Zooplus

Zooplus

Guest write-up by Vetle Forsland

Introduction

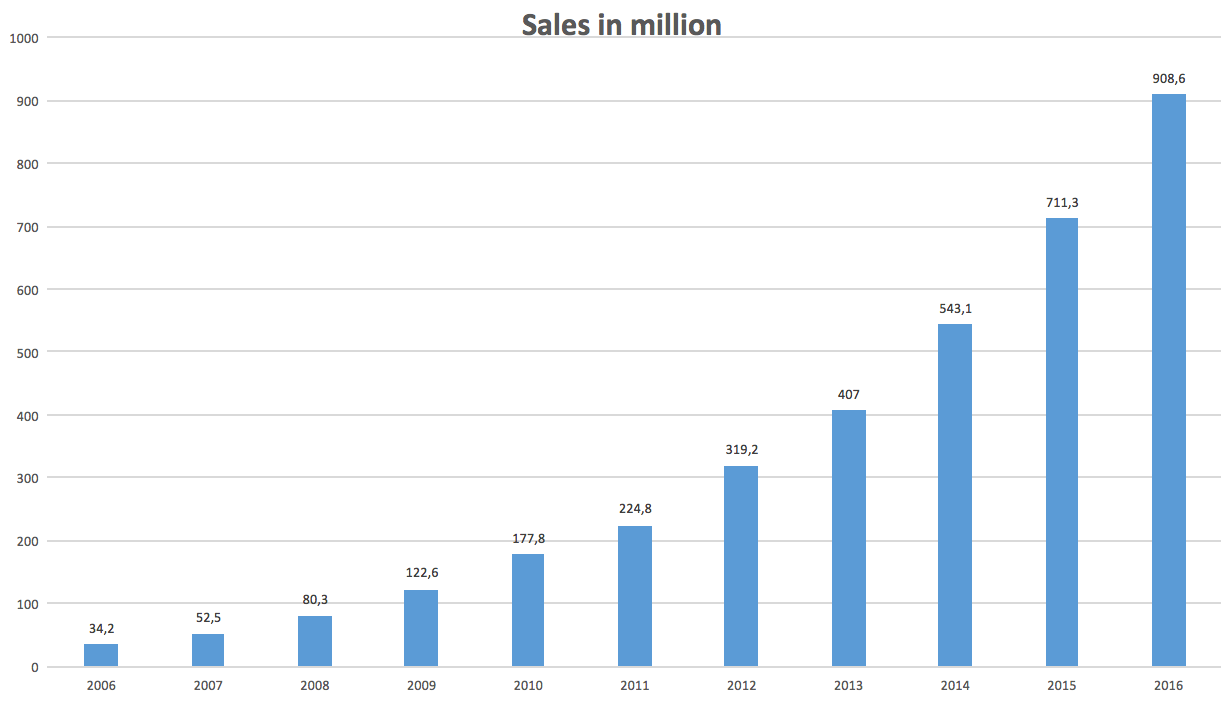

Zooplus is the leading online pet food retailer in Europe. It has on average grown sales 38% annually since 2006 (IPO in 2008) and annualized sales growth since 2010 is a 31%. In 2016 sales grew by 28%, to 908 million EUR, and there is room for additional expansion. Generally, the retailer with lowest prices and best customer service will come out as the industry leader. I believe this will be Zooplus. Lower prices and good customer service will lead to a high customer retention rate, the latter being at 92 % today. At the same time, this is a company with a lot of room for future growth, good financials and no debt.

Since its foundation, Zooplus has grown to become the clear leader in online pet supplies in Europe. The company also ranks number 3 in the overall European market for pet supplies after Fressnapf and Pets at Home. As Zooplus grows, it will become more cost efficient through economies of scale. More revenue will justify building distributing centers, which will bring the depressed margins today upwards, and create a good profit for shareholders.

Zooplus was formed in 1999, and has been operating in the pet market for more than 17 years, and on the way launched their business model in 30 countries. Pet supplies is a big segment of the European retail industry. In 2016, gross sales of pet supplies added up to around 26 billion EUR. Because of higher populations and more pets in the majority of countries, I expect this figure to continue growing over the years. Furthermore, Europe is expected to see considerable growth in online retailing, which will propel Zooplus’ sales momentum.

