Becoming a Better Investor: Reading One 10k After Another

I’m a big process guy. I believe if you have the correct processes in place and develop the right habits over time, you will succeed in whatever it is that you want to accomplish. Geoff and I get asked all the time a variation of: How do I become a better investor? The answer is simple, but not easy. I would say it really boils down to reading. A lot. Okay okay yes, I know if you are a Buffett / Munger fan you probably already know that. But, what should you read to get better? I believe people waste their time reading too many books on theory, when really, they can become a better investor overtime by reading one 10k after another. Geoff said it best in one of his blog posts when he said: if you’re reading more books than 10ks, you’re doing it all wrong. Truth be told, I once fell into this category. I felt like If I read more investing theory books it would help me overall as an investor. While this is true, I feel like once you have the basics down and a solid rational way of thinking about stocks and the market, from there on out all you will need to do is read and learn about different businesses and practice valuing them. If someone came to me today and asked me how to get started in investing, I would point them in this direction:

- Learn the basics of accounting and how the financial statements “work”. There are tons of free resources out there on Google, YouTube, etc.

- Read Warren Buffetts shareholder letters

- Read Howard Marks’ Memos

- Read “You Can Be A Stock Market Genius”

- Read Joel Greenblatts Audited Class notes (I’ve read these probably over 5 times in my life)

- Read Focused Compounding ?

While reading books of course is beneficial and fun, I believe if you want to get better as an investor the 6 things I just listed above is all you need to know fundamentally speaking. From there you can proceed to reading 10k’s, which is the main activity that will make you better. As you may or may not know, Geoff and I meet 1-2 times a week. This topic of “how to get better” and “focus” is one that we talk about often and is one of great interest to me. Here is some tough love on how to get better. Stop being so lazy. If you want to get better, then get better. The opportunity is 100% there. I always say we are living in the luckiest time in life because of the technology that’s available to us that allows us to get access to whatever it is we want to learn about. Think about how much that has changed within the last 15-20 years. Being in Dallas, I could have a package shipped to China tomorrow if I wanted to. Technology has changed and gotten better, so we must adapt to get better. Think of your favorite successful investor that you admire and look up to. If he or she is over the age of 40-50 and you are younger than him, I would argue you have a better advantage to learn than he had when he was your age. Even if he has an MBA or went to a top tier school and you didn’t. I believe realizing this and just making the choice to get better while utilizing all the internet has to offer to learn from can take you far. Maybe Ray Dalio said it best in his opening line of his new book, Principles when he said:

“Before I begin telling you what I think, I want to establish that I’m a “dumb shit” who doesn’t know much relative to what I need to know. Whatever success I’ve had in life has had more to do with my knowing how to deal with my not knowing than anything I know.”

Maybe if we all look at ourselves as “dumb shits” and then take whatever steps that are required to learn and get better, we will be better off. Why do I think after you have the fundamentals down the next step to getting better is just reading a bunch of 10k’s? Simply put, it’s because the more experience you have with different companies the better off you will be. Warren Buffett and Charlie Munger are way better investors today than they were even 5 years ago. Why? Because all knowledge in investing is cumulative. It all builds up like compound interest. When I did research on Green Brick Partners, I also read the annual reports for NVR, LGI Homes and KB Home. So, during this due diligence process on Green Brick Partners, I also learned about 3 other separate homebuilders and their individual business models. In the future If I come across a new homebuilder or a company in that industry, I will be much further ahead than before I learned about them all. All knowledge is cumulative. Learning about these different companies even though I didn’t invest in all of them is still a very valuable exercise to gain experience for the future.

One thing I have been really trying to work on lately is to improve my focus. Geoff for example, has an incredible ability to focus and tune the world out. Me? Well this is something I have to consistently work at. Again, being honest with myself allows me to take the steps forward to getting better. Here is what I have learned about myself and what I do to try to improve my focus:

-

Multitasking DOES NOT WORK. Don’t do it. Focus on one task at a time.

-

Building focus is like a muscle, you can develop it and it can become stronger/better.

-

If you have a TV on in the background, you won’t be 100% focused. I limit this by not having a TV in my office. Simple, right?

