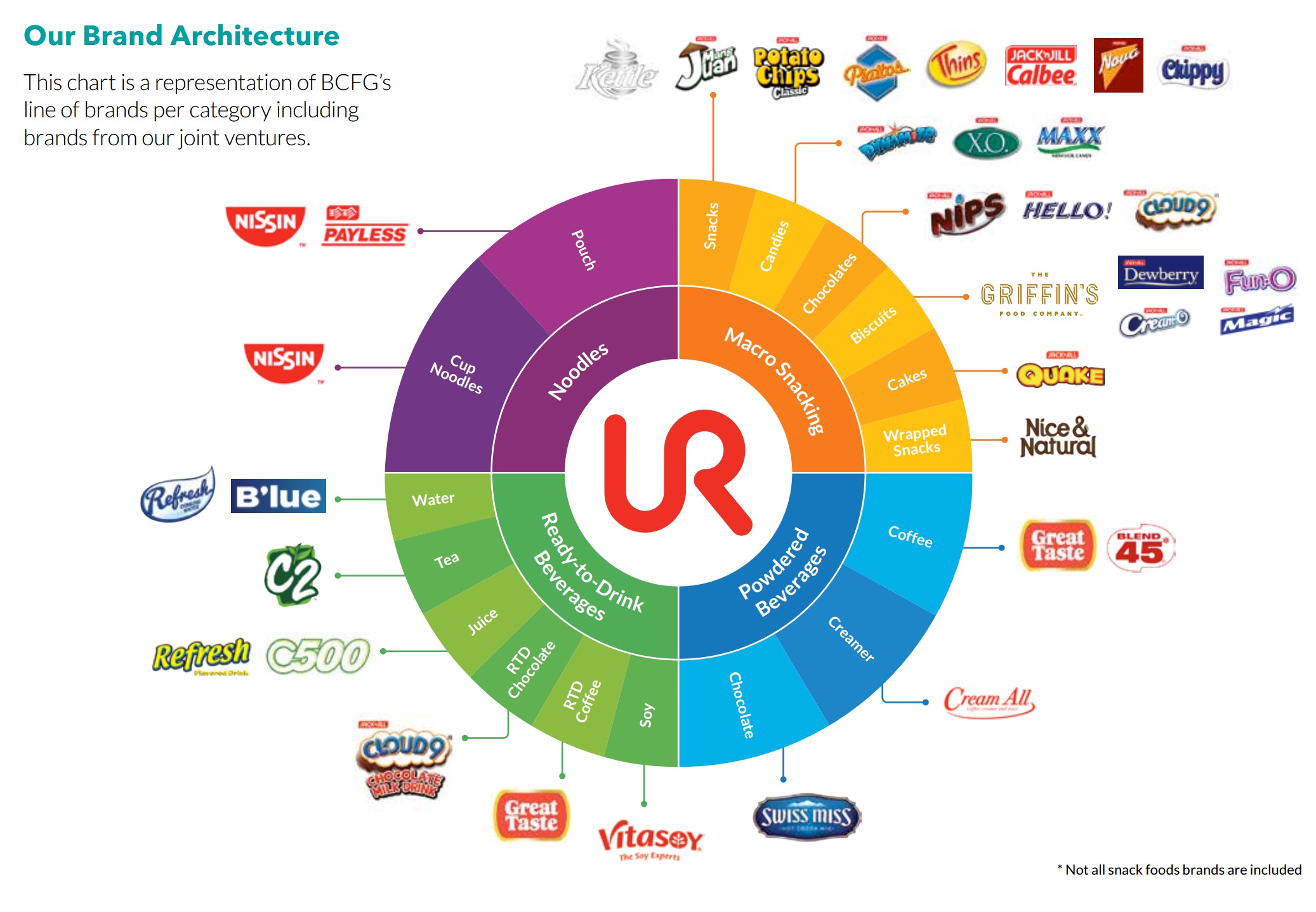

Founded by John Gokongwei Jr., Universal Robina Corp. (URC) has come a long way since its humble inception as a corn starch manufacturer in 1954. Through decades of diversification, URC is now a leading producer of branded snacks and beverages in the Philippines. To a certain extent, URC is like a mixture of Pepsi Co. and Mondelez in Southeast Asia. While URC does not have a cola product, the Company, similar to Pepsi Co., does have a diverse portfolio of snacks, including potato chips and cheese rings, and beverages, such as bottled water and other ready-to-drink (RTD) beverages. URC also competes with Mondelez in the confectionery business through its products of cookies and chocolates.

