Summerset (SUM): A New Zealand Retirement Village Developer with “Float”

Member write-up by: André Kostolany

| Investment Horizon: 5+ years | Market Cap: 1,494MM NZD |

| Type: Compounder | Net Debt: 348 NZDMM |

| Target Upside: 150% (ability to compound 20%+ p.a.) | Price/Net Tangible Assets: 1.95x |

| Country: New Zealand | Price/Underlying TTM EPS: 18.0x |

| Industry: Senior Living | Price/IFRS TTM EPS: 6.8x |

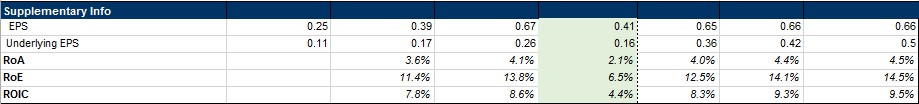

- Summerset (SUM) is a retirement village developer and operator. It has created 20% CAGR in shareholder value since its IPO in 2011 and is just entering an accelerating growth period

- Summerset’s operating model is that it operates its retirement villages and provides care to residents at very thin margins of 3-5%. In return residents are inherently selling Summerset a free call option on real estate/entry fee appreciation as well as providing Summerset with interest-free float

- Summerset is currently trading at around 1.95X Price/net tangible assets, 6.8x NTM IFRS EPS and 18.0x NTM Underlying EPS while generating a 14.3% ROE, providing a wide margin of safety to its intrinsic value. Summerset will grow at a minimum of 18% p.a. to leverage demographic tailwinds. There is some downside protection through the highly conservative assumptions CBRE uses for appraising Summerset’s real estate

Key Thesis Points

- Call Option on Real Estate/Entry Fee Appreciation

- Float: The business model inherently generates a large amount of float, which finances the majority of development costs for new retirement villages and provides leverage to the above-mentioned call option

- Demographic Tailwinds: New Zealand is now entering a demographic sweet spot for Summerset, brought about by accelerating aging trends

- Understated Book Value: Accounting conventions, coupled with CBRE’s highly conservative valuation depress book value but also “bake in” rapid future book value appreciation

Industry

- Summerset is a New Zealand based retirement village operators

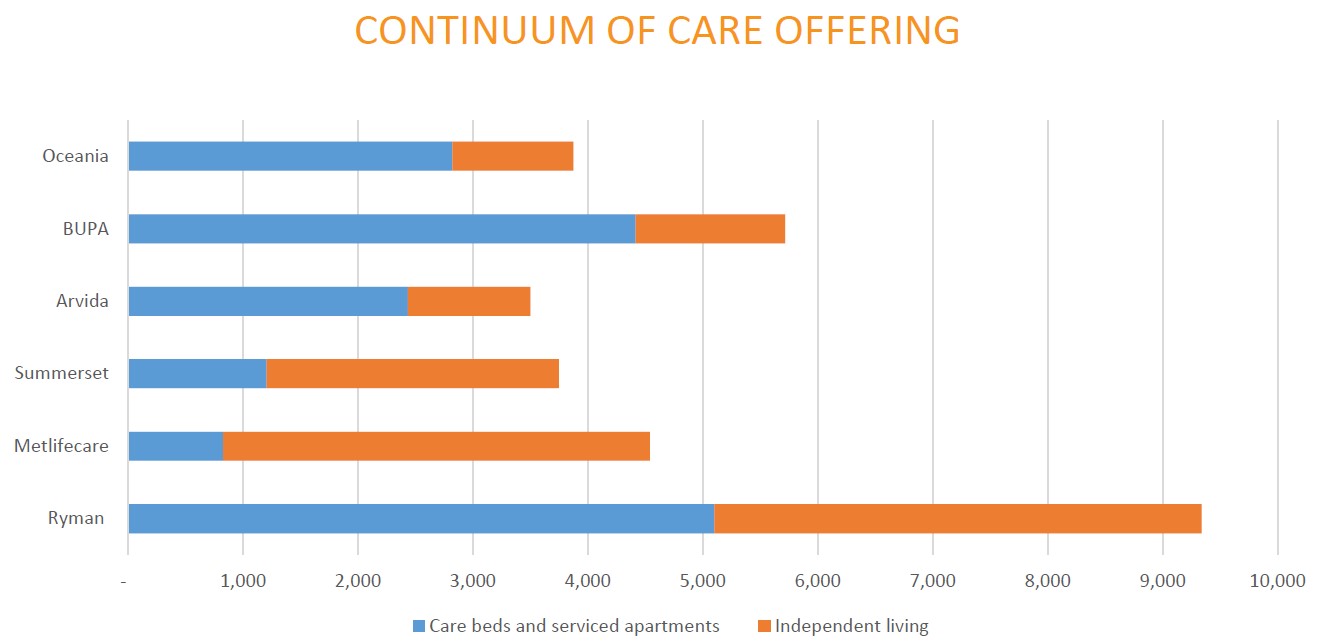

Source: Ryman Investor Presentation 2017

- As shown above, there are five other large retirement village operators in New Zealand (Ryman, Metlifecare, Bupa, Oceania and Arvida). The top six operators have around 65% market share and are continuing to grow their market share at the expense of smaller operators at about 2% p.a. This report focuses on Summerset due to the combination of inexpensive valuation, quality and scale

- Operators face a tradeoff between focusing on independent living and senior care. Summerset falls more heavily on the independent care end of the spectrum, a business that more closely resembles that of a hybrid real estate developer plus property manager

- Ryman is the largest and highest quality operator with about 18.5% market share of the retirements units market in New Zealand whereas Summerset has a market share of 11%.

