Keywords Studios: A good business with a leading niche in a terrific industry – but perhaps too expensive to buy (for now)

Written by: Vetle Forsland

Introduction

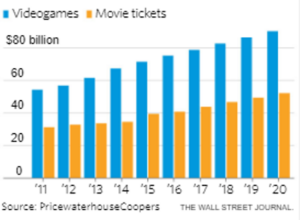

The video game industry is a large and rapidly growing market with revenues projected to reach nearly $200 billion this year, a consistent growth rate in the high single-digits, and over 2.3 billion gamers across the globe. As video games have developed in graphics, gameplay and story, while moving most of the gaming experience online, it has silently become the largest entertainment industry on the planet. According to IDG Consulting, by 2020, the video games industry will bring in more revenue globally than the music business, movie ticket sales and home entertainment combined, after an impressive 26 percent revenue jump from just two years ago. This write-up is centered around Keywords Studios (LSE:KWS), a niche leader set to benefit from all the major developments within this rapidly growing industry.

The Video Game Industry

Major video game releases put Hollywood to shame. While Avengers: Infinity War brought in $640 million globally during its opening weekend, Red Dead Redemption 2, released the same year, generated over $725 million in worldwide sales during its first three days.

The industry has gone through a big change over the past decade plus. First and foremost, the rise of online gaming, streaming and Esports turned video games from a relatively isolated experience into mass entertainment for everyone to enjoy.

For instance, the 2019 League of Legends World Championship drew 200 million viewers in 2019, more than twice that of the Super Bowl. Major players like Amazon (through its Twitch acquisition), Facebook (Oculus), Snap and Nike are entering the industry. Further, the casual mobile gaming market practically didn’t exist in the 2000s, but generated $38 billion in revenues in 2016, versus $6 billion for the console market, bringing gaming to everyone’s parents and even grandparents. Additionally, in its early history, video games were mostly a single-player activity – but the consoles of the early 2010s made online gaming the main form of gameplay, and together with streaming, turned the industry into something undeniably social.

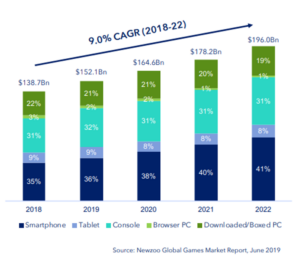

In the years ahead, the video game market is expected to grow at a strong, consistent CAGR of 9 percent from 2019-2023. This increase is driven by the continued development of higher definition- and complexity games, next-gen consoles coming out in late 2020, and new ways of playing video games – like AR, VR, video game streaming, subscription models – as well as more sophisticated mobile games. It is in this market that Keywords Studios operates, without direct exposure to the successes or failures of individual game titles.

Keywords operates in a niche within the video game market that has grown, and will continue to grow, even faster than the overall industry – specifically the outsourced video game services “industry”, a niche set to continue to expand.

Why?

First of all, the video game industry is trending more and more towards outsourcing important tasks to third-parties, as video game developers experience increased complexity, volume and speed of content generation within competing developers. Secondly, it can be ineffective for publishers to hire full teams of video game developers every time a new game is ordered, and then lay them off as the game is published, leading to a flawed boom and bust cycle. Instead, many parts of video game development can be outsourced to service providers, that specialize in all the different aspects that goes into producing a successful game.

These outsourceable tasks often include most parts of the value-chain from the process of developing a video game – including art creation, bug fixing, customer support, gameplay development, audio, 3D animation, visual effects, voice-overs and translations.

This is where Keywords Studios (KWS) comes in – by far the largest video game service provider in the world. Through a long history of big, successful acquisitions, Keywords has become the only global outsourcer of video game production in the world, with the ability to support almost every single part of the art of video game production, from art creation to customer support. That means that Keywords has the in-house capability to build an entire video game from scratch, should they want to do so.

