Keweenaw Land Association: Buy Timberland at Appraisal Value – Get a Proxy Battle for Free

Keweenaw Land Association (KEWL) is an illiquid, unlisted stock. It trades something like $15,000 to $20,000 worth of stock on an average day. The company does not file with the SEC. However, you can find plenty of information – including investor presentations, annual reports, quarterly reports, and other news – at the “company reports” section of Keweenaw’s website. You can also find news about the company – including press releases from a 26% shareholder who is trying to take control of the board – at Keweenaw’s OTCMarket.com “News” page.

Keweenaw Land Association owns timberland in Upper Michigan. It has 185,750 acres of timberland and 401,841 acres of mineral rights. The difference between those numbers – 216,091 acres of mineral rights – is “severed” mineral rights where Keweenaw sold timberland without selling the mineral rights on that land.

The company has 1.3 million shares outstanding. So, each shares of Keweenaw Land Association is essentially made up of 0.14 acres of timberland, 0.31 acres of mineral rights, some cash, some marketable securities, and some debt. Of those assets and liabilities – it’s the 0.14 acres of timberland that matters most. Unlike many of the big, publicly traded timber companies, Keweenaw Land Association is not a REIT. However, the current board has said they plan to convert to a REIT for tax year 2018.

First Let’s Deal with the Catalysts: 3 Weeks till a Contested Proxy Vote, REIT Conversion, Copper, etc.

I say “current board”, because Keweenaw is in the middle of a proxy battle that will decide board control at the April 12th vote. So, there is a catalyst here. Control of the board might flip 3 weeks from today. The party contesting the election is Cornwall Capital. Cornwall has 2 of 8 board seats right now. They are contesting 3 board seats at the April 12th election. If they win all 3 board seats, they will have a majority (5 of 8) board seats. Cornwall Capital is a long-term holder of the stock. I believe they have held Keweenaw shares for about 10 years. The firm is run by Jamie Mai (who already sits on Keweenaw’s board). Cornwall Capital owns 26% of Keweenaw’s shares outstanding. Jamie Mai was mentioned in Michael Lewis’s “The Big Short”. The Paul Sonkin that Cornwall is running on their ticket for the April 12th vote is the nano-cap/micro-cap investor who used to run Hummingbird Value, works at Gabelli, and co-wrote one of Bruce Greenwald’s value investing books. I don’t have much of an opinion on this board vote, the nominees, etc. I just thought it was worth mentioning that if you – as a value investor – are thinking the names Jamie Mai and Paul Sonkin sound familiar, it’s likely because you read “The Big Short” and “Value Investing: From Graham to Buffett and Beyond”.

Another potential catalyst is that Keweenaw could convert to a REIT. The board had previously said this was a bad idea. Now, they say they’ll do it for the 2018 tax year. A warning here: this board explored selling the company and didn’t do that and explored setting up a timberland management fund and didn’t do that either. Don’t assume there’s a 100% chance of a REIT conversion happening this year.

There’s also a publicly traded Canadian company called Highland Copper Company interested in mining on Keweenaw’s land. You can go to the mining company’s website and read about the Copperwood project. Keweenaw Land Association says the mine should begin construction in late 2018 and be online in 2020. Presumably, Keweenaw may start earning copper royalties in 2020 or 2021 if that schedule turns out to be true. Like I said, Highland Copper is a public company in Canada. So, it files things regularly that allow you to keep track of what’s happening with Keweenaw’s mineral rights. This isn’t a big lottery ticket. If you do the math on Keweenaw’s potential royalties according to the company’s latest investor presentation – it would be $20 to $25 a share in undiscounted royalties. Those royalties might never start at all. And they might trickle in for a long time. The copper isn’t a game changer here.

Finally, the company did hire an investment bank to explore a sale of the company. They ultimately decided not to sell the company. I suppose a sale of the company is still a potential catalyst now. This might be more likely if Cornwall Capital took control of the board. That is certainly the way the current board paints Cornwall’s proxy campaign. They say Cornwall owns 26% of an illiquid stock and has for many years – Cornwall wants out. The only way to do that with such a big position in such an illiquid stock is to organize a sale of the whole company. That may be true.

My own approach to analyzing Keweenaw Land Association is to just ignore all these potential catalysts. Some of the outcomes from these catalysts could be as much good as bad. I’m not sure a REIT conversion is a great idea. I’m not sure Cornwall will definitely do a better job running the company. I have no idea if that planned copper mine will ever get up and running. So, I’m going to just stick to valuing the timber.