Pet supplies is not a cyclical industry. Sure, people will try to avoid high-end pet food brands in economic downtrends – but unless they want Kitty to starve, pet food will forever be in high demand. I believe Zooplus is in a good position to make money from these facts.

Online groceries have not lived up to the potential they once were estimated to have, so why do I think customers will shift to online pet supplies in the future? (only 6.8% of pet supplies are sold online). First of all, our beloved pets need food just as much as we do. As pet food has a (very) long expiration period, pet owners will want to buy it in bulks for lower prices – to make sure they’re never out of food for the little ones. That’s how my parents (and I) buy pet food in Norway. However, in brick and mortar stores, it is problematic for customers to buy in large bulks, since they actually have to carry the bags from the store and home. Additionally, Europeans live in dense and urban areas, where public transportation/walking is more common, making it even more difficult to buy pet food in bigger bulks.

The online pet food segment has solved this issue by shipping the goods to the customer’s doormat. Statistics will argue that customers think this way of buying pet supplies is handy, as they are ordering more times per year (4.7% CAGR) and buy in larger quantities for each time they order something online (7.9% CAGR).

The Threat of Amazon

It is virtually impossible to discuss any retailer without considering the threat of Amazon. Right now, the stock market expects Amazon to crush every competitor there is. As a result, the retail industry, at least parts of it, might be misunderstood by Mr. Market. That doesn’t necessarily mean that the sector is a screaming buy. Neither does it mean that Amazon won’t crush everything that today is a threat to the tech company. But it does mean that investors today are avoiding retailers like the plague, leading to potentially cheap stocks.

Zooplus may be one of these. Although it’s not a value play, it sure isn’t prized through the roof at 1x sales (ignoring the artificially high P/E). Given that Zooplus wins in the online pet industry in the long-term, this is an investment case well worth looking at.

Zooplus is by far the biggest player in the market, with a market share of about 50 %. Amazon hasn’t released any information on how they stand in the game. However, Zooplus themselves have estimated that Amazon have a market share of about one third of Zooplus. So we can say 20 %. This means that they are the second biggest online pet food supplier – and the 500 billion company have vast resources. Despite this, Zooplus may have the upper hand.

The key word is logistics and distribution centers. Amazon’s distribution centers in Europe is not made to ship and store big bulks of pet food. They are not made for heavy items. They are made for smaller goods. In fact, the average Amazon package is less than a cubic foot and weighs less than 10lbs. Zooplus’ average order is over 30lbs and is about four cubic feet.

These are two very different logistics profiles, that require totally different distribution centers. Zooplus’ distribution centers are like the back of a Costco store. They have shelves with room for bigger, heavier items, while Amazon’s European centers are made for the smaller products they ship.

As you can see from the pictures above, Zooplus have made DC’s for pet food, and pet food only. They are set up to ship pet food cost-effectively – Amazon’s distribution centers are not. This is a low margin industry, so cutting logistics costs is important to make a decent profit. Amazon will need to invest capital in their business, and build new distribution centers, if they want to compete (and make a profit off) the online pet food industry. Furthermore, even if Amazon captures the 50% market share that Zooplus doesn’t have, this will only result in 1 Billion EUR, or spare change for the multibillion-dollar company. The question is if Amazon has the incentive to invest capital in this relatively small industry.

Moreover, Amazon got outcompeted by Chewy.com in the American market, where Chewy has a market share of 51 %. Chewy was founded at the same time that Amazon bought Wag.com. Amazon also bought Wag’s parent company for 2x sales, which is twice what Zooplus is trading for right now. So if Amazon really wanted to come out on top in the Europe online pet industry – why not purchase the seemingly cheap Zooplus? We can learn from the US market, and potentially draw the conclusion that we will see the same picture in Europe, where Amazon eventually gives up their ambitions in the online pet industry.

