Inseego (INSG): A Uniquely Positioned 5g Company

Write-Up by Long-Short Value

- With ZTE and Huawei recently shut out of the US and Canadian Market and likely most European Markets, Inseego is uniquely positioned to take advantage and gain market share in mobile connectivity at a crucial time in the 5g cycle. This Chinese OEM ban has pushed several customers to recently sign design and development deals with Inseego.

- Inseego’s new management has a depth of experience in telecommunications equipment and has positioned the company for both the 5g Hardware cycle and to expand its Telematics Business (CTrack) into new markets

- Inseego’s customer relationships with Verizon and close ties with Qualcomm make it the premier connectivity partner in the US and Canada.

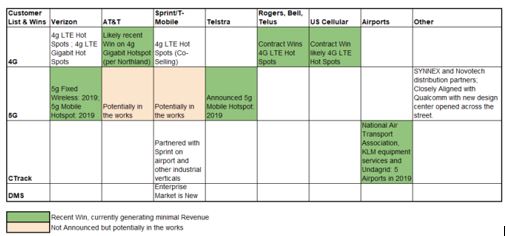

- Inseego has recently signed all Tier 1 Carriers in the US and several other carriers in the US, Canada, Australia, and Europe for either their 4G LTE, Gigabit 4G LTE, or 5G products. Several of these recent contract wins have yet to begin producing any material revenues and are expected to ramp up in 2019 significantly.

- Inseego’s Enterprise SaaS business (DMS and CTrack) operate in an extremely attractive high margin segment. Recent wins for CTrack in the Aviation space will help propel the segment to high teens to low twenties revenue growth over the next few years.

- My base case valuation of Inseego is $7.80 a share, Upside Case could be well above $10 a share if Verizon 5g Fixed Wireless is a success.

Inseego Summary

Inseego is a Telecommunications Equipment and Enterprise SaaS design and development company with products focused on the Internet of Things (IoT) and Mobile Solutions. Inseego is one of the few US based companies that makes Mobile Connectivity products like 4G Hotspots that traditionally compete with Chinese companies like ZTE and Huawei. Inseego is closely aligned with Qualcomm and Verizon highlighted by the new design center they opened across the street from Qualcomm and the recent showcasing of the Verizon 5g NR utilizing the Qualcomm Snapdragon chipset. Inseego has undergone several recent management changes and a restructuring which started with the hiring of Dan Mondor as the new CEO in June of 2017. Dan has a very solid background in the Telecommunications Equipment space with experience as CEO of SpectraLink and as CEO of Concurrent Computer Corporation (CCUR). Dan has assembled a stellar team to position Inseego for the coming 5g Telecommunications Cycle.

Here is a primer on 5g (Mckinsey Link) as it is a key component of the thesis around Inseego. 5g will bring not only faster speeds to wireless but also lower latency, which is important in applications like medicine, connected cars, and many IoT applications. I have done an extensive amount of research on 5g and I believe it is a much larger step change from both a performance standpoint and an infrastructure investment standpoint than the transition from 3g to 4g.

Inseego has two businesses, Mobile Connectivity Solutions Hardware (Mobile Solutions) and SaaS, Software, and Services (Enterprise SaaS). Mobile Solutions is a hardware business that designs, develops, and sells mobile hotspots, wireless routers for IoT, USB modems, integrated telematics and mobile tracking hardware devices primarily under the “MiFi” brand. This hardware business is highly cyclical and driven by the Telecommunications upgrade cycle, of which the next rollout is about to begin with 5g. Their Enterprise SaaS business is broken into two major offerings, CTrack which is their Fleet SaaS Telematic’s business and a Devices Management Systems (DMS) business.

5G Opportunity is Really Big

I came across Inseego when a fellow investor pointing them out as a potential way to invest in the coming 5g upgrade cycle. Inseego’s opportunity within the US, Canada, and Europe has increased significantly over the course of 2018 due to the serious worries over allowing Chinese Networking maker’s products into the US, Canadian, and European Markets. Here are two articles explaining the situation with ZTE and Huawei, Link & Link. This could only get more positive for Inseego if the White House issues a formal ban for Huawei and ZTE in the US. The big three US Telecom providers (AT&T, Verizon, and T-Mobile) are already clearly not going to use Huawei and ZTE for anything due to regulatory and security concerns, but many smaller rural Telecom providers who do use them will likely have to drop them going forward. This has all pushed several Telecom providers to sign recent deals with Inseego for both 4g and 5g mobile solutions (see Customer Table in Valuation Section for further deal details). You can expect this trend to only increase as we get closer to the 5g rollout in 2019 and 2020. This is an incredible tailwind for Inseego and several other network hardware providers like Ericson and Nokia.

Inseego is a key partner to Verizon. Inseego has had a great relationship with Verizon for many years providing it most of their 4g hotspots which generated a high portion of Inseego’s revenues (~51% in 2017). Verizon is getting ready to roll out their 5g Fixed Wireless offering in 2019, which Inseego is the key designer and developer. 5g Fixed Wireless is a new offering that is aimed at competing with broadband service from the cable companies. 5g Fixed Wireless is different than a wireless hotspot in that it needs to be installed in a stationary spot in your home and have a special antenna attached. 5g Fixed Wireless is essentially very similar to broadband, but instead of a fiber wire going into your home, you have a high powered Wifi receiver that connects to a 5g cell located within a quarter mile. It basically just cuts out the last 1000 feet of fiber or cable from the system. While many are skeptical of 5g Fixed Wireless, Verizon CEO Hans Vestberg is very excited about it and 5g in general. Verizon is targeting the 5g Fixed Wireless market in the US at 30 Million homes “over the next few years”. These will largely be in Urban areas where the spectrum dynamics of 5g make the rollout economic, but that could be a huge market for Inseego in and of itself.