Now Let’s Get The “Who to Vote For” Question Out of the Way

Before valuing that timberland, though, I guess I have to give my opinion on the April 12th board election. If you put a gun to my head, I’d vote for the 3 Cornwall nominees. However, I don’t think the current board or Cornwall is all good or all bad. Neither group has its interest perfectly aligned with yours. Cornwall has a lot of skin in the game. But, you can sell your position in the open market if you put in $10,000 or $100,000 or $1 million into this stock. No, you can’t sell it instantly. But, you can sell your position in a perfectly orderly way. Cornwall can’t sell a $35 million position in a stock that trades less than $500,000 in many months. So, they may have an incentive to sell the entire company at a worse price than you’d like. Also, Cornwall may be more aggressive in harvesting timber than they should be. On the other hand, there’s the risk of professional management – not owner/operator – type behavior from the board as it currently exists. For example, this board has taken on debt to buy more timberland. My general impression is that Cornwall’s policies when it comes to existing timber wouldn’t match mine if I was running the company. And the current board’s policies when it comes to capital allocation wouldn’t match mine. I don’t think a victory by either party would be a disaster for passive shareholders though. In fact, I’m not sure my appraisal of the company would change at all depending on who is in charge. The one caveat is that I’m not sure how leanly the organization could be run. If Cornwall takes over, I may be surprised that expenses I assumed were legitimate weren’t really necessary. Maybe. On the other hand, Cornwall could add expenses.

What’s important is keeping expenses as low as possible, harvesting the right amount of timber to maximize long-term returns, minimizing and deferring taxes, and minimizing the use of shareholder money when investing in more timberland. I don’t see one side or the other getting a perfect score on all those points. So, I’m pretty neutral about the board election.

One of our members – and a frequent stock idea write-up author – Vetle Forsland sent me some bullet points on why he’d vote for the incumbent board. He agreed to let me share his case for the current board with you. Here it is…

Why Vetle Would Vote with the Board

- Cornwall, a NY Hedge fund, wants three additional members on the board

-

- Cornwall wants to sell the company

- If elected, they will make up 63% of the board, while owning 26% of Keweenaw (Now they make up 25% of the board with 26% of the shares)

- Managing member states “The company intentionally under-harvests its timber in favor of increasing biological growth, (…) and is perpetually cash starved”

-

-

- In my opinion this sounds like a good decision by Keweenaw, as inflation and housing starts have been low, hurting timber prices

-

- Current Keweenaw board

-

- Plans to convert to REIT

- Sounds like the current board and management wants to continue operations as the company stands today, instead of actively trying to sell the company

- The company is extremely illiquid (days when it doesn’t trade at all) and peers are 10x+ bigger, which makes me think selling the company could be a good idea

-

- But Cornwall might just want out of the company, and could approve a lower price than what’s fair

- Keweenaw explored a sale possibility in 2017, but the proposed offers were too low, as acquirers were unwilling to pay for the capital gains created over the past 25 years

- Converting to REIT will reduce taxes on dividends from 39.6% to 29.6% after the tax cut, while eliminating built-in gains

-

- This of course could lead to better offers from bidders

- The current board have better timberland knowledge than Cornwell, knows how to generate long-term value for shareholders, and are also actively making Keweenaw more attractive to acquirers.

Therefore, I believe voting in line with the board recommendation is the right thing to do.

Okay. Now, I can talk to you about timberland. The key point is how much this timberland is worth per acre and how many acres (0.14) there are per share. We’ll do that math in a bit. But, first, I want to talk to you about timberland as an asset.

Timberland as an Asset

I wouldn’t be looking at this stock if I didn’t like timberland as an asset. Timberland is an attractive asset because it has historically provided returns more similar to stocks than to bonds or less productive land. The similarity between common stocks and timberland is that they both have a harvested yield – timber cut and sold this year and a stock’s dividend yield – and they both have retained yield (retained earnings for stocks and biological growth for timberland). If a stock doesn’t pay a dividend, the earnings will build up in the form of corporate asset growth (and often later earnings growth, dividend growth, etc.). If timberland isn’t heavily harvested, the potential harvest in future years will build up in the form of more valuable trees (and often later harvest growth). Timberland is also attractive as an inflation hedge.