In addition to its home market, URC also has presence in 12 other countries in Southeast Asia and Oceania. Its major international markets include Vietnam, Thailand, Indonesia, Australia and New Zealand.

In addition to its home market, URC also has presence in 12 other countries in Southeast Asia and Oceania. Its major international markets include Vietnam, Thailand, Indonesia, Australia and New Zealand.

However, URC is more than just a branded food producer. In the Philippines, URC has two other segments, Argo-Industrial Group and Commodity Foods Group. The former is engaged in hog and poultry farming, while the latter involves flour and sugar milling. This part of the business is similar to Seaboard Corporation.

URC is thus divided into 4 segments: 1) Branded Consumer Food Philippines (CF Philippines), 2) Branded Consumer Food International (CF International), 3) Argo-Industrial Group (AIG), and 4) Commodity Foods Group (CFG). (3 and 4 are collectively known as the Non-Branded consumer food segment. We will refer it as the Non-Branded segment, even though there are still some branded offerings within this segment.)

Segment Breakdown

CF Philippines is the most important segment for URC. It contributed 48% of revenue and 53% of EBIT in 2017. It is followed by CF International in terms of revenue contribution at 34%. Yet, the international segment actually has the lowest margins among all the segments. As such, only 19% of EBIT comes from this segment. In other words, while the Non-Branded segment only generated 18% of total revenue, it was responsible for 28% of EBIT.

In summary, in terms of operating profits, URC is roughly 3 quarters a branded consumer food company spanning in Southeast Asia and a quarter of a commodity foods producer in the Philippines.

Durability and Quality

Branded Consumer Food Segment

Branded snacks and beverages, with brand heritage, tend to score very highly on the scale of durability. The keys to the business are brand recognition and shelf-space availability. The more well-known your brands are, the more willing retailers are to stock your products; and, the more available your products are, the more frequent customers will come across your products. There is thus a reinforcing element in the equation that favors incumbent players.

This is not to say that there is no threat from new entrants. A major concern to the durability of well-established players in this space is the ongoing change in customer behavior, such as the trend toward healthy foods, that opens up room for new entrants. However, I believe this problem is more serious in the West than in Southeast Asia. Given the extremely low level of snack consumption in the emerging and developing markets, this underlying growth provides a buffer for any earnings impact from the increasing prominence of healthier options.

Branded Consumer Food Philippines (CF Philippines)

For URC in particular, since they have been in the branded food business for over 50 years in the Philippines, they have very strong brands locally. In fact, they have leading positions in 5 of 7 key categories. All of these categories are relatively concentrated, with the top 3 players controlling close to 50% or more market share.

| Category | Market Share | #1 | #2 | #3 |

| Snacks | 35% | URC | 23% | 6% |

| Candies | 27% | URC | 12% | 11% |

| Chocolates | 24% | URC | 12% | 9% |

| Biscuits | 17% | 26% | 19% | URC |

| Cup Noodles | 50% | URC | 41% | 5% |

| RTD Tea | 85% | URC | 3% | 3% |

| Coffee | 24% | 37% | 34% | URC |

There is also little doubt about the distribution capabilities of URC, as URC’s products are distributed in more than 120,000 outlets in the Philippines.

(Note: The Gokongwei family also controls Robinson Retail Holdings, one of the leading retail groups in the Philippines. Robinson Retail owns one of the leading supermarket chains in the country.)

In the past 11 years, CF Philippines has demonstrated meaningful scale economies. Annualized sales growth since 2006 was around 16%, achieved mostly organically. And EBIT margin expanded from 11% to 15%. Importantly, returns on incremental investments have been more than 20%.

