Entercom Communcations (ETM): The Second Largest Radio Station Owner in the U.S. Trades at a Lower EV/EBITDA Than its Debt Laden Peers

Member write-up by Vetle Forsland

Introduction

Entercom Communications (ETM) is an American radio company founded in 1968 by the Chairman Emeritus Joseph Field. He alone represents 21.8% of the total voting power, while his son, CEO David Field, represents an additional 6.2% of the voting power. For years, Entercom operated as a top five radio broadcaster. In the fall of 2017, when they acquired the much larger CBS Radio through a Reverse Morris Trust merger, ETM became the second largest radio broadcasting company in the US.

A special situation always interests me, and this particular merger was interesting primarily for one reason: the former CBS shareholders would own 72% of the new ETM stock. Since the former CBS shareholder never actively sought out a position in Entercom, many shareholders would be pressured to sell their stock, which explains why ETM has dropped from about $12.20 per share to $10.50 today. In my opinion, the stock trades at a significant discount to its fair value, as the market believes the recent struggles of several radio companies have been caused by a bleak radio industry, although the real reason has been over-leverage and poor management.

Business overview – is radio dying?

Entercom operates 235 stations in the mid-and-top tier cities of the US. They reach over 100 million monthly listeners, and generate revenue from the sale of broadcast time to advertisers. They sell ad time to local, regional and national advertisers. The largest portion of revenues comes from local, in which each station’s local staff generate ad sales, while the rest is handled on a national basis. Radio is a capital-light business, which is mirrored in their 5-year average EBITDA margin of 25.1%. It is also very asset-light, as 75% of their assets come in form of licenses and goodwill. Furthermore, the company is the second largest podcaster in the market, owns Radio.com (a website for music news) and generates revenue from organizing festivals, concerts and other live events.

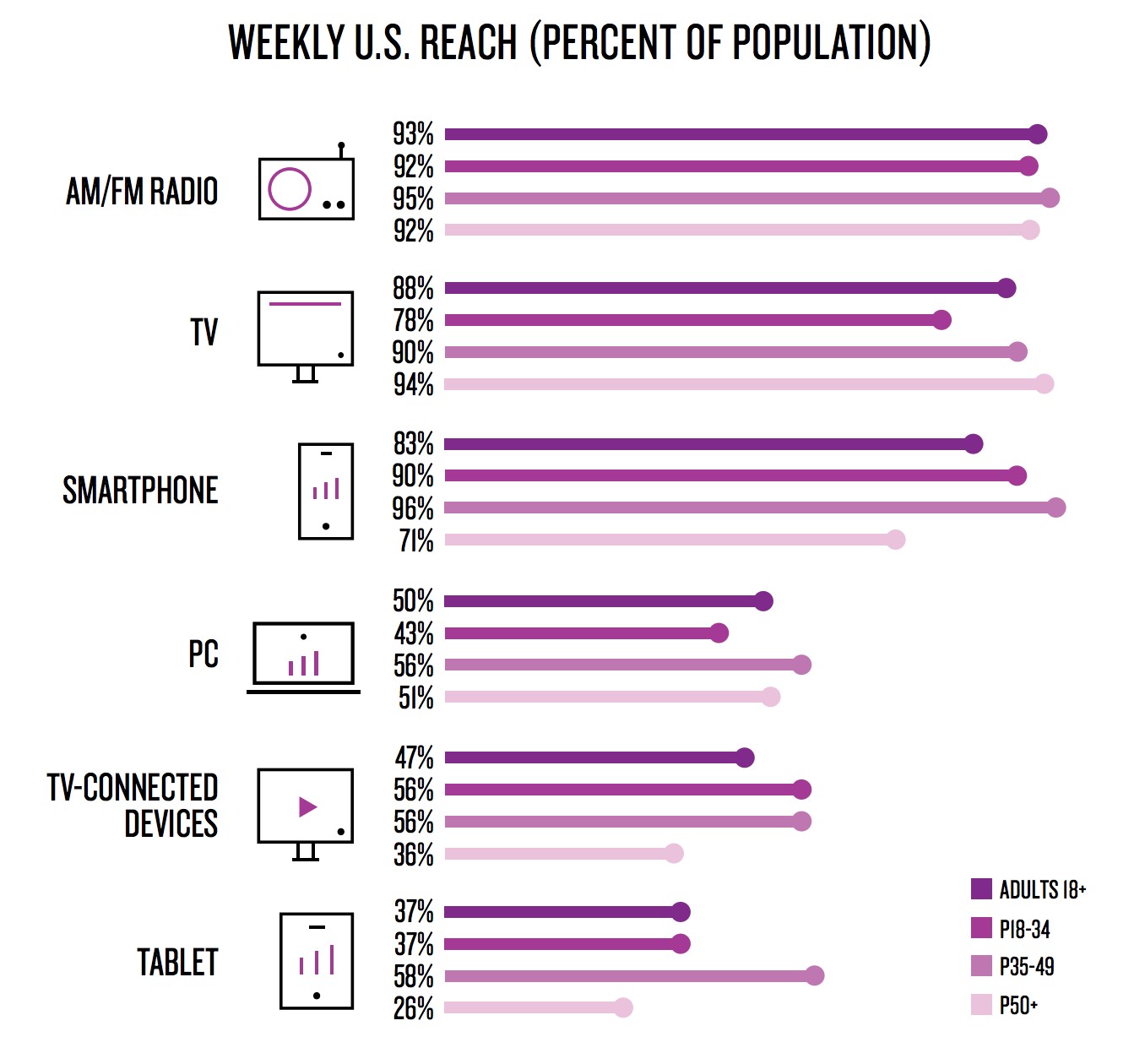

Since they get almost all of their revenues from radio broadcasting, the prime concern is whether or not radio will stay intact over the next decades. At a first glance, it might sound like a dying medium in a world of Spotify and YouTube, but research completed by reputable firms shows the opposite. For instance, research conducted by Nielsen, a company with 44,000 employees, show that radio reaches more Americans each week than any other platform. Radio reaches well over 90% of the US population, compared to just ~85% for smartphones and the same for television. Furthermore, the amount of weekly listeners has increased over the past three years and ten years.

Radio also offers a high return on capital for advertisers, as compared to other mediums. Procter & Gamble recently stated that they are spending “more and more” on radio advertising and declared a $100 million investment in digital ads “largely ineffective”. It wouldn’t surprise me if other major companies will mirror the actions of Procter, which …

Read more