A Blast from the Past: Warren Buffett’s 1977 Shareholder Letter

Whenever someone comes to me asking for advice on how to get started in investing, the first place I direct them to is reading all Warren Buffett’s Berkshire shareholder letters. It is no secret that his letters have tons of golden investing-wisdom nuggets laid upon them. I have read them many times but interestingly enough, I always take something new away from them every time I reread them. In this series, we’re going to go all the way back and start from the beginning and review all of Berkshires’ Investor letters and all the significant passages, starting with 1977; a cool 19 years before I was born.

Focus on Return on Invested Capital, instead of EPS growth

“Most companies define “record” earnings as a new high in earnings per share. Since businesses customarily add from year to year to their equity base, we find nothing particularly noteworthy in a management performance combining, say, a 10% increase in equity capital and a 5% increase in earnings per share. After all, even a totally dormant savings account will produce steadily rising interest earnings each year because of compounding. Except for special cases (for example, companies with unusual debt-equity ratios or those with important assets carried at unrealistic balance sheet values), we believe a more appropriate measure of managerial economic performance to be return on equity capital. In 1977 our operating earnings on beginning equity capital amounted to 19%, slightly better than last year and above both our own long-term average and that of American industry in aggregate. But, while our operating earnings per share were up 37% from the year before, our beginning capital was up 24%, making the gain in earnings per share considerably less impressive than it might appear at first glance. We expect difficulty in matching our 1977 rate of return during the forthcoming year. Beginning equity capital is up 23% from a year ago, and we expect the trend of insurance underwriting profit margins to turn down well before the end of the year. Nevertheless, we expect a reasonably good year and our present estimate, subject to the usual caveats regarding the frailties of forecasts, is that operating earnings will improve somewhat on a per share basis during 1978.”

Warren is talking about looking through the noise and thinking about how a business has gotten to present day. What does Warren mean by this? Well, let’s look at a disastrous investment example to illustrate.

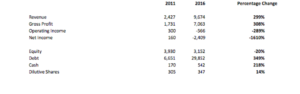

Valeant was the darling of Wall Street for quite some time, and everyone reading this blog will be familiar with what happened to them. The most alarming thing for me when I did some due-diligence on Valeant when it was in the $200’s, was their exploding debt followed by declining operating/net earnings… A true recipe for disaster. Growing revenue is good, but you want to understand how they got to where they are. The whole Valeant saga was, and still is, a case study in action. Standing from the sidelines, I have been able to learn/gain experience from it. In a world where Wall Street analyst are so short-term oriented and focused on the next quarters’ EPS estimates, you can greatly improve your odds in investing if you can close your eyes and think about what the business will look like in 2-5 years and use this short-termism to your advantage. It was hard for me to do this with Valeant, so I decided to pass. Always remember an investment idea should be simple and blatantly obvious. As I wrote about in my Punch Card Mindset post, “The stock market in the short term is a voting machine; voting on emotions, traders trading, headline news, politics, etc. But in the long-term It’s a weighing machine; weighing to the true fundamental facts of the business. Therein between lies opportunity for you and I.”

Warren also wrote about the importance of thinking about the business earnings in the form of return on capital, as opposed to standard EPS. Return on invested capital (ROIC) is a key driver of value in a business. If a company can continuously earn a return on its invested capital above the cost of that capital, that’s an indicator of a good business. We can take ROIC a little bit further and think about a metric that I think is the best form of a business’ ability to produce value going forward; that is ROIIC: return on incremental invested capital. Warren also talked about ROIIC in his 1992 shareholder letter when he said the following:

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” – Warren Buffett, 1992 Shareholder Letter

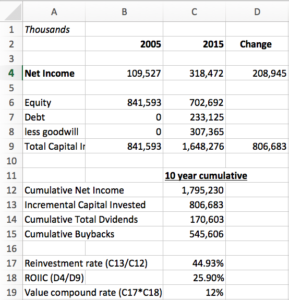

Normal ROIC is simple to calculate, all you do is take some earnings measure or bottom line cash flow, and divide it by the total debt and equity in the business you are evaluating. This will tell you the return that the company is generating on capital that has already been invested in the business. This is good information to know, but investing is all about the future. We want to get an idea on how much return the company can generate going forward on future investments; this is where ROIIC comes in. Just taking some basic back of the envelope type math, here is an example of a company I have invested in, in the past:

Side notes:

- Cumulative Net Income is the sum of all the earnings during the period

- Incremental Capital Invested is the difference in total capital invested during the period

- Cumulative Total Dividends is the sum of all dividends paid out during the period

- Cumulative Buyback is the sum of all buybacks during the period

The whole idea of ROIIC, is to think about the amount of capital a business has added over a period and the incremental growth of earnings that came from that capital. As you will see above, the company was able to reinvest almost half of its earnings at 25% returns; not too bad. Generally speaking, a company will see its intrinsic value compound at a rate that approximates it’s ROIC and reinvestment rate. The company above should see its intrinsic value compound in the ball park of 12% per year. That’s just a very rough way of measuring ROIIC, but it’s generally how I think about it. Always remember it’s better to be approximately right than precisely wrong. Keep the big picture in mind; think of logic and not just a formula. Ask yourself: “How much cash does this company earn and how much of that cash can they reinvest into the business? What will the return be on that investment?” Like Warren said, the best businesses to own are ones that can grow incrementally at very high rates of return.

Be a business analyst, not a stock analyst

“We select our marketable equity securities in much the sameway we would evaluate a business for acquisition in its entirety.We want the business to be (1) one that we can understand, (2)with favorable long-term prospects, (3) operated by honest andcompetent people, and (4) available at a very attractive price.We ordinarily make no attempt to buy equities for anticipatedfavorable stock price behavior in the short term. In fact, iftheir business experience continues to satisfy us, we welcomelower market prices of stocks we own as an opportunity to acquireeven more of a good thing at a better price.”

Warren’s 4 filters have stood the test of time. You can find him still saying these exact 4 filters at present day interviews. Notice how he focuses on the business first and then the company being at an attractive price last. As I also wrote about in my punch card post, you will give yourself such an advantage if you build up a watchlist of great companies and wait for them to come to you. Every smart investor I know does this. Warren read over 30 years of Coca-Cola annual reports before finally making an investment. Always keep that in mind.

Key Takeaways

- Look for companies that are growing internally at high rates

- Focus on ROIC and ROIIC over EPS

- Always ask yourself “how did the company get to where they are today?”

- Be a business analyst, not a stock analyst

- Exploding debt with declining earnings is a recipe for disaster