Nuvera Communications (NUVR): A Microcap Telecom Company in Rural Minnesota With Stable Earnings and Effective Management That Is Trading At A Cheap Price to Free Cash Flow

Write-up by Carleton Hanson

Investment Thesis Summary

Nuvera Communications (NUVR) is a micro-cap regional telecommunications company that operates primarily in south-central Minnesota. The company has a long history of operating profitably and growing revenues with timely acquisitions, yet due to its small market cap, OTCPK listing, and limited share liquidity NUVR is trading at very reasonable levels. NUVR’s market cap currently sits at about $100 million, with $8 million in net income in 2018 and $10 million in free cash flow. During 2018, NUVR was able to simultaneously grow revenue 20% YoY and begin integrating a major new acquisition, Scott-Rice Telephone Company. The company also benefits from federal programs that pay telecom providers to install fiber data connections in rural and under-served areas. These incentives are guaranteed for 10-year periods and the terms have become even more favorable recently, with payments to NUVR from these programs rising 10% YoY in 2019. The full effects of the Scott-Rice acquisition and increased federal subsidies are becoming clearer as the company moves into 2019, with NUVR generating just over $4 million in FCF in Q1, putting it on track for a 14-16% FCF yield for the year. For reasons I will discuss, I don’t believe the market is keeping pace with the increased value of NUVR’s business and I think an opportunity exists to establish a long-term position in the company at these levels.

For me to get excited about establishing a long-term position in a company, there are a number of things that I look for. First, I want to make sure that the company has stable earnings and cash flow, which indicates that the core business model is healthy. I also want to make sure that the management is trustworthy and effective and that I feel comfortable investing with them for an extended period of time. Ideally, I would also like to see that the company has avenues to grow the underlying business, and if I can get this growth paired with stability at a reasonably cheap price I am comfortable establishing a position. I believe that NUVR meets all of these criteria and is worthy of investment consideration.

NUVR is Stable

One of the major appeals of NUVR is the stability of its core business. At the most basic level, NUVR provides phone, video, and internet service to its customers for recurring monthly fees. NUVR is responsible for keeping up the maintenance of their infrastructure and providing customer support, but if they can do that the company gets the benefit of steady cash flow coming in every month as customers pay their bills. As a value-add for customers, the fact that NUVR has voice, video, and data/internet options allows customers to bundle their telecom products together into one monthly bill, giving them one point of contact when they need support and a discount from NUVR for using multiple services. While there is competition from other companies offering individual services, few offer bundled services to their customers, making NUVR often one of two most convenient options. Comcast is the other major player in NUVR’s service area and also offers bundled solutions. Due to Comcast’s scale, they are able to offer lower pricing for an internet and cable TV bundle, but if I pretended to be looking for service in the New Ulm area I had trouble finding a plan that also included voice solutions. The hassle of switching providers provides at least a partial barrier to NUVR losing customers to competition, and with NUVR having been around since 1905 they have had a distinct ‘first mover’ advantage in the areas they service. For what it is worth, my own general impression is that a smaller and more local provider is able to provide better and more targeted customer support, given their narrower regional focus and presence in the community. Essentially, NUVR’s customers are theirs to lose, and if the company can continue to provide satisfactory service it will be difficult for other companies to steal their customers away.

It is important to note that even if NUVR isn’t losing many customers to direct competition, there has been a noticeable and sustained downtrend in the number of customers using their telephone services. This makes sense as more and more households are eschewing having a landline phone at all and are relying entirely on cellular phones to meet their voice needs. In addition, there also appears to be a trend towards customers “cutting the cord” and dropping cable TV subscriptions in favor of internet TV solutions. As NUVR has been seeing a decrease in the number of voice customers, their data solutions area (internet, fiber, etc) has been growing to match the drop-off.

In addition to a steady customer base, NUVR also participates in federal programs that are designed to help provide rural and under-served areas access to fast and reliable internet connections. In NUVR’s case, this means receiving roughly $9 million a year in federal funding to build out fiber networks in their service areas. While these funds must be used for a narrow purpose, they do provide steady cash flow for NUVR, essentially subsidizing the company’s CapEx growth. These funds are also guaranteed for ten-year periods, as long as NUVR continues to meet the fiber build-out commitments. I will get more into NUVR’s cheapness factor later in this article, but if one were to estimate the value of just this federal funding alone and discount it out over ten years at a 5% discount rate, you end up with a value in the ballpark of $70 million, which is 70% of the NUVR’s current market cap.

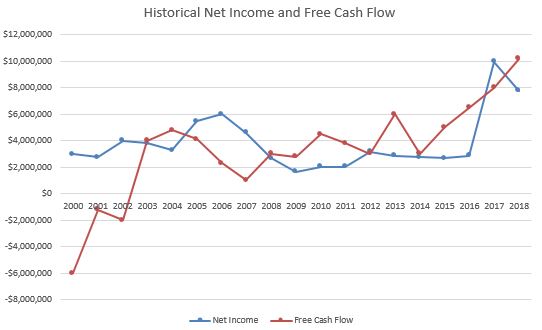

Compiling data from the company’s SEC filings back to 2000, we can see that NUVR has never had an annual net loss in that time frame and has had positive free cash flow since 2003. With this time frame including both the dot-com bubble and the Great Recession, it speaks to the stability of the underlying NUVR business that the company has been profitable through all of it.

Rather than being a one-time abnormality, the 2018 numbers are a better indicator of future years to come, now that NUVR has completed the acquisition of Scott-Rice. What is interesting is that the market does not appear to be valuing the acquisition very highly. The acquisition was announced in Feb 2018, and since that time the stock has only increased 14% while YoY cash flow is set to nearly double. The apparent disconnect between cash flow and share price is one of the major reasons that NUVR shares look appealing.

NUVR has Effective Management

Building on the theme of stability, what I will call the ‘modern era’ of NUVR has been presided over by CEO Bill Otis, who was appointed to his position in 1985 and is still CEO today at the age of 61. During Otis’ tenure, NUVR has methodically acquired six additional telecom companies, become an Internet Service Provider, established operations in new communities from scratch, and gone through a number of corporate re-branding efforts. I appreciate the long-term view that a CEO of 34 years brings to operating a business, especially in Otis’ case when it comes to acquisitions. Management has not levered up the company to make a large number of rash purchases in order to try and grow quickly with more risk. Instead, they have made sure their balance sheet is strong and have waited for opportune moments to acquire additional businesses. For example, in 2008, the company was carrying no long-term debt and was able to acquire Hutchinson Telephone Company (another rural telecom company based in Hutchinson, MN) at a favorable price, resulting in a doubling of their revenue YoY. As someone who is hesitant about using debt to finance acquisitions, I appreciate that management made sure their debt burden was low before adding Hutchinson, and