Fear the Brick and Mortar

It isn’t natural to sell pet food online. It is natural to sell razors and auto insurance on the internet. But pet food is another story. I believe brick and mortar will forever be the leader in the sales of pet food. On the other hand, the online businesses of the industry will undoubtedly have higher sales growth than the traditional grocery stores. It is not unreasonable to believe about 20-30 % of all pet food will be sold online when the sector reaches maturity. Today only 7 % of all pet food in Europe is sold online, so there is a long runway for additional growth in the industry.

This means that Zooplus’ biggest competitor in today’s market are brick and mortar stores. These stores are formed by supermarkets, groceries and stores that specializes in pet food sales (Fressnapf and Pets at Home).

Larger companies have, overall, more power to bring down costs of goods sold through economies of scale. This is a strength Zooplus lacks. For instance, Pets at Home has 24.3 percentage points lower COGS compared to Zooplus. However, Zooplus have 13% lower operating expenses. It is expensive for brick and mortar stores to pay rent, have in-store personnel etc. Zooplus doesn’t have to pay either of these expenses. And as Zooplus matures, their COGS will decrease substantially, as economies of scale goes for them too.

As a result of this, Zooplus can afford lowering prices of their goods sold. Actually, they’re about 5% cheaper than their peers. More on that later.

Online pet food stores have as mentioned a handful of advantages over brick and mortar. One of these are that customers spend more per order. The top sellers at Sainsbury’s (a grocery store in UK) are smaller sized packages of around ~2kg. Zooplus typically sells products that weigh 15kg (33 pounds). This fact further strengthens the theory that it is inconvenient and a hassle to buy bigger bulks of pet food in offline stores. Prices at Zooplus are on par/cheaper than brick and mortar, and when you can get your 15kg pet food bags shipped to your door instead of dragging heavy bulks to and from your car/bus stop, shopping at Zooplus sounds like the better move.

Logistics, Logistics, Logistics

Zooplus have been selling pet food online for 17 years now. That’s a huge advantage. Brick and mortar stores are just now moving from their offline stores to the internet, and without distribution centers for their packaged goods. Building a logistics network from scratch takes a long time, and it can be expensive. You may think brick and mortar already have complex logistics systems – that part is true. However, they only have a network for getting packages to their stores, not to the customer’s doorstep. This is the most expensive part of the transportation, the last mile from a warehouse to an apartment building.

In the US today, Chewy.com has an online market share of 50 %, while Amazon is second with 35 %. The rest of the group is fragmented and divided by many different stores, mostly brick and mortar who are late to the game.

We can assume that the European market will play out in a similar pattern, where Zooplus and Amazon leads the way. However, Zooplus are in a better position relative to Amazon than what Chewy was, considering that Zooplus already have a 50 % market share compared to Amazon’s 20 %. It is likely that Amazon will do worse in the European online pet food market in the future, compared to their performance in the US.

In this low margin industry, it is vital to avoid losses and unnecessary damages. It is really all about setting up a warehouse, having a logistics system that can handle massive amounts of volume, and in order to make money, a business will need regionalized distribution centers. Zooplus are aggressively building these, and surprisingly, it’s not too costly. Although, logistics is the number one cost for the company, with 19.5 % of the cost structure coming from logistics. This has decreased from 24 % in 2011.

Zooplus will add a regionalized distribution center to a country when the given country reaches sales of EUR 100 Million. Germany is Zooplus’ most mature market, and consequently they have a dedicated distribution center. Their logistics expense in Germany is as low as 15% – compared to the overall company’s 20 % (and this 20 percent is a mixture of companies both with and without DC’s, so we can estimate that a DC will improve margins in a country by more than 5 %). According to Zooplus, returning customers have a margin of 4 %, so by adding the savings from DC’s, that’s an operating margin of 9 %.

Building distribution centers is not a big expense for Zooplus. They are partnering with three logistics providers, Katoen Natie, Rhenus and De Rijke, who basically operate the centers, and run the cap-ex costs. Zooplus, in return, use their services singularly and pays their partners based on how much is shipped and handled. So, really the only cost here is technology and inventory. Not much additional capital is needed for the business to grow (on the other hand, changes in working capital have been negative for 4 years in a row).