Branded Consumer Food International (CF International)

The International segment is less attractive. Even the earliest markets, including Thailand and Vietnam, are less than 20 years old for URC. Moreover, the product offerings are more limited in each of the markets.

The four markets that URC has a stronger position are as follows:

| Country | Category | Market Share | #1 | #2 | #3 |

| Thailand | Biscuits | 29% | URC | 13% | 8% |

| Wafers | 26% | URC | 13% | 11% | |

| Vietnam | RTD Tea | 15% | 52% | 16% | URC |

| Energy Drink | 2% | 45% | 26% | 17% | |

| New Zealand | Sweet Biscuits | 42% | URC | 20% | 13% |

| Crackers | 10% | 31% | URC | 13% | |

| Australia | Salty Snacks | 25% | 55% | URC | 5% |

Importantly, even though the business of branded foods outside of the Philippines collectively is 70% the size of that in the Philippines, each market is subscale because this group is comprised of 12 markets. Even the biggest market, such as URC’s operation in Australia, is less than 20% of CF Philippines. The lack of scale entails a lower EBIT margin, which currently stands at 7.5%, for this segment than CF Philippines. Annualized sales growth for branded foods outside of Philippines since 2006 has been attractive at 17%, but it is partially a result of acquisitions.

In the long run, there is room for margin expansion in this segment. But as management has commented, given the differences in country size, only a few countries within the International segment have the potential to reach the margin profile of CF Philippines. As such, while we can reasonably assume margin to increase for CF International, we should not expect the international segment to deliver a margin level similar to that of CF Philippines.

Non-Branded Consumer Food Segment

The non-branded consumer food segment is more of a commodity business. Players in general lack pricing power and the cyclicality in demand and supply brings about highly fluctuating margins. Nevertheless, the non-branded segment has proven to be an integral part of URC because of its value as part of the value chain for the branded consumer food business.

Argo-Industrial Group (AIG)

This segment is comprised of 4 subsegments, including poultry farming, hog farming, commercial feeds, and commercial drugs. The former two together are known as the farming segment, while the latter two are known as the feed segment. AIG is roughly split between farming and feeds in terms of revenue.

URC has a much weaker position in the AIG business than in branded consumer foods. First of all, this industry is more fragmented. Backward operations, i.e. small farms run by families, account for 60% of livestock inventory in the Philippines. While they mostly supply the families’ own needs, they can still affect the market price if they all overproduce to sell to the market. Furthermore, these backward operations are a significant consumer of the animal feeds.

There is also a much bigger competitor. San Miguel Pure Food, the food arm under the San Miguel conglomerate, is roughly 8x bigger than URC in this market.

While the industry, like many others in the Philippines, are semi-protected domestically through tariffs on imports (import rates are 40% to 70% for pork and chicken), the regulations are not able to tame the cycle. In fact, for URC, this segment is the most volatile in terms of margins. The coefficient of variance of EBIT margin is 53%.

The best part of this segment is the relatively high asset turnover, whose average is around 1.5x. In good years, the pretax return on asset for this segment can reach above 20%.

URC’s strategy is to be an upscale player and to offer higher value-added products. By way of example, its farms are credited with Good Animal Husbandry Practice, and its meat and eggs are all certified as No Hormones and Antibiotics Residue Free.

Commodity Foods Group (CFG)

CFG is composed of sugar milling and flour milling. On face value, this is also a commoditized category. However, the markets are more concentrated, and URC has a strong competitive position in these two subsegments. More importantly, URC Consumer Branded Food Segment is a bigger captive customer for CFG than AIG. (Intersegment sales accounts for 20% to 46% of total sales of CFG since 2006)

For sugar, URC is the biggest producer in the Philippines. The company is waiting for government approval for an acquisition of their 7th sugar mill, which I estimate will increase the Company’s sugar production market share to above 20% nationwide. More specifically, the new sugar mill will render URC an effective monopoly of the sugar milling capacity in Batangas, one of the main agricultural production regions in the Philippines. Sugar mills tend to source sugarcanes locally from numerous farmers. The imbalance between the number of sugar mills and that of farmers gives the sugar millers significantly stronger bargaining power. This explains why local sugarcane farmers in Batangas vehemently oppose the acquisition.

