Box (BOX): Negative Earnings and Free Cash Flow Disguise Beautiful Customer Economics

Member write-up by Jayden Preston

Overview

Founded in 2005, Box offers a cloud content management platform, as a subscription-based service, that enables organizations of all sizes to securely manage and access files from anywhere, on any device. The company initially offered a free version in hopes of growing their user base rapidly, leading them to surpass 1 million registered users by July 2007. The Company realized that their users started bringing their solutions into the workplace and businesses were eager for a solution to empower user-friendly content sharing and collaboration in a secure, manageable way. In 2007, Box then made the strategic decision to focus more on the enterprise market by investing heavily to enhance the security of their platform and building an enterprise sales team. In 2012, Box introduced Box OneCloud platform and Box Embed framework to encourage developers and independent software vendors to build applications that connect to Box, creating an ecosystem of applications. The Company has also formed alliances with numerous software companies, bringing about more than 1,400 integrations with offerings from Google, Office 365, IBM and so on. This continual evolution of their platform features allowed the Company to sell into increasingly larger organizations.

Today, Box has a user base of over 58 million users. As of January 31, 2018, over 17% of their registered users, or close to 10 million, were paying users who registered as part of a larger enterprise or business account or by using a paid personal account. The Company has over 82,000 paying corporates. Around 70% of the Fortune 500 companies are their clients. In FY2018, Box generated $506 million in revenue, in which 96% is recurring.

Durability and Moat

With cloud content management business being the newer technology and current disrupter, it is difficult to see what would come and disrupt this business in the next decade or two.

The value proposition of cloud content management should be strong. Not only does the cloud allow for higher flexibility in accessing content and collaboration among colleagues, it also helps corporates cut costs through streamlining the content management process. Increasingly, through more integrations with other software offerings, the value proposition of cloud content management should only increase.

Complementing the above is Box’s strategic focus on the enterprise market. During the sales process of convincing a large enterprise to sign up as a client, Box often finds the need to tailor its offerings to the needs of the enterprise. This should increase the switching costs for the users. It is quite expensive to acquire such customers. For instance, by the end of FY2017, Box had 71,000 customers, covering 64% of the Fortune 500. The Company spent $303 million on sales and marketing in FY2018, during which the number of corporate customers increased by around 12,840. (Here I assume FY2017 year-end number of customers decreased by 4%. The difference between this number and the FY2018 year-end figure should equal to the number of new customers added) Assuming all marketing expenditure is for acquiring new customers, this equals to more than $23,598 per corporate client. (The actual cost per corporate client should be lower as part of the marketing expense is also for convincing existing but non-mature customers to expand their usage) The fact that Box has to spend so much capital on acquiring users also makes it less likely to lose the business to another service provider. Last but not least, as cloud storage is likely to be very much imbedded into the daily workflow of users, there exists another incentive to discourage corporate clients from switching service provider unless the current one totally screws up.

All this can be reflected by the exceedingly low churn rate of Box. In FY2018, the churn was 4%. Since the company was listed, churn has ranged from 3% to 5%. This remarkable level of churn rate forms the foundation of both the durability and moat of the Company.

One more point before we move on to the next section: I believe it is worth identifying companies that are willing to go through short-term pain in pursuit of greater profits in the long run. They often face less competition at the initial stage of building the needed foundation for a successful and sustainable business until the value being created becomes too palpable. I believe Box is one of such companies, especially when compared to Dropbox, which has a much bigger individual or consumer business.

Stratechery has a good post on the difference between the two companies. I think it is worth a read. A quick summary: Box ought to find it easier to monetize its user base going forward than Dropbox, since it is easier to convince enterprises to upgrade their current plans by offering more solutions than asking consumers to do the same.

Quality

The product economics of Box is superb as well.

Let’s look at the level of invested capital first. In FY2018, Box generated $506 million in revenue. Supporting this level of revenue was an asset base of $553 million. Property and equipment was $124 million. The company mostly leases its data center needs. Deferred revenue of $292 million helps drive working capital to negative. In fact, I estimate average invested capital to be negative for FY2018.