Considering the above, it might not make sense that Zooplus are waiting till each country has sales of EUR 100 million before a DC is built. The company has yet to reveal why they are holding back on expanding their DC portfolio. Most likely, the logistics companies just have a threshold they want their partners to reach before building centers. When a country has sales of EUR 100 million, and a logistics expense of 20 %, that leads to a EUR 20 million revenue for the logistic partners. With an operating margin of 10 % (about the same as Fedex & UPS), that’s an income of 2 million euros. So, about EUR 18 million is being poured by Zooplus’ partners into launching a new distribution center.

Another thing to consider is that building these centers won’t just increase profit margins. Delivery speed and delivery satisfaction will increase, which of course directly relates to better customer service. Happier customers result in higher retention rates. So Zooplus’ logistics expansion is a crucial element of their future success. The CEO, Cornelius Pratt (who also founded the company, and the co-founder still owns 14 % of Zooplus) has mentioned that he projects Spain, Italy and the UK will reach the EUR 100 million threshold sometime over the next three-four years. UK is an especially important market for Zooplus. It is also a very tough country to wrestle your way into. The industry is less fragmented than most of Europe, and Zooplus only have a 1.6 % market share (compared to the average of 3.4 % per country). A DC in UK will probably lower costs by about 5 %, and if I owned the company, I’d transfer these savings into lower prices for customers. So the management will possibly do that. As a result, they will capture a bigger portion of the market through this competitive advantage (given that customers see this ~5% price discount as good enough to change stores).

Sales Growth, American Car Style, and a Bigger Pie

Zooplus have grown their sales from EUR 178 million in 2010 to EUR 909 in 2016, which is equal to a compound annual growth of 31 %. At the same time, the industry has grown from 21 billion euros to 25 billion. This means that Zooplus had a ~0.9 % market share of the European pet food industry 6 years ago, compared to 3.6 % today. At the same time, the online segment of the industry has grown 15 % yearly since 2010, to 6.8 % of total sales.

Europe is a lot denser and urban compared to the United States. In Europe there are 72.9 people per square kilometer, more than twice as many as 33 per square kilometer in the US. Europe’s demographics are simply better for online stores than other continents of the world. Because so many live in urban environments, public transportation and biking is frequently used as a way of conveyance, especially compared to the car-loving America. A study from 2010 showed that 85 % of all Americans drove for their daily trips, compared to 50-65% of all Europeans. Even more revealing, on shorter trips (1 mile or less), Americans drove almost 70 % of the time – while Europeans made 70 percent of their short trips by bicycle, foot, or public transportation.

This is huge for online pet food stores in Europe, and shows why you can’t blindly compare the American industry with the European – the differences are staggering. It is not irrational to guess online sales will take a bigger piece of the pet food pie in Europe, compared to the US. Bringing a 30lbs bag of pet food on a bike or bus is not easy.

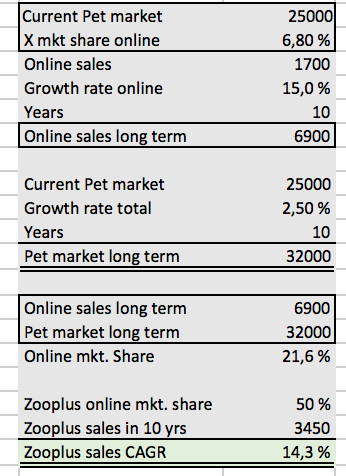

Despite this fact, the American online pet food industry is bigger (in percentage) than the European. Another study from 2015 showed that 12 % of all dog owners in the US buy their pet food online, and 19 % of those living in urban areas regularly had dog food delivered at home (12 % and 14 % for cat owners). This at least twice the size of online pet food sales in Europe, assuming basket sizes etc. are the same as in brick and mortar stores. Considering an industry growth rate of 15 % for online, and 2-3 % for all pet food, online will capture 21,6 % of all sales in 10 years (see spreadsheet). Given that Zooplus keeps it 50 % market share, that’s an annual sales growth of 14,3 %. Keep in mind, this is with industry growth alone. Zooplus will most likely take market share, thus growing faster than the overall industry, as their reputation grows and they can lower prices because of economies of scale and other advantages. In this industry, there’s usually one dominant winner – the most convenient store with the lowest prices and best customer service.

