Bank of N.T. Butterfield: A great wealth franchise and interest rate derivative

Bank of N.T. Butterfield (NTB)

Overview

N.T. Butterfield (NTB) is a Bermuda-based bank whose shares trade on the New York stock exchange. Bermuda’s corporate taxfree status, together with a conservative culture helps Butterfield generate a superior return on equity with limited risk. That’s right, Butterfield doesn’t pay taxes!

History

After English explorer George Somers crashed into the island in 1609, N.T. Butterfield first opened its doors as a trading firm in 1758 and later received its banking license in 1858. For a long stretch of time, NTB grew in-line with Bermuda’s insurance industry. When in 1956 American International Group, Inc. (AIG) became the first insurer to move its captive unit to Bermuda, an influx of other captive insurers followed in the 1960s and 1970s, and by the 1980s, some of the mutual insurers such as Excel and Ace also came to the island. Now, Bermuda is a global hub for reinsurance. In 2009, NTB required a recapitalization due to investing in CMO, ABS and CRE lending that went bad. Since then, the bank has become extremely conservative in its asset allocation, holding exclusively GSE insured RMBS and treasuries in its securities portfolio.

Business

NTB is a full-service community bank and wealth manager, operating in Bermuda, the Cayman Islands, Guernsey, Switzerland, and the United Kingdom. NTB’s community banking operations provide retail and corporate banking products to individuals, local businesses, captive insurers, reinsurance companies, trust companies, and hedge funds. NTB has seven Bermuda branches and 49 ATMs and a 39% and 35% deposit market share in Bermuda and the Cayman Island.

In Bermuda, the Cayman Islands, Guernsey, and Switzerland, NTB offers wealth management to high-net-worth and ultra-high-net-worth individuals, family offices, and institutional and corporate clients. In practice, the wealth business can be further segmented into trust, private banking and asset management divisions. The trust business has over $92 billion in assets under administration while the custody business has another $29 billion in assets.

The asset management business had $5.6 billion in assets under management as of September as well. This business targets clients, including institutions such as pension funds and captive insurance companies, with investable assets over $10 million, and private clients such as high-net-worth individuals, families, and trusts with investable assets of more than $1 million.

These businesses generate both a stable fee stream as well as a low-cost deposit base that NTB invests in mortgages and low-risk bonds.

Balance Sheet

NTB is extremely asset sensitive, with every -100bp change in interest rates having a -11% impact on net income according to their disclosures. This is because NTB holds about 40% of its assets in agency MBS and Treasuries and another 26% percent in cash and equivalents. The remainder of NTB’s balance sheet consists of loans. This has specific historic reasons: The cash and equivalents are higher than at most banks because Bermuda does not have a central bank or monetary authority. Instead, Butterfield is the lender and liquidity provider of last resort. As such, Butterfield’s liquidity portfolio is much larger than that of most banks.

The loan book mostly consists of conservatively underwritten mortgages in Bermuda. This is a good loan book and income generator for NTB, but there is limited demand for mortgages and other lending in Bermuda relative to the size of Butterfield’s deposits. Bermuda’s legal framework prevents non-Bermudians from owning Bermudian real estate. In general Bermudians therefore end up owning more than one home and renting them out to ex-pats. The average home price in Bermuda is more than $1MM USD. As there is limited competition for mortgages in Bermuda, NTB is able to charge north of 5% for floating rate mortgages that are tied to NTB’s base rate. There is also an even small commercial real estate book with loans in Bermuda and the United Kingdom. The overall asset quality of the loan book is extremely high.

Money that Butterfield is not required to hold in cash and is unable to find good lending opportunities for is invested in a large agency MBS and treasury portfolio. This securities portfolio is almost 100% AAA rated and exists because NTB is extremely wary of repeating its past mistakes. After its experience in 2009, NTB has basically not deviated from this approach of investing excess cash into AAA US securities.

This is what makes NTB so interest-rate sensitive. As a wealth management bank with limited competition in Bermuda its cost of deposits tends to be very low. Its loan portfolio is 84% floating rate and produces a good yield for the bank, but only makes up about 1/3rd of the bank’s assets. Yields on both its cash and equivalents and its AAA securities portfolio move more or less in-line with US interest rates. When the fed cuts rates, yields on its cash fall. When rates on treasuries fall, Butterfield’s reinvestment opportunities reset. Worse, Butterfield keeps its duration very short, at about 2.6 years. Because of this the securities turn around rather quickly, and current rates on US treasuries and agency MBS completely dictate what NTB earns on its assets.