The return in timberland is basically:

(Profit from the harvest / appraisal value) + biological growth rate post-harvest + the rate of inflation

So, if a company has timberland appraised at $100 million and it produces $2 million of free cash flow from timber operations and the volume of timber grows at 3% a year even without that harvest and the rate of inflation is 3%, that’s actually a return of 8% on the appraised value of the timber (2% + 3% + 3% = 8%). In the U.S., quite a lot of timber is used for housing construction. So, the two key cyclical inputs for medium-term returns in timberland are: rate of housing construction and rate of inflation. Well, for the last 10 years, the rate of housing construction and the rate of inflation have been low. This makes timberland look like a terrible investment when compared to the stock market for the period 2009-2018.

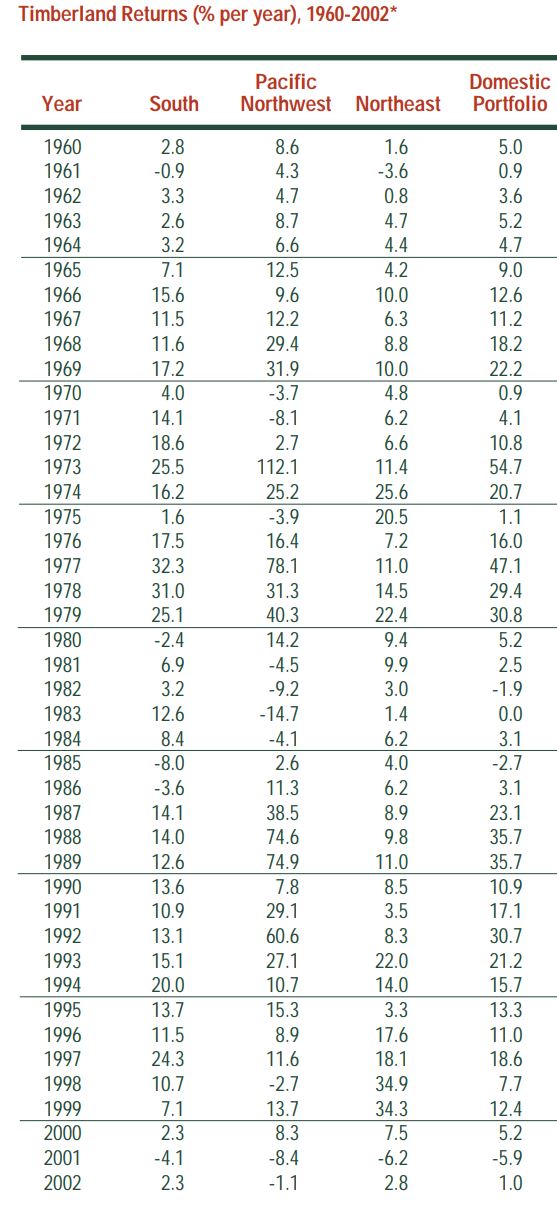

However, if we go back to the 1900s, you can see that my comparing timberland as an asset to common stocks as an asset isn’t so far-fetched:

