Qurate Retail: The Perfect Candidate for a Leveraged Turnaround?

Qurate Retail

Prelude

This is the year 2019. And shopping has never been easier. Browse for a product on Amazon, and tens of thousands of options show up; with just one click, your chosen product will be by your doorstep in 1 to 2 days. Shopping online offers the broadest range of products and the convenience to receive your purchased item without even leaving your room. And while Amazon has close to half of the US e-commerce market, most retailers now have an online offering.

Of course, if you insist on your desire to get the product in your hands immediately, the option to purchase the item at physical stores is still very much in place. Or you might look for a social gathering, in which you spend time with family and friends in shopping malls, picking a few things up along the way. Even though the world is inevitably moving more and more toward e-commerce, the majority of retail spending is still conducted at physical stores.

To most people, the retail landscape seems to be divided between the above two options. That is unless you belong to a small group of mostly female baby boomers. They are typically home-owners, married, college educated, aged 35 to 64, and shopping for themselves. They shop without leaving their home. Yet, they shop “with their friends” as well. They do so by devouring live TV shows that are hosted by “lifestyle influencers” whom they have grown to be “close to”. Almost every day, the hosts, through a dialogue among themselves, will introduce and recommend quality items that are being sold at a discount. As a viewer, if these female baby boomers are interested in the product being discussed, they can place their orders through a call, using the TV remote control, or via the retailer’s website. They may not have an item to purchase in mind at the beginning. But after watching the demonstration and receiving recommendation from the TV hosts, many of them would make the decision to give the item a try.

The above, in essence, describes the business of QVC and HSN, the two TV shopping businesses that serve as the core of Qurate Retail.

Business Overview

Corporate History

Qurate Retail was formerly Liberty Interactive. Being a Malone company, Liberty Interactive has a convoluted corporate history. What matter to our understanding of the current Qurate are the following:

- QVC came under the control of the predecessor of Qurate Retail in 2003.

- In 2008, HSN was spun off from IAC/InteractiveCorp, and Liberty Interactive established a stake in HSN. Liberty Interactive completely acquired the remaining 62% of HSN that it didn’t already own in July 2017 for USD 2.1 billion. Included in the HSN deal is a group of catalog businesses in the home and apparel space, collectively referred to as Cornerstone group.

- In August 2015, Liberty Interactive paid USD 2.4 billion for zuilily, an online flash retailer.

- Finally, during the reorganization in March 2018, QVC Group received assets, including stakes in ILG and FTD, a portfolio of green energy investments, and certain exchangeable bonds, from Liberty Ventures Group, which was also owned by

Liberty Interactive. Liberty Ventures Group was then effectively spun off and QVC Group became the remaining asset of Liberty Interactive.

- Liberty Interactive was then renamed Qurate Retail in April 2018.

Business Breakdown

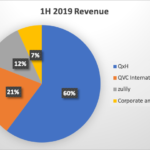

Qurate is now composed of four segments: 1) QxH, 2) QVC International, 3) zulily and 4) Corporate and other.

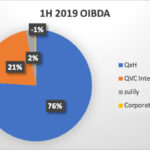

QxH, which houses QVC US and HSN, focuses solely on the US market. It accounts for 59% of revenue in the first half of FY2019. However, due to higher margins (around 15%), this segment contributes to 86% of consolidated operating income.

QVC International (QVCI) is the other main segment, contributing 20% of total revenue and 11.8% of operating income. Its markets include Germany, Austria, Japan, the UK, Ireland and Italy. Its Japan business is conducted by a JV that QVC set up with Mitsui. The JV is 60% owned by QVC and 40% owned by Mitsui.

zulily made USD 760 million in revenue in 1H 2019, or about 12% of total revenue. However, underperforming management’s initial expectation during the acquisition, zulily remains to be unprofitable, making a loss of USD 31 million in the first half.

The “Corporate and other” segment include Cornerstone, along with various costs and equity method investments.

Qurate focuses a lot on cash flows. The key metric the company uses is OIBDA, which stands for Operating Income Before Depreciation and Amortization. It’s essentially EBITDA with share-based compensation added back. On an OIBDA basis, zulily generates cash flow. As such the relative weighting of QxH and QVCI are lower in terms of OIBDA than that in terms of operating income.