Grabbing a bigger piece of the pie is vital for Zooplus to grow faster than the industry. This requires happy customers. Customers are satisfied if two things are fulfilled:

- Good customer service and

- Lower prices.

Let’s begin with number one. Without good customer service, customers simply won’t return to a business. I wouldn’t go back to a store if I wasn’t treated well. Lower prices can compensate mediocre customer service, but it can’t compensate bad customer service. For attractive retention rates, both are necessary. And attractive retention rates are key for Zooplus to make a profit. According to the company, they take a 3 % loss in the first year of a customer relationship. The margin improves to positive 4 % in the second year of a customer’s lifetime.

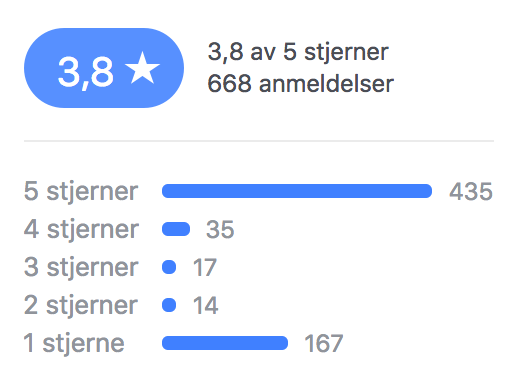

Above, you can see Zooplus’ reviews from Facebook. An average of 3,8 is not impressive by any means, but it’s certainly not bad. Most of the time people give Zooplus 5/5 stars – and the second most frequent rating is one star. (This is usually the case for online 5-star reviews, as most of the time people will rate something only if their experience was very good or very bad. Just look at any product on Amazon.) So what is the main take-away from this rating? It is not easy to extract information from reviews on Facebook. However, there are several people claiming service in the past year has gone downhill, and that delivery time has gone up from ~3 days to 7-10 days. As this has been reoccurring, it is concerning. Shoppers would also occasionally complain about the customer service received when something was wrong with their package. On the other hand, the majority are satisfied with Zooplus – and state that when problems occurred, customer service would be helpful and make sure the parcel would arrive safely. But, if Facebook is a reliable enough source, then Zooplus currently have a problem in building healthy customer relationships that will keep customer retention rates soaring in the future. We can also compare Zooplus’ ratings with competitors like Pets at Home and Fressnapf on Trustpilot.

Zooplus’ reviews on Trustpilot are excellent, and simply a lot more impressive than on Facebook. This is what I want to see in an online retailer. Only 8 % (6 % bad) of the reviews are below average, and the overwhelming majority supposedly had an excellent experience shopping at Zooplus.

Fressnapf’s reviews are comparable, holding a rating of 9.1/10 (same as Zooplus), and saying they are any worse based on Trustpilot would be nitpicking.

Pets at Home on the other hand, are not doing as well on the customer service part. More than half rated their service bad, and they are currently holding a rating of 3.7/10.

So, mostly reviewers on Zooplus are satisfied, because of their low prices, fast delivery and great customer service. Despite this, they do have their fair share of displeased customers, which is a worry in terms of future growth.