Turning to the earning side: At the moment, Box is running at a loss. Moreover, if we do not add back stock-based compensation, free cash flow is still negative. Nevertheless, given the level of churn the Company enjoys, we can be confident that the losses are a result of the rapid investments Box is undertaking to grow their client base. Below is a key paragraph from the annual report of Box (emphasis is mine):

“Because of these dynamics, we experience a range of profitability with our customers depending in large part upon in what stage of the customer phase they are. We generally incur higher sales and marketing expenses for new customers and existing customers who are still in an expanding stage. For new customers, our associated sales and marketing expenses typically exceed the first-year revenue we recognize from those customers. For customers who are expanding their use of Box, we incur various associated marketing expenses as well as sales commission expenses, though we typically recognize higher revenue than sales and marketing expenses. For typical customers who are renewing their Box subscriptions, our associated sales and marketing expenses are significantly less than the revenue we recognize from those customers. These differences are primarily driven by the higher compensation we provide to our sales force for new customers and customer subscription expansions compared to the compensation we provide to our sales force for routine subscription renewals by customers. In addition, our sales and marketing expenses, other than the compensation we provide to our sales force, are generally higher for acquiring new customers versus expansions or renewals of existing customer subscriptions. We believe that, over time, as our existing customer base grows and a relatively higher percentage of our revenue is attributable to renewals versus new or expanding Box deployments, we will experience lower associated sales and marketing expenses as a percentage of revenue.”

What might the normalized margin be if the Company is at steady state?

Given the extremely low churn the Company is experiencing, it is reasonable to treat most of the sales and marketing cost as expense for growth. Box also invests in R&D to enhance its offerings to better serve existing customers and better attract potential ones. This means part of the R&D cost should be treated as growth investments as well. To simplify our analysis, we will treat 100% of R&D as “maintenance expense”. At the same time, we will assume all of the sales and marketing expenses as investments for growth. If this expense is “capitalized”, at the current churn rate, it should be amortized over 20 years. Here, we conservatively assume a 10% annual amortization rate, i.e. amortization over a 10-year period. The above assumptions result in an operating margin of 23.5%, or an operating income of $119 million in FY2018.

Clearly, the traditional ROIC calculation for Box will show an infinite number. However, this calculation is not reflective of the actual return on investments for the company, since the above invested capital calculation does not capture the key investment being made in the business: sales and marketing expense. Instead, what matters is the customer acquisition cost versus the life time value of customers for Box.

As mentioned, the current churn rate for Box is below 5%. Furthermore, contract value from existing customers tends to increase due to corporate clients paying for more services or simply adding users within the organization. Box refers to this phenomenon as “Net Expansion”. Since FY2015, Net Expansion has trended downward from 30% to 14%. The resulting “Retention rate” [1] decreased from 126% to 110%. Nonetheless, if an existing customer increases its spending by 10%+ annually with minimal additional sales effort, mathematically speaking, the life time value would be infinite, since this growth will exceed any discount rate we should reasonably use.

Instead, let’s use conservative assumptions and see at what multiple of yearly sales customer acquisition costs could be for the investments to still make sense. We will assume churn rate stays at 5%. If remaining customers grow their spending by 5%, essentially the

spending from this overall cohort of customers will remain the same. This 5% can be achieved through price increases and expanding usage of existing customers. In other words, “retention rate” will stay at 100%. If we use a standard discount rate of 10%, the NPV of a fixed stream of cash flow will be 10x the annual cash flow.

