Entercom Communcations (ETM): The Second Largest Radio Station Owner in the U.S. Trades at a Lower EV/EBITDA Than its Debt Laden Peers

Member write-up by Vetle Forsland

Introduction

Entercom Communications (ETM) is an American radio company founded in 1968 by the Chairman Emeritus Joseph Field. He alone represents 21.8% of the total voting power, while his son, CEO David Field, represents an additional 6.2% of the voting power. For years, Entercom operated as a top five radio broadcaster. In the fall of 2017, when they acquired the much larger CBS Radio through a Reverse Morris Trust merger, ETM became the second largest radio broadcasting company in the US.

A special situation always interests me, and this particular merger was interesting primarily for one reason: the former CBS shareholders would own 72% of the new ETM stock. Since the former CBS shareholder never actively sought out a position in Entercom, many shareholders would be pressured to sell their stock, which explains why ETM has dropped from about $12.20 per share to $10.50 today. In my opinion, the stock trades at a significant discount to its fair value, as the market believes the recent struggles of several radio companies have been caused by a bleak radio industry, although the real reason has been over-leverage and poor management.

Business overview – is radio dying?

Entercom operates 235 stations in the mid-and-top tier cities of the US. They reach over 100 million monthly listeners, and generate revenue from the sale of broadcast time to advertisers. They sell ad time to local, regional and national advertisers. The largest portion of revenues comes from local, in which each station’s local staff generate ad sales, while the rest is handled on a national basis. Radio is a capital-light business, which is mirrored in their 5-year average EBITDA margin of 25.1%. It is also very asset-light, as 75% of their assets come in form of licenses and goodwill. Furthermore, the company is the second largest podcaster in the market, owns Radio.com (a website for music news) and generates revenue from organizing festivals, concerts and other live events.