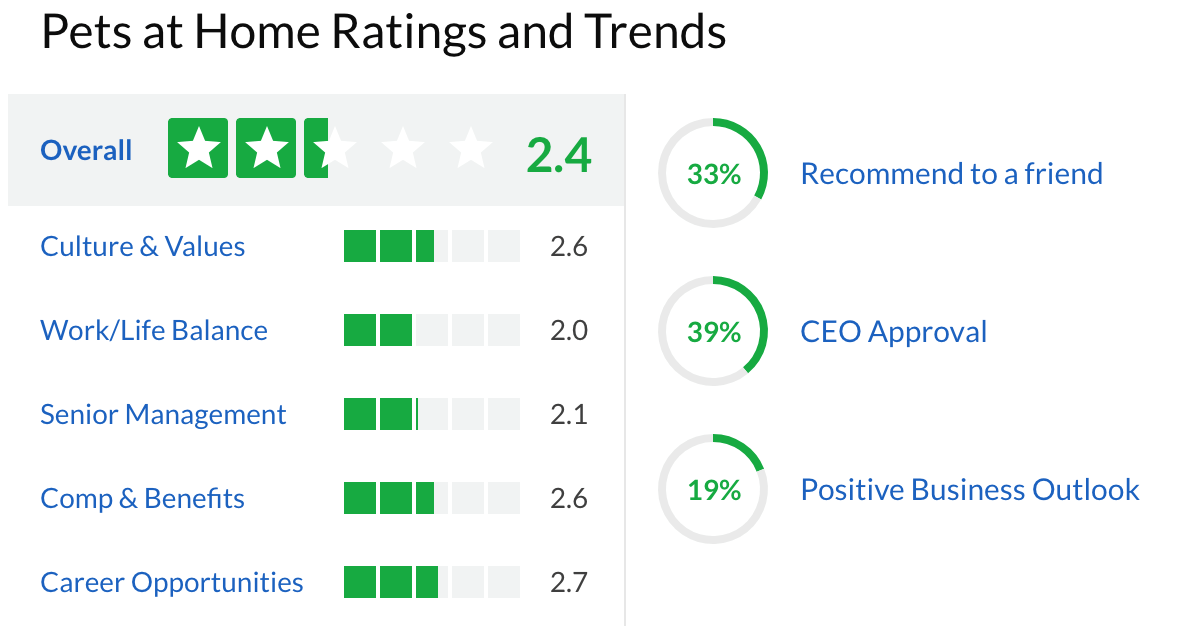

We can do some similar comparisons on Glassdoor, a review site that lets employee’s rata their firm. Phil Fisher used to see how workers were treated at companies he researched, and meant happy employees were vital for a business to grow over time. Again, Zooplus outperforms its peers.

Overall strong rating, high recommendation rates and a perfect CEO score are key takeaways from these statistics (bear in mind, you should always take these ratings with a grain of salt). However, Zooplus vastly outdoes Pets at Home here also.

Overrall, a score of 2.4 is weak, and so is more or less every other measure of business environment at Pets at Home. These are not numbers to buy or sell from, but it can be useful to look at these ratings and try to draw a picture of what the overall labor culture thinks of the company.

Again, Fressnapf comes awfully close to Zooplus in terms of score. But it does stand out negatively, as only half would recomment to a friend, and a handful of the scores are relatively damaging for the company.

Furthermore, Zooplus’ prices are cheaper than its peers overall. They have the opportunity to save costs, and therefore transfer this money into lower prices. Zooplus’ future moat will be oriented around lower prices, better customer service and economies of scale. These are competitive advantages that will help Zooplus grow stronger in the future. After all, they are the biggest online pet food retailer in Europe, they can buy products in bigger scale, and get it for a lower cost. This advantage will only increase as Zooplus grows.

In the last years, the industry has engaged in a price war, decreasing the already low margins the companies have. Zooplus have contiuned to grow and maintain its margins (by cutting expenses) despite this. These low prices hurt Zooplus’ competitors more than the debt-free Zooplus, and eventually, other businesses will have to start taking losses etc. As retailers have to go out of business, Zooplus will be able to raise prices again, and increase profit margins substantially (this is the strategy Wal Mart used in the ‘70s and ‘80s).

So Zooplus’ good customer service and low prices explain their high retention rate of 92 %. Customers at Zooplus returns their orders only 2 % of the time – a very low number for the online retail industry.

As shown above, there are several reasons to believe Zooplus will continue its aggressive expansion, and thus, continue its high growth rate over the next 10 + years.

Risks

In my opinion, Amazon is the prime risk to Zooplus’ business model (as described in more detail earlier in the analysis). The idea that Amazon is the Google of shopping is a huge threat to the online pet food retailer, no matter how low prices are, or how good the customers are treated by employees. There are also a few risks other than that which may cause problems for the company.