URC is less dominant in flour production. It is only the fourth largest flour miller, controlling around 7% of the flour milling capacity in the country. This industry is also getting more crowded. Currently, there are 21 companies engaged in flour milling in the Philippines. But 2 more companies are expected to join the fold in the near term. In addition to producing flour, URC also sells its own pasta line, EL Real, which has a 12% local market share.

In aggregate, this segment has exhibited superb financials since 2006. Annual sales growth is 10%, driven by strong growth in sugar through acquisitions. EBIT margin is also exceptionally stable, with a coefficient of variance of 15% only. Pretax returns for this segment have ranged from 16% to 39%.

The key concern for this segment is that incremental returns have been nonexistent since 2012. In the past 4 years, URC has started to expand their sugar operation into renewable energy, using by-products from their sugar production as raw materials for fuel production. This may have dragged down the returns. But this does not explain why the returns on incremental investments have essentially been zero. This remains an unanswered question for me and a major red flag.

Recent Situation

URC was seen as a major growth stock just 3 years ago. However, after a string of problems, the share price of URC declined by almost 50% since hitting the all-time high in the spring of 2015. I summarize the major issues that URC has encountered in the past 3 years below:

Price War in Coffee Segment in the Philippines

This is the most impactful problem URC is facing, and thus warrants a more detailed discussion.

Let’s start from the significance of the coffee market. The Filipinos loves their coffee. But in particular, they favor soluble coffee (i.e. instant coffee, a powered and water-soluble version of regular coffee) In the Philippines, soluble coffee represents close to 90% of total coffee consumption. In fact, the market for soluble coffee in the Philippines is even larger than in China. (Not only per capita, but even in terms of total consumption) The market is highly concentrated with 3 major players and was historically dominated by Nescafe. The other player is Mayora from Indonesia.

In 2011, URC introduced Great Taste White and thus created the “White” coffee mix market. The product was milkier and sweeter than existing instant brown coffee. It became an instant hit, and before long, it started to become a meaningful contributor to URC’s overall revenue.

From 2012 to 2015, the growth of the coffee market accelerated due to the rapidly expanding popularity of “White” coffee mix. White coffee mixes, spearheaded by URC, helped URC gain market share, at the expense of the two other major competitors, in the overall coffee business from the low teens to above 30%. The coffee segment for URC grew 65% p.a. in this period. Great Taste White became the single biggest SKU item for URC by 2015 and because of its above average margins, propelled CF Philippines EBIT margin to a peak level of 18.6% in 2015.

With high growth comes heightened competition. By 2016, growth in the coffee market began to slow down. A major signal of a maturing market is a shift toward value offerings. At first, Great Taste White was offered in single pack formats. As competition heated up, to keep attracting more customers, Great Taste introduced twin packs that offer a better value proposition to customers. Twin packs are sold at a larger absolute amount but have lower gross margin of 30% (vs 40% of the single pack). In addition to cheaper offerings, competition also led to increased marketing spending. Mayora was particularly aggressive. At one point, it was outspending URC on marketing by 3 – 4x.

The result of all the above was a decline in coffee market share for URC from 30% to 24%. Revenue from coffee turned from increasing by 60%+ to dropping 10%+. (It was even down 20% YoY in a recent quarter) Coupled with lower margins, earnings contribution from coffee declined further. Alongside rising raw material costs, EBIT margin of CF Philippines dropped to around 13% in the last twelve months. Nestle was also the loser in this price, as Mayora gained market share.

Granted, since twin packs now account for 80% volume of the White Coffee offerings, there is a permanent reduction in the margin profile of coffee for URC. Nevertheless, I believe the Filipino coffee segment will begin to stabilize. First of all, coffee revenue decline has already dropped to single digit in the latest quarter. Secondly, a quick review of Mayora’s financials does not suggest they have any sort of cost advantages. As the decline in coffee decelerated for URC in Q3 2018, Mayora’s EBIT margin has instead decreased sharply, reflecting increased advertising and promotion expenses (A&P expenses). Given the rapidly rising A&P spending and declining margins, the return on A&P investments for Mayora should be decreasing.