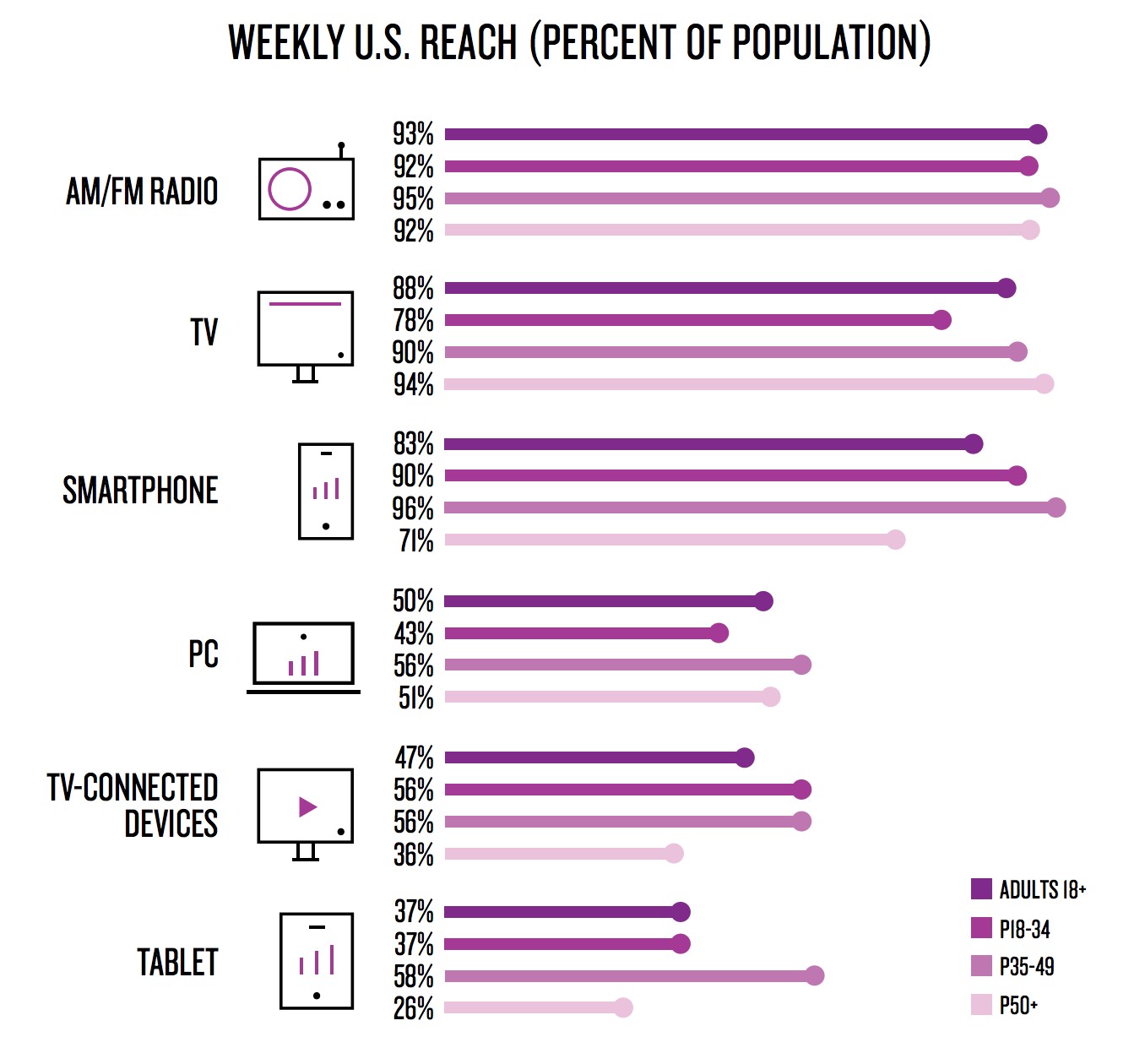

Since they get almost all of their revenues from radio broadcasting, the prime concern is whether or not radio will stay intact over the next decades. At a first glance, it might sound like a dying medium in a world of Spotify and YouTube, but research completed by reputable firms shows the opposite. For instance, research conducted by Nielsen, a company with 44,000 employees, show that radio reaches more Americans each week than any other platform. Radio reaches well over 90% of the US population, compared to just ~85% for smartphones and the same for television. Furthermore, the amount of weekly listeners has increased over the past three years and ten years.

Radio also offers a high return on capital for advertisers, as compared to other mediums. Procter & Gamble recently stated that they are spending “more and more” on radio advertising and declared a $100 million investment in digital ads “largely ineffective”. It wouldn’t surprise me if other major companies will mirror the actions of Procter, which in turn will mean more revenues for radio.

So, if radio isn’t dying, why have the peers of ETM failed? As I mentioned in the introduction, the failure has been caused by too much leverage, not a fading market. iHeartMedia, the largest radio broadcasting company in the US, currently has a Net Debt/EBITDA of 11.35, and has been struggling to pay down the $20 billion in debt they assumed from a leveraged buyout in 2008. On March 14th, the company filed for Chapter 11 bankruptcy – so, its failure was undoubtedly caused by poor management decisions and over-leverage. Similarly, the Debt/EBITDA of Beasley Broadcasting Group, Cumulus Media, Townsquare Media and Salem Media is 5.3, 12.6, 5.9 and 5.9, respectively. Entercom currently has a Debt/EBITDA of 3.8 after expected synergies, which is much more tolerable. The company is currently targeting a leverage of 3.5 times EBITDA.

Moat

When I first read about ETM, I was interested in whether or not this was a business with a moat similar to the moats of local newspapers, since the company often owns several radio stations in the same cities. However, on examining the markets they operate in, I found that on average, their stations only make up about 8% of all the stations in the respective areas (with moderate or better signal, source: Radio-Locator). They own about 16% of all radio stations in Buffalo (NY), Greenville (SC), Miami (FL) and Portland (OR), but other than that, it’s usually around 6%-10%. The reason for this is that the FCC has regulated the amount of stations one entity may own (in markets with more than 45 stations) to 8 stations. So, even in a best case scenario, one entity cannot own more than about 18% of all the stations on the market.