Firstly, Zooplus’ customer service doesn’t impress me. There are definetlely enough unhappy customers on the web to scare a shareholder. Especially the supposed trend that their customer service has worsened over the past year, including a twice as slow delivery time. I look forward to seeing if this is an actual development in the next annual report.

Secondly, Cornelius Patt is a very talented CEO that founded the firm, and has been an important part of Zooplus’ success. If he was let go, the company’s future prospects would worsen. But, there are no signs of him leaving yet. He owns shares worth EUR 40 million, is in his late 40s, and has shown big interest in what the future holds for Zooplus.

Additionally, if a market correction were to happen any time soon, Zooplus would definetely be dragged down by its extremely inflated P/E of 90 (due to Zooplus continously reinvesting its earnings). Stocks with a high Price to Earnings ratio often drop sharper than other stocks on the market when there is a major sell-off. This however, will only be an opportunity for potential investors, as they have no net debt, and it won’t influence the fundamental parts of the business.

Value

For many value investors, this is often one of the most important part of an analysis – what is the business I’m buying worth? As this is a prospering growth company, it is difficult to put a specific price tag on the stock. However, we can make a guess on what Zooplus will be worth in different future scenarios, when the industry has matured.

Basically, what we can do when valuing a stock like this, is take estimated growth rates of the industry (both online and overrall) and compare it with what we believe Zooplus’ market share will be at that time.

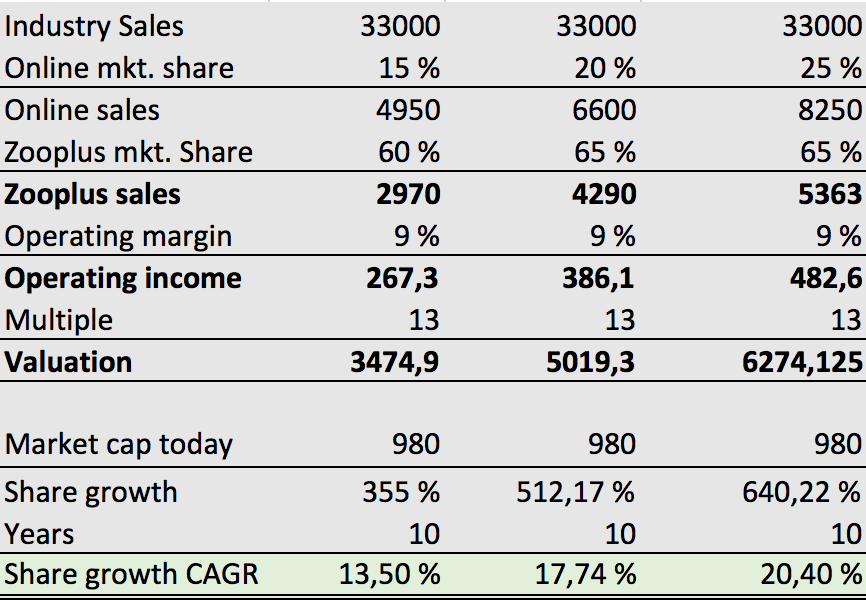

I believe online pet food sales will be about 25 % of the entire industry in the long term. At the same time, the pet food industry will slowly coumpound 2.5 % annually. Given that Zooplus grows to 65 % of online sales, from todays 50 % (they are growing 1.5x faster than the online industry), and they improve their operating margin to 9 %, we can come up with specific valuations for the company.

As you can read from the table to the right, Zooplus will probably return 14-20 % on your investment if the situations pictured occur. The column to the left is more pessimistic, and to the right, more optimistic. This is all based on a share price of about 140 EUR. It is fairly easy to calucate what your returns will be if the stock price plummets in the near future. Only a week or so ago, the share price hit 127 Euros per share, which would change these share growth prospects to 15 %, 19 % and 22 %, respecitivly.

Zooplus is cheap considering its future. It’s trading at about 1x sales right now. This is low, especially for a high growth company with a positive future and next to no debt. However, there are several obstacles and threats that stand in the way, so 15 % + is far from a guaranteed return over the next years. But I believe if an investor were to add Zooplus in their portfolio and hold it for a decade – they’d beat the market comfortably.

