Kaanapali Land (KANP): A Super Illiquid Speculation on Hawaiian Land

Member write-up by DAVE ROTTMAN

Overview

Kaanapali Land LLC (KANP) is a business that owns land on Maui, one of the major Hawaiian Islands. Because Kaanapali is the name of the region of Maui that Kaanapali Land LLC owns land in, this report will refer to the business as KANP.

The island of Maui was formed by two volcanos that grew next to and eventually into each other. This is referred to as a volcanic doublet. The western part of the doublet is mostly mountainous forest reserves in the interior. Moving “makai”, meaning “towards the sea” in Hawaiian, the landscape changes to agricultural land. Finally, the coastal areas are filled with residential and commercial activity. It is on the western coast of the west side of Maui that Kaanapali is located, minutes away from the Kapalua Airport.

KANP has a rich history going back over 150 years. In the beginning, the company was called the H. Hackfeld & Company and began as a general store opened by a German boat captain, only later branching into other activities such as sugar production land ownership. Through a series of events around the time of World War I, it became acquired by a group of businessman and was renamed American Factors and later Amfac. Amfac was one of the “Big Five” in Hawaii, a powerful group of corporations that controlled 90% of sugarcane production – a huge component of Hawaii’s economy – during part of the 20th century. During this time, sugarcane production was Amfac’s focus, and at its peak it owned 60,000 acres of Hawaiian land. Because of their control over such a huge portion of the economy, the Big Five wielded a large degree of political clout. In the 1950s, political change and international competition damaged the economics of sugarcane production in Hawaii, and the Big Five entered a period of decline that was characterized by declining sugarcane production and diversification into other industries. In 1988, Amfac was bought out by JMB Realty for $920 million, a very large real estate developer based out of Chicago. During the continued period of sugarcane decline, much of the property related to sugarcane and other activities was sold off. In 2002, Amfac declared chapter 11 bankruptcy due to operating losses related to agricultural operations and to a lesser extent other smaller operations including golf course businesses, coupled with an unmanageable debt load. The business emerged from bankruptcy in 2005 as Kaanapali Land, LLC and is the reorganized entity from Amfac Hawaii and a few other entities. The stock became available over the counter in 2007. Today, KANP is focused primarily on land development, although it produces a small amount of coffee, too.

Before proceeding, it is relevant to mention that KANP is similar to another business that has been discussed on Focused Compounding: Maui Land & Pineapple (MLP). If you have not read the report on MLP, it is recommended you do so, as understanding MLP will help with understanding KANP.

The Business

Land Development

KANP is essentially a real estate development company. KANP owns 3,900 total acres, of which 1,500 are conservation land and 2,400 are potentially economically useful land.

The company’s 10-K gives a concise overview of KANP’s operations and risks:

“The primary business of Kaanapali Land is the investment in and development of the Company’s assets on the Island of Maui. The various development plans will take many years at significant expense to fully implement… Proceeds from land sales are the Company’s only source of significant cash proceeds and the Company’s ability to meet its liquidity needs is dependent on the timing and amount of such proceeds.”