The TV retail business (QxH and QVCI) together contributes to 81% of revenue and 97% of cash flows. As such, we will focus on this segment, with a specific focus on QVC, before we briefly discuss zulily.

Durability and Business Quality

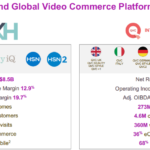

First, some basic metrics of the two businesses, QVC and HSN, that highlight their scale.

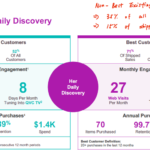

Above is a summary of the 2017 operating metrics of the two main segments. The customer figure for QxH excludes overlap between QVC and HSN. The percentages in mobile for both segment are expressed as a percentage of e-commerce orders.

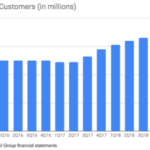

Reaching 79% of total households in the US, QxH has around 3.3% of the total population as its customers. Although the TV shopping business was born in the age of television in the late 70s to early 80s, the company has been successful in adapting to the current internet landscape to reach its customers. 53% of QxH’s revenue was generated through its online platforms, with 61% of that e-commerce business generated through mobile. This means QxH is generating USD 4.5 billion from its e-commerce business. According to Internet Retailer, QxH is the third largest e-commerce retailer in the US, trailing behind only Amazon and Walmart.

Qurate prides itself as a retailer that offers a unique shopping experience, different from traditional physical retail and online e-commerce. In fact, it sees itself as more than a retailer, an entity that lies at an intersection of Retail, Media and e-Commerce. The company has trademarked the term “Third Way to Shop”. And this third way entails making shopping “joyful” and “inspirational”. QVC and HSN aim to do so through live videos in which TV hosts sell products with humor and honest feedback. QVC hosts, for instance, improvise, fielding calls and social media questions from viewers in real time. The QVC channel broadcasts every day, except on Christmas Day, featuring 770 products each week on air in the US. This regular contact with TV hosts helps make shopping on QVC or HSN a social experience rather than just transactions like on Amazon. Moreover, for this set of customers, this media component is crucial. Not only are they shopping when they watch the QVC’s TV programs, they are also effectively getting entertained. Shopping on QVC or HSN is a way for them to kill time and feel relaxed. This is a key element that makes shopping on QVC and HSN unique and that attract these customers to keep coming back to QVC.

This content production part of the business, however, is not the only thing that differentiates QxH among retailers. Due to instant feedback from customers on products being shown live on TV, QVC has been able to track shoppers’ behavior in real time since the 1980s. As such, even before the emergence of online retailers, companies such as QVC and HSN have already begun accumulating a trove of customer data. They have therefore been able to manage its TV content, inventories and overall merchandising strategy better than most retailers.

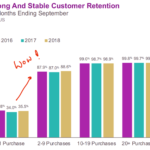

QVC US Customer Purchases Per Yearly Cohort

Qurate further differentiates itself through sourcing unique products. 75% of the product offerings on QVC are proprietary or exclusive items.

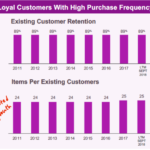

Together, an engaging selling format, decades of better customer data, and exclusive product offerings bring about one of the best retail customer bases, especially for QVC. This customer base is highly sticky and exhibits consistent shopping behavior, making QVC more like a subscription business than your average retailer:

- 89% customer retention rate, very consistent by year and geography

- Average customer buys 28 items and spends USD 1,500 on QxH per year

On a yearly basis, 51% of customers are existing customers, defined by customers who made a purchase in two consecutive 12 month periods, 22% are reactivated customers who purchased in the past but not in the past 12 months, and the remaining 27% are new customers who have never purchased on QxH. Overall sale is very skewed toward the existing customer base as expected. The 49% of customer base constituted by new and reactivated customers only contributes to 13% of shipped sales.

Why QVC is a High Quality Business

Qurate provides a further breakdown of the existing customer base of its QVC US business. Below are numbers from FY2017.

A Highly Engaged and Sticky Customer Base as the Moat of QVC

In FY2018, QVC US generated 45% of total revenue and 84% of total operating income of Qurate. If we assume percentage of shipped sales is a good proxy for percentage of operating income and numbers remain roughly the same for FY2018, this group of “Best Customers” would be responsible for 60% of the overall operating income of Qurate. In reality, I believe it ought to be higher, since it tends to require less costs to serve your best customers than your newly acquired ones. As such, each dollar revenue generated from your best customers should be worth more.