However, in November 2017, the FCC voted to bring an end to several rules on local broadcast ownership. These includes limits on “cross-ownership” of radio, newspaper and TV assets in a market, which is what’s stopping ETM from having wide moat right now. You might have heard of Sinclair Broadcast Group, a television broadcaster that practically has a monopoly on local news stations, as they went viral recently (search for Sinclair on YouTube). As a result of the relaxation of the FCC rules, they proposed a $3.9 billion acquisition of additional local TV stations. Something similar might happen to Entercom going forward, as their competitors are going through solvency issues while ETM has plenty of cash on hand. The removals of the imposed rules are unquestionably great news for Entercom, given that they are much more capable of aggressively acquiring TV stations versus their competitors. Therefore, while Entercom might not have a monopoly-like moat in certain markets just yet, recent FCC deregulation might change this going forward. Note that these rules were put in stone in the 1970s, so this could mark a new era of local radio ownership in the US.

Do they have any other form of moat?

Well, there are economics of scale, which was strengthened further after the CBS acquisition – Entercom went from being a $400 million company to a $1.3 billion company, or a threefold increase. Since ETM is one of the two largest players on the market, advertisers will undoubtedly deal with the company if they want to expose their ads to radio. They also have exclusive, unrivaled stations for several sports teams in MLB, NFL, NBA, NHL and NCAA, but this is unlikely to be the reason behind their success.