Outside of 5g Fixed Wireless, Inseego has contract wins around 5g Hotspots (similar in use & design to the current 4g LTE or 4G Gigabit hotspots) with Verizon and Telstra. A few other recent contract wins in 4G Hotspots likely include Rogers, Telus, and Bell in Canada and US Cellular in the US, and potentially AT&T with the 4G Gigabit Hotspots although it has not been confirmed. Almost all the recent contract wins have yielded minimal revenues in 2018 and will ramp in 2019. The 5g opportunity is still very early and it is believed Inseego is in conversations with over 10 potential clients for 5g products.

Enterprise SaaS

Inseego’s Enterprise SaaS segment houses two separate businesses inside it, their Device Management System (DMS) business and their Telematics business called CTrack. CTrack is the more interesting business of the two. CTrack is a very highly desirable SaaS business that operates in three verticals, Airports, Small and Mid-Sized Business (SMB), and Fleets. Telematics businesses have been extremely attractive acquisitions targets recently highlighted by TomTom Telematics and Fleetmatics (FLTX) being acquired at 6x to 8x revenues. Inseego recently brought on John Weldon, a former Verizon Connect manager, to run the CTrack business and help expand the business into new verticals and offerings. The Airports vertical has seen recent success with customer wins at National Air Transport Association, KLM equipment services, and Undagrid. 5 Airports will roll out CTrack in early 2019 based on these wins, and it is expected to expand to other airports within those networks over time.

Inseego’s DMS business is a lower value business than CTrack, but they have partnered with Sprint and T-Mobile in the space to expand from just focusing on Governments into the Enterprise space.

Valuation

To forecast out the future of Inseego you first need to understand the recent contract wins and how those will affect next year’s revenues and EBITDA. I put together the below table to help break down the recent contract wins and upcoming revenue channels.

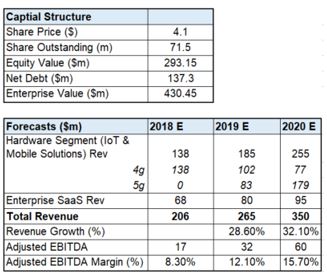

Based on the above list of contract wins and taking into account recent analysts’ projections I came up with a two-year projection of each business, and even took a stab at breaking Mobile solutions down by 4g & 5g products.

Based on the above list of contract wins and taking into account recent analysts’ projections I came up with a two-year projection of each business, and even took a stab at breaking Mobile solutions down by 4g & 5g products.

I think my projections are likely P50, but it is very hard to tell how many of these contract wins will turn into revenue, especially the 5g Fixed Wireless with Verizon.

I think my projections are likely P50, but it is very hard to tell how many of these contract wins will turn into revenue, especially the 5g Fixed Wireless with Verizon.

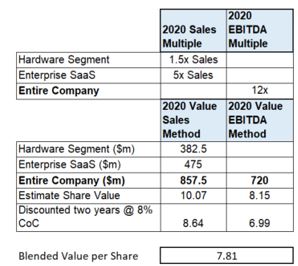

I used two separate valuation methodologies to determine a 2020 value for shares (Sales Multiples and EBITDA Multiple), then discounted it back two years at an 8% Cost of Capital. Feel free to use whatever your own hurdle rate is to determine your own valuation. I arrived at a blended valuation of $7.81 a share, or about 90% upside from here.

If everything takes off and scales quickly, there could easily be an upside case in which 5g Revenues scale to +$350m quickly. Inseego did $250m of hardware revenue with Verizon at the peak of the 4g cycle, with just the 4g hotspot. With the current customer list, Inseego’s peak 5g Hardware revenues could be 2-4x that amount.

If everything takes off and scales quickly, there could easily be an upside case in which 5g Revenues scale to +$350m quickly. Inseego did $250m of hardware revenue with Verizon at the peak of the 4g cycle, with just the 4g hotspot. With the current customer list, Inseego’s peak 5g Hardware revenues could be 2-4x that amount.

From funding perspective Inseego recently raised $20m in equity capital via shares and warrants in August from two notable institutional investors. The two investors were Tavistock Group (Billionaire John Charles Lewis) and North Sound Partners (Former Elliot Head Trader) whom I would consider to be smart money. This capital will help support the 5g rollout. Both investors have also picked up more shares as recently as a few days ago per SEC filings.

Inseego’s has a significant amount of debt right now for their size at $137m. I expect with the fact they just turned EBITDA and CFO positive they will begin deleveraging their balance sheet in 2019. This deleveraging should also bring additional value to shareholders, as management has said their second priority behind funding growth is deleveraging their balance sheet.

Catalysts

- Verizon 5g Fixed Wireless is successful

- More contract wins as Telcom providers distance themselves from ZTE and Huawei

- 2019 Ramp of existing contract wins alongside of the 5g rollout

- CTrack expansion of service offering and Aviation rollout begins

- Two well-known investors are involved buying large stakes

Risks

- Recession or other issues slow 5g rollout timing

- Additional competition enters the space as 5g rollout begins

- Verizon 5g Fixed Wireless offering fails miserably

- ZTE and Huawei get back access to US, Canadian, and European markets (low chance with current administration)