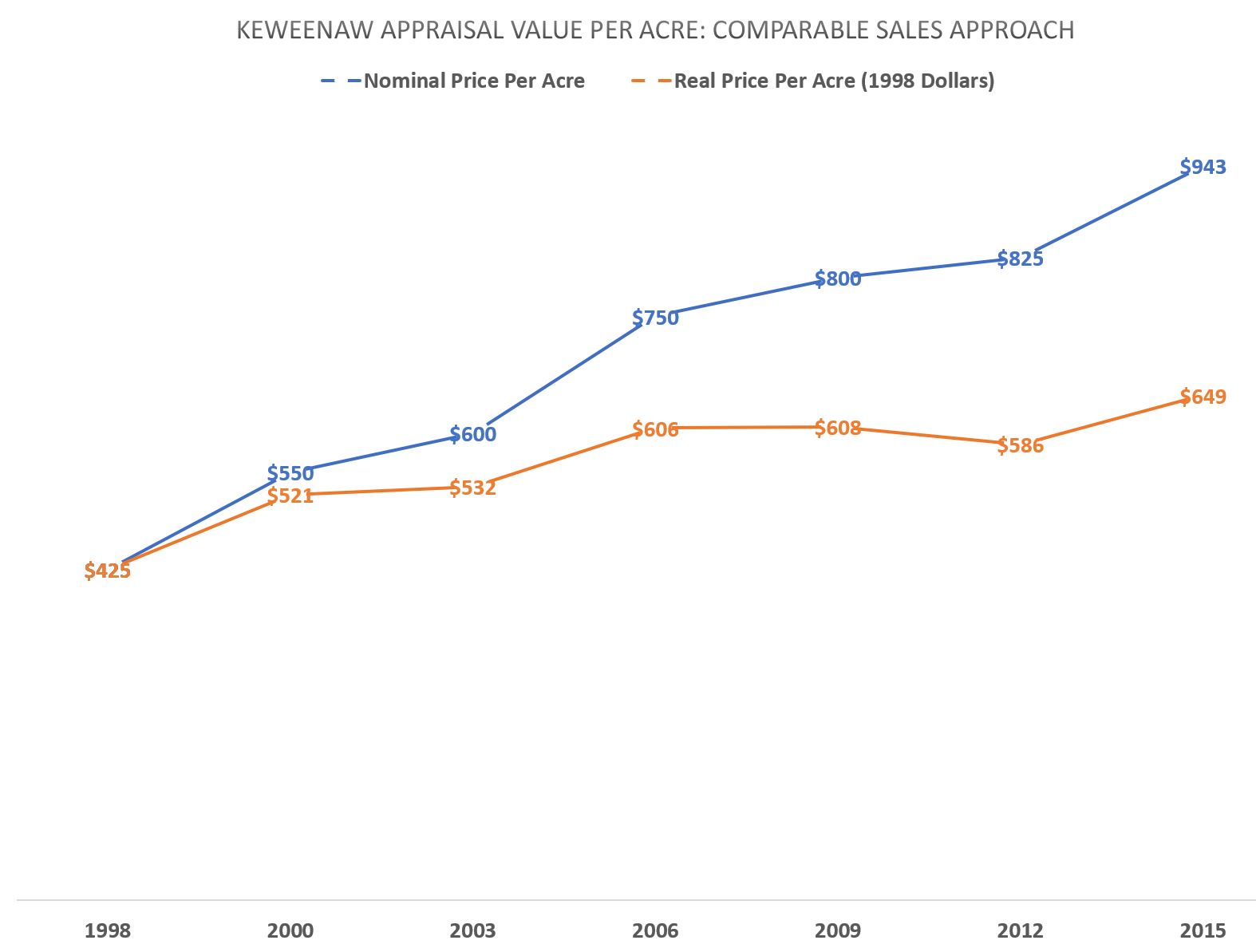

That’s from a biased source (a company that manages timberland). But, it shows that buying timberland at its fair market value is not like buying a pile of cash, undeveloped land, etc. The returns are much more like owning a stock market index. In fact, GMO (Jeremy Grantham’s firm) had recently set 7-year projected returns for timberland above those of U.S. stocks generally. And I’d agree with that. From 2018-2025, I’d expect holding timberland to offer better returns than holding the S&P 500. However, this isn’t because timberland is a superior asset. It’s because timberland hasn’t been increasing in price over the last 9 years the way the S&P 500 has been. Investors should prefer stocks over timberland if they can get each asset at the same price relative to its own historical price levels. Today, it’s hard to get stocks anywhere near the levels they traded at in the past. It’s possible to get timberland at levels – in real prices – that are somewhat similar to where it traded at in the past. Under the comparable sales approach – which I’ll explain why I think is best – to appraising Keweenaw’s timberland, the nominal value per acre has climbed consistently while the real price per acre hasn’t changed much since the housing boom in 2006.

The company has an appraisal done of its own lands every 3 years. The appraisal they refer to is an average of multiple different approaches. However, based on what I’ve read about why appraisers use different methods and the information we have that Keweenaw misjudged the amount of timber on their land by 25%, because it relied on flawed internal models – there’s really no reason to use the income capitalization method. Appraisers like the income capitalization method, because the land owner can provide them with all the information they need to do the calculation and because appraisers are supposed to use more than one method. In reality, the company’s modeling of its timber growth hasn’t been good. And an income capitalization method uses a discount rate assumption – which I don’t have much faith in. The comparable sales approach could be flawed. But, it’s the best method we have. So, I’d prefer using the comparable sales approach when valuing Keweenaw. But…

The company says – in a recent press release criticizing Cornwall Capital – that the timberland has most recently been appraised at $901 an acre. Again, this is probably using a combination of appraisal methods. I actually think relying just on the comparable sales method alone is better.

But, we’ll use the $901 an acre appraisal.