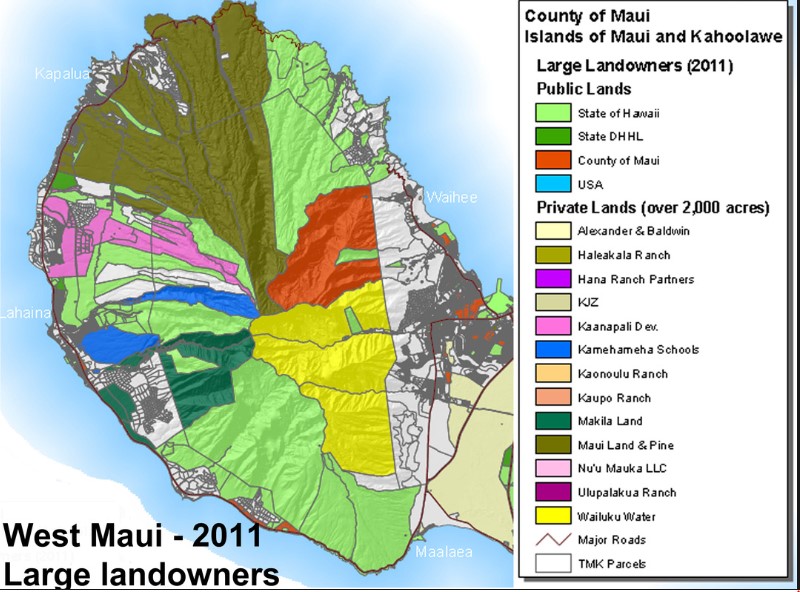

It is helpful to have a visual representation of KANP’s land. The following graphic was constructed using 2011 land ownership data, which is similar to 2018 data as KANP has not had significant changes in its landholdings. On the map, KANP’s land is the pink portion that runs from coast to island center along the western portion of the land. Maui Land & Pineapple’s land is the dark green/brownish portion along the northwest portion of the island. For both KANP and MLP, the portion of land most valuable is that closest to the coast with development potential. For both companies, this represents only a small portion of the total land held, as much of the land is conservation land that is unlikely to ever be of economic value.

In addition to developing this land, KANP operates coffee farms. Beginning in 2006, KANP developed a 336 acre project called Kaanapali Coffee Farms which consisted of 51 agricultural lots. After completion, KANP offered these lots for sale to individual buyers and has sold all but 4. Although the lots are owned by separate landholders, KANP farms and markets the coffee. In KANP’s 10-K, Agriculture operations are broken out separately from Property, but the truth is KANP’s agricultural operations in 2018 going forward are limited to the cultivation, milling, and sale of coffee related to Kaanapali Coffee Farms orchards, not an especially large operation. In recent years, the Agricultural operations have been slightly unprofitable. For purposes of analyzing KANP as a whole, the Agricultural operations are immaterial, generating a small cash burn on the overall business.

Focusing on the core of KANP’s value, investors need to understand that although they have 1,500 acres of non-conservation land, this land is not uniformly valuable and the overwhelming majority of it is a very long time away from being legally positioned (i.e. zoned/entitled) to develop. Even more so than other states, obtaining entitlement from local governments is a slow and potentially costly process in Hawaii that faces fierce resistance from many local groups that resist development including local groups, environmental organizations, civic groups, condominium associations, politicians with no-growth agendas, and more.

With that said, KANP does have a plan. The company’s focus is holding land for development rather than investment, and seeks to enhance the value of the land in phases. A recent example of this was the development of the Kaanapali Coffee Farms which, after the lots were developed with residences, sold for around $225,000 on a per-acre basis. This is an example of, on the high-end, what KANP hopes to accomplish.

The current focus of the business is the Kaanapali 2020 project. The development consists of 913 acres with the majority located near the Kaanapali resort area along the coast. These development lands have been part of a community-based planning process that commenced in 1999. The development’s plan includes a mix of residential, commercial, quasi-public, recreational, acute care medical facilities, agricultural, rural, and open space. As to not overstate the potential of this development, most of the oceanfront properties have been sold, but the remaining property still remains to be developed. However, the majority of the property under this development plan is still subject to approval and regulation by various state and county governing entities. It is extremely difficult to assess the timeline in front of Kaanapali regarding the development of the land. As of the present, the only portion of the Kaanapali 2020 land that has the necessary entitlements to proceed with mixed-use developments is the Puukolii Village development which is approximately 300 acres.

It may seem that after 20 years KANP is not making much progress, but the progress to date is consistent with the company’s comments that the Kaanapali 2020 development will be completed in phases over approximately 50 years.