- Summerset eventually plans to expand into Australia. Australia has a larger number of smaller competitors including publicly listed Japara Healthcare, Regis Healthcare, Ingenia Communities, Stockland and Aveo

- Over time, the New Zealand retirement village industry has tended to consolidate. I believe the same will happen in Australia due to the advantage that large float and cheap access to capital markets confer upon larger players

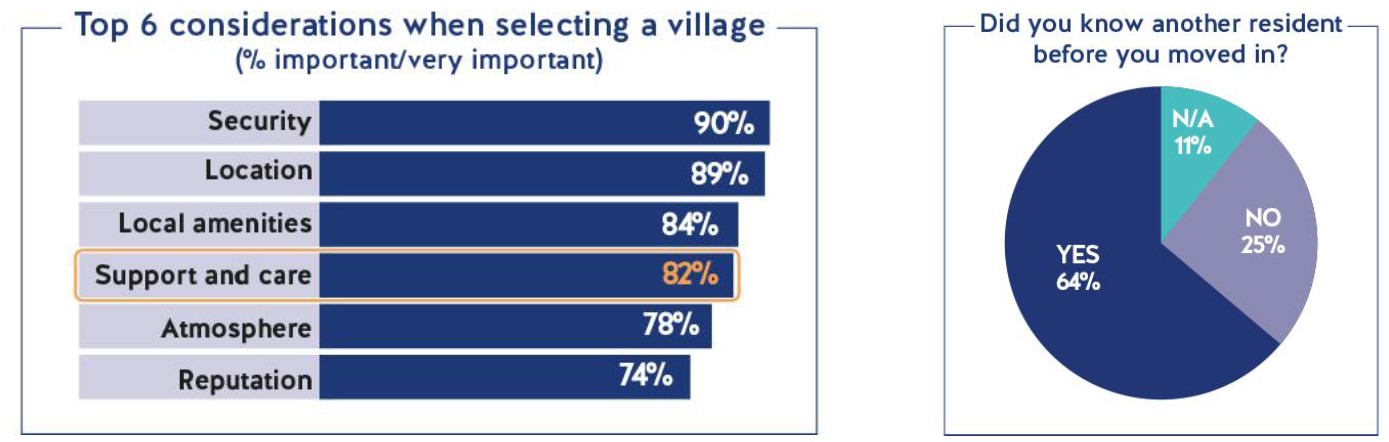

Source: Metlifecare Presentation

- Summerset sells three types of apartments: Villas, independent living units and serviced and memory care apartments. Villas require a higher entry fee than independent living units, whereas serviced and memory care apartments typically come with higher care fees

- The main considerations for the elderly when choosing a retirement village are security, location, local amenities, support and care, atmosphere and reputation. However, many customers simply choose the closest retirement home to their current community, particularly if they have friends that are already enrolled in a nearby community

- One of the main differentiators of Summerset versus its competition is that its villages are larger, have embedded healthcare facilities and are able to provide the full continuum of care. Operators such as Oceania, Arvida and Bupa tend to build villages with around 60 units, while Summerset, Ryman and Metlifecare focus on villages with 150+ units. The larger villages offer better service, are more prestigious and typically sell units at a higher prices. They also make it easier for residents to transition to a higher level of care should this be needed. To further build out this competitive advantage, Summerset has been focusing on its senior care and memory care/dementia units. In 2017, Summerset became the first aged care provider in New Zealand to offer apartment style living for people with dementia in a license to occupy model.

Business Model

- Retirement village development and the actual operation of villages require two broadly different skills sets, however it is the combination of the two businesses and the ability of developed villages to generate float with which to fund the development of new villages that make hybrid retirement villages developers/operators great businesses

- The industry operates with an Occupational rights agreement (ORA) system in which the resident buys the right to occupy a unit until death without actually taking title to the underlying real estate (similar to a vacation timeshare). In practice, the resident pays a partially refundable entry fee of around $200-700K when moving in

- When the resident vacates the unit (usually upon death), the operator returns the entry fee less a deferred management fee (DMF). The DMF is an annual, non-cash charge that is typically 5% of the original purchase price. The DMF is capped between 20-25% of the purchase price at Summerset. For example, if a resident buys an occupation right for $200,000[1] at the age of 80 and passes away after five years, their designated heir will receive $150,000 cash while Summerset will retain $50,000 as profits

Summerset’s sources of earnings are:

- Weekly Fees paid by residents. Weekly fees range between $110-$150 per week. Together with care fees they guarantee a highly stable stream of cashflows that, together with the deferred management fee covers operating expenses[2]. Care Fees are more expensive than weekly fees and are paid by residents who require a higher level of care

- Deferred Management Fees derive from selling occupancy rights, as explained previously

- Development Margins are the margin Summerset makes between selling initial occupancy rights and development costs on those properties. Development margins tend to be between 20-25% depending on the strength of the real estate market. The construction period of a retirement village ranges from 3-5 years. Summerset maintains between 15-20% debt/assets to help fund the development of new properties whereas the remainder is fully funded by the float generated by entry fees. Summerset, upon selling occupancy rights on a completed property, gets back its entire development capital during the first cycle, as well as an additional development margin

- Resale Margins are derived from the resale of occupancy rights when a resident passes away or moves out and vacates a property. On resale, the retirement village operators capture any entry fee appreciation that has occurred in the interim, as well as the DMF discount. Summerset incurs only marginal taxes on this, as the repayment of a “Resident Loan” is not a taxable event The difference between the price of the initial occupancy right and the resold occupancy right define the resale margin