I would argue this ought to be expected. Network effects is one of the best competitive advantages a business can have. The greatest benefit a network effect brings is the declining customer acquisition cost as the customer base grows, a phenomenon that works the opposite to businesses without a network effect experience. There are no network effects for the packaged foods business. At the moment, Mayora already has increased its coffee market share to 40%. Without network effects, the law of diminishing marginal return dictates that it gets increasingly costly to acquire more customers. It is especially difficult to do so in a mature market.

All in all, I believe the coffee business will stabilize for CF Philippines.

Beverage Product Recall in Vietnam

The second most significant issue for URC was a product quality issue the Company experienced in Vietnam.

Vietnam is a beverage market for URC. They have a leading position in the RTD tea market. The Company has also been building their energy drink business.

In 2016, batches of URC’s RTD tea and energy drinks were found to contain high levels of lead. (Note: 0.052 to 0.085mg per liter vs the acceptable limit of 0.05 mg per liter. Vietnam actually has a relatively strict limit. As a reference, Singapore’s limit is 0.1 mg per litre) The Company faced a modest fine of USD 260,000. The real damage was caused by a halt in sales that lasted around 2 months and the resulting disruption in distribution, from which the Company had to rebuild some of the channel relationships. As a result, URC’s market share in RTD tea dropped to 15% from 35%.

Vietnam historically was the biggest market in BCFI. In fact, the EBIT margin was once on par with CF Philippines. With such a substantial decline in market share and thus volume, Vietnam turned a loss and dragged down the overall margin of the International segment.

URC has relaunched and introduced a new image of the main brand C2. They are also targeting a younger target audience. The initiatives seem to be working as C2 volume has now recovered to around 70%+ of the peak level. I do not see any reason why C2 cannot reach the peak volume level again.

New Entrants and Price Competition in New Zealand

To be better positioned in the trend of premiumization, URC purchased Griffin’s, a premium snacks and biscuits maker, from New Zealand in 2014 for NZD 700 million. The Company paid a price of 2.7x EV/Sales and 9.8x EV/EBITDA. Unfortunately, the acquisition is proving to be a mistake, at least in terms of the price URC paid. In the past year, Griffin’s revenue declined by more than 10%. The biggest reason for the decline has been cheap Oreo imported from China. But there are also new products from small local players. A trend toward premiumization has attracted new players into the market. URC has also benefited from the trend as they have invested in several new brands that saw strong growth in sales. Nevertheless, the net impact currently is clearly negative.

Furthermore, the strategy to cross sell Griffin’s premium offerings into ASEAN is taking more time than expected. As of now, Griffin’s sales into ASEAN is still relatively minimal.

It is difficult to foresee how much longer Griffin’s will continue its recent decline. But given its competitive positioning in New Zealand (the company was founded in 1864) and the long-term growth potential for premium snacks in ASEAN, I think the probability for Griffin’s to grow revenue again is high. It just might take a longer time. In any case, the impact to URC is not significant as Griffin’s contributes less than 10% of total revenue.

Sugar Tax on Sweetened Beverages in the Philippines

A sugar tax on beverage was implemented in the Philippines in January 2018. Retail prices of sweetened beverages have risen as much as 13%. URC’s beverages have fared relatively well, with volume declining by only single digit vs double digit for most other sweetened beverages.

The impact from sugar taxes tends to be a one-off. As customers got used to increased pricing, the overall market can grow again from the lower base.

High Inflation Rate in 2018

With oil prices shooting up and major commodities, such as sugar, facing a bad harvesting season locally, inflation rate in the Philippines reached 6.4%, a 9-year high for the country, in August 2018. Private consumption, especially on discretionary items such as snacks, thus weakened.

But this is only a short-term issue, as inflation has already begun to ease. Oil price plummeted near the end of the year; the government reduced tariffs on major food imports; and rice supply improved in the latest harvest season. The government now expects inflation rate to fall within the target range in 2019.