The Puukolii Village is comprised of two parcels: the Puukolii Triangle and Puukolii Mauka. The Puukolii Mauka development is the priority between the two, with a focus on developing affordable and market housing units, a small commercial area, a school, a park, and the improvements associated the preceding developments.

More broadly speaking, the company is aiming to proceed through the entitlement process and obtain classification of more of its land as urban. As a side note, at the state level in Hawaii, all land is divided into four land-use classifications: urban, rural, agricultural, and conservation. Since the majority of the Kaanapali 2020 plan’s land is currently classified as either agricultural or conservation, KANP has a lot of work ahead of it. KANP has directly stated that it does intend to apply for reclassification for a portion of its agricultural land and perhaps some of its rural land to urban, but it does not intend to reclassify the conservation lands. This is why zero value should be ascribed to the conservation acres.

Still, despite the long pathway ahead of them, KANP has seen positive signs. In 2012, Maui County updated its General Plan which included maps with directed growth areas. In this Plan, they recognized the Kaanapali 2020 development plan to be within the urban growth limits, which speaks towards the long-term outcome to be expected. There is a long way to go, but there is good reason to believe that much of KANP’s development plans will ultimately be completed. It is just uncertain when, with what restrictions, at what cost it will be able to do so. These are very large uncertainties.

In fact, this is one of the biggest uncertainties facing KANP. It is not at all clear how the business will ultimately monetize its landholdings. There are a few ways a company such as KANP can monetize their land. They can either sell the land directly to an entity with a use (e.g. a builder), they can contribute the land to a joint venture with an entity with a use, or they can take on debt to develop the land into something else. The company’s communications through their SEC filings and website indicate a strong preference for developing rather than simply selling land. Therefore, if management is taken at their word, the second two options seem most likely. With that said, option three is contingent on finding adequate financing and completing large projects themselves. This comes with risk, as does development through a joint venture. Of the three options, the first option seems the least risky, but as stated above is not the expressed intention of management. Despite this, KANP basically did this with the 230 acre Wainee Lands development. This project was listed on their website and discussed for some time as a development, but was ultimately sold essentially as undeveloped land, despite this land being shown in the Maui County’s General Plan as a future urban area, and therefore at much lower value than could be realized through alternative means. This sale must be weighed against management’s stated intentions and considered as a real outcome for more of their landholdings.

The above discussion is useful in gaining a sense of the possibilities, but does not assign probabilities to the likelihood of each. The actual process of monetizing the land is a key driver of value at KANP, and it is ultimately one that investors do not have clear insight into. This makes KANP a stock with a highly uncertain future. This is not to say it is necessarily risky, but that its potential value is very uncertain and thus spans a wide range.

Cash Flow

The implications of this long, uncertain process of land development are that KANP needs to be able to sustain itself for quite a long time to come. How it will do this is not clear. As discussed above, KANP’s agricultural operations are not profitable. Considering both its losses from its Agricultural operations and the corporate costs of running the business, KANP generates approximately $2.5M (million) of operating losses per year. This is not a favorable situation for a business with a long horizon to realize value.

To support itself, KANP has sold off various parts of its landholdings over time. At first blush, this may sound similar to Sears’ recent past, but to date KANP has not sold off material amounts of its assets, and the prices realized on those sales seems reasonably attractive. These sales will be discussed later in the report, but the real (inflation-adjusted) price per acre of realized sales points to a range of value between $36,000 and $180,000 per acre. Several sales that failed to go through for one reason or another were for even higher amounts, but as they did not go through are not as useful in estimating value. It is reasonable to expect that, going forward, KANP will continue to make strategic bulk sales of land to fund the Kaanapali 2020 developments.

