Homasote (HMTC): A Perfect “Cocaine Brain” Candidate

Member Write-up By Luke Elliott

Quote: $10.58

Shares Outstanding: 360,219

Market Cap: $3.81M USD

Before getting started, read Geoff’s latest memo “Cocaine Brain,” if you haven’t already.

Homasote is a well-known brand name associated with the product generically known as cellulose-based fiber wall board. The material is 98% recycled paper fiber and 2% environmentally-friendly materials. The company has two divisions and claims to be America’s oldest green building products manufacturer. The millboard division makes sound insulation and concrete joint filler and their industrial division focuses on protective shipping products for glass, paper, and steel.

To get a snapshot of where the company was in 2012, take a look at this Oddball Stocks post by Nate Tobik.

http://www.oddballstocks.com/2013/09/homasote-is-it-cheap-or-bankrupt.html

As Nate notes, this is a company that went an 11-year duration, from 2002 to 2011, losing money hand over fist. They somehow managed to destroy almost $40/share in equity over that period and accumulate over $6M in long term debt on a $1.4M Market Cap. The company had negative $15/share in book value when Nate wrote up the stock. Fast-forward 5 ½ years and the company has made some serious progress.

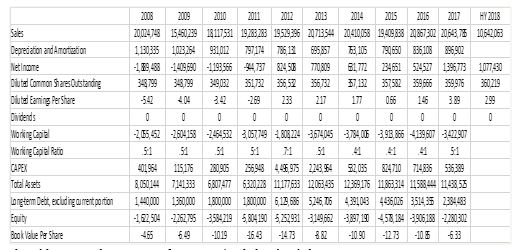

The company posts their financials on OTCMarkets.com, although their reporting is not the most punctual. The 2017 Annual Report was just posted a few weeks ago in August 2018. From 2012 through the first half of 2018, the company has sustained profitability. Below is a Five Year Highlights Table the company provides in their Annual Report, but I’ve consolidated two to show the last decade.

The table gives a clear picture of Homasote’s Jekyl and Hide history.

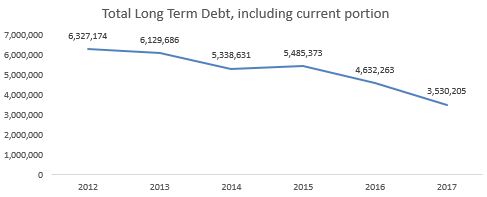

At this point you’ve probably picked up on a few things. At a superficial glance, the company looks really cheap on an earnings basis. It’s trading at a trailing P/E of 2.2 (10.57/4.77). This is what perks investors excitement. Two, the company has used that profit stream to take a chunk out of the debt and subsequently reduced the equity deficit to negative $6/share at the end of 2017. Looking at the below chart, we’re starting to infer that this must be a turnaround. We’ve seen it in the movies so many times that we immediately identify the same story playing out in real life.

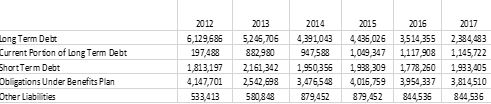

These results are good and well. The company has survived and scrapped back. But here’s where we typically pump the brakes a little and try to force ourselves to be rational. We know that it can’t all be good news. When we look at the balance sheet, it’s clear that the creditors still own the company.

Now the brain starts searching for a way to discount or justify the remaining leverage and pension obligations. We want to believe it’ll get paid down before the company experiences a downturn and that the 2002-2011 period won’t happen again. The company has turned a new leaf, right? To be fair, the company has come a long way and their results have been impressive.

Take a look at the aggregate maturities of long-term debt in 2013 compared with 2017:

| 2014 | 0.88M | 2018 | 1.2M | |

| 2015 | 2.78M | 2019 | 2.3M | |

| 2016 | 0.45M | 2020 | 0.05M | |

| 2017 | 0.48M | 2021 | 0.03M | |

| Thereafter | 1.53M | 2022 | 0.02M |

At some point, data points translate into narrative. We start to form a story. We create a hypothesis about what will happen, and we look for specific verbiage and numbers to back it up.