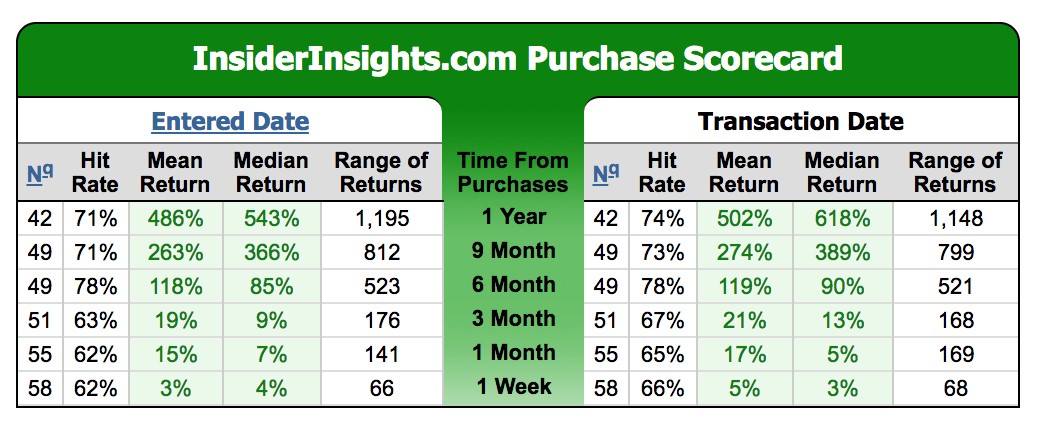

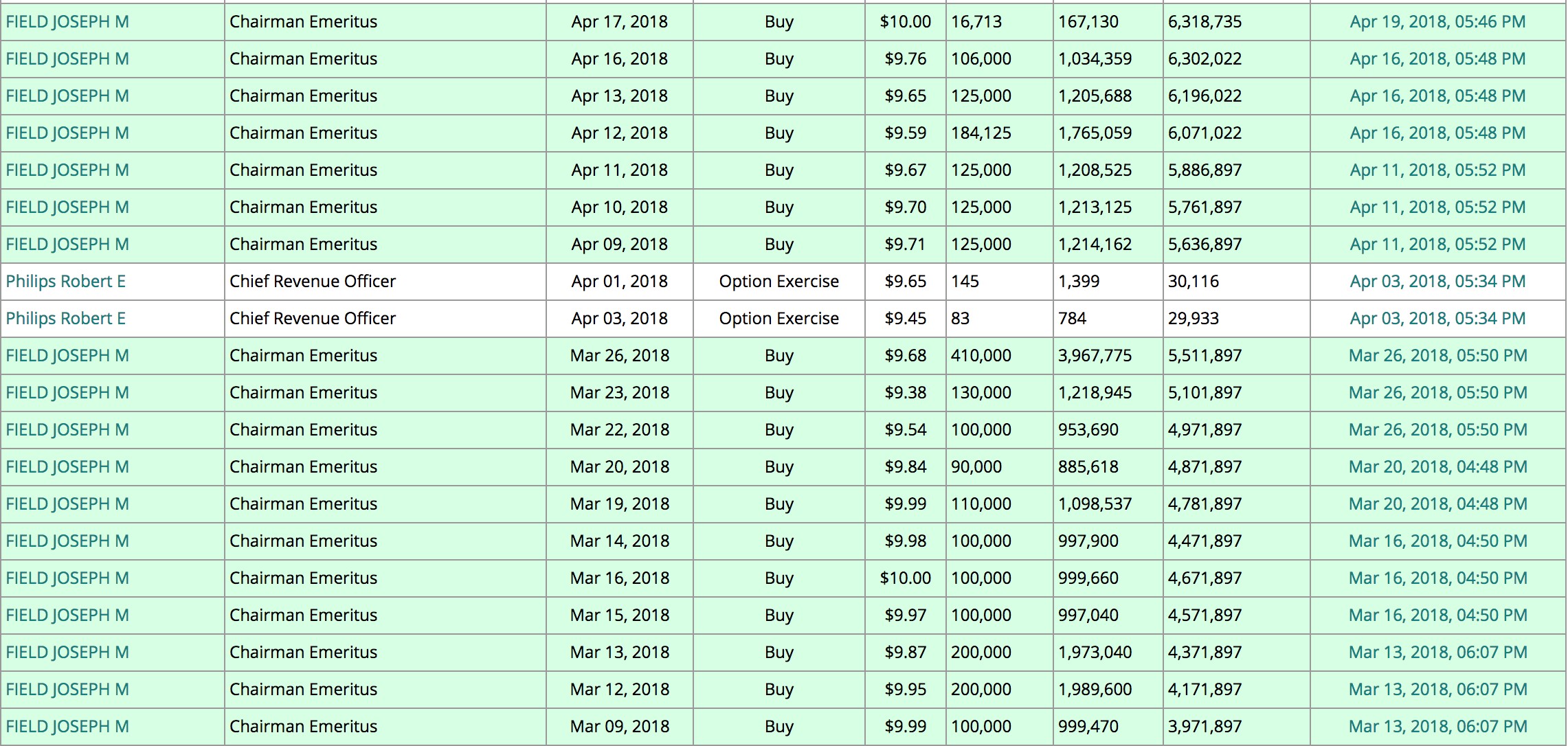

Personally, I believe the management might be the closest we get to a moat at Entercom. They have done an excellent job compared to their peers; Entercom brings in $6.6 million of revenue per station every year, as compared to $4 million, $2.6 million and $1.7 for iHeart. Cumulus and TownSquare, respectively. ETM also brings in about 112 million listeners each month across 235 stations, or 477,000 listeners per station, while iHeart only brings in about 292,000 listeners per station (250 million listeners across 855 stations). This might prove the efficiency of founder Joseph Field, who has been a part of the business for 50 years, and his son David Field, who joined the company in 1987. They have dedicated their whole life to the business, and own major parts of the stock. Speaking of which, founder Joseph Field has been on a bit of a buying spree recently. Since May 2017, he has accumulated about six million shares – or in other words, he has gone from owning 238,000 shares to owning 6,300,000 shares in less than a year. He has bought about 2,300,000 of these shares since March 9th (this year), mostly in the open market, at around $10 a share (data from InsideArbitrage). Furthermore, his track record has been outstanding according to InsiderInsights, and the last time he bought shares in the open market was in September 2010. In other words, he is not the kind of insider who buys shares recklessly or to make the stock seem cheap to outsiders – he clearly believes the stock trades at an attractive price, and has allocated his personal money accordingly.