To put this into context, though, it is necessary to understand that in the past decade KANP has generated a large portion of its cash requirements through the sale of the Kaanapali Coffee Farm lots. The development and sale of these lots is an example for what KANP is trying to accomplish with the Kaanapali 2020 project, so the successful implementation and follow-through of this project, while one-time, does indicate a successful strategy. Still, it is important to keep their cash flow situation in mind, with recognition that, as the company says, “The Company has found it necessary to sell certain parcels in order to raise cash rather than realize their full economic potential through the entitlement process.” Or, as they say at another point in the 10-K, “Proceeds from land sales are the Company’s only source of significant cash proceeds and the Company’s ability to meet its liquidity needs is dependent on the timing and amount of such proceeds.” This may seem redundant, but this point cannot be overstated in grasping KANP’s ongoing cash flow situation and the real risk of value impairment it faces if it is forced to make sales of land below its full economic potential.

Further bolstering the case for KANP’s liquidity over the next decade and on is its cash and pension holdings. As of 03/31/2018, KANP has $31M of cash and $14M of net pension assets. As KANP has about $12M of Other Liabilities, it is more reasonable to say that they have accessible cash of $19M. Ignoring any land sales and taking into account the cash burn rate discussed above of $2.5M, this implies KANP can continue to operate without any major changes or actions for almost 8 years. While this seems like a long time, it is important to remember that this development will likely continue for decades to come, and development itself will require capital, so this is by no means sufficient for KANP’s long-term plans.

The pension assets are more uncertain. The overfunded pension situation came about by KANP transferring the obligation to pay benefits for 96% of the pension obligations to Pacific Life Insurance Company in 2016 in exchange for cash. This puts KANP in a position now with less than $1M of pension obligations and around $15M of pension assets. KANP states in its 10-K that it does not consider these assets a source of liquidity. However, they are sitting on net pension assets of $14M, which represents around 20% of their current market cap. It seems likely that there is some plan to utilize these assets, but given the difficulty and cost of doing so, it does not seem prudent to assign much value to the assets. Investors with a strong understanding of pension laws can assess the situation more accurately, but it is conservative to assign no value to these assets.

Valuation

Valuing KANP’s stock is challenging due to characteristics of the business itself and the land and land development projects.

First, there is a significant amount of net cash ($10 per share) and overfunded pension assets ($8 per share) that are of uncertain value. While the cash is clearly a large portion of the company’s current market capitalization, the business also loses money on its ongoing operations and only generates cash through property sales. This should indicate a conservative valuation would consider the cash to be pegged for sustaining the business throughout the development period. Regarding the pension, it is simply unclear what, if anything will happen with this. It may be too conservative to assume zero value, but it is speculative to assume it will be fully available. These two factors combined can sway the value of the company up or down by $18 per share depending on assumptions.

Next, as discussed above, KANP’s ongoing business is unprofitable through a combination of agricultural losses and corporate costs. This is despite a strong economy. If the economy were to sour, KANP could be hit even harder and it could burn though its cash, forcing it to make unfavorable land sales. In the best case, this would slightly erode the value of the business, and in the worst case it could create solvency issues. Therefore, it is simply unclear as to how strong KANP will be going forward. The large cash balance and pension offer a potential offset to this, but this is a very real risk for investors to consider.

Further, the actual value of KANP’s landholdings is difficult to ascertain. This is for two reasons. First, the land is fairly diverse with a range of potential uses. That is, it’s not all the same, so it’s difficult to find adequate comparables to apply to the amount of land. Second, the timeline for developing Kaanapali 2020, despite its name, is uncertain and likely way out in the future. So not only is the ultimate value difficult to ascertain, but when and how that value will be realized is difficult to determine, too.