Growth

Despite the above challenges, the structural growth potential for URC remains much intact.

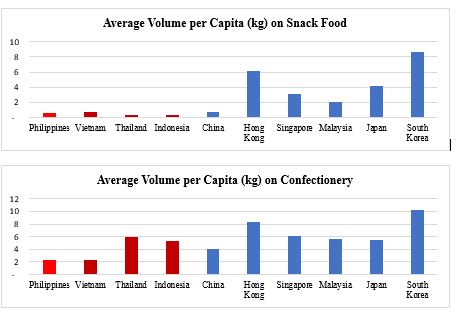

Take a look at the following two charts.

The average volumes (not value) per capita of snacks and confectionery are materially lower in URC’s major markets than in more developed Asian markets. The difference will be even more significant if we compare ASEAN against the West.

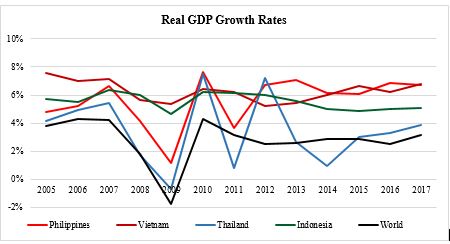

These countries are also growing very fast.

Against the backdrop of a more stable political system, the real GDP growth rate of the Philippines actually picked up from the 4%+ in 2005 to 6.5% last year. Even if the Filipino economy continues to grow at the current rate for another 10 years, the absolute GDP per capita of the Philippines will still be below the current level of Thailand.

One may question the utility of the above analysis by suggesting everything in the Philippines is worth a purchase because of the growth potential. I would disagree because it is usually difficult to predict who the winner will be in a rapidly growing market. In other cases, the industry in discussion tend not to have favorable economics. However, given the nature of the branded food business and the legacy of URC’s brands, I would argue that URC’s case is an exception.

With real GDP growing 6%, coupled with inflation and relatively stable market share, we should expect annualized revenue growth to be at least high single digit over the long run for CF Philippines. As margins expand, earnings growth would be closer to 10%.

For the International segment, the matured Oceania businesses would drag down overall growth. But since this segment is smaller and has higher margin expansion potential, I believe long-term earnings in this segment can also be close to 10%.

In aggregate, URC should be capable of growing earnings by at least 8% to 10% for a very long time.