Thesis Point 1: Call Option on Real Estate/Entry Fee Appreciation

- Summerset’s business model creates a free levered call option on entry fee/real estate appreciation

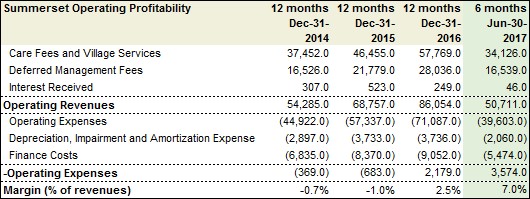

- Summerset has historically priced its services so that the Deferred Management Fee (DMF) + Weekly Fees cover operating costs. More recently Summerset has begun generating a profit margin on its operations (2.5% in 2016 and 7% in 1H2017. Seasonality is likely to drag down full year operating profitability to 5-6%). This was primarily due to a decrease in operating costs/revenue

- The implicit financial contract between Summerset and its resident seems to run as follows:

- Summerset provides its services (operating retirement villages, senior care) at slightly more than cost to residents. In return, residents:

- Sell Summerset a free call option on entry fee/real estate price appreciation

- Provide Summerset with interest-free float/leverage of about $200K per resident which Summerset then deploys into constructing more retirement villages

- As a result, the bulk of Summerset’s true profitability stems from resale margins and development margins

- Resale margins are a function of entry-fee price appreciation, which are themselves mostly a function of real estate price appreciation as well as supply and demand for retirement village units

- Development margins are a function of both entry-fee price appreciation and development costs

- Summerset’s independent houses sell at a discount to the median home price in New Zealand. This gives Summerset the ability to set entrance fees in-line with housing values in New Zealand. If a retiree can sell their house for $500,000 (about the median house price for new Zealand), they’ll be able to afford the $200,000 (partially refundable) entry fee for an independent living unit

- An owner of a 3BR apartment may trade down for a smaller 1BR independent house, etc. This allows homeowners to sell their house at retirement, roll the proceeds into occupation rights and still leave the majority of the original proceeds from selling their house behind for inheritance or other purposes

- The property manager has the opportunity to remarket the properties at a higher price in line with housing prices in the area, which gives Summerset a mechanism to monetize any property price appreciation that has occurred in the interim. This has been the largest driver of gain on resale margin

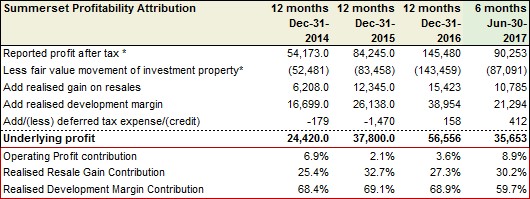

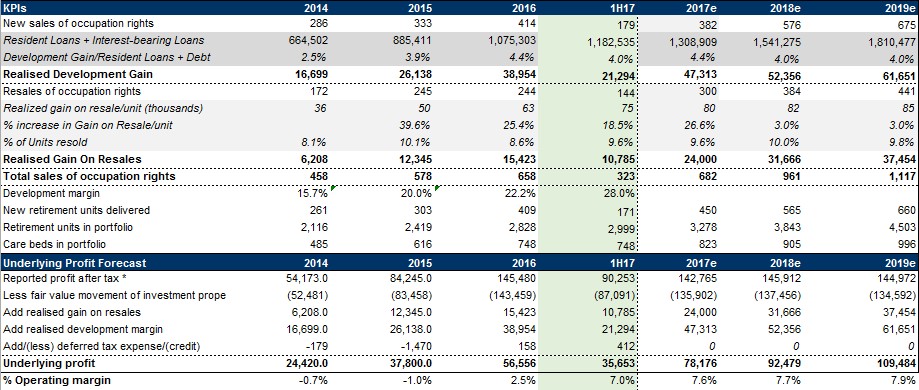

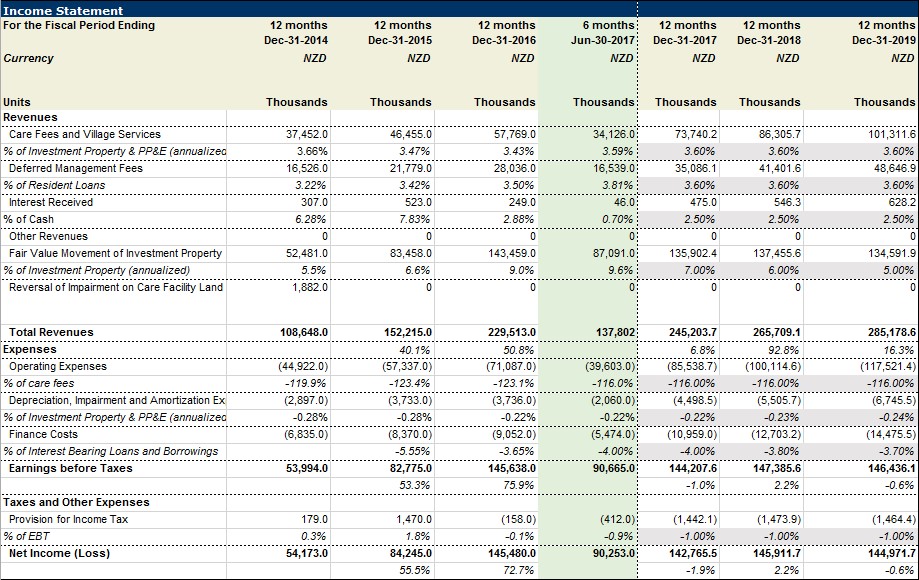

- As IFRS profits include the full amount of fluctuation in the value of the company’s real estate, but don’t show profits from resale margins and development margins, a better measure of profitability is Underlying Profitability, which strips out the FV movement of Investment Property:

- Summerset provides its services (operating retirement villages, senior care) at slightly more than cost to residents. In return, residents:

Underlying Profitability = Reported Profit After Tax – Fair Value movement of Investment Property + Realized gain on resales + Realized development margin

- The above attribution shows clearly that the bulk of Summerset’s profits (60-70%) comes from development margins. Another 25-30% is derived from the resale of properties. Operating profitability has only recently begun meaningfully contributing to underlying profits. As Summerset is currently in a high-growth phase, this is only natural. As Summerset’s growth slows and the company scales, profit contribution should shift towards resale contribution and operating profits

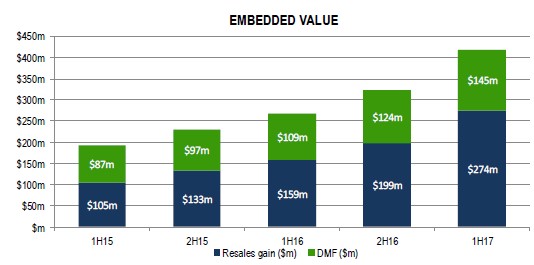

- Gain on resales are quite persistent in that they reflect the differences between entry fees years ago and the present. IFRS profitability may be a good directional indicator of “stored up” gain on resale for the coming years. An even better measure is the difference between the original sales price and the expected resales price for apartments, plus the total accumulated DMF, called “embedded value”. Embedded value currently stands at $274MM for resale gain and $145MM for the DMF

- Gains from realization of development margin only occur for a fraction of the company’s properties in any given year. Fair value changes in the portfolio eventually feed through to the entire portfolio and turn into realized gains as occupancy turns over and developments are completed

- The above table lays out how Summerset can continue to grow its underlying profits through development gains and gain on resales

- Development gains are difficult to forecast, but essentially the company uses the entirety of its resident loans plus interest bearing loans for development to finance the development of new properties (whereas it does not leverage developed properties). The average development gain as percentage of resident + interest-bearing loans has been about 4.0% p.a.

- Gain on Resale = Number of Units Resold each year x $ Gain on resale per unit. Per unit $ Gain on Resale has grown rapidly over the last couple of years and I am only modeling only a limited amount of further appreciation, as I am not sure whether entry fees can continue increasing at their historical pace. The number of units resold should continue to grow along with the size of Summerset’s property portfolio.

Thesis Point 2: Float

- Operators in the retirement village industry generate costless float with every sales cycle which they can use to fund new developments without using large amounts of equity. This is especially effective when there is already a large, mature base that can generate the float to fund newer developments

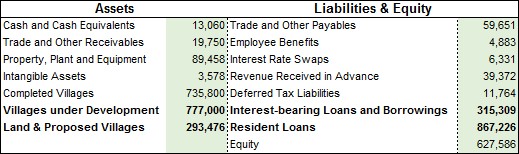

- The float is booked as a liability called “Resident Loans” on the balance sheet. By selling what are effectively timeshares in retirement units, developers can finance over 80% of capital for new property developments at zero interest rates. At the same time, the DMF portion pays for ongoing operating costs at existing villages

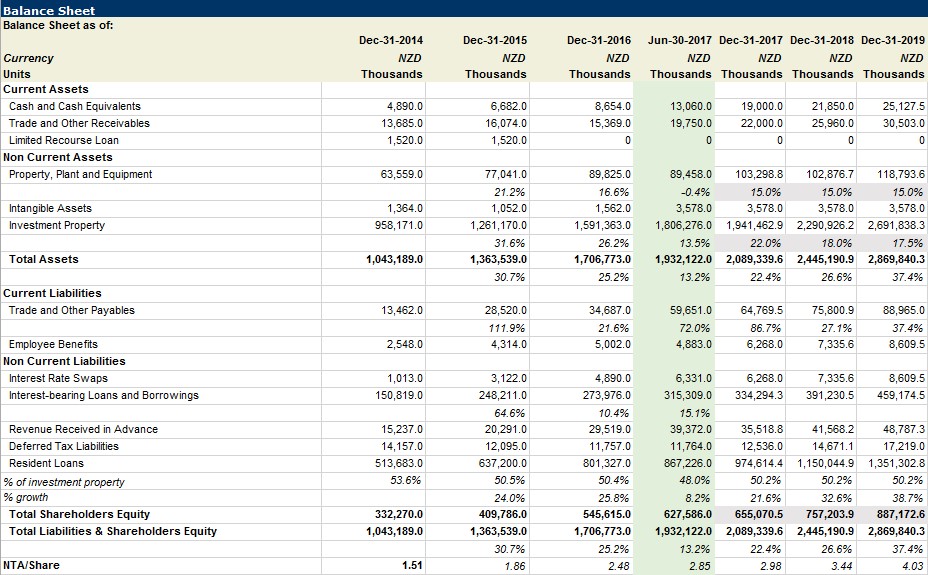

- A look at the balance sheet confirms that $735MM in completed villages are currently generating $867MM in resident loan float. Summerset is borrowing an additional $315MM from banks to build out $777MM in additional retirement villages currently under development as well as a $293MM Landbank for future propsed villages. The astute reader will note that the $ value of properties under development is currently larger than the $ value of completed villages

- As shown in Thesis Point 1, the development of new villages is generating a ~4% ROA per annum through development margins. If, at some point Summerset stopped growing, it could invest its float into bonds and probably generate a similar ROA. At this point, growing the float by building out further retirement villages is, however, more value accretive