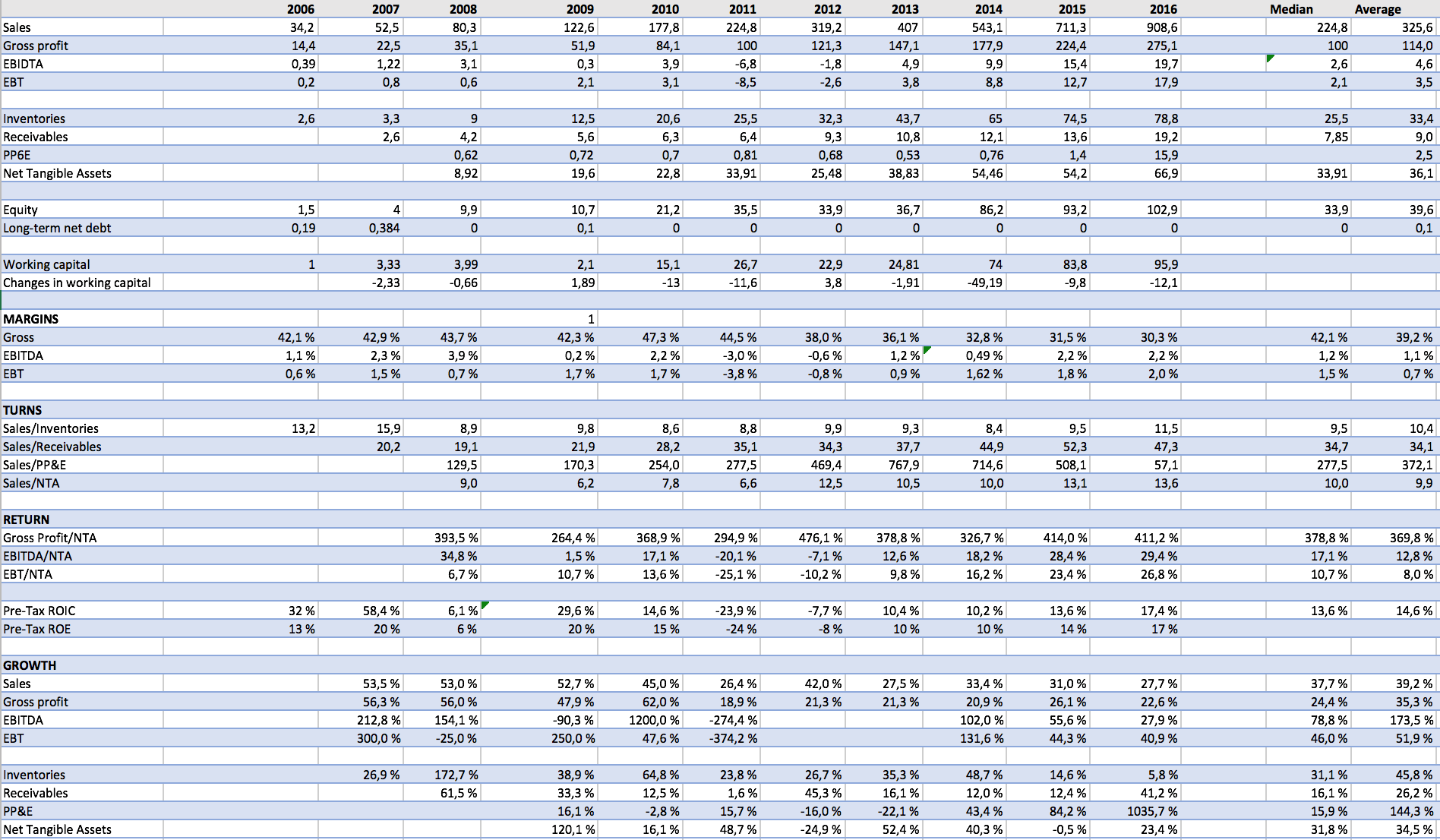

Zooplus in numbers