One of these data points is the companies $1M H1 2018 net income. With such a strong first half, certainly, they’ll be able to pay off the 2018 obligations, leaving just the short-term debt, pension, and 2019 LT obligations. Compared to what they’ve already accomplished, they’ll certainly be able to make it over the hump….

The search continues………………

The company has 2 major input costs to their operations, which can shift their gross margins substantially. The first is the cost of energy, both electricity and natural gas, and the second is recycled paper. Last year, an 18% shift in the price of natural gas had a 3% impact to their gross profit while a 5% increase in the cost of paper swung it 6%. If you’ve been following economic news at all, you’ve likely heard about China’s ban on foreign waste. This event has depressed the costs of virtually all recycled products (including paper) in 2018 and must be a strong tailwind at Homasote’s back. This is the catalyst we’ve been searching for. We can always find one if we dig hard enough.

Furthermore, Homasote has an improvement in the works for that other big input cost- energy. In 2012, the company installed an expensive Cogeneration System to supply “substantially all” of the plant’s electricity requirements in addition to the heat required for the pulping process. In 2014, an equipment breakdown occurred which prevented the company from utilizing the Cogen System. Since then, the company has been in the works to resolve the insurance claim and find the funding to restart the system. According to the latest filing, “last year we talked about, again, restarting the Cogen facility to benefit from its heating of our process water while producing a good portion of our plant electricity. As of this writing, that work is about to start.” Now we’ve got catalyst #2.

These are legitimate plans, they may come to fruition. It’s true, the stock may triple or more. Remember, there’s a probability to everything, but what happens when we turn the hypothesis upside down? If we’re honest, investors always tell themselves that they can argue the other side of the investment, but at this point, are we really being intellectually honest with ourselves? Have we already over-weighted the probability of the upside? Can we now assign an accurate probability to the downside? Well, if the heart rate is slightly elevated and your neurons are releasing dopamine, maybe not.

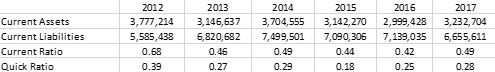

When we argue the downside, it goes something like this. Homasote is a no-moat, leveraged, cyclical, commodity business. They have several macro-economic risks, are heavily reliant on the housing industry and commodity inputs, and are funding operations with presumably expensive, short term debt. Liquidity ratios still show signs of distress.

They’ve been unsuccessfully pursuing a restart of their Cogen System for several years and their estimated completion has been delayed by more than 4 years now with the estimated cost increasing 50%. The company will pay for the 1.2M project, in-part, with more debt. The project may never be completed. Furthermore, the company routinely requires substantial investment to both their facility and equipment. If the company ever does shore up the balance sheet and produce free cash flow, there’s no way of knowing how management will allocate the capital. The CEO may be an empire builder or sink it into expensive projects. Even if the housing market stays strong, Homasote managed to lose money in 2007 & 2011 real estate bull markets. If they start losing money again, the price could very well return to its low of $0.25/share.

They’ve been unsuccessfully pursuing a restart of their Cogen System for several years and their estimated completion has been delayed by more than 4 years now with the estimated cost increasing 50%. The company will pay for the 1.2M project, in-part, with more debt. The project may never be completed. Furthermore, the company routinely requires substantial investment to both their facility and equipment. If the company ever does shore up the balance sheet and produce free cash flow, there’s no way of knowing how management will allocate the capital. The CEO may be an empire builder or sink it into expensive projects. Even if the housing market stays strong, Homasote managed to lose money in 2007 & 2011 real estate bull markets. If they start losing money again, the price could very well return to its low of $0.25/share.

Maybe Homasote will end up being the ultimate comeback story. But there’s also a saying in Puerto Rico that says, “Tanto Nadar Pá Morir En La Orilla.” It means- so much swimming to die at shore. In the end, it’s better to spend your time and money focusing on entrenched, boring stocks with P/E’s of 15 that will consistently compound, rather than these ultra-cheap roulette wheel companies.

Readers may or may not relate to the way the investment case was formed. There was modest exaggeration for purposes of illustration. But whether you do or don’t, every investor knows the temptation. We can all relate to experiencing “cocaine brain” when looking at a company like this, even the guys who coined the terms: “heads I win, tails I don’t lose much,” and “the first rule of investing is to never lose money.”