Past Transactions

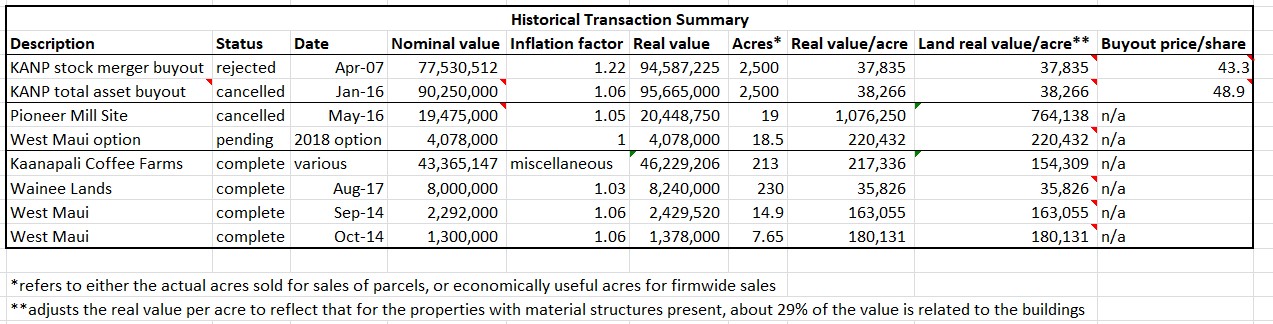

Despite these factors, there is data that points towards what KANP’s landholdings may be worth. The following table breaks out a series of past offers for KANP’s stock/assets that were rejected by KANP or retracted, data on what several failed or pending sales of KANP’s land went for, and data on consummated transactions.

This data does not provide perfect data in valuing KANP, but it does give a general idea of what this sort of land and the business could be worth. The data has been adjusted for inflation to reflect the significant timing differences between the transactions. To summarize the table, two separate transactions spread over a period of 10 years valued KANP’s total landholdings at around $50 per share. One transaction that was cancelled for high-value land went for $764,000 per acre. Another transaction that is pending may go for $220,000 per acre. And four transactions that were completed show land goes for between $36,000 per acre and $180,000 per acre.

To disaggregate this data more, the Wainee Lands sales point towards the value of land that is largely undeveloped and zoned for agricultural of $36,000 per acre and Kaanapali Coffee Farms sales point towards land value of $154,000 per acre for land that has been fully developed. This provides some context for a range of value for KANP’s landholdings.

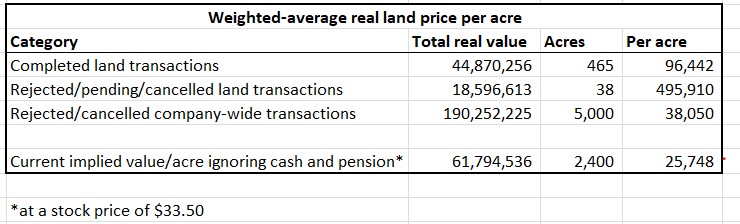

The following table aggregates the above data further while weighting the per-acre values based off the quantity of land involved. This is done so as not to overweight the effect of high-value but low-acreage land sales.

What is clear from this table is that the current trading price of KANP’s stock (~$33.50) values land in aggregate around $26,000 per acre, whereas past transactions suggest that KANP’s land value could be materially higher. How much higher is a function of how similar the remaining land is to the land previously sold, how well KANP is able to develop the land, and how long it will take to develop the land.

Calculation a Range of Value

To value the business accurately, investors need to take a more granular look at KANP’s landholdings. And as the case with most businesses, it makes more sense to paint a range of value for KANP as opposed to one value. The following analysis attempts to do this.

There are four pieces of KANP’s landholdings that can be valued separately: the 913 acres of potentially developable land in Kaanapali 2020, the non-developable non-conservation land, the remaining coffee lots, and the Pioneer Mill site. There are different assumptions one can apply to them depending on conservative, moderate, and aggressive assumptions.

Regarding the 913 acres of potentially developable land in Kaanapali 2020, a reasonable estimate of value can span from land values of around $36,000 per are (the lowest price land transactions have gone for in the first table above) to land values of $96,000 per acre (the average price land transactions have gone for). To assume value per acre much higher is speculative as the properties that have gone for larger amounts were uniquely valuable and are unlikely to represent the likely outcome for the remaining acres. While this range of value is large, it seems reasonable. This implies value of $33M to $88M.

