DPI Holdings Berhad (KLSE:DPI): A Tiny Developing Market Aerosol Paint Manufacturer/Distributor with 16%+ Operating Margins, Wholesale Pricing Power and 12 to 15 Years of Growth Capex in the Bank

Write-up by Warwick Bagnall

DPI is a Malaysian manufacturer/distributor of aerosol paint and paint solvents. It’s listed on the ACE market, a secondary board of Bursa Malaysia. It listed in early 2019 and was heavily oversubscribed so it’s not exactly overlooked. Market cap is around MYR 85 MM (one USD is a little over four MYR at the time of writing) so it is a microcap. Normally I wouldn’t bother to look at a recent IPO but two things made me take a closer look – I think consumer paint businesses have significant pricing power and DPI reports margins that are higher than most paint businesses. It doesn’t hurt that the share price is well below the IPO price of MYR 0.25.

The company segments total revenue into three product categories – aerosol paint (73%), industrial aerosols (8%) and solvents (19%). It sells these products through three channels – 70 distributors within Malaysia, via DPI-owned distributor DPIC which has 630 sub-distributor and reseller customers within Malaysia and to eight private label customers, six of which are located outside Malaysia. Most of DPI’s business is in Malaysia but it has recently indicated that it intends to enter the Myanmar and Vietnamese markets.

Aerosol paint manufacture is not high-tech and for a manufacturing business it doesn’t require much capital. I estimate you could set up a factory like DPI’s replacement cost of MYR 20 MM in the same location with similar input costs and start trying to sell to Malaysian distributors within 12 months. You could also import similar products from suppliers in China, duty free and with a freight cost that would detract from your margin but not prevent you from making a decent profit at the same price DPI sells for. At the very least, one of the other multinationals with factories in Malaysia such as Nippon Paints should have competed DPI’s margins away long ago. But that hasn’t happened – DPI made an operating margin of 16 to 25% between 2016 and 2018.