More than 60% of operating income being derived from 17% of customer base suggests a business with fairly high customer concentration. Yet, this also provides a great deal of stability for the company, as evidenced by the 99.7% retention rate of this group of best customers. This group is said to be spending 2 hours with QVC US on any given day. Such an engaging customer base is an important attraction to potential vendors, especially smaller or newer brands, to sell on QVC. QVC also allows vendors to control messaging and, through its TV hosts, tell the brand story in an “authentic” way. Putting your products on the live TV shows is itself a form of marketing. In fact, vendors have historically see sales lift at other distribution platforms when their products are on-air. No doubt, this group of best customers forms the basis of the moat for QVC.

Low Asset Requirements and Abnormally High Margins

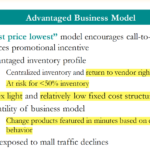

QVC, being a video commerce business, has other advantages that make it a high quality business.

First, QVC has a natural advantage with its inventory management. For instance, instead of hoarding all the inventories, QVC can order from vendors in real time as purchase orders come in during live broadcast of its TV content. Based on such real-time information, QVC can also adjust its near-term merchandising strategies, further optimizing their inventories. Considering the biggest product categories of Qurate are home and apparel, together making up 58% of sales in 2018, the inventory days of 60 days is relatively good. Importantly, for most of its inventories, QVC owns the rights to return the items to the vendor. Inventory at risk is less than 50%

However, as a retailer, QVC does have a high level of receviables – at nearly 50 days. (Qurate does not break everything down into each business segments. But as QVC is the bulk of Qurate’s business, I will use Qurate’s balance sheet as a proxy for the following discussion) This is due to QVC’s “Easy-Pay” offering, which QVC offers to customers in the U.S., U.K., Germany and Italy (known as Q-Pay in Germany, and Italy). “Easy-Pay” allows QVC customers to pay for certain merchandise in two or more monthly installments. When “Easy-Pay” is elected by the QVC customer, the first installment is billed to the customer’s credit card upon shipment and an “Easy-Pay” receivable is established to account for the collection of subsequent installments. There was a class action complaint against Qurate for poor disclosure on their “Easy-Pay” payment scheme in September 2018. The plantiffs alleged that Qurate had been falsifying its growth by loosening credit terms and that the accounts receviables pertinent to this newly acquired group of customers through the lure of credit posed a high risk of write-off. The case was later settled for USD 5.75 million in May 2019.

Despite a higher level of receviables, Qurate’s working capital requirement is very managable. Against its vendors, Qurate is able to get a credit period of around 30 days. Overall, the cash conversion cycle is at a decent 75 days. When we include the accrued liabilities, Qurate’s overall working capital needs is only 7% to 9% of revenue.

The video commerce model really shines with this next advantage: Without physical store fronts, Qurate has minimal lease expenses and no store labor costs. The company only leases business offices, satellite transponders and certain equipment (likely for content production for instance). For FY2018, Qurate spent only USD 80 million, or around 0.5% of total revenue, on such rental costs. Moreover, it also spends as low as 2% of revenue on capital expenditure. The low asset needs is most obvious when we calculate the tangible invested capital turnover for the business. I estimate the number to be 5x to 6x.

Gross margin has been fairly stable at around 35%. Together with great scale, the crown jewel of Qurate, QVC, has an operating margin as high as 17%, almost unheard of for a retailer. At a lower scale business such as HSN, the margin is closer to 10%. For the overall business, the Return on Tangible Invested Capital is above 40%, clearly qualifying Qurate as a high quality business.

Strong Moat…

You have a pretty strong sign of competitive advantage if your biggest threat tried but failed to compete in your business.

Amazon tried to create a competing business in 2016 with the launch of “Style Code Live”, an online show that is hosted by millennials promoting beauty and fashion products that are available on Amazon. However, in May 2017, a little more than a year after introducing the show, Amazon cancelled it. Even with all its resources, Amazon couldn’t make video commerce a viable business. On the other hand, QVC pointed out that 74% of its customer base also shops on Amazon. This stark contrast further highlights the unique shopping experience of QVC, and that despite all the convenience Amazon provides, shopping on QVC can still be desirable.

But What About Growth…?