FY2017 revenue was $399 million. With a “retention rate” of 110%, revenue would have grown to $439 million. FY2018 was $506 million instead, meaning new customers contributed around $67 million. An estimated 12,840 new customers were acquired. Revenue per new customer was thus $5,200. With gross margin at 70%, this equates to gross profits of $3,640. If we simply divide the total revenue by average of total customers for FY2018, revenue per customer would be $6,614, this figure is higher due to taking into account mature customers. As mentioned, the estimated customer acquisition cost per corporate customer was $23,598. This suggests customer acquisition cost is no more than 6.5x the yearly gross profits from the new customers. Even if we lower “retention rate” to 100% in the long run, the return on investment on their customer acquisition expense could still be as high as 42%.

| Back of Envelop Return on Investment Analysis for Box

(Using FY2018 figures) |

Per Customer |

| Estimated Yearly Revenue | $5,200 |

| Estimated Yearly Gross Profit at 70% Gross Margin | $3,640 |

| Conservative NPV/Life Time Value at 10% discount rate | $36,400 |

| Estimated Customer Acquisition Cost | $23,598 |

| Estimated Operating Cost (R&D and Admin)[2] | $2,897 |

| Gain on Customer Acquisition Cost | $9,905 |

| Pretax Return on Investment | 42% |

Growth

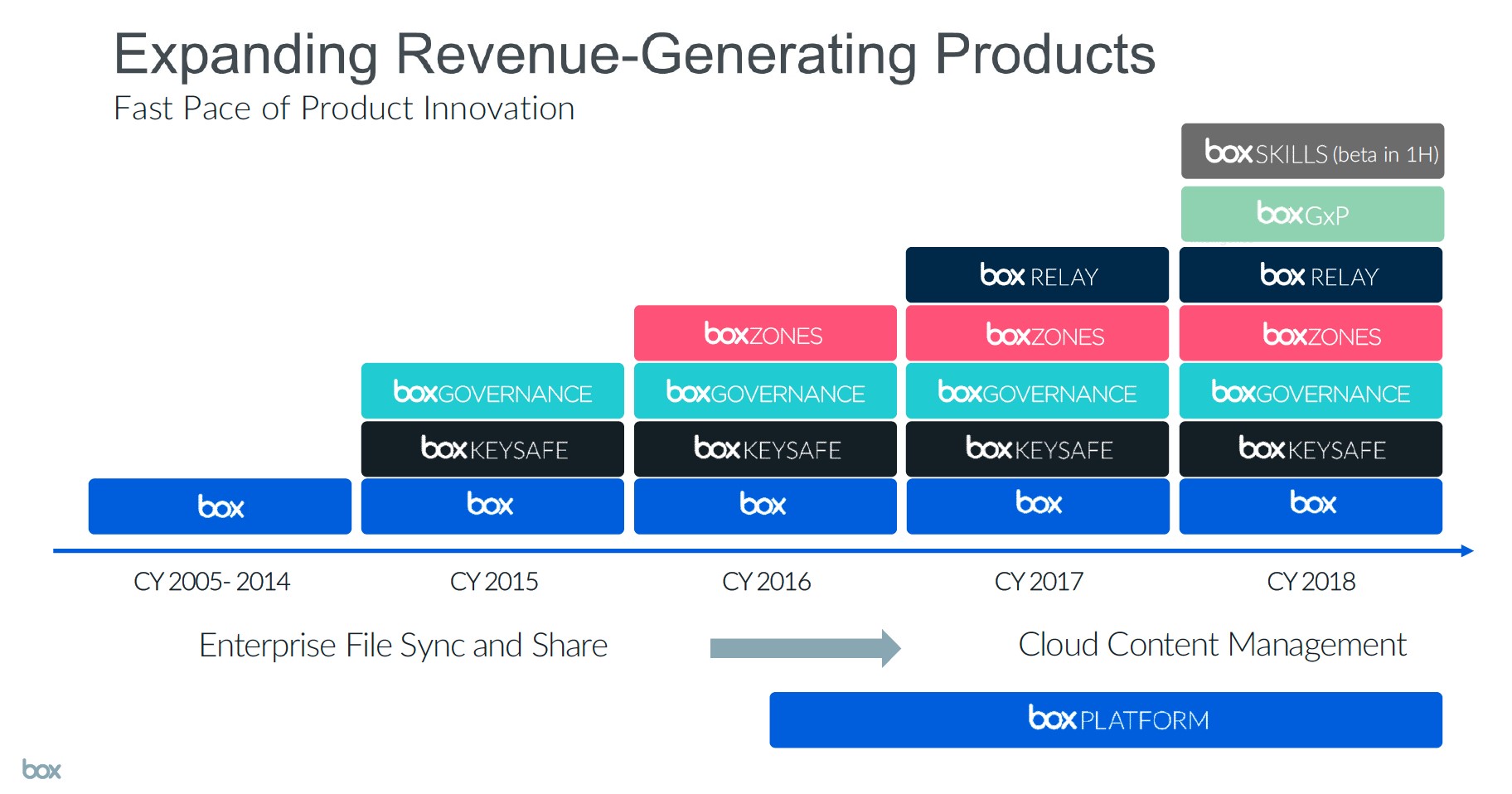

Historically, Box has grown by adding new functionalities to their offerings, which helps upsell their existing client base, while attracting new customers.

Since FY2014, revenue has grown at a CAGR of 32%. Billings, as defined by revenue plus changes in deferred revenue, is perhaps the better metric to track as it reflects Box’s sales activity better. This figure has been growing at 46% annually since FY2014.

Growth is certainly slowing down. Yet, revenue and billings still grew 27% and 29% respectively in FY2018. This was achieved by customer count growing by more than 15%, coupled with “retention rate” increasing by 10%. Nevertheless, as Box is still growing rapidly, it is quite difficult to forecast the Company’s growth rate in the next decade with as much confidence as we would on a more mature company. Industry reports would suggest the current rate is sustainable at least for the next 4 to 5 years.