Regarding the remaining 1,468 acres that are not developable in the Kaanapali 2020 development, it is reasonably conservative to apply a $10,000 per acre value. This is at the higher end of what agricultural land goes for on the mainland US, but is low in relation to listings for similar land in west Maui. This implies value of $15M.

Regarding the remaining 4 coffee plots, applying the average per-acre value (~$217,000) to the average number of acres per plot (~5.2), this implies value of $4.5M. A range of value is not used here as there is extensive data on what these lots go for.

Regarding the Pioneer Mill site, there was a transaction that failed to go through that points toward the value of these 19 acres. A reasonable estimate of value is 50% to 100% of the offer for these acres. This implies value of $10M to $20M.

The preceding numbers all reflect the amount of cash KANP would receive before paying income taxes. It is difficult to estimate to the rate of taxes KANP would pay on its gains. If it is assumed they would pay taxes on 100% of the sales price, the rate would come to around 26%, as Hawaii has a high state income tax rate. However, KANP carries land on its books at a financial accounting basis of $63M. But around 40% of the land is for conservation land that would not be sold. So, if it is assumed that half of the $63M is tax basis for the land sold, then even under the aggressive sales price assumptions KANP would only be paying an effective rate of around 20%. For purposes of analysis, 20% is reasonable and conservative. Therefore, the value of land should be reduced by 20%.

The preceding discussion focused on the value of the land, which is by far the lion’s share of KANP’s value. However, as discussed above, KANP also holds material net cash and an overfunded pension. Conservatively it makes sense to assign no value to the net cash and pension, as they are either likely to be used to finance the business or uncertain as to the eventual outcome. Under aggressive assumptions, an investor could assign half of the value of each: $9.3M available of net cash and $7.2M available of pension assets.

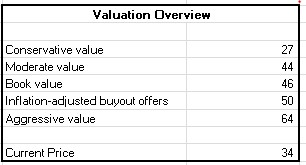

Under these assumptions, a conservative valuation comes to $27 per share, moderate valuation comes to $44 per share, and an aggressive valuation comes to $64 per share.

Book Value

In addition to coming at value from the bottom up, it is useful to note that KANP has a book value per share of $46. As the land has been on the books for some period of time, it is reasonable to consider whether that amount is conservative. Since the company has shown consistent gains on its property sales, it seems likely that the book value of land is conservative.

Further, the company has recorded a deferred tax valuation allowance for $9.6M, which is the full amount of the NOL tax benefits. The facts suggest the $11M net deferred tax liability may be overly conservative. For example, the company utilized $1.7M in 2017. This is an example of a company saying one thing and doing another. They are recording a valuation allowance for the full amount of the NOL benefit, saying the NOLs are not likely to be utilized, but yet they have in some years used them when they had land sales, a trend likely to continue. For background, the Federal NOL tax benefits of $6.9M were generated in 2006 and later years and expire started in 2026, and state NOL tax benefits of $2.6M expiree between 2019 and 2035. The point is that considering the company has a history of generating profitable land sales, it seems reasonable that at least some of the $9.6M of tax benefits will be utilized in the coming years. This implies there may be up to $5 per-share of value from tax savings that the balance sheet is not reflecting.

As an offsetting factor, the recorded value of the overfunded pension is unlikely to represent its true economic value to KANP, as discussed above. It seems unlikely that KANP will be able to extract more than 50% of the recorded value of these pension assets. Subtracting out the full amount of the pension would lower the book value by $8.

Assorted Transactions Value

Between 10 and 15 years ago, KANP went through a period with several interesting transactions.

First, in 2003 and 2005 they had two land sales for 40 and 27 acre lots that went for over $800,000 per acre. Although this is interesting, it is not directly useful in valuing KANP’s land today, as they do not hold beachfront property anymore.