While I am confident in the stickiness of QVC’s existing core customer and hence the “moat” this core business has, the Amazon experiement highlights one big concern about the business for me. A careful reader would have noticed that Amazon was smart to not compete with Qurate directly. Instead, the company created a variant of the QVC’s business by focusing on beauty for millennials. The reason to shut down the initiative was most likely because the company was not able to attract enough customers.

The market has long been concerned about Qurate’s ability to attract younger customers. Historically, the concern was focused specifically on the low rate of cable subscription among millennials. But the company no longer relies on cable channels for distributing its contents. You can now watch the content of QVC on your computer, mobile devices and smart TVs, using Apple TV or the Roku app for example.

Instead, the bigger problem Qurate now faces is that its business model is rapidly losing appeal toward the millennials. Video commerce as a shopping format will not go extinct, but how and where users engage with such videos will change. In other words, I believe the biggest risk Qurate faces is a media risk.

Why spend 2 hours on QVC’s content when you can watch Netflix and YouTube or browse Instagram and Snapchat? Compared to the entertainment options the previous generations had, millennials simply have way more options for entertainment nowadays. And if a customer doesn’t really engage with QVC’s curated content, then QVC is just another retailer to her. This will either make it difficult for QVC to acquire or retain her as a customer.

Let’s delve deeper into this media risk as it is important for gaining a more complete understanding of the business of Qurate. As mentioned, Qurate is a company that combines a media business and a retail business. In essense, the media business is comprised of two major elements: 1) content production and 2) content distribution. Entering the late 70s when HSN was founded, TV was the dominant content distribution channel. As early movers, HSN and QVC were able to build the best production teams, create the best TV shopping contents and thus attract a critical mass of highly loyal users. This active customer base has generated the most spendings among competitors, rendering these two channels some of the most desirable contents for cable operators to carry. In other words, these two giants in the video commerce industry became dominant in both content production and content distribution. As we are well into the 21st century, things have changed, on both the content production side and the content distribution side. With rapidly improving photographic equipment, whose costs have declined significantly, video production has been democratized. A crew of 5 to 10 people can now use non-professional grades equipment to stream high quality live content on the Internet. On the distribution side, Internet social media has become the dominant channel. Even though the social media industry is controlled by a handful of players like the TV indusry, the major difference is that social media faces no constraint in the number of contents it carries. Facebook or Instagram does not have to pick which content to carry. Without needing any approval from the social media companies, an Internet influencier, together with his or her team of 5 to 10 persons, can create high quality live content to broadcast to the world. QVC can also get on Instragram to sell its products. However, it is no longer the only player in town. It now has to compete against thousands of other content creators on such platforms for the eyeballs of millennials.

In the US, social media ecommerce remains a nascent industry. However, this is already an established market in China. Taobao has started its live broadcast commerce business back in 2016. And major social media players such as Tik Tok and Wechat have since followed suit. It is estimated that such live-streaming is currently fueling almost 32% of Chinese e-commerce.

After its last failed attempt, Amazon has again started a live-streaming business in early 2019. This time it is called Amazon Live. Are the Chinese and Americans so different that this live-streaming model cannot work in the States? Or will Amazon learn from its mistakes and make it work this time? In any case, I remain confident that Qurate can retain its existing customers. But to acquire new customers, the challenge will only get tougher.

The Problem for Qurate is Growth and Debt

Negative Growth Rate

The company is keen to point out that QVC US is acquiring new customers from the whole age spectrum. Furthermore, new customers have been converting to best customers at an improving rate since 2013. At the same time, existing customer behavior for QVC US has been remarkably consistent. As a corollory, even without acquiring too many new customers per year, earnings at QVC have remained at a stable to slightly growing level.

The problem for Qurate though is that while QVC is ekeing out minimal growth, the other segments are declining relatively rapidly, dragging down the overall results.

Qurate does not break out HSN’s customer behavior by itself. However, I suspect it is meaningfully worse than that of QVC. From 2016 to 2018, HSN’s revenue has actually declined by 11%. In FY2018, units shipped plummeted by more than 9%. A combination of lower (or deterioriating) customer retention rate and less effective marketing at HSN has likely caused the decline. The reason why QVC and HSN have such differing performances seems to be a difference in execution capabilities. From reviews on the Internet, you will find comments saying that HSN is overall an inferior offering, in terms of both content production and product offerings. Purchasing lower quality products from HSN seems to be a main reason why a user would stop buying from it. Secondly, HSN has a different product mix than QVC. For QVC, more female driven product categories, including Home, Apparel and Beauty together make up 70% the overall sales. For HSN, the equivalent number is only 62%. Electronics is 20% of HSN, but only 10% of QVC.