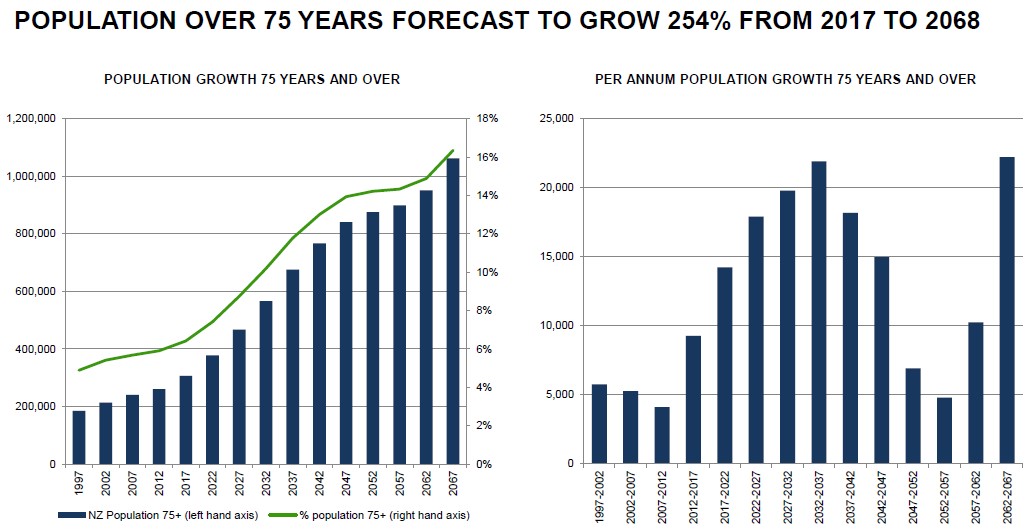

Thesis Point 3: Demographics

Source: Summerset 2017 Presentation

Source: Oceania 2017 Presentation

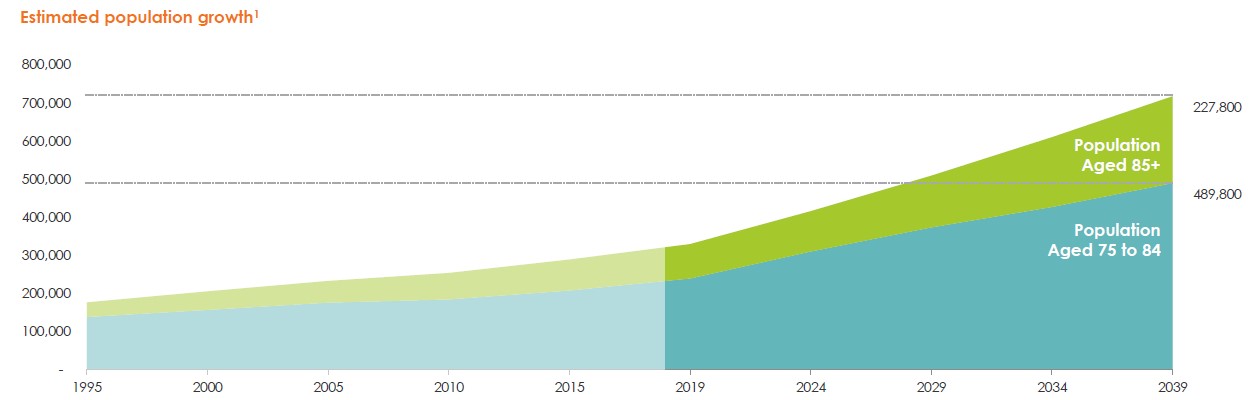

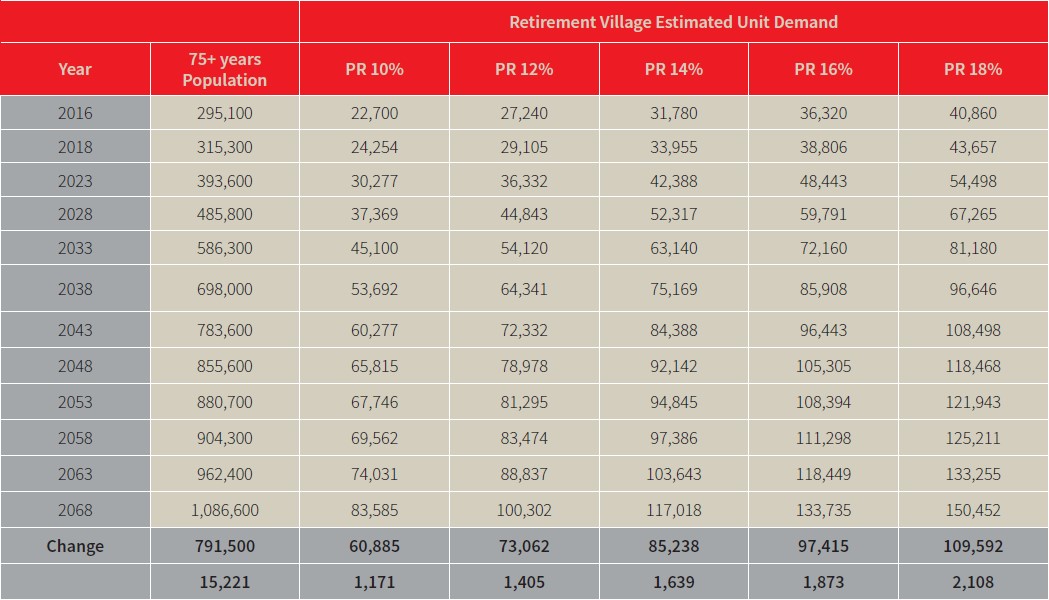

- The number of people above the age of 75 is currently 300,000 in New Zealand. While there were only about 10,000 new retirees per annum between 2012-2017, the annual number of new retirees is projected to grow to 14,000 per year between 2017-2022 and rise to over 17,500 in the 2022-2027 as baby boomers retire. The total number of New Zealanders aged 75+ years is set to double from 295,070 in 2016 to 588,770 in 2033