Second, in 2007 KANP entered into merger agreement whereby shareholders would receive a right worth $43.25 per share in exchange for their shares. This is interesting because although KANP has sold off a relatively small amount of land and closed down some of their small operations (e.g. golf), it has not changed substantially in the subsequent period. So, on a per-share basis (the share count has not changed during this period), investors over a decade ago were offered $43.25. An investor group filed a lawsuit against KANP and Pacific Trail Holdings, its largest shareholder, which led to the merger being terminated, on claims that the offer undervalued the company.

Finally, in 2016 KANP was offered $95M (around $49 per share) for all of its real property and related assets. The buyer failed to deliver their acceptance notice on schedule, so this transaction ultimately failed to execute.

These events are not helpful in directly assessing KANP’s value as they were either unrepresentative of KANP’s landholdings or not actually consummated, but they do provide clues as to what some other parties thought KANP or KANP’s assets were worth. In the case of the latter two examples, the purchase of all of KANP’s assets, the fact that the implied inflation-adjusted value per economically valuable acre was so similar (~$38,000) helps investors triangulate towards value.

Valuation Summary

The following table summarizes all of the different calculations of value in table form:

The range of these calculations of value is large: $27 conservatively calculated to $64 aggressively calculated, with moderate value, book value, and inflation-adjusted buyout offers somewhere in between. The current price sits in the lower range of this value, 25% above the most conservative metric of value and 53% of aggressively calculated value.

As a side note, it should be made clear that data on per-acre land values from the MLP report are not incorporated into this valuation. The reason for this is simple: MLP holds a large tract of fully-entitled land ready for development right next to an established master-planned community, a situation quite different from KANP. In checking similar properties in the Kaanapali region around the coast, it is clear that such properties go for similar amounts to MLP (land values in excess of $500,000 per acre), but again, that is not representative of the land KANP holds.

The Holding Period

It is worth discussing what is likely to happen to the underlying value of KANP’s land during the holding period. As discussed in the MLP report, the nominal price of residential housing units has increased around 6% for about 40 years. It seems reasonable to expect that going forward Maui’s land values will increase at a comparable, if slightly lower, rate.

To gain a sense of what drives tourism, a major driver of land values on the Hawaiian Islands, it is helpful to have a sense of tourist traffic. According to Hawaii.gov, the number of visitor days on all of the Hawaiian Islands increased from 53,772,839 in 1991 to 79,669,135 in 2016. The number of visitor days on Maui increased from 12,687,184 to in 1991 to 21,447,140 in 2016. This corresponds to a compound annual growth rate of 1.6% and 2.1%, respectively. The distribution of visitors between U.S. residents and international residents in Hawaii overall is 73% U.S. and 27% international, and in Maui it is 84% U.S. and 16% international. These ratios have stayed relatively consistent over the prior 25 years. Note that this metric, visitor days, just tracks the number of days tourists spend on the islands and is not indicative of the amount spent on the trip on lodging, flights, restaurants, entertainment, etc. It is simply a volume metric. As discussed above, property values on Hawaii have increased historically at 6%. It is likely that over a long period of time they will continue to grow between 4-6%. This increase in tourist volume over the last several decades helps partially explain the incrementally higher increase in Hawaiian land values relative to the U.S. mainland. It is reasonable to think that as more and more people join the middle class worldwide that demand for Hawaii tourism will continue to increase for a long time to come. This bodes well for the future of land values, and indicates that the value of land in Hawaii should continue to exceed the rate of inflation by a couple of percentage points annually.

This bolsters the case for the buy and hold investor, who, even caught in a dead-money stock for a long period of time, will see growth in the value of Hawaiian land at a rate that will exceed the rate of inflation. On the other hand, it is important to note that because an investment in KANP is not held directly, there will be the drag of corporate costs discussed above.

Overall, the long-term growth profile of KANP’s value seems decent but not overly attractive, especially considering the risks of operating losses.