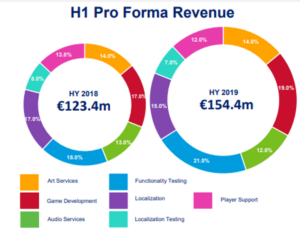

Today, the company may provide video game services within:

- Functional testing, 20% of sales

- Quality assurance, bug testing

- Localization, 18% of sales

- Translation of in-game text to different languages, cultural adaptation, marketing

- Art creation, 17% of sales

- Video game art, concept art, game trailers, marketing

- Player support, 14% of sales

- 24/7 multilingual player support for gamers

- Audio, 14% of sales

- Voiceover recording, voice production, music management and sound effects

- Engineering, 10% of sales

- Game development, consultant services

- Localization testing, 8% of sales

- Testing languages

Keyword’s wide range of offerings makes them the only provider of global outsourced creative and technical services for the video game industry, the only outsourcer that provides services to 23 of the top 25 video game companies and 10 out of the top 10 mobile game publishers in the world. They are, without a doubt, the leading company within this market niche.

Furthermore, this niche is set to grow more over the next years. Today only 40% of all video game services are outsourced to third parties like Keywords. However, it is expected that this percentage will grow closer towards 80%+, like the film industry – which outsources 90% of production costs. Over the past three years, Keywords has seen an impressive sales growth of 63% annually and an EBITDA CAGR of 67%. At the same time, they have consistently experienced 15%+ organic growth.

Basically, there are three major growth factors at work in this case:

- Overall growth in the video game industry segment (9%+);

- Growth within outsourced video game services (40% -> 90%); and

- Keywords growth within its niche, as the only major player -> continue acquisitions, capturing market share, cross-selling etc.

The future growth rate will be very important in deciding whether KWS-stock may be undervalued or overvalued, as the stock is most definitely overpriced by most traditional metrics.

At around 1400 pence, the stock is trading at:

- Enterprise Value/TTM Free Cash Flow: 40

- Adjusted P/ 2018 E: 28

- P/ 2018 E: 35

- Enterprise Value/Sales: 3

In other words, it is a pricey stock. But it’s also an amazing business with a long enough growth runway that it might justify the expensive price – and if not, it’s a terrific company to have on your watchlist for the next correction. In this write-up, I will focus on the business aspects of the company, before concluding with a discussion of the valuation, where we will see when I might buy the stock for myself, and at what price I think buying the stock will provide a sufficient return for investors.

Business overview

Keywords Studios is the largest roll-up operator in the video game services industry. Their roots goes back to 1998, but they have since acquired, and grown, their way to become a significant player within the video game industry, and is today considered the go-to provider of technical services within the industry. By working as the video game developer’s external development partners, Keywords has become leading content creators and publishers of games services. In 2020, the company has a market leading position as the only global provider of fully integrated outsourced creative and technical services to the global video games industry. The group has more than 50 studios in 40 cities all over the world, making them flexible and able to work on many different projects in varying cultural environments.

Over the past 2+ decades, Keywords has built up a strong relationship with most of the leading companies within the industry, including major names like EA, Ubisoft, WB Games, Nintendo, Google, Microsoft and Activision. As previously mentioned, they provide services to 23 of the top 25 game companies, and 10 out of the top 10 mobile games publishers by revenue.

This has lead the company to working with the biggest titles in the world, including Call of Duty, Destiny, Just Cause, Assassin’s Creed, Borderlands, Zelda, PES, Fortnite, Clash of Clans, The Walking Dead, League of Legends, NBA 2K, and so on. If you been near the gaming community you will have recognized most, and probably all, of the games mentioned above, and a fair amount of the games below – meaning that Keywords are highly respected within the development teams of the best video games in the world.

Source: Company presentation, September 2019

I mentioned above the kinds of work that Keywords provides for their clients – below I will include their growth YoY as well:

- Functional testing, 20% of sales

- Quality assurance, bug testing

- Grew 64% as they acquired VMC, 26.5% organic

- Localization, 18% of sales

- Translation of in-game text to different languages, cultural adaption, marketing

- Grew 5%, 3% organically, due to Fornite Effect

- Art creation, 17% of sales

- Video game art, concept art, game trailers, marketing

- Revenues grew 59%, and 12% organic

- Player support, 14% of sales

- 24/7 multilingual player support for gamers

- Quadrupled, like-for-like was 94%

- Audio, 14% of sales

- Voiceover recording, voice production, music management and sound effects

- Grew 65%, 10% organic

- Engineering, 10% of sales

- Game development, consultant services

- Grew seven-fold due to big acquisitions, 23% organic

- Localization testing, 8% of sales

- Testing languages

- Declined by 11%, like-for-like down 9% as projects got delayed to Q1 2019

- Testing languages

As the close reader may notice above, Keywords has successfully managed to split their income through seven core services within the video game development services industry, providing stable revenues and low risk for the broader company, as long as the outsourced game development market continues to thrive (which it most likely will).