-

I have found I am able to focus better with actual PRINTED documents. So, I print out all transcripts, 10ks, 10Qs, etc.

-

When you commit to reading a 10k, turn your phone off or remove it from the room. There have been studies that show even if your phone is flipped over but you can still see it in the corner of your eye, your brain will be multitasking and develop the impulse to check your phone.

-

Get off Facebook.

-

Get off twitter.

-

I like it to be 100% quiet when I read, so I use construction ear-plugs to tune the world out.

I’m confident that if you are honest with yourself and can work to improve your focus, you will become a better investor. My goal every day is to go to bed a bit “better” than when I woke up. If we are consistent and do this every day, I believe the odds of success will be tilted in our favor.

As I said at the beginning of this post, I’m a big process guy. So, I thought I would outline my general “process” for getting better. I try to draw inspiration from Warren Buffett’s early BPL days. There seems to be a general misconception that Warren doesn’t work “hard” nowadays. While he may not be grinding it out all day every day anymore, he’s able to do that because he has so much knowledge stored up from studying companies his whole life. He’s 87 and I’m 21, so I’m trying to catch up and model from his BPL days when he was basically obsessed with investing and worked to improve all day. The advantage I have as I alluded to above is I have access to instant information at the touch of a mouse, which of course Warren did not have the luxury of doing. Below is my process, and after that, we can go over Geoff’s research process. Since mine is like his, I figured I would just use his for this post.

Andrews Process for Getting Better:

I read the WSJ every morning, typically in print edition, although if you have an iPad you can download it every day which also is great. This typically takes about 45 minutes to 1 hour.

I read Barrons every weekend.

I try to read 2+ annual reports a week, all printed out and marked up, which takes about 2hrs each. Geoff and I choose a company every week and then meet up to chat about it. The Idea Exchange is a great place for you to do this. Use it as your personal journal.

I will print out and read all the SEC filings, presentations and transcripts on the companies I own and the 30 or so that are on a close watch list.

I only read the transcripts, I never listen to the live calls. It’s faster to read and it removes some biases (focus on what is said, not how it is said).

I keep an ongoing Excel file on each company I follow, so after reading a call transcript or something I normally write out the key takeaways in bullet points. Geoff’s memory is like an Excel file, unfortunately mine is not. No worries though because saving notes helps : ) (we’re being honest with ourselves here, remember?)

I read some investing blogs that are likeminded.

I love reading about investing in general, so when people post shareholder letters, blogs or investment pitches I also print those out and read.

I’m a delayed member of Value Investors Club so from time to time I’ll surf through there. Even though I’m delayed, often it doesn’t matter.

I listen to books that interest me on audible mainly when I’m doing cardio or driving in the car. This allows me to still read (listen to) interesting books, but also gives me time to focus on getting better at investing (reading 10ks).

To find ideas, sometimes I screen for companies, but I have found that my best ideas haven’t come from screens. They’ve come from learning about a business I would like to own at a future price and then waiting for that price. This allows me not to mistake a margin of safety from a statistically cheap stock.

I try to only check stock prices occasionally. I went through a stretch where I would check prices multiple times each day and that’s just distracting. Remember, markets move faster than businesses do, don’t let that scare you. In the short term, the stock market is a voting machine but in the long term it’s a weighing machine.

I like to talk and network with other investors. As I said, Geoff and I meet at least once a week.

I really try to limit my computer time, everything is printed out and I read through it with a highlighter and a red pen.

Here is Geoff’s Research process, which as I said is similar to mine (I’m a copycat).

My Research Process

Andrew asked me to lay out my research process for this post.

Initial Impulse

First, I get the germ of an idea. I am usually tipped off to a specific stock by:

- A news article (examples: “Barnes & Noble Says Investor Plan to Take It Private Not Bona Fide”, “Comcast, Verizon Approached Fox to Buy Some Assets”, etc.)

- A blog post (examples: “NACCO Industries: Hamilton Beach Spinoff” by Clark Street Value, “Cars.Com – Interesting Spin-off Opportunity?” by Value and Opportunity, etc.),

- Or a well-publicized stock drop (examples: General Electric down 22% in the last month, Funko IPO planned at $14 to $16 a share a few weeks ago yet closes its first day of trading at $7 a share, etc.).