Coupled with the large degree of uncertainty in the ultimate realization of value from KANP’s landholdings that could easily be more than a decade in the future, this makes KANP a stock with a very uncertain future. Specifically, the issue of uncertainty in the timing of value realization suggests that investors should be cautious in using land values to calculate intrinsic value.

In other words, because the value of the land is unlikely to be realized in the near-term, investors would be wise to demand a larger-than-normal margin of safety from an intrinsic value calculated using land values. This is simply because the corporate drag and risks of forced sales may not be offset by the rate of growth in the land’s value, and therefore the ultimate value realized by KANP may be less than the appraisal value investors calculate today.

Ownership and Liquidity

KANP has a very concentrated ownership base. Currently, Pacific Trail Holdings, a related entity to JMB Realty, owns 80% of the total stock. The owners of Certificate of Land Appreciation Notes (COLA notes) on the date of bankruptcy as a group hold another 9% of the total stock. Both of these holders are long-term investors with holding periods well in excess of a decade.

The remaining 11% of the stock is available to the public. As of the current market price of $33.50, this means that the float available to the public is around $7.1M.

The tiny size of the float leads to one of the more interesting facets of KANP, which is how illiquid of a stock it is. The 90-day average volume is around 85 shares. To put this into perspective, at a price of $33.50 per share, that is only around $3,000 per day that changes hands. The consequences of this are that this is a stock whose ownership is basically limited to individual investors with a relatively low net worth. It is not realistic that even a small fund could acquire enough shares of KANP to move the needle without spending months and months building a position.

Pacific Trail Holdings has total control of the business. It is unclear exactly what their intentions are. As discussed above, in 2007 they supported a buyout offer of $43.25, but because of litigation concerns, the company ultimately walked away from the offer. In 2016, they supported a total asset sale agreement whereby shareholders would receive approximately $50 per share, but the buyer failed to deliver its acceptance in time. Both of these transactions point to a controlling shareholder who values the business materially higher than it trades today and who has been willing to transact around $50 per share.

A Comparison

Maui Land & Pineapple has been referenced throughout this report as a business with many similarities to KANP. The following chart summarizes several similarities and differences between these two businesses:

| Attribute | KANP | MLP |

| Primary Activity | Land development | Land development |

| Location | Western coast of Maui, Hawaii | Western coast of Maui, Hawaii |

| Total acres | 3,900 | 22,800 |

| Highly valuable acres / other valuable acres | 932 / 1,468 | 900 / 12,900 |

| Progression with entitlement | 300 acres partially entitled | 900 acres fully entitled |

| Implied market value* / economic acre | $26,000 | $250,000 |

| Conservative value* / economic acre | $21,000 | $500,000 |

| Quality of comparables | Low | Moderate |

| Liquidity of shares ($/day average traded) | $3,000 | $400,000 |

| Core business profitable | No | Yes |

*ignoring excess cash and securities

The overall takeaway from the table is that MLP’s land is significantly more valuable in terms of potential use, MLP’s land is much further along the development process, MLP’s core business is profitable which allows for flexibility throughout the development period, KANP trades at a premium to a conservative calculation whereas MLP trades at a large discount, and KANP is much more illiquid than MLP.

Conclusion

Putting it all together, Kaanapali Land LLC is a real estate developer whose shares are very illiquid, very speculative, and under some assumptions very cheap. If KANP is able to monetize its land through its development plans successfully within a reasonable time period before draining its cash stores, investors purchasing stock at $33.50 will do well. During the holding period, the underlying value of the land should increase at a decent but not great clip.

But, because KANP’s development projects are likely so far in the future, its cash flow profile is currently negative, and the actual mechanism of development is unclear, it is a highly speculative stock where the actual value and the timing of any value realization is very uncertain.

Nevertheless, for investors looking to own highly illiquid stocks whose value is tied to real estate, KANP is worth considering for investment.