Undoubtedly, when Qurate bought out HSN, there must have been hopes that it can revamp HSN’s performance. Nevertheless, the combination does not seem to be going well. HSN employees feel like they are not appreciated, and they are not accepting the QVC way readily. These internal issues have likely contributed to the poor performance of HSN.

And then there is zulily, which is doing even worse than HSN.

zulily – A Failed Acquisition

Purchased by Liberty Interactive in August 2015, zulily is an online flash sales retailer. The main target customers are moms with young children, whom zulily provides a fun and entertaining shopping experience with a fresh selection of flash sales events with over 4,000 product styles offered on a typical day. These products are sourced from thousands of vendors, including emerging brands and smaller boutique vendors, as well as larger national brands, and they are priced as low as 30% of the suggested retail price. zulily does not buy the inventories outright beforehand, but only makes an order to the vendor once it receives one from its customers. This means a customer cannot expect an expedite shipment from zulily. The flash sales typically run for 72 hours. By bringing together millions of moms and a daily selection of products chosen from its more than 15,000 vendors, zulily has built a large scale and uniquely curated marketplace.

Since inception through June 30, 2013, when the company got listed, zulily had already worked with over 10,000 brands, featured over 1.6 million product styles and sold over 42 million items to over 2.9 million customers across its platforms. Its sales rose from just USD 18 million when the company was founded to over USD 1.2 billion when it was acquired in August 2015. Qurate, or Liberty Interactive to be exact, paid USD 2.4 billion for zulily, a nearly 50% premium to the then traded stock price. Using 2016 consensus numbers, Liberty Interactive paid 1.35x forward revenue and 23x forward EV/EBITDA.

Before the acquisition, zulily saw its customer base slightly decline. Qurate then succeeded in driving customer growth at zulily in the first two years after the acquisition. But now, the problem is more aggravating. zulily’s revenue sank 13% in the second quarter of 2019, the largest decline since being acquired, as its active customer base fell by 3%.

zulily is clearly underperforming management’s projection. For instance, management expected revenue of USD 2.5 billion and EBITDA of USD 259 million from zulily in FY2018. The actual results were USD 1.8 billion in revenue and USD 108 million in EBITDA, an underperformance of 28% and 58% respectively.

Despite the similiarity in utilitizing discovery as a method to sell and rapidly changing product offerings, I think, fundamentally, zulily is proving to be a different business than QVC. While Qurate highlighted that pricing is not a primary factor for QVC customers, its decision to add a price comparison feature on zulily earlier in October 2019 suggests otherwise.

In response to a question on what management plans to do to fix the current situation, CEO Mike George said that the company needs to find “more effective forms of marketing beyond Facebook and must improve the customer experience with freshness of products and the website.” George also hinted that the retention rate at zulily is much worse than that at QVC, rendering acquiring new customers even more imperative for the business.

Huge but Smart Debt Load

Further compounding the issues for Qurate as a stock is its debt load. As of June 2019, Qurate has a total debt level of USD 7.46 billion. With only USD 519 million in cash, the net debt level is more than USD 6.9 billion. Qurate made USD 2.15 billion in adjusted OIBDA in FY2018, giving it a net debt to adjusted OIBDA level of 3.2x.

Qurate’s debt is divided between corporate level debentures and subsidiary level notes.