- In 2016 the population of people aged 75 years+ grew by 11,650. Penetration rates (the percentage of people who decide to move in to retirement homes) stood at around 12.4%[3] meaning that around 1,400 out of the 11,650 new retirees decided to move to retirement homes. If 1.3 people moved into each home together this would have generated demand for 1,077 new retirement homes. Any net migration into New Zealand would have generated additional demand

- The penetration rate is set to further increase (historically it has grown at around 60bp p.a.) due to

- An increased availability of suitable product at villages with quality facilities including an expansion of care options

- Increased market acceptance of the retirement village lifestyle as an accommodation option

- Recent increased property values helping retiring homeowners afford the large entry fees

- Socio-economic and demographic influences such as longer lifespans and the breakdown of the extended family

- Better and more transparent pricing structures at villages

Source: JLL Retirement Village New Zealand Database 2016

- The penetration rate is an important swing factor for retirement villages. The above table illustrates how, if the penetration rate rose to 16%, there would be scope for 1,873 new retirement units p.a. On the other hand, if it remained at its current 12%, there would only be a need for 1,405 units p.a., which could lead to overcapacity

- In Australia, a market that Summerset has plans to enter the addressable market is even larger with about 1.8MM people above the age of 75 and a similarly accelerating number of retirees above the age of 75

- Inventory continues to be low and real estate tight. According to management, there are hundreds of applicants that have to be waitlisted upon completion of a new retirement village

- Summerset and Ryman both have a build rate of around 15% their current property, but a land bank that is over 60% their existing portfolio size. Their target is to double in size every five years through 15% growth p.a. This is highly likely to happen as development of the land bank and new villages is already well underway. Other operators have less ambitious growth targets at this point

Thesis Point 4: Understated Book Value

- Book value and growth in intrinsic book value per share are a good indicator of value for Summerset (as opposed to earnings or EBITDA)

- Net tangible assets per share are 3.48 vs a share price of 6.8 NZD. A 95% premium to book doesn’t look cheap at first sight, however a closer look reveals that the book is undervalued for two reasons: 1) CBRE valuations and 2) float liability accounting on the balance sheet

- The following table from the 1H17 presentation provides an overview of valuation assumptions used:

- CBRE Valuations: CBRE provides valuation for SUM’s villages every 6 months:

- CBRE has data on the entire retirement village industry and a 15-year history of transactions across the market. Their models correspond to economic reality relatively well

- CBRE produces a 20-year DCF analysis with retirement unit sales price, projected price inflation, discount rate, entry age of residents, mortality rates, maintenance capex and idle time between sales

- The weekly fees and operating expenses are projected to grow at similar rates and thus only contribute on a linear basis to the valuation

- CBRE uses a conservative growth assumption of 0-2.5% growth over the next 4 years and 3.25% over the long term

- Village level cash flows are mostly discounted at a 14-16% rate (though this is reduced over time)

- As villages mature, CBRE lowers the discount rate down to as low as 10%. Once the assets mature through the first sales cycle there is a big improvement in pricing. Finally, CBRE reduces its discount rate for mature villages over 10-15 years, which provides an additional valuation uplift.

- Due to the 14-15% discount rate, a rapid rate of cash-flow compounding is already baked-into valuations.

- At the same time, any reduction in the discount rate would lead to significant increase in NAV. I believe that the discount rate CBRE uses is highly conservative, and as properties mature, there will be an additional uplift in valuation from reduction of discount rates. For example, a 1% reduction in discount rate from 15% to 14% would boost a generic retirement village’s value by between 7-8%. As explained above, this will automatically happen as properties matures

- It follows that if CBRE used a lower discount rate of 10%, Summerset would be trading at about 1.5x book

- Float Liability Accounting: Resident loans (the float) actually bear negative interest since SUM on average has to repay 25% less than residents have paid for ORA’s. Resident loans are only growing because SUM a) is expanding faster than resident loans are shrinking and b) real estate prices are rising providing an offset. Another way of thinking about this is that if SUM went ex-growth and entry-fees stopped increasing resident loans (the majority of liabilities) would start shrinking at a rate of 5% p.a.

Valuation

- The combination of 1) the 15% discount rate + 2) the float liability accounting will ensure that book value continues to compound at a pace of around 20% p.a.

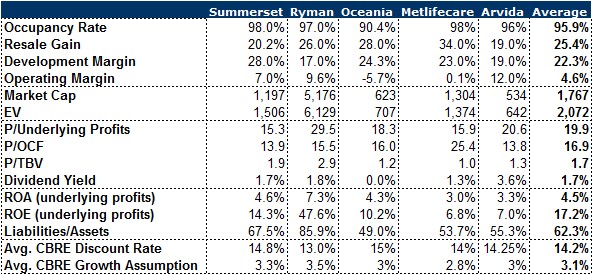

- When using Underlying profitability as a measure of earnings, Summerset trades at about 14.2x 2018 underlying profits and 18x 2017 underlying profits. Considering the growth rate and secular tailwinds this seems cheap on an absolute basis as well as cheap to competitors at an average of 19.9x. At the same time, operating metrics such as occupancy rate, resale gain, development margin and especially operating margin compare favorably to the rest of the industry