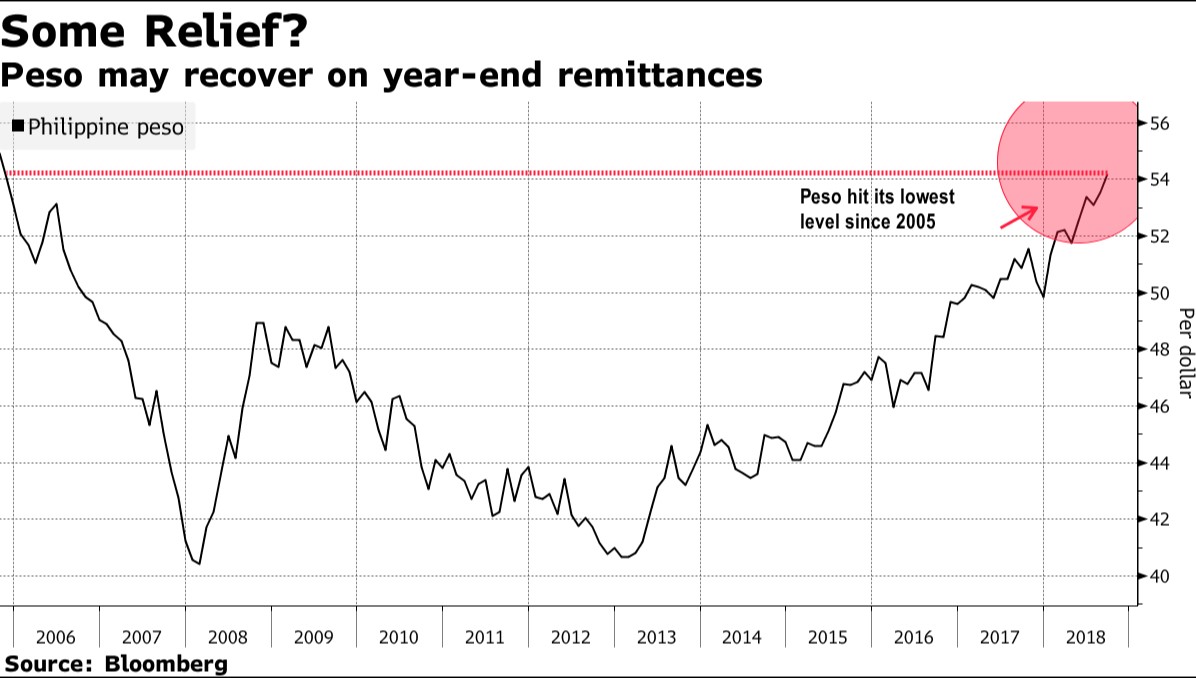

Currency

That is 8% to 10% annual growth in Philippines Pesos. However, what you will receive as an investor depends on your local currency. Assuming it is USD that you care about, the good news is, based on purchasing power parity, the Philippine Peso clearly isn’t overvalued against USD at the moment. In fact, it might be slightly (6% to 10%) undervalued now. What your REAL return will be is difficult to estimate though. It is simply too difficult to predict where the Philippines Peso or USD will be in the next 3 or even 5 years. What I can say is that if you were to hold URC for a very long period of time, say 10 to 15 years, it is more likely than not that the fluctuations in currencies will not detract your annualized return meaningfully.

(USDPHP = 52.21 as of 22 Feb 2018)

Valuation

As of 15 February 2019, URC’s market capitalization is Php 321.8 billion. The Company has net debt of Php 21.4 billion, giving them an enterprise value of Php 343.2 billion. With estimated sales in 2018 of Php 129 billion and EBIT of Php 13.8 billion, the Company is trading at 2.6x EV/Sales and 24.9x EV/EBIT. These are fairly high multiples regardless of the business quality and growth prospect. As such, I am not recommending a purchase of URC’s shares now.

Comparables

To estimate the intrinsic value of URC, I first looked into comparable valuations for both branded consumer foods and non-branded foods companies in Asia. I have decided to focus on EV/Sales as it minimizes the impact from recent or temporary changes in margins.

Companies Selected:

| Branded Consumer Food | Non-Branded Consumer Food |

| Mayora Indah | Roxas Holding |

| Want Want China | Khon Kaen Sugar |

| Tingyi | MSM Malaysia |

| Uni-President | Thanh Thanh Cong-Bien |

| Dali Foods | Kaset Thai International |

| Bright Dairy | Thaifoods Group |

| Indofood CBP | Hunan New Wellful |

| Thai Union | Nippon Flow Mills |

| Nongshim | Nisshin Seifun Group |

| Nissin Foods Holding | CP Food |

| Calbee | RFM Corp |

| Nestle India | |

| Nestle Malaysia | |

| San Miguel Food and Beverages |

Average EV/Sales for Branded Consumer Food is 2.7x and that for Non-Branded Consumer Food is 1.3x. Applying these multiples to the respective segments of URC and deducting capitalized pretax corporate expenses (I used 10x) give us an estimated enterprise value of Php 307 billion. Backing out the net debt results in an implied NPV per share of Php 129.7.

Sum-of-the-Parts

Next, I tried to value each 4 of the segments separately, applying more judgement to select the most suitable comparables.

Starting with CF Philippines, I chose the following three companies:

1) Kinh Do Corp., the leading confectionery company in Vietnam. Mondelez purchased it at 2.57x EV/Sales in 2016.

2) Indofood CBP, the dominant noodle maker in Indonesia. It has 80% of the market. The margin profile of Indofood is also similar to that of BCFP. It is currently trading at 3.2x EV/Sales.

3) Mayora, the coffee manufacturer from Indonesia we mentioned. It is trading at 2.7x EV/Sales.

The average of the 3 multiples is 2.8x.