In 2017, the cloud storage market size was estimated to be $30.7 billion. Reportlinker forecasts it will grow to $88.9 billion by 2022, for an annual growth rate of 23.7%. Mordor Intelligence forecasts the market to reach $101.6 billion by 2023, for an annual growth rate of 22.5%. It is definitely not a stretch to believe Box can at least grow as fast as the overall market.

Social Capital founder Chamath Palihapitiya recently pitched Box in the latest Sohn Conference. He argued that Box will be a great beneficiary of the upcoming AI revolution. AI could augment the efficiency of workflows by better management of data. With all the data Box already has, they are at a nice position to make use of such AI capabilities being built. The AI wave could thus further accelerate the adoption of cloud storage and content management. With such a strong tailwind at its back, Paliapitiya believes Box can grow its revenue by 25% annually in the next decade. He also pointed out the gross margin of such AI services will be more than 90%. You can watch his presentation here.

Nevertheless, growth is inherently speculative, especially when such a high growth rate is being forecast. A more prudent analysis would be to calculate a minimum valuation for the company without factoring in strong growth ahead. I propose two methods, which in essence is the same but from slightly different angles, below.

Valuation

Method 1 – Looking at the Whole Company at Steady State

As discussed above, if we treat sales and marketing as growth expense, FY2018 operating margins would have been 23.5% if capitalized marketing expenses is amortized over 10 years. The same treatment to previous years’ financials would show Box has expanded their operating margins from -33.7% in 2013. The source of margin expansion comes mainly from slowing growth and economies of scales in R&D and G&A expenses.

Gross margin on the other hand has trended downward as Box ramped up their data center investments as well as more functionalities being added. Nevertheless, at an actual steady state and with much more scale, it is highly possible gross margin could again be 75% or above. If we amortize marketing expense for 20 years, operating margin would improve to 26.5%. Adding in potential gross margin expansion, I believe it is reasonable that Box, at a steady state, could fetch an operating margin of 30%, or an after-tax margin of 23.7%.

