Hamilton Beach Brands Holding Co: HBB

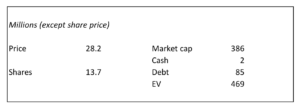

Hamilton Beach Brands Holding Co should not be a completely new stock to Focused Compounding members – but, for those who may be new I will provide a bit of a background. Hamilton Beach Brands Holding is the stock that was spun off from NACCO Industries (NC) last year, which of course NC is the stock that Geoff put 50% of his portfolio in. Hamilton Beach Brands Holding Co opened up post spin at $32.86 and quickly ran to $41.00 per share, only to fall back down to a low of $20.97. With HBB currently sitting at $28.20 about 8 months after the spinoff took place, we felt like it was worth another look.

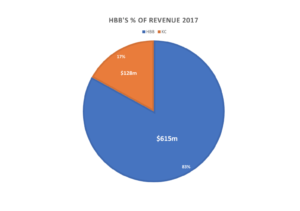

Hamilton Beach Holdings is an operating holding company that has two business segments: Hamilton Beach Brands (HBB) and Kitchen Collection (KC). HBB sells small electric household and specialty houseware appliances to brick and mortar and through e-commerce channels in about 50 different categories. They sell through Walmart, Target, Kohls, and Amazon. If you’ve ever been down a Walmart blender aisle I’m pretty confident you have come across their products. They make blenders, toaster ovens, coffee makers, indoor grills, etc. HBB’s business model is asset light because they outsource all of their manufacturing to 3rd parties in China which allows them to earn a high ROC (total CapEx for 2018 is only expected to be $10.5m, or about 1.7% of revenue). If you think about the staying power of the products that they sell it’s pretty safe to say we will still be using blenders, crockpots, and toasters 10 years into the future.

Kitchen Collection is the problem child in the business that is a specialty retailer of kitchenware in outlet and traditional malls throughout the United States. Management talked about their challenges in their last quarterly conference call, which they’re handling those challenges prudently. Their revenues fell $4.6m in the first quarter (their revenue comes from selling specialty kitchenware items in their retail stores) and management said in the conference call that they expect 70% of their leases to be one year or less by the end of 2018. Although KC is in decline mode with no favorable happy ending in sight, management is being proactive by not investing much capital into the business. Total CapEx for KC is expected to be only $500k for 2018.

For the investment case, I factored in zero value for KC.

Revenue breakdown from HBB’s most recent 10k:

What’s it worth?

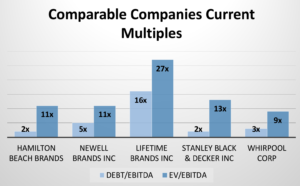

Management has long-term objectives (which excludes KC) of $750m – $1B in sales with an EBIT profit margin of 9%, which would translate into an EBITDA margin of 10%. We can use this as a base in our minds, but to start let’s run through a few different scenarios to see what HBB could be worth. In the examples below, I grew revenue first by 2% for the next 5 years in addition to growing EBITDA margins to their target of 10% by 2022. To look for what a private buyer would pay for a business like HBB I did some research to see what previous buyers have acquired businesses for while also looking at their comparable companies to see where they are currently trading at.

I think 12x EBITDA is a fair multiple for a business like HBB. Of course, anything above 12x would be the cherry on top of the value cake. We can take a step further and read about past transactions that have happened in this industry. I was reading the proxy on when Newell acquired Jarden Corporation back in 2016. On page 101 the proxy goes into past transactions.

| Announcement Date | Acquirer | Target | ||

| December 2015 | JAB Holding | Keurig Green Mountain, Inc. | ||

| February 2015 | J.M. Smucker Company | Big Heart Pet Brands | ||

| May 2014 | Tyson Foods, Inc. | The Hillshire Brands Company | ||

| January 2014 | Suntory Holdings Limited | Beam Inc. | ||

| March 2013 | JAB Holding Company | DE Master Blenders 1753 B.V. | ||

| November 2012 | ConAgra Foods Inc. | Ralcorp Holdings Inc. | ||

| September 2010 | Unilever N.V. | Alberto-Culver Co. | ||

| July 2010 | Reckitt Benckiser Group Plc | SSL International Plc | ||

| January 2010 | Shiseido, Co. | Bare Escentuals Inc. | ||

| November 2009 | The Stanley Works | Black & Decker Corporation | ||

| September 2009 | Kraft Foods Group, Inc. | Cadbury Public Ltd. Co. |

Based on all of these transactions, the EBITDA multiple reference range was 12x – 14x.

Here is how I thought about valuing HBB:

Best Case:

5 years from now – $750m in revenue (4% per year)

10% EBITDA Margins = $75m

12x EBITDA = $900m

HBB should do at least $20m in FCF per year, so $100m over the next 5 years

They currently have $85m in debt, we’ll just say they cancel each other out

13.7m shares outstanding

= $65 per share, or an 18% annual return from today’s price

Plus a 1% dividend yield = 19% total return

10 Year Case:

10 years from now – $750m in revenue (2% per year, or the rate of inflation)

10% EBITDA margins = $75m

12x EBITDA = $900m

HBB should do at least $20m in FCF per year, so $200m over the next 10 years

They currently have $85m in debt, we’ll just say they cancel each other out. For this investment case I didn’t account for the extra FCF to be extra conservative.

13.7m shares outstanding

= $65 per share, or an 8% annual return from today’s price

Plus a 1% dividend yield = 9% total return

If you think the market will do 2-4% over the next 10 years (like a lot of pundits do) HBB may be worth a further look. There are risks though:

- If we go into recession this company will definitely take a hit

- I ascribed zero value to Kitchen Collection. If Kitchen Collection adds negative value that would affect the investment case.

Would I purchase this stock today? Yes. Would it be my favorite stock in the portfolio? Probably not. This all being said, I would bet if you bought the stock today it would be higher 5-10 years into the future.

I will continue to follow the situation and will follow back up.