Basically, Keywords Studios handles the production of video games through their many activities, taking difficult tasks off the hands of both small and big video game studios, with the ability and synergy to pay lower wages but provide high quality work for their clients.

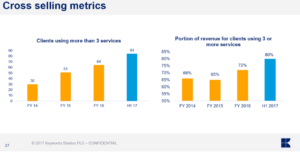

Furthermore, as a major player in this niche market, they have the unique opportunity to cross-sell their services to studios that only uses one or two of their services. According to Keywords, only 12% of customers use 3 or more services from the company – but that number is actively increasing. Keywords wrote in their 2018 annual report that they saw “considerable cross selling progress with a 14% increase in clients buying three or more services” in 2018, when they saw an increase of clients from 99 to 113, a 14% increase YoY.

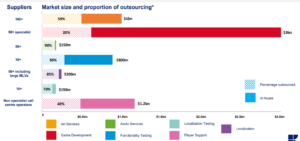

Even though Keywords is the major player within their niche, the video game services market is still an industry with plenty of opportunities for companies like Keywords. Most competitors offer only one or two services (of the above) within a limited geographical reach, as global clients require higher costs, flexibilities, scalabilities and language knowledge. And with hundreds of suppliers (as visualized above) there are plenty of golden opportunities for Keywords to grow through acquisitions over the next years. The company itself has stated that they will focus on acquisitions within engineering and game development services, two of the more underdeveloped parts of Keywords. According to the company, there are 50+ suppliers within this niche today, and they will use these opportunities to grow their service capabilities, geographical presence and client relationships. So, let’s talk about growth.

Growth

Keywords Studios has grown at an incredible rate of over 50% for over a decade through major acquisitions, while providing an organic growth rate of 15%+ for several years. Even though KWS is moving closer to billion-dollar market cap, there is still room for significant growth for years to come – and maybe even decades – for this business, because of a favorable and rare triple-growth situation.

I mentioned those three factors earlier in the article:

- Overall growth in the video game industry segment (9%+)

- Growth within outsourced video game services (40% -> 90%)

- Keywords growth within its niche, as the only major player -> continue acquisitions, capturing market share

I won’t speak too much for 1), as there are hundreds of articles, industry primers and opinion pieces online on this subject. They mostly point towards the same thing – a long-term growth rate in the high single digits. The video game industry can most likely grow indefinitely at close to 7% a year, as it becomes a bigger and bigger part of the economy, while more basic consumer categories like food, clothing, etc. shrink as share of spending, and video games becomes a normal way of entertainment across the world.

Number 2) is about the growth within the outsourced video game services segment, driven by more outsourced work within game studios. There are several reasons for why this growth should continue over the next few years.

First, only about 40% of the video game market is outsourced today. There are not a lot of statistics on this niche (the former number was from Keywords themselves). A voluntary survey conducted by International Game Developers Association in 2016 showed that 29% of video game developer employees were outsourced, far lower than today’s figure. I wouldn’t pay too much attention to the study though, as it was both voluntary and measured direct employees, while Keywords’ measure in revenues.

However, it is obvious that a big change has swept the industry over the past decades.

In 2015, Wall Street Journal reported that 20 years ago, when the first versions of “Tomb Raider” and “Grand Theft Auto” were highly popular, companies directly employed “almost everyone” who worked on their games – developers would hire across the entire value-chain, from full-time programmers to 3D-modelers to audio producers. WSJ spoke to the chief executive of Trion Worlds, a successful video game developer, Scott Hartsman, about the difficulties this system offered:

“Teams at some stages of the production process ballooned, but it was tough to keep everyone busy, says Scott Hartsman. (…) Layoffs often hit after a game was released, which was hardest on workers who were let go and damaged morale for those who stayed. “It was like ‘Welcome to the family!’ ” he recalls. “Then we released the game, and it was ‘See you later!’ ” Outsourcing became a solution to the hire-and-fire cycle, says Mr. Hartsman.”