|

Corporate level debentures |

Year Due |

Outstanding Principal in USD M as of 30 Jun 2019 |

% of Total |

|

8.5% Senior Debentures |

2029 |

287 |

|

|

8.25% Senior Debentures |

2030 |

504 |

|

|

4% Exchangable Senior Debentures |

2029 |

432 |

|

|

3.75% Exchangeable Senior Debentures |

2030 |

434 |

|

|

3.5% Exchangeable Senior Debentures |

2031 |

307 |

|

|

1.75% Exchangeable Senior Debentures |

2046 |

332 |

|

|

Sub-Total |

2,296 |

31% |

|

|

|

|

|

|

|

Subsidiary level notes and facilities |

Year Due |

Outstanding Principal in USD M as of 30 Jun 2019 |

% of Total |

|

5.125% Senior Secured Notes |

2022 |

500 |

|

|

4.375% Senior Secured Notes |

2023 |

750 |

|

|

4.85% Senior Secured Notes |

2024 |

600 |

|

|

4.45% Senior Secured Notes |

2025 |

600 |

|

|

5.45% Senior Secured Notes |

2034 |

400 |

|

|

5.95% Senior Secured Notes |

2043 |

300 |

|

|

6.375% Senior Secured Notes |

2067 |

225 |

|

|

Bank Credit Facilities |

1,733 |

23% |

|

|

Sub-Total |

5,108 |

69% |

|

|

Total Consolidated Debt |

7,404 |

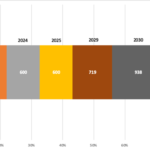

Debt (Except QVC Bank Credit Facilities) Breakdown by Due Year

This is a John Malone company. You should expect it to be leveraged, but smartly so. First, these are fairly long-term debt. Out of the USD 7.4 billion in outstanding prinicpal of debt, only USD 2.45 billion of QVC debt is repayable in the next 5 years. The insolvency risk is therefore remote in the near future. Second, the exchangeable senior debentures provide tax benefits. These debts have higher deductible interest rate for tax purposes than actual annual cash coupon. In FY2018, Qurate paid USD 362 million in cash interest expenses versus USD 381 million in accounting terms. However, this means Qurate has accumulated sizable deferred tax liabilities, amounting to around USD 1 billion, that must be repaid when the debentures are redeemed. The deferred tax liabilities, through “compounding”, are expected to grow to USD 3.3 billion toward the maturity days of these exchangeable debentures in 2029, 2030 and 2031. The company expects a “significant” deferred interest carryfoward by 2029, which should offset a portion of the above deferred liabilities. But no amount is specified.

Qurate also owns a portfolio of alternative energy solution entities. Together they generate a loss of around USD 100 million and provide additional tax credits of around USD 90 million.

Valuation and Margin of Safety

Valuation?

Let’s take a look at how much you would be paying if you buy the stock.

Qurate has two classes of shares: Series A and Series B. Series B has 10x the voting right per share as compared to that of Series A, but is thinly traded. There are 388.57 million shares of Series A common stock outstanding, each trading at USD 9.52 as of this writing. For Series B, it is 29.33 million shares at USD 9.77 per share. In total, the market capitalization of Qurate is USD 3.96 billion. As mentioned, the company has USD 6.9 billion in net debt, the enterprise value of Qurate is therefore USD 10.86 billion. Let’s call it USD 11 billion. Qurates earned USD 1.3 billion in EBIT in the latest 12 months up to June 2019. Current EV/EBIT is thus 8.5x.

On a free cash flow basis, however, the stock looks extremely attractive. LTM free cash flow is USD 811 million. Against a market capitalization of USD 4.02 billion, that is a free cash flow yield of 20%.

Importantly, this free cash flow yield is very “tangible”. No doubt, Qurate has made one bad acquisition in zulily. But by and large, Qurate has a very focused capital allocation policy. It does not hoard cash and it favors paying out all its free cash flow through share buybacks. The company spent USD 799 million, USD 765 million and USD 988 million on share repurchases in 2016, 2017 and 2018 respectively. If both the share price and free cash flow stay the same, the number of share outstanding could be reduced by half in a little more than 2 years.

At the current valuation, an attempt to calculate the “intrinsic value” of Qurate is moot. This will no doubt be a home run investment if free cash flows remain at around the USD 800 million mark. The crucial question is whether the current level of free cash flows can be sustained. In other words, we need to answer the question Ben Graham posted for us: What is the margin of safety here?

Margin of Safety

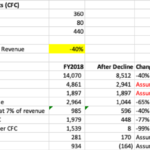

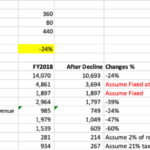

To calculate the margin of safety an investor has in Qurate, I wanted to estimate how much revenue can decline before Qurate can no longer support its fixed costs. I conducted some simple calculations as shown below:

For starters, I segregated true fixed costs, including interest expenses and operating lease, from other costs. Together, they costs USD 460 million per year. Next, I assume gross margin and operating expenses to be stable at 35% and 7% of revenue respectively. (Operating expenses are considered variable because they primarily consist of commissions, order processing and customer service expenses, credit card processing fees and telecommunication expenses). And then I assume SG&A expenses to be fixed in absolute terms in the near to medium term. (Note: Depreciation and amortization are not included in SG&A expenses and thus are not included in the above calculation)

My calculations show that Qurate can withstand at most a 40% decline in revenue before it cannot cover its fixed costs fully.