- The above table also reveals what sets industry leader Ryman Healthcare apart from its competitors: far higher use of leverage. While Ryman is about 6.5x levered, Summerset just uses 3.2x leverage and the rest of the industry is at 1.0x. This is not necessarily a bad thing as no one in the industry uses more than 15-20% debt/assets. If Ryman’s valuation metrics were similar to Summerset, I would have a clear preference for Ryman. In a situation where occupancy rates sharply fall, Ryman would, however, be more likely than competitors to run into liquidity issues

- On a P/TBV basis Summerset is more expensive than competitors at 1.9x vs 1.66x. Some of this may be due to the higher discount rate used for its villages

- This is a great business as long 1) real estate prices keep rising and 2) occupancy rates remain high. If demand for new retirement villages should stop surging at some point, Summerset could start deploying its float into an investment portfolio. For now however deploying capital into new villages is far more attractive

- To summarize, Summerset is trading at 2x 2018 underlying earnings and growing at 15% p.a. from new village development. If we assume that existing villages can grow revenue at about 3% p.a. in line with CBRE, we arrive at 18% growth p.a.

Risks

- Supply Side Risks

- If the market became saturated due to sector-wide overbuilding, occupancy rates would drop due to overcapacity. This would cut Summerset’s development margin, diminish resale margin and cut into Summerset’s float. Overbuild risk does not seem to be an issue yet. However, JLL estimate that there will be demand for an additional 1,654 retirement village units every year in New Zealand between 2016 and 2043. While I have no exact numbers for new unit build per year, at the very least I don’t think the industry is underbuilding new units. However, in an industry with over 30,000 retirement units, very high occupancy rates and quickly growing demand, it would take a while before marginal overbuilding of a few hundred units had an impact. Nevertheless, this is a topic that investors should discuss and warn management teams across the industry about. In particular, a tendency to invest the full amount of float available into the development of new villages could bring about overcapacity. Some degree of restraint and using part of the float to invest into bonds may be a good idea.

- In my opinion, the threat of overcapacity to the industry should be monitored, but not overstated. Occupancy rates across the industry are still high and stable (Summerset leads the industry at 98%) and development margins healthy across the industry. Anecdotal evidence from management teams indicates that waitlists for new villages are long and fill up quickly. It could be that new retirement units are just catching up with pent-up demand. However, the threat of overbuilding is real and should be closely monitored