This hire-and-fire cycle was/is obviously very damaging for work morale and most likely scares talent away. Furthermore, games are getting more and more complex, which requires a broad set of skills. So, a constant boom and bust before very release is very inefficient – especially for smaller video game developers – and outsourcing has been the solution to that problem for years now.

At the same time, outsourcing benefits from what we may call “The new economy of modern games”. Before online games became the norm, the economics of a video game developer was simple:

- Develop game

- Sell game for a profit

- Repeat with a new game; possibly a sequel

But this has changed. The rise of online gaming has drastically increased the lifetime, and workload, for some game titles, thanks to “DLCs“, or Downloadable Content Packages, and the infamous “Microtransactions”.

DLCs usually costs around $20-$30, and in return, users can play new stories, new maps or similar within an already developed game. Therefore, the studio enjoys a high return on capital as these new investments don’t require much additional game development. They will mostly just have to develop new art (maps), game mechanisms and test for new bugs. Further, they will have to adapt the new content to their global audience – for instance an American game studio will have to translate their content to their Chinese customers – this is called “Localization” and is almost always outsourced. All these services are offered by Keyword’s segments of Art Creation, Engineering, Functional testing and Localization.

While DLCs have existed for a while, the even more profitable microtransactions emerged most prominently in the latter half of the 2010s. In short, microtransactions are a business model where users can purchase virtual goods with micropayments (often no more than a couple of dollars per item), like a new gun, a new camo, etc. Often these items must be bought through an in-game currency, like GTAV’s Shark Cards – one Shark Card costs between $3 and $99. So it’s in many ways similar to DLCs, with the main difference being scale – DLCs are almost like a new, small game inside an existing game, while Microtransactions are bought in smaller quantities (new weapon or armor to simply look cool for your in-game friends).

Through DLCs, game studios can extract more value per customer:

- Develop game

- Sell game for profit

- Develop DLC 1

- Develop DLC 2

- Develop DLC 3

- Repeat with new game

Developers took this trend to another level through microtransactions, as there is no limit to how much any customer can spend on microtransactions – while a customer can only buy the x available DLCs. There are plenty of stories, both online and stories I am familiar with in real life, where a customer spends thousands of dollars on a game that only cost $30-$60, through the wonder of microtransactions.

Here are some headline examples:

Meet The 19-Year-Old Who Spent Over $10,000 On Microtransactions

‘My son spent £3,160 in one game’¨

19-year-old gambling addict lays out a case against video game microtransactions

One Player Spent $150,000 On Transformers Microtransactions

Further, certain games are released for free – and then the studio turns a profit through microtransactions. For instance, while Fortnite is free-to-play, the game made more than $1.8 billion selling costumes and other microtransactions to players last year.

These two trends open opportunities for Keywords as the game studios don’t want to hire new employees that they must later lay off when new content is released (hire-and-fire cycle). Further, all new content will have to be localized, which is almost exclusively outsourced to firms like Keywords.

Furthermore, video game developers want to stay as small as they can, and if they want to release a successful, international game with a small headcount, outsourcers are necessary. Take the extremely popular racer soccer game Rocket League as an example, a game that outsources work to Keywords. By early 2016, the game had 29 million unique players, and the developer – Psyonix – had earned over $110 million in sales after only one year. However, the company had just 81 employees.

““The smaller we can be, the better,” says Chief Executive Dave Hagewood, even though relying on contractors means less control over the speed and quality of the work needed to keep “Rocket League” humming.”

Hagewood estimates that 50 percent of the 120 people that work on Rocket League are contractors with Keywords’ Montreal studio. They test the game for bugs (Functional testing), translate into foreign languages (Localization), transfer the software to new types of consoles (Engineering) and handles customer service (Player support). So, through only one client, Keywords’ can utilize more than 50% of their segments on one game – which is key to the third part of the company’s growth and success story.

So, the video game industry is growing at an impressive rate, and the video game services industry is grabbing a bigger slice of the video game industry pie.