A company with a net income margin of close to 24%, with sticky relationships and the ability to grow 3% to 5% per year should be worth 5x revenue at least. This suggests a minimum market capitalization of $2.5 billion for Box. With 140 million shares outstanding, this suggests a stock price of $17.86. As the return on investment on acquiring new customers is highly positive, Box is definitely worth more than this figure.

Method 2 – Splitting the Existing Customer Base from the Future Customer Base

Instead of looking at what the company could achieve at a steady state, we look at what the existing customer base is worth. This smarter and cleaner angle is suggested to me by, as you can easily guess, Geoff.

Based on historical record, the single metric we can be most confident at is the 5% or less churn rate. Let’s say in 5 years, all the existing customers would be mature enough to not need any marketing expense. If we add back all the marketing expenses in FY2018, neglecting the technicality of amortization as it will be a total sunk cost at that point, we will arrive at an operating margin of 29.5%. As such, Box should be able to extract 30% of operating margin out of revenues from this group of totally mature customers.

Say we believe “retention rate” should be 100%, in 5 years, this same customer base should still be generating $506 million in revenue. With operating margin at 30%, this gives out $152 million in EBIT. At a market multiple of 12x EV/EBIT, this suggests an enterprise value of $1.8 billion for the existing customer base.

At the moment, Box has an enterprise value of $3.7 billion. This means the current market value has $1.9 billion tied to speculative component of growth and $1.8 billion tied to the foundation of long-term value of existing clients. In other words, around half of the current market value is sales-force dependent, while the other half is not.

This best time to buy into Box is if the market gives no value to the speculative component that is dependent on their sales force despite obvious sign showing Box is growing its customer base by a number that is clearly above your hurdle rate for investments.

Misjudgment

The biggest potential misjudgment is if Box’s customer churn rate increases.

The cloud content management market is getting more crowded. Competitors of Box include many companies that are magnitudes its size, such as Microsoft, Google, Oracle and Dropbox. The industry giant, Amazon, has also moved into the cloud storage market 3 to 4 years ago through the launch of Amazon WorkDocs. There are also numerous smaller competitors. Despite all this competition, Box’s churn rate has remained very low. Additionally, it hasn’t stopped Box from growing rapidly. I believe this is not an unusual situation. The potential market for cloud-based storage market is immense and the majority of the market is still held by legacy, on premise, systems. Given the high retention rate of corporate customers, the real battle lies in converting the legacy users to cloud customers.

As such, the bigger risk lies in escalating customer acquisition cost. Using the same calculation method suggested above, I estimate that customer acquisition cost per paying corporate increased 37% from FY2016 to FY2018, while the revenue per average number of paying corporates were up only 11%. More importantly, as the current “retention rate” is 10%, in theory the NPV of a new customer could be infinite using any realistic discount rate at or below 10%. This means the temptation to spend too much on acquiring customers can be very high for Box. Marketing spend vs number of new customers acquired would be key metrics for me to monitor going forward.

Conclusion

Box is an interesting company where a high-quality business is masked by aggressive investments for growth. Despite the heavy upfront investments, due to high retention rates and low ongoing expenses for serving existing customers, Box should be able to achieve very satisfactory return on these investments. If there is an opportunity to purchase shares of Box when the market only gives value to its existing customer base, which is around $13 to $18 per share, investors will effectively be given the promising growth for free.

Other Materials:

https://techcrunch.com/2017/06/06/boxs-cloud-content-management-vision-showing-results/

https://www.networkworld.com/article/3054636/cloud-computing/idc-cloud-is-eating-legacy-systems.html

http://www.eweek.com/cloud/microsoft-box-partner-on-cloud-content-management-and-collaboration

https://blog.box.com/blog/box-microsoft-azure-now-available/

[1] Retention rate is defined as the net % of Total Account Value (TAV) retained from existing customers, including expansion. This metric is calculated by dividing current TAV of customers who 12 months ago had $5,000 in TAV by their TAV 12 months ago.

[2] Dividing the sum of R&D and G&A expense by the average number of paying corporates in FY2018