If each share of Keweenaw Land Association stock has 0.14 acres of timberland worth $901 an acre – then, the market value of the timberland per share is $126. The company says there’s a $50 million gain embedded in the timberland that reduced the bids potential buyers made for the company. That’s presumably a tax hit of $8 a share ($50 million / 1.3 million shares = $38 a share in gains; $38 * 0.21 corporate tax rate = $8 a share). It’s impossible to judge this number exactly. The tax hit could be higher than the 21% federal corporate tax rate. But, you’d think that any sale of the company or its timberland would be something both the buyer and seller designed with an eye toward minimizing taxes. The company says bidders took this embedded gain into account and reduced what they bid for the company. However, there are ways to defer and avoid gains like this. It’s not like Keweenaw is being forced to liquidate this instant. In reality, taxes might reduce the value of Keweenaw Land shares by less than $8 a share. But, I’m going to use $8 a share. So, that’s $126 in timberland minus $8 in taxes on that land equals $116 a share. Debt is $18.5 million. That’s $14 a share. So, that bring the company’s value per share down from $116 a share to $102 a share. The company has a little bit of cash, some marketable securities, and mineral rights. I’ll assume those are all worthless. They’re not. But, they’re also irrelevant to our conclusion.

The stock would then have an appraisal value of $102 a share. The stock last traded at $102.50 a share.

So, the conclusion is that buying Keweenaw Land Association shares is a way to invest in timberland without paying any more than it’s worth.

I think that’s a conservative appraisal value for the stock. And yet, I can’t get an appraisal value for the stock that’s below the market price on the shares. In other words, you can buy into this stock at a conservative appraisal of what it’s worth.

I’m sure that doesn’t sound exciting. But, in today’s stock market – that’s pretty rare. For most stocks, I can come up with some appraisal method that is within the realm of reasonableness and yet values the stock at less than where it trades. Here, I can’t find a reasonable method for valuing Keweenaw that is less than its current stock price. That doesn’t mean there’s much upside. It just means there’s no downside.

There are questions about whether timberland might be undervalued right now. Over the past 20 years, Kewanee grew the value per acre by about 5% a year. If we use more like the projected return for timberland as an asset over the next 5-10 years, it’s possible we’d get closer to 8% a year. But that’s a macro-call. This would happen if housing construction and inflation both increased over the next 5-10 years.

I think we’re talking about an asset that will return 6% to 8% a year if bought at its appraisal value.

I suspect Kewanee Land Association will outperform the S&P 500 over the next 5-10 years. There’s some pretty conservative assumptions in my calculation that you might not have noticed. For example, it’s very easy to get very long-term financing on timberland. It’s also very easy to get biological growth that allows for quite a bit of deferred taxes. If a company isn’t cutting down many trees and is using quite a bit of debt – returns could be good. There may be better ways to run this company. Though I’m not sure either the current board or Conrwall is likely to financially engineer this thing to perfection.

What are the risks?

This is a small company, so there are plenty of risks of high expenses. The current board claims that expenses will rise if Cornwall Capital takes over, because Cornwall will add to travel expenses for the board, exploring strategic alternatives costs money, etc. I think that’s a real risk. A change in control at a company always presents risks of big changes to the board expenses, expenses of top managers, etc.

The board also says that Cornwall doesn’t understand the timber industry and got an appraisal – without notifying the board – that used satellite images and incorrectly gave a much higher value for the land than it’s really worth. This is because Cornwall misidentified what land belonged to Keweenaw.

So, it may be that Cornwall will take control of the company and seek to sell it quickly to make up for this mistake. That’s the risk.

On the other hand, it’s possible that Keweenaw’s land is worth more than the current board claims. The current board has timber experience and yet erred about as badly in determining how much timber was on their land as Cornwall did in trying to get a satellite based independent appraisal. In addition, if you read between the lines, it seems like Keweenaw’s lender was the catalyst for doing a timber cruise to better determined the actual amount of timber on Keweenaw’s land. In other words, if Keweenaw hadn’t sought to borrow money – it never would have known how much timber it had.

So, it’s possible that Keweenaw’s tax situation isn’t as insurmountable as the current board says and that their land is worth more than the current board says.

But, I wouldn’t count on it.

I’d count on $100 of Keweenaw stock being worth about $100 of timberland. Right now, I think timberland is a better asset than the S&P 500. So, I’d say that switching money out of an S&P 500 index into Keweenaw Land would be a good diversifying move.

I’m also pretty confident that Keweenaw Land Association stock is not worth less than its market value. I can’t say it’s cheap. But, I can say it’s definitely not expensive.

Geoff’s Initial Interest Level: 90%