Next, I wanted to know how much can revenue fall before the stock price becomes fairly valued, a level I defined to be 15x free cash flow. With a market cap at USD 4 billion, we need at least USD 268 million of free cash flow from Qurate. The maximum decline in revenue is around 24%.

Qurate mentioned that it wanted to increase marketing expenses from 1% of revenue to 3% of revenue by 2021. If we assume this will increase the SG&A expenses, then the maximum decline in revenue before we overpay for Qurate would be reduced to 12%.

A margin of safety of only 12% decline in revenue no longer makes Qurate seems as attractive, right?

But let’s remember the Qurate management team are good operators. If the business continues to decline, I do not believe the company will go ahead and increase marketing spending, which would then have been proven to be ineffective. With this point in mind, I believe the 24% maximum decline in revenue is a better reference point.

Next, I want to understand how bad the situation will be if the current decline in business continues and even worsens a bit.

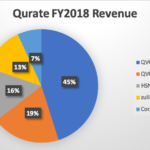

Let’s review the FY2018 revenue composition of Qurate. (We use FY2018 figures to get clean figures for QVC, separate from HSN)

The most stable segment QVC US is 45% of revenue. The second best segment QVC International is 19% of revenue. HSN is 16% of revenue, and its revenue plummeted by 6% in FY2018. If we assume the decline continued in the first half of FY2019, then QVC US would have declined by 1% in 1H 2019. QVC International’s revenue declined by nearly 4% in the first half of 2019, while zulily has had an even worse performance, with its revenue declined by 9% during the same period.

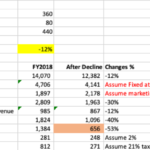

I assume the business to continue to decline for the next 5 years before it stablizes. Below I present my “doomsday” scenarior:

- QVC US to decline by 2% a year in the next five years (Down 11% in total)

- QVC International to decline by 4% a year in the next five years (Down 22% in total)

- HSN to decline by 8% a year in the next five years (Down 39% in total)

- zulily to decline by 15% a year in the next five years (Down 54% in total)

- Corporate and other to be cut in half

In total, the overall revenue would have declined by 27%.

Under the above scenario, I do not expect management to keep increasing marketing expenses. Using the sensitivity analysis where we assume SG&A expenses to stay flat, a 27% decline in revenue would lower free cash flow to an estimated USD 184 million. The free cash flow yield will then decline to 4.6%. This suggests Qurate will still be able to service its fixed costs and thus will not face immediate bankruptcy risks. However, the company will become way overleveraged and thus will find it difficult to refinance its debt going forward. Qurate is priced at the current level because the market believes a decline of the above magnitude is more likely than not.

Conclusion

Qurate reminds me of Weight Watchers as the business itself requires no debt to produce a satisfactory return on equity, but the owners elected to run the business as a permanent private equity operator would, leveraging the business up and using the debt to reduce the share count. The two companies also share the challenge of acquiring new customers. The major difference though is that Qurate has a much higher customer retention rate. As a corollary, I expect the company to handle its debt load better than Weight Watcher did.

But how much better?

While we see no evidence that the existing customers are changing their purchasing behavior, muted underlying growth in Qurate’s strongest segment, deteriorating performances from the rest of its business and the major long-term headwinds it faces to acquire new customers do make Qurate at least half a turnaround story. With such a sticky core customer base, Qurate might be the perfect candidate of a successful leveraged turnaround. But the success is in no way guaranteed.

For Qurate, it is a question of how the company will manage growth in an age of increasingly fragmented entertainment options. While the smartly managed debt schedule will give it some time to stem the recent revenue decline and to find a path toward growth again, the problem of growth itself might prove to have no solutions. All the capital allocated for growth, in aggregate, might produce negative value. It is the fact that the company will keep attempting to attain growth instead of just milking the current customer base that makes me hesitant to recommend the stock even at its current price.

P.S.: For those who use or know someone who uses HSN and zulily, please share your thoughts in the comment section on whether those businesses can be turned around!