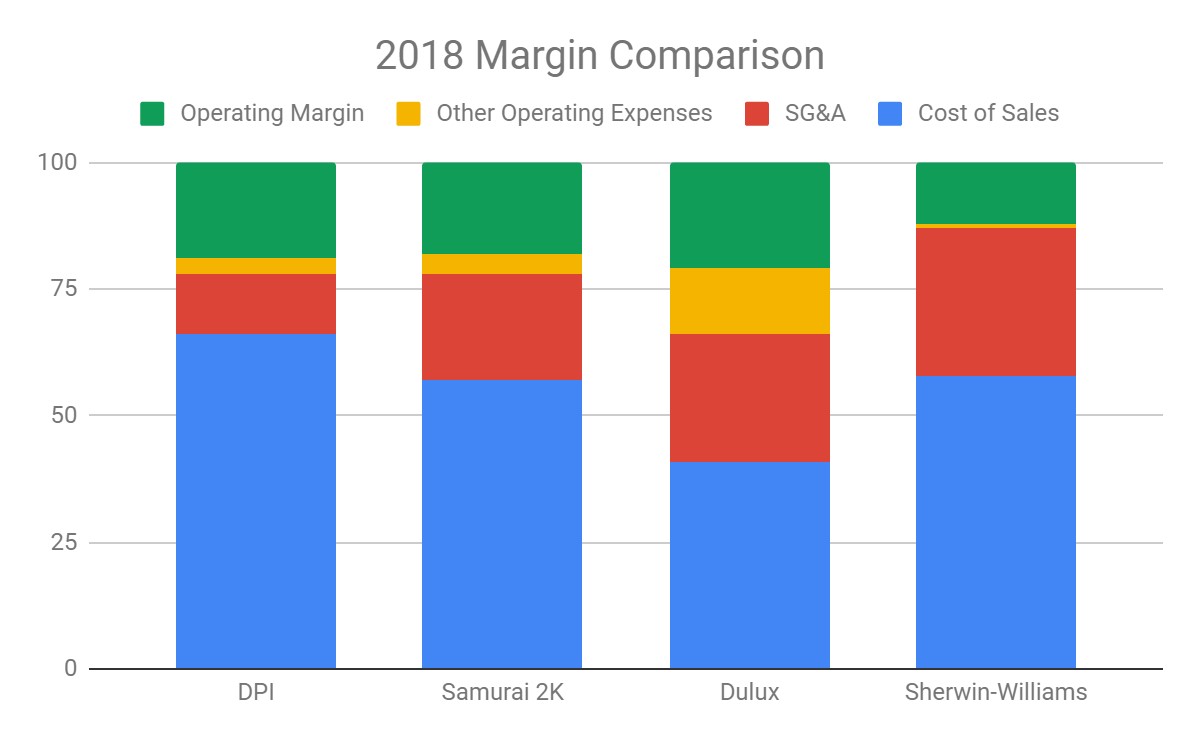

Paint businesses such as Sherwin-Williams (NYSE:SHW) and RPM (NYSE:RPM) are generally known for having pricing power and steady operating margins in the low teens. But DPI’s is exceptional. I can find only one other paint businesses with similar profitability to DPI – Samurai 2K (SGX:13C) which is a direct competitor to DPI. I don’t think this is a coincidence.

To value DPI at anything higher than liquidation value requires three things:

- Confidence that they can maintain market share and pricing power in Malaysia.

- Confidence that management and competitors won’t attempt to grow market share by cutting prices.

- Willingness to substitute transparent unit economics for a long term history of profitability under public ownership. The company has been listed less than one year.

I’m going to focus on the aerosol segment of DPI’s business. DPI sells solvent at a gross margin around 3%. There don’t appear to be any synergies between the solvent and aerosol businesses – DPI’s competitor achieves similar or better aerosol margins without engaging in solvent trading. If DPI stopped selling solvent it wouldn’t change the valuation appreciably.

I’m also going to focus heavily on the market for DPI’s products in Malaysia for two reasons – most of the value of the company comes from this market; and because I think DPI’s overseas growth markets in 10 years’ time will look a lot like Malaysia does now.

Malaysian Aerosol Paint Market

DPI was founded in 1975 and entered the Malaysian aerosol paint market in 1982 in the hope of avoiding the competitive pressures that were forming in its existing markets. There are currently five main manufacturers in the market – Nippon Paints (TYO:4612), Aeromix, Samurai 2K, RJ London and DPI. On an ex-works production basis, DPI holds about 25% of the Malaysian market and Samurai has 22%. Aeromix and RJ London are private companies and Nippon doesn’t split out results by category or geography so information on their performance is scarce. However, Samurai is listed in Singapore. I relied heavily on material from Samurai’s disclosures in preparing this write-up but as an investment I decided it was a pass – as a stock it looks way too promotional for me.

Both Samurai and DPI are recent IPOs with similar products and category overlap in the two-wheeler (motorbike and scooter) paint market. Samurai and Aeromix are heavily focussed on two-wheelers. Nippon is focussed on architectural paint and DPI and RJ London do a bit of both.

DPI manufactured 7.5 million cans of aerosol paint in 2018; Samurai manufactured 15.8 million, up 129% on the previous year (more on that later). Each can retails for between 8 and 25 MYR (approx. 2 to 6 USD). To put this in perspective, this is roughly what the average Malaysian office worker would spend on lunch each day. It’s not a large enough purchase to shop around for and I think availability and choice of colour is more likely to determine which product gets purchased by consumers rather than price. Many purchases are incidental to repair work on two-wheelers so the consumer may not even be aware of the price they pay for paint. No consumer buys more paint when the price is low – here’s not much of an incentive for the retailer to discount prices to drive increased sales.