M&A

NTB has been acquiring the smaller trust and wealth management units of larger banks in the Bahamas, Bermuda, Cayman Islands and Guernsey. Several acquisitions in this space have been made from HSBC, ABN Amro and Deutsche Bank. From the perspective of larger banks, trust and wealth management businesses in jurisdictions that some view as ‘tax havens’ tend to be subscale and carry a degree of reputational risk. Due to a higher compliance burden smaller businesses are having trouble growing and the expense burden is increasingly difficult to bear. NTB on the other hand specializes on trust and wealth management in markets where it has scale and is a suitable acquirer for sub-scale local competitors, consolidating market share. When acquiring another trust bank, NTB tries to move target customers to its platform, remove some costs and retain USD deposits. After the most recent ABN Amro transaction, NTB actually tried to shed Euro-denominated deposits as they felt that they had no origination capabilities in the Euro-area and there was no safe asset to invest in that would have exceeded the cost of deposits (most European government bonds have negative yields). Butterfield does have a small mortgage operation in London where it originates and retains mortgages to high-net worth clients. As a result they are trying to only retain USD and some GBP deposits.

Regulatory Risk

As Bermuda’s tax regime is attractive to tax avoiders and money laundering the world’s largest countries want to make sure that Bermudian banks’ customers are paying their proper taxes. Bermuda has entered into a series of agreements to ensure transparency. These include:

- A signed tax information exchange agreements (TIEAs) with 40 countries

- A tax treaty with the US as well as full compliance with the US Foreign Account Tax Compliance Act (FATCA) that requires banks to send American customer statements to the IRS regularly

- NTB only accepts US accounts if the client as a reason to be doing business in Bermuda and passes several screens to detect fraudulent behavior

- NTB also does an annual review screening for politically “high-risk” persons

- As part of the U.S. regulatory “Know Your Customer” rules, NTB’s U.S. dollar transaction clearing partners, Bank of New York Mellon and Wells Fargo both complete annual on-site exams of NTB’s operations.

Valuation

Despite having a relatively simple business model, NTB is somewhat difficult to value. As the bank is incredibly interest rate sensitive, it makes sense to buy NTB when interest rates are low and expected to rise and sell NTB when interest rates are expected to fall. I think Geoff mentioned at one point that the way he thought about Cullen Frost (CFR) was that it made more sense to buy it when rates were at 0% than when they were at 5% (or any other arbitrary high number). NTB is a more extreme version of this. Why? Both Frost and NTB have a great deposit franchise, but while Frost’s deposit franchise stems from corporate deposits NTB’s deposit franchise stems from its wealth and trust business. A deposit franchise built on a strong corporate business helps generate lots of loans. Loans typically have wider spreads than the securities banks buy. Banks have more pricing power over their lenders than they do over the securities market. A deposit franchise built on a wealth and trust business typically generates only limited opportunities to lend money to high-net worth clients (primarily mortgages). Because of the lack of lending opportunities that the wealth and trust business generates, wealth focused banks end up investing a large portion of their deposits into securities. Because of the importance of reputation in the wealth and trust business, banks in this line of business are further constrained in their ability to invest deposits into higher yielding opportunities. As a result, the net interest margin component, which makes up two thirds of NTB’s revenue is highly sensitive to US short-term rates.

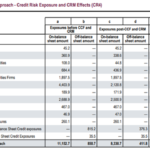

In the current environment, NTB could probably earn $3.45 per share on a 2.45% net interest margin. At a price of $34.19 it is trading a little below 10x 2020 earnings and 2.1x tangible book value, justified by a 21% RoTE. While I usually spend more time on capital when looking at banks, in the case of NTB this is less of a concern. NTB has a 17.4% common equity tier 1 ratio and a 5.8% leverage ratio. The divergence is explained by the low risk-weighting of the securities portfolio. NTB is highly capital generative ($3.45 of earnings on $16.20 of tangible book value) and is far less likely than most other banks to run into credit issues due to the high credit quality of the book.

NTB currently has a 5% dividend yield, returning about 40% of its earnings in dividends. In 2018 it repurchased another 2% of its shares. Share repurchases at NTB tend to be opportunistic rather than systematic. The first and best use of capital tends to be tuck-in acquisitions of other wealth and trust banks. After this NTB does not require much capital as the securities it buys have low risk-weightings. NTB can easily return a large amount of excess capital through dividends and repurchases every year. I think for the next several years NTB will continue paying out at least 5% per year in dividends (assuming the current stock price), produce another 1-2% in stock repurchase yield and grow deposits at 4-5% per annum. As the table below shows, NTB’s average risk-weight is 40%. Lets assume NTB grows its balance sheet by 5%, or $700MM in 2020. It would have to retain $700MM x 17.4% x 40% = $49MM in equity to keep its common equity tier 1 ratio stable. So about $49MM of the $190MM ($3.45 per share) that I would expect NTB to earn in 2020, or 25% would have to be retained. The remaining capital could be used for buybacks, dividends or M&A. From that perspective, NTB should be able to generate $190MM-$49MM = $141MM / $1,900MM = 7.4% buyback + earnings yield + 5% growth = 12.4% returns over a longer time period. This however, assumes that interest rates will remain stable.

The best long-term buying opportunity in NTB will clearly be at times when rates bottom out and start rising again. I would estimate that, if interest rates In the US fall back to zero, NTB’s Net Interest Margin would compress to somewhere between 1.7%-2.0% which would lead to EPS between $1.00 and $1.70.