Quality

I mentioned that radio is a capital light business. EBITDA margins confirm this, as it has averaged 25% over the past five years or so, and it is projected to move higher after synergies from the CBS acquisition. The company believes it will stabilize at 30% by 2020, which is by all measures a great margin. Furthermore, D&A has historically been about 2% of revenues, while interest expenses have been about 7% of revenues. That gives us a net margin of 21%. Keep in mind that leverage will be lower going forward than it has been in the past, which means that margins will probably be higher – but a net margin around 20% and an EBITDA margin around 30% is nonetheless enough to call ETM a quality business. Their peers have also managed to perform with an EBITDA margin in the ballpark and well above 15%, which reflects the attraction of the radio industry.

Entercom also brings in a fair amount of Free Cash Flow. They had a FCF yield of 11.6%, 16.5% and 12.6% in 2016, 2015 and 2014, respectively. I’m excluding 2017 here because CapEx tripled while cash flow from operating activites was cut in half – most of this was because of the acquisition of CBS, provisions for bad debts (restructuring) and other stuff – so FCF in the past three normal years have been well above 10%. In the earnings call for the fourth quarter of 2017, CEO Field mentioned that the stock was trading with a FCF yield in the high teens. That’s about $1.50 to $1.90 per share, given that the stock trades around $10 per share. Basically, this company has managed to operate with a FCF yield above 12% for four years now. By any measures, that is an outstanding achievement.