Because of lower margins and less entrenched competitive position, CF International deserves a lower multiple. I picked the multiple URC paid for Snack Brands Australia (SBA) as the main reference. SBA is the second largest snack player in Australia, with a total market share of close to 30%. URC purchased the company in 2014 for 2.2x EV/Sales. SBA has higher margins than the average of BCFI, but the country is a much slower growth region. I arbitrarily assume the stronger margin and competitive profile is balanced out by lower growth.

For Argo-Industrial, the obvious comparable is San Miguel Pure Foods. Before it was merged with San Miguel beverage businesses, the company tends to trade close to 1x EV/Sales. Looking into the historical record, San Miguel Pure Foods exhibited less attractive financials than AIG. As an upshot, I assigned a slightly higher multiple of 1.1x EV/Sales to AIG.

Finally, for Commodity Foods, I looked into the price URC paid for Batangas Sugar Central as the main reference. The price was 2.4x EV/Sales. The main listed comparable is RFM Corp, a flour miller in the Philippines. RFM trades at 1.2x EV/Sales. But RFM has lower growth, lower asset turnover and lower margins. CFG clearly deserves a higher multiple. I picked 2.3x EV/Sales.

Summing all the results and again deducting capitalized corporate expenses, the target NPV per share is Php 121.2

Recommendation

We have established that URC is likely worth around Php 120 to Php 130 per share. But what is a good price to pay for URC’s shares?

As discussed, the Non-Branded segment is not as high quality as the Branded Consumer Foods business, and I have much less confidence in former. If we ignore the sales contribution from the Non-Branded segment, URC is now trading at 3.3x EV/Sales. And if CF International is worth 2.2x EV/Sales, the overall Branded Consumer Foods segment should be worth at least as much. If we can purchase URC at a 2.2x EV/Sales, the Non-Branded segment can become our margin of safety. Historical return on assets for the Non-Branded segment has been above cost of capital, and the segment has always been profitable. In my opinion the segment is definitely worth more than zero. At 2.2x EV/Sales, the resulting NPV per share is Php 94.6. The implied P/E is 22x, on what is arguably depressed earnings. This target price is 73% to 78% of our estimated intrinsic value of URC.

Misjudgment

In face of the recent adverse development of Kraft Heinz, it is understandable one might cast doubt on the future prospect of URC. The widely shared public opinion is that two major factors contribute to the headwinds Kraft and other branded packaged foods are facing: 1) An ongoing shift toward healthier products and 2) the Internet has made it easier to create a new brand.

But as Buffett explained (and Geoff concurred) on a recent CNBC interview, the bigger hinderance has been the rising power of retailers, especially in the US. First of all, while there are certain ongoing changes in customer taste, they have not been widespread or meaningful enough to create any new billion-dollar brands. The volume market shares of the top brands have stayed relatively consistent. The issues instead have been the inability to increase prices and the decline in value of lower tier brands, both of which are results from the rising power of retailers. In the last few years, price increase in groceries have been around half a percent, trailing the inflation rate of nearly 2%. Geoff theorizes that this is because the intense competition physical retailers face from online competitors is forcing them to keep grocery prices low in order to attract traffic to their stores. At the same time, the retailers, especially Costco, have allocated more shelf space to their own private labels, leveraging on the increasing loyalty of their customers to increase profitability.

The implication for our analysis is not to neglect retailers as a competitive threat. On that front, the retailers obviously have less power than the big brands, since roughly half of the local markets are still occupied by traditional retailers, i.e. mom-and-pop operators. The competition from private labels will not be a meaningful threat in the near to medium term.

Conclusion

URC is an integrated producer of packaged food and beverage products in the Philippines, with presence throughout ASEAN. Through more than 50 years of operating history, it has created one of the strongest portfolios of branded foods and beverages in the region. With strong brand equites and distribution capabilities, URC is well positioned to capture the value from increasing spending on snack foods and beverages in the fastest growing region of the world.

Nevertheless, while URC is a high-quality business with strong growth prospect, valuation discipline demands a lower entry price. I propose that an entry price of Php 94 per share will provide enough margin of safety to own a packaged food and beverage company with one of the best growth prospects in the world.