Thirdly, as the only major player within this niche, Keywords is set to grow its market share within the services industry as well, through cross-selling, a leading market position and continued acquisitions. The company expects the services market to be worth around $6.5 billion – so with a revenue of $270 million, that’s a 41,5% market share, meaning a lot of smaller fish that are capturable.

Their primary strategy is to acquire companies across the services industry and integrate them into their giant enterprise, extracting synergies and cross-selling to create value. Most acquisition activity for Keywords is focused on newer services like Engineering, Game Development services, Marketing and developing the Audio services further. As you can see from the table below, there are several opportunities in this fragmented market based on the number of suppliers (Customer support has few specialized suppliers because of Keywords’ ability to capture most of that very market).

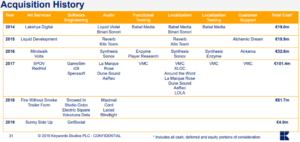

Below is a graphic of the company’s acquisition history over the last six years, counting over 50 acquisitions costing $250 million over the seven segments Keywords’ operates in. This strategy allows the company to grow through cross-selling, extending their range of services, growing market share, expanding geographic reach and, after a while, introduce brand new technology to the industry.

The valuations on these acquisitions have averaged at 1x revenue or 5-10x EBITDA, and probably a bargain post-synergy and taking cross-selling into account (reminder: Keywords’ trades at 3x sales). According to a company presentation, they are preferably on the lookout for targets that are not already performing well, giving them the opportunity of a turnaround.

On average, most Keywords acquisitions have a ROI of around 10%. But, after a year, they have increased to 15% after growth and improved operating efficiency. The internal goal after two to three years is for ROI to hover between 15% and 30% – an ambitious goal, but one they have met with the following acquisitions: Babel, Enzyme, Alchemic Dream, Lakshaya and Liquid Violet. A rough back-of-the-envelope calculation makes me estimate that these five acquisitions alone gave Keywords’ a $50 million gain after three years.

Over the next years, Keywords’ strategy is to continue to make six to ten “bolt-on” acquisitions per year, plus one to two larger transactions. Very often, clients of Keywords themselves introduce potential buyout-opportunities to the company, as they have a reputation as buyers, and most outsourcers are sellers. Some people I have talked to about this stock have expressed concerns about cultural misfits when acquiring new studios. Very often, mergers and acquisitions can lead to cultural misalignments, which turns into inefficiencies and bad morale. But, Keywords acknowledges this, and they “normally don’t even talk” if the cultural fit isn’t there. Further, Keywords has a solid 3.0 score on Glassdoor, with 56% of employees being positive, 25% neutral and only 19% negative. Additionally, 60% would recommend the company to a friend, and 61% approve of the CEO.

Speaking of the CEO, Andrew Day – I, too, have a favorable view of Mr. Day. He’s been with the company for 11 years, and has experience within the corporate world, the software world as an engineer, and the world of manufacturing. Day owns 3,3 million shares, equal to a bit over 5% of the shares outstanding, making him the third largest shareholder. His share ownership is worth over $50 million, compared to last year’s salary of $300 thousand.

Added together, the directors of the company own a respectable total of 10.7% of the shares in Keywords, giving them a good amount of skin in the game.

In conclusion, Keywords have demonstrated for years now that they can grow organically while also making acquisitions and integrating them, including proving that there are valuable synergies in this market highly fragmented services market. Going forward, the company is riding very favorable trends that might make their historical returns continue.

Quality

Right now, Keywords has a moat through their unique ability to provide services within most segments of the video game services industry, and through cross-selling. So, the company has economies of scale and some switching costs. But it’s not very strong, and on a long enough timeline, their moat will fall apart – this is not a very difficult industry per se, it’s just difficult to scale up to Keyword’s size.

Their margins are solid, as gross profits hover between 37-39% of sales, with 22.5% going to SG&A, leaving us with ~12% profit margin, and a free cash flow margin around 10-12%. Keywords expects to maintain that margin, which is surprising. I’d think that a high-growing company making acquisitions in a far from mature industry would eventually see margin expansions, but, as far as I’m concerned, that’s not in the management’s long-term outlooks.