Source: JLL Retirement Village New Zealand Database 2016

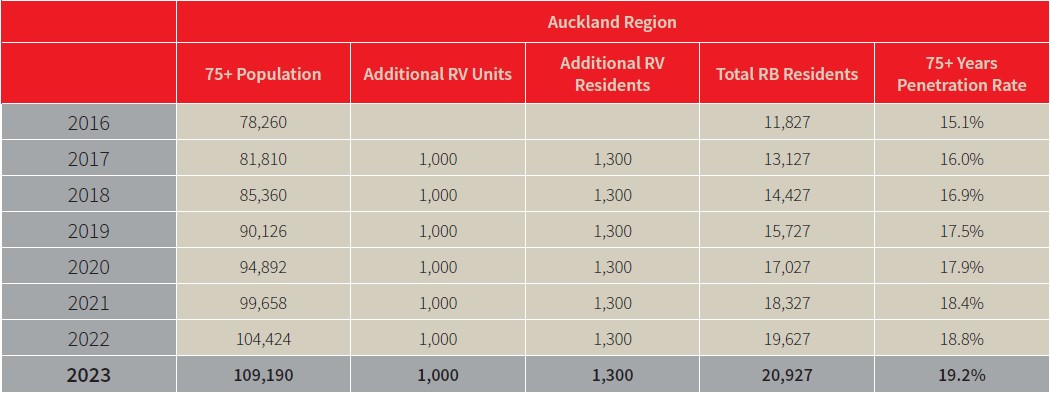

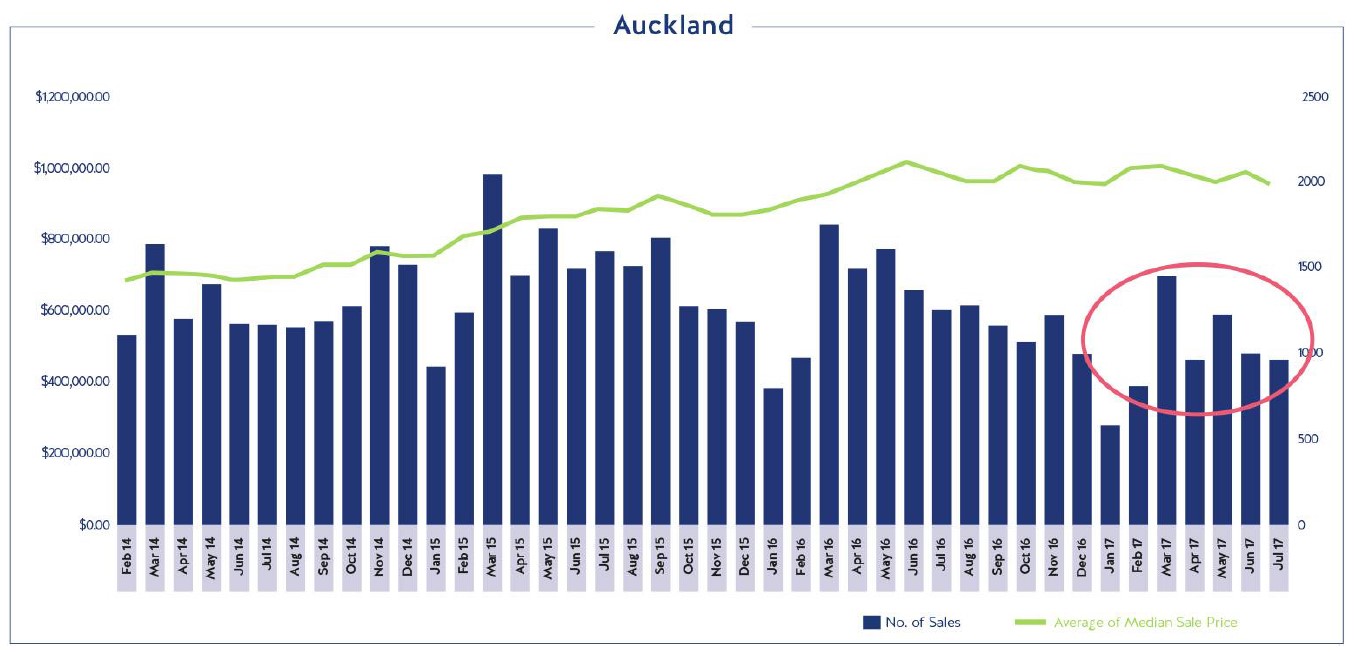

- An additional threat is that around 44% of new retirement village developments are currently being completed in the Auckland region where housing prices are highest. JLL calculates that in order for the current development pipeline to be absorbed in Auckland, penetration rates would have to increase from 15.1% in 2016 to 19.2% in 2023. Some operators may have to slow down the development of their landbank in Auckland to let market demand catch up. Auckland also has by far the highest housing prices in New Zealand at an average of $1MM, so operators are able to charge a significantly higher entry fee and generate more float and DMF there than in the rest of the country

Source: Metlifecare 2017 Investor Presentation

- In addition, monthly transaction volumes have started coming down from an average level of 1,500 in 2016 to around 1,000. Despite this, median house prices in Auckland, New Zealand’s largest market are flattening off but not falling. This should be enough to keep entry fees stable at a minimum.

- Operators are also seeing labor shortages in Auckland, which will raise the cost of new developments. This situation could get worse before it gets better if the new government chooses to implement anti-immigration policies and have an impact on development margins

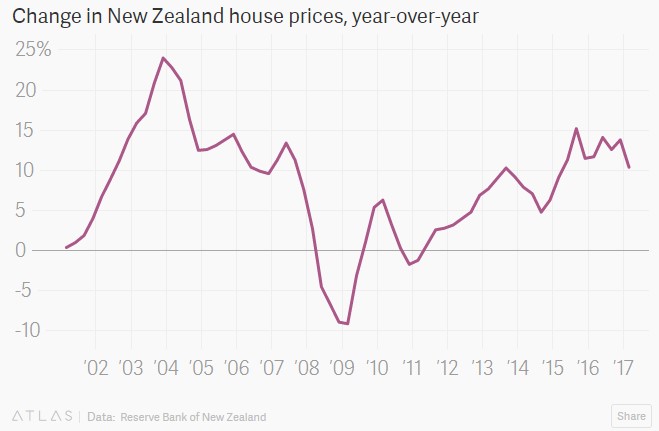

- If general real estate prices in New Zealand stagnated or depreciated Summerset would lose its pricing power, as new residents’ ability to pay the entry fee depends on the price they can sell their houses for. The last time this occurred was in the 2008-2009 period. While Summerset was not yet a public company back then, Ryman Hospitality weathered this period relatively well with a ~9% decrease in profits year on year and rebounding quickly in 2010. The worst case scenario for Summerset would be a long-term deflationary environment as it would be forced to re-price entry fees downwards which would cut into both development and resale margins. In such a world, Summerset would have to change its business model and reprice its services to earn money through operating profits

- Cost pressures in the construction market. If construction costs rose significantly due to labor shortage, this would affect development margins

- Demand Side Risks:

- Negative Publicity: If it turned out that one of the retirement homes in New Zealand was taking advantage of its residents, the industry’s reputation as a whole would deteriorate and market share could shift back towards in-home care or family-provided care.

- Changes in government policy: Reduced immigration would lead to both lower availability of construction workers and caretakers for the elderly.

Financials Snapshot

Further Reading and Resources

- Unwary residents caught in villages’ rules trap (16 Mar, 2014) http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11220355

- Aveo and the Australian Market http://www.theage.com.au/interactive/2017/retirement-racket/the-price-of-freedom/index.html

- Retirement Village Association of New Zealand http://www.rvranz.org.nz/r

- Village Guide https://www.villageguide.co.nz/village-voice-blog/australia-new-zealand-retirement-system

- Regulation https://www.cffc.org.nz/retirement-villages-at-a-glance/

[1] For details and comparisons between villages see https://www.agedadvisor.nz/Compare-Retirement-Villages-Entry-Age-Costs-Fees-Conditions

[2] An interesting side note on weekly fees + care fees is that the risk of any resident not being able to pay them is very low. The New Zealand Superannuation fund guarantees every retiree above the age of 65 a minimum retirement income between $200-600 depending on marital and tax status, as well as a host of other variables. Any eligible New Zealander receives NZ Super regardless of how much they earn through paid work, savings and investments, what other assets they own or what taxes they have paid. This ensures that every New Zealand retiree is able to afford weekly fees. In addition, the rates are reviewed and adjusted to take into account any increases in the cost of living (inflation) and average wages. This gives Summerset flexibility to also increase weekly fees upward in-line with the superannuation fund. See https://www.workandincome.govt.nz/map/deskfile/nz-superannuation-and-veterans-pension-tables/new-zealand-superannuation-and-veterans-pension-ra.html

[3] up from 6.8% in 1998