However, sometimes the initial impulse to research a stock comes from:

- Randomly checking tickers and being surprised by how low the price of some stock has gotten (examples: Avon Products at $2 a share, Bed Bath & Beyond at $21 a share, etc.)

- Noticing a one-year price decline in a stock I previously researched or owned (examples: Omnicom down 21% year-to-date, Village Supermarkets down 23% year-to-date, etc.)

I also meet with Andrew in person about once per week. We each read and mark-up a 10-K and bring it with us to this meeting. Sometimes Andrew picks the next stock we’ll discuss. Sometimes I pick the next stock we’ll discuss.

Data Check

Second, I will usually check a website like GuruFocus for long-term financial results and today’s valuation metrics. This takes about 60 seconds. I will usually scan about 15-30 years of past financial data where available.

Required Reading: Secondary Sources

I will collect and read all:

- Blog posts about the stock

- Write-ups at Value Investors Club

- Mentions of the stock at Corner of Berkshire and Fairfax

Required Reading: Primary Sources

Where available, I print out and mark up three documents:

- The company’s most recent earnings call transcript

- The company’s most recent investor presentation

- The 10-K

Generate “Leads”

Once I’ve marked up the 10-K, I have a series of questions I want answered. From this point forward, my research process is 100% focused on the specific notes I’ve written on the 10-K. I no longer care what other people have to say. I’m not looking for new questions. I just want answers to the key questions I laid out.

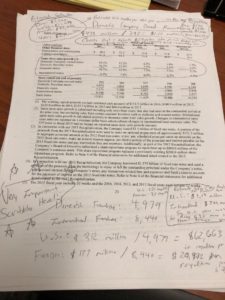

I literally write these notes on the 10-K. Here are 2 pictures from my phone to prove it:

#1 NACCO (NC)

#2 Domino’s (DPZ)

Finally, I come up with a specific method for how I think this particular company should be valued (examples: 1 times sales, 10x EBITDA, etc.). I try to use a method that is reasonable but errs on the side of being based on conservative assumptions.

I always calculate an exact figure for my appraisal value. You can see examples of this in the Singular Diligence reports in the “Library” section of Focused Compounding.

Margin of Safety

Once I have set an exact appraisal value, I won’t consider buying the stock till it trades at 65% or less of that appraisal value.

For example, if I appraise a stock at 1.5 times sales and the stock now has $70 a share in sales, that means my updated appraisal value would be $105 ($70 * 1.5 = $105). So, I won’t allow myself to buy the stock at any price above $68.25 ($105 * 0.65 = $68.25).

Comfort Level

Once I’ve decided on an appraisal value and the stock is trading below 65% of that appraisal value, my research will be focused on assessing my comfort level with the stock. What if I couldn’t sell this stock for 5 years? What would happen if there was a credit crisis? A recession? How big is my margin of safety? How comfortable would I feel holding this stock forever? Those are the kinds of questions I think about once I’m done appraising the stock. I’m no longer thinking about valuation at this point. Just my comfort with the business, the balance sheet, management, etc.

Last Step: Opportunity Cost

Finally, I compare buying this stock to 4 alternatives:

- Buying more of each of the stocks I already own

- Keeping everything I own instead of selling a stock to fund this purchase

- Buying my favorite stock I don’t yet own

- Holding cash (that is: waiting for future opportunities)

For example, today I have 7% of my portfolio in Natoco and 14% of my portfolio in BWX Technologies. So, if I was considering buying Omnicom (OMC), I would compare that stock to BWX Technologies and Natoco (the two stocks I’d probably sell to fund a new position in Omnicom equal to 20% of my portfolio).

I would also compare buying Omnicom to the next best stock idea I have that I haven’t acted on yet. So, as of today, I might compare buying Omnicom at $67 to buying Cheesecake Factory (CAKE) at $45.

I am looking for a clear answer that buying this stock is better than all the alternatives I’ve listed above.

If it’s a close call, I choose inaction.

Till I can clearly prove the stock I don’t yet own is better than the stock I might sell to buy this one – I stick with what I already own.

I do nothing.

In the meantime: I move on to researching another new stock idea and the process starts all over.