Additionally, they have an acceptably high Return on capital employed. In 2016, 2017 and 2018, their ROCE was 27%, 16% and 19%, respectably, giving us an average of 21%. It’s also worth noting that the ROCE for 2018 was negatively affected by the major acquisition of VMC. For the first half of 2019, ROCE was 19.7%, up 210bps from the year before. So, we can conclude that the returns in Keywords are adequate.

Further, the industry is probably one of the most durable industries you might find.

Put these factors together, add some growth, and you get a very good business. Let me quote Geoff Gannon, the creator of the site, for a second, from one of our conversations about this stock:

“I love the business. But, I also feel the price here means that for this stock to return 10% a year for sure as a stock, you would need to feel good about like 15% type growth from the business.”

For reasons discussed in great length above, both Geoff and I believe a growth around 15% over a long period of time is unusually possible:

“If it was growing at 14% a year it would only roughly quadruple or so in like “market share” (if you want to call it that) type size (basically, if the industry grows at 7% a year and outsourcing quadruples over 20 years) you can see a path to like 14% a year growth being possible for like as long as 20 years. That’s very unusual – to find a company that could grow double-digits % a year for two decades. It seems possible here.”

Valuation

That last paragraph from Geoff Gannon is a deciding factor when analyzing this company. Because yes, while it’s a wonderful company, it’s also for sale at a high price.

So, at what price is this a good buy?

That’s a difficult question, given the company’s nature of operating in an undercovered niche, their high acquisition activity, the effects of cross-selling and so on. I’m not planning on given a specific figure for their intrinsic value.

But, we may work out the math of what they might be able to grow by for the next 10 years, and work back to what kind of return we’d get by buying in as a high a multiple as we have today, by attaching a multiple “drag” on the stock price.

So, we already know that the video game industry will most likely grow at around 7-9% over the next ten years. However, there is room for higher growth here, as video games become less stigmatized, next-gen consoles launch in late-2020, AR and VR hits markets as 5G-technology rolls out, and the rise of cloud-based gaming as well as streaming games. These might make the industry grow in the double digits – but for now, we may use the industry-average estimate of around 9%.

Basically, it boils down to this: can Keywords grow more than 10% a year over the next decade? It seems likely to me, driven by industry-wide growth as well as the trend towards more outsourcing and Keyword’s position as a niche leader.

Further, we are in a unique position where we might buy a growth stock which ten years later, is still a growth stock. It’s not impossible – they’ve already grown at almost 20% over the last two decades.

This is important because of the high hurdle we are given by the stock’s multiple. I’m going to use EV/Sales for this.

Keywords’ market cap is £945 million, minus net cash of £40 million, giving us an Enterprise Value of £905 million. Sales for the trailing twelve months were £294 million. So EV/Sales is 3.07x – let’s say 3x for simplicity.

As an above average company, Keywords should probably trade around 1.5x EV/Sales at maturity. So, if the multiple contracts from 3x to 1.5x over the course of a decade, that’s a drag on the stock of around 6.5% annually.

In other words, if we assume that the S&P 500 will return 6.5% a year over the next decade, Keywords Studios will have to grow sales by 13% annually to counter the multiple drag on the stock. In other words, at today’s price – 1,448 pence as I write this – KWS seems fairly valued to me.

But I think an investor will have the chance to buy this stock at a cheaper price than today. As late as in November, Keywords was trading at 1070 pence (coincidentally when I first tweeted about it at @vetleforsland), giving the stock an EV/Sales multiple of 2.2x. That equals a drag at just 3.5% – suddenly the hurdle is much lower.

Furthermore, this is a somewhat conservative estimate. As mentioned, it is unusually possible that Keywords is still a growth company in 2030, which means two things:

- EV/Sales multiple might be higher

- Keywords may grow around 15% for more than one decade

Basically, if an investor manages to buy shares at 2.2 times sales – with the assumption that growth may continue for 15 years – you “only” need a growth rate of 10% percent annually to comfortably beat the market. And, if you believe in Keywords’ chances of growing at a very high rate for 15 years, today’s price shouldn’t scare the average growth investor. It’s a cheaper growth stock than most other options out there, with a leading position in a great industry. In many ways, Keywords Studios is a 21st century version of “selling shovels in a gold rush”.