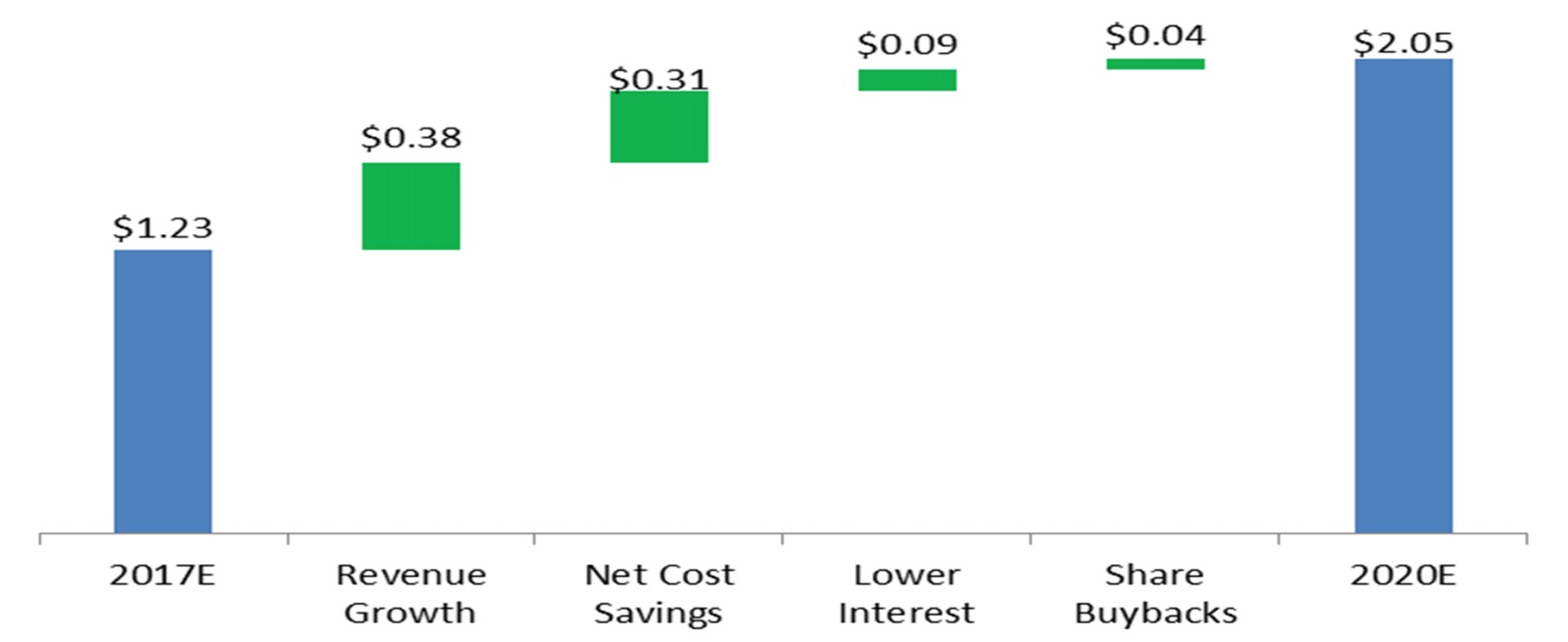

Furthermore, the company projects FCF to increase to $2.05 per share by 2020, as you can see on the graph above from the company presentation. I’m not sure if I agree with their calculations completely, and therefore I won’t pay it much attention – but it’s a promising sign for sure.

Their peers have shown a similar performance, and they too, have impressive product economics. Both Cumulus Media and iHeart Media have grown revenues and their EBITDA margins are in the twenties. The reason behind their bankruptcy is simply too much debt. But, if you were to look at the stock price or read anything about radio stocks in the news, you wouldn’t think these were fundamentally sound companies on measures like profit margins.

Value

CBS Radio and old Entercom combined will bring in about $1,586 million in revenue. The company also projects around $110 million in net cost synergies from the acquisitions, which adds up to $1,696 million in revenue. Assuming an EBITDA margin of 25%, even though the company projects this margin to stabilize around 30%, gives us an EBITDA for 2018 of $424 million. This is slightly lower than the company’s own forecast of $450 million in EBITDA for 2018, which leaves us some upside. Furthermore, management expects EBITDA to expand to $535 million by 2020, after additional synergies and investments.

At $424 million, Entercom trades at an EV/2018 EBITDA of 7.5, and at an EV/ 2019 EBITDA of 6, although the latter EBITDA figure might be a tad too generous. This is well below the 12x multiple of their closest competitor, iHeart Media, even though they are going through a bankruptcy right now. Furthermore, Liberty Media have offered to buy a 40% stake in iHeart at 8x EBITDA, also above our lowest multiple for Entercom. Beasley Broadcast Group, another debt-ridden radio company, is also trading at 12x EBITDA, while Saga is trading at 8x, Cumulus at 11x, TownSquare at 7x and Salem at 8.5x EBITDA. These are all companies that are having serious solvency issues, while margins are significantly lower than that of Entercom. Furthermore, these peers are all way smaller than Entercom, with the exception of iHeart, so they do not have the economics of scale of Entercom. Therefore, ETM should trade at a premium.

On average, radio broadcasters trade at an EV/EBITDA of 9.5. If we slap that multiple on Entercom’s 2018 and 2020 EBITDA, we get an Enterprise Value of $4,028 million and $5,082 million, respectively. ETM has about $1,860 million in debt and not a lot of cash, which results in a potential equity value of $2,168 million and $3,082 million in 2018 and 2020. The debt figure for 2020 assumes a 3.7x leverage, even though the company projects it to be at 3.5x by then. If we divide those figures by the 89 million shares outstanding, plus the 3 million shares available for grant, we get a share price of $23.57 and $32.44 in 2018 and 2020, respectively.

In other words, you can buy into a quality company that trades at a significant discount to its peers today, while FCC are relaxing rules on the industry. This stock is definitely at the top of my research pile, and I will most likely build a position soon.