Resellers such as motorbike shops and hardware stores often display aerosol products from two or three suppliers – there don’t appear to be any exclusivity agreements in place. You can see what a typical retail display looks like by checking Samurai or DPI’s Facebook feed. Merchandising is the area that I think has the greatest impact on sales growth. Whoever can get the right colour on the shelf at the retailer when the customer walks in probably has as much chance of a sale as the competitor on the next shelf. Discounting may help this a little, but not as much as either having replacement stock readily available or providing stock on extended payment terms. Manufacturers can influence the availability of stock by having more wholesalers and keeping them stocked. I doubt the wholesalers are willing to provide extended terms to the retailers just to help the manufacturer out.

Both companies manufacture each can for a little over MYR 3 and sell it to their distributors for average prices between MYR 5.41 and 5.74. Those gross margins are comparable with much larger paint manufacturers. Both DPI and Samurai have raised their sell prices between 5 and 10% at a time in recent years to cover increased input costs even though inflation in Malaysia has been negative for part of that period. It appears they both have sufficient pricing power to maintain margins. This is consistent with the pricing power of other consumer paint manufacturers.

DPI spends around MYR 0.16 per can on selling and distribution. Samurai spends MYR 0.46 – the difference is mainly due to promotional costs incurred by Samurai in expanding into foreign markets. Marketing within Malaysia for both companies consists mainly of product demonstrations which are advertised on Facebook. DPI’s promotional activity seems less frequent than Samurai but DPI has earmarked MYR 0.40 per can worth of additional marketing spend from IPO funds to be executed by January 2021. Given that DPI are constrained for capacity until their new lines are installed I wouldn’t expect to see an increase in promotional activity and sales until the first line is commissioned in mid-2019.

DPI’s aerosol sales growth seems in line with market growth but something unusual is happening if you look at Samurai’s financials. Over the short period of time (2016-2018) that data is available for, Samurai grew Malaysian sales at 19% CAGR from 2014 to 2016, volumes were flat for 2017 then in 2018 grew by 36%. At the same time, Samurai’s receivables outstanding grew from 64 days up to 121 days and overdue receivables shrank dramatically. DPI’s receivables outstanding were at 61 days at the end of 2018. Perhaps there is a lot of Samurai product on wholesaler’s shelves on extended payment terms. Overall market size has grown at around 2.4% CAGR during that time. DPI grew aerosol revenue at 4% CAGR. Importantly, both companies maintained their wholesale price.

I can’t say for sure that distributor turnover is very low but many of DPI’s distributors have been with the company for a long time. Five of them have been buying from DPI for 11 to 30 years; another five have been buying for more than 20 years. The largest customer makes up 8.24% (MYR 4 MM) of DPI’s revenue. This should bring in about MYR 4 MM in gross profit for the distributor – not an insignificant amount for an owner of three medium-sized hardware stores. The top four distributors account for 23% of revenue and the ‘youngest’ one of these is 11 years. The ‘oldest’ is more than 30 years. It’s not clear if DPI’s internal distributor (DPIC) currently captures much of the value from the supply chain or helps to increase sales. However if the retail market was to consolidate it could be a key factor in allowing DPI to meet the requirements of chain retailers.

Other fixed costs account for MYR 0.53 and 0.87 per can for DPI and Samurai respectively. Both companies would be profitable at much lower volumes of sales.

Production lines available for filling aerosols are limited in speed to around 600 cans per minute. To put that in perspective, a typical line for filling beer cans runs at 1500 to 2000 cans per minute. Unless the technology improves dramatically there isn’t much scope for reductions in direct manufacturing labour. Even if higher speed lines were available, the high number of different colours to be filled would negate much of the speed increase due to the downtime required to stop and change products. Component costs account for most of the cost of sales – it’s unlikely that any of the companies in this market could gain a significant scale advantage in manufacturing.

Both DPI and Samurai are explicit in detailing their input costs, down to the price of the can and individual component classes. In IPO documentation they also reported average selling prices and gross margins for regular and premium product categories. Recommended retail prices are provided to wholesalers and resellers. If either party wanted to reduce prices in order to try to damage the other then they have plenty of information to help decide by how much and for how long. So far I see no evidence of discounting.

Putting all of the above pieces of information together, I come to the conclusion that the Malaysian aerosol paint market has less pricing pressure than the average business. I put this down to the way the paint purchase is made (lack of price sensitivity), lack of customer concentration and a lack of destructive price competition. I think the price insensitivity is likely to persist and that should deter price competition. What could change is the degree of customer concentration and promotional costs. If the Malaysian hardware industry were to consolidate then I think merchandising and promotional costs could increase, in which case operating margins could look more like those of paint manufacturers in developing countries – somewhere in the low to mid teens.

Whilst I think consolidation is unlikely in the next 10 years I wouldn’t rule it out. Malaysian hardware retail is very fragmented. It’s so fragmented that it is hard to place it on the consolidation timeline that developed markets have followed. There is only one large chain (ACE Hardware) and it is a small-format store found in high-end malls. When I’ve visited those stores they appear to have very little patronage. Customers looking for paint, particularly for auto applications, are much more likely to go to a store located in a more convenient, low-cost, urban location. Small hardware and auto stores are found in most suburbs and traffic between urban centres is often heavy. The convenience offered by big-box retail is largely negated by the travel time to reach the store and the perceived higher price once customers arrive there. That could change if wages increase to the point where larger stores gain a cost advantage sufficient to outweigh the travel time cost. A lot of aerosol paint purchases are also incidental to auto repair work so I doubt those purchases will ever move to big-box stores.

Private Label Market

DPI’s private label customers appear to be quite sticky. For example, Ichinen Holdings Co., Ltd of Japan took six years to complete negotiations and quality requirements before starting business. In my experience this is extreme but not unusual for Japanese buyers and suggests that this relationship is likely quite sticky. DPI’s Australian customer, Campbells Wholesale Pty Ltd, has been with the company for 17 years. Ichinen uses their own brand in Japan but Campbells uses DPI’s brand in Australia. DPI’s Indonesian customer sell cans with DPI’s colour scheme albeit with a different brand name (Diton) in Indonesia. The retail price in Indonesia is comparable with Malaysia. In Australia the retail price for similar products is around MYR 35 – much higher than Malaysia.

Growth and Export Markets

DPI has indicated it intends to enter the Myanmar and Vietnam markets. Both of these countries are already serviced by other manufacturers. The aerosol paint market in most Asian countries is supposed to grow at 4 to 6% CAGR over the next five years, a similar rate to that forecast for Malaysia. In their IPO documents, Samurai forecast Vietnamese aerosol sales growth into the two-wheeler market at 9.7%. I don’t think anyone can forecast the magnitude of growth with any accuracy but I think there are two things worth knowing. Australians use 2.5x as many cans of aerosol paint per capita than Malaysians and, Malaysia’s population is quite young and growing. I am confident that these markets are likely to grow at least as fast as GDP in these countries and certainly faster than GDP in most western economies.

I don’t think it’s possible to predict sales growth for DPI’s private label customers – the private label customer’s markets are forecast to grow at around 5 to 6% but I don’t know how much of this DPI’s customers will capture. However I do think that this segment is unlikely to detract from DPI’s growth due to the stickiness of the customers.

Samurai splits out some useful information on the cost of growth in their IPO prospectus. Between 2014 and Q12017 they added 580 new customers, growing sales by MYR 8.7 million – an average of MYR 15,000 per customer. To achieve this they grew sales and marketing headcount from 14 to 35 and spent MYR 5 MM on sales and marketing. If Samurai had spent just enough per can to maintain revenue (as DPI did) then they would have spent roughly MYR 2.2 MM. So if you divide the difference in spend by the number of customers you could say that it costs about MYR 5,000 to acquire a customer who will sell an average of MYR 15,000 in the first year, generating about MYR 6,000 in gross profit.

That’s a very rough calculation and it makes a lot of assumptions about the markets that DPI wants to enter but it suggests that where growth is available, the payback on marketing spend is very fast. I think the easiest way to account for the marketing cost of growth is to assume the marketing and distribution costs will rise to be similar to those of Samurai. I mentioned above that DPI has allocated an amount for increases in sales and marketing spend equivalent to MYR 0.40 per can. That would make their sales and marketing spend per can slightly higher than Samurai. I think the most reliable way to account for this component of growth spend is to reduce their operating margin by the same amount – that still gives me an operating margin of over 20%

Capital cost is another matter. DPI’s depreciation rate seems in line with maintenance capex. Based on the new factory budget it costs at least MYR 24 MM to add 10 million cans of annual nominal capacity. If they achieve the utilisation rate of the existing factory (which at 78% is actually quite high) then that would allow them to produce another 7.8 million cans. At 5 to 6% CAGR the new factory would be full in 12 to 15 years. The conventional way to look at it would be to say that for every can of new sales, DPI needs to put aside MYR 3.08 to maintain their growth uninterrupted once the factory is full. Another way would be to say that no growth capex will be needed for another 12 to 15 years, following which the company will need to fund an expansion project that will either make sense based on the funding costs at that time, or it will not. Given that the company already has the cash for the current expansion project I would prefer they take the second approach and return a high proportion of earnings as dividends or buybacks unless they can allocate cash to growth inventory. DPI’s investors should be able to compound surplus cash faster than DPI can.

Inventory does need to grow in proportion to sales. DPI carries 11 to 21% of sales in inventory. That figure has been closer to 21% recently, possibly because they are about to do a lot of renovation work on their factory. So for each can of new sales DPI needs to retain up to MYR 1.16 (21% of DPI’s sell price) worth of inventory. Another way of putting this is to say that the return on incremental additional inventory is 54 to 72% depending on whether you set the operating margin at 15% or 20%.

Safety

DPI has no bank debt, MYR 439,000 of operating lease obligations and cash equal to about half of its market cap on the balance sheet. I have no concerns about DPI’s financial stability.

As I mentioned above, DPI’s market is quite fragmented and sticky and the company would be profitable at much lower sales volumes. I have no concerns regarding the long-term impact of losing a large customer.

Given that DPI is listed on a secondary exchange in a country that is not renowned for its lack of corruption you could be excused for worrying about fraud. I have verified that DPI make and sell the products that they say they do. The factory is real. They don’t carry any deferred revenue or large accumulations of inventory or receivables on their balance sheet. Operating profits roughly match cash flow from operations. They don’t appear to be capitalising customer acquisition or R&D costs.

For what it’s worth, DPI use a large firm of auditors (Crowe). Because all private companies in Malaysia are audited each year they would have been audited for many years before listing. Absence of evidence doesn’t prove anything and I would much prefer this company already had a long history of public listing but I don’t have any legitimate concerns with respect to fraud.

The biggest safety question with DPI is the majority shareholder control issue. The MD and his son hold 74% of the company. The MD was a former Nippon paint executive who joined DPI in 1980 before acquiring the company in 1985. I can’t find any Malaysian court judgements relating to management or directors. DPI pays MYR 47,000 in rent to the MD – that’s the only related party transaction since the capital structure was cleaned up for the IPO. Management and board remuneration is reasonable – in the past the bulk of the MD’s remuneration has come from dividends. The first of two red flags is that the company obtained permission from the Malaysian Securities Commission to avoid having to disclose 2015 financials in the IPO prospectus. In lieu of a longer history as a listed company I would really like to know what profitability was like in earlier years. I’ve queried DPI’s IR people about this – the reply is still pending.

Capital Management

Given its short life as a listed company there isn’t much information on this. They have paid dividends in the past under private ownership but their stated dividend policy is that they will retain earnings to fund future growth where needed whilst also rewarding shareholders.

One second red flag is that management recently signed an MOU with a Chinese company to investigate setting up a manufacturing operation in China. No funds have been committed yet but I would see it as a negative if management suddenly decided to divert funds earmarked for the new Malaysian factory to a country with capital controls that make it difficult to repatriate profits.

Running Return

Ignoring valuation for the time being and assuming no buy-backs, the running return on owning DPI’s shares is:

Return (%) = (Dividends + Retained Earnings x ROIC/Cost of Capital)/Share Price

If we assume an operating margin of 15%, annual sales of MYR 49MM and a 24% corporate tax rate then DPI’s EPS should be around MYR 0.015. 15% operating margin is up to 10% less than DPI usually makes but one or two percent above what larger paint companies like Dulux make. The main difference in margins is the SG&A cost. DPI spends 5 to 15% less as a percentage of sales than the larger listed manufacturers. I’m comfortable that DPI is not going to need to add overheads to the extent that larger companies have any time soon. But I do want to use a lower than normal margin in my analysis in case DPI cut costs to an unsustainable extent in the lead up to their IPO.

At the time of writing the share price was MYR 0.18. If there is zero growth and MYR 0.015 EPS then the running return at that share price is 8.3%. If the operating margin ends up being 20% then EPS becomes MYR 0.02 and the running return is 11%.

If we assume 15% operating margin, 6% growth, 54% ROIC and 8% cost of capital then we need to retain 11% of EPS to fund inventory but the running return increases to 13.6%. I don’t think we can know which of the above cases is the most likely one – but I’m confident that the pessimistic case will give me a return similar to what I expect the market index to return in the medium to long term. I’m also confident that DPI’s revenue will grow at at least 4% over the next 10 to 15 years, provided they stick to their core business.

Valuation

If we continue with the above margin and tax assumptions and compare DPI with our assumed return for the benchmark index (S&P 500, ASX 200 etc) then for the no-growth case the company would need to sell for a P/E of 12.5 to match the market return. That’s about what DPI sells for currently. If we assume 4% growth then given the company’s economics the running return would be 11.7% and the company should sell for a P/E of about 18 or share price of MYR 0.27.

To compare DPI with other (albeit larger) paint businesses, Nippon Paint recently offered to buy Dulux for 18.6x EBIT. Dulux is a much larger company in a more developed market but it has lower growth prospects than DPI so you could argue with that number in both directions but let’s stick with 18x. To come up with an EV for DPI I reduce cash to MYR 17.4 MM by stripping out the allocation for the new factory. That gives me a valuation of a little more than MYR 0.30 per share.

I’m comfortable that DPI is worth MYR 0.27 to 0.30 per share. Given that I’ve used low-side operating margins and growth rates to come up with those numbers I’d normally be happy to buy it at a ⅓ discount. But apart from a small parcel of shares I bought so I can say I’m a shareholder when pestering their IR people, I plan to wait. The main shareholders have undertaken not to sell any shares until six months after listing – that means some time in early July 2019. The recently signed MOU also expires in August 2019. That provides a couple of litmus tests to see what management’s intentions are likely to be in future. I’ll also keep chasing an answer on the pre-2016 financials.

The next few years could be tougher than usual for DPI – I suspect there is more product in the supply chain than the Malaysian market can quickly absorb. Sales may slow temporarily. I might be wrong about Samurai and they may be growing rapidly by displacing DPI’s competitors. I’m not sure how that situation will be resolved but I am confident DPI will retain distribution and pricing power in the long term if management can think clearly about how they allocate capital.

Disclosure: The author holds KLSE:DPI at the time of writing. This is not a recommendation to buy or sell any securities, nor is it financial advice. All information presented is believed to be reliable and is for information purposes only. Do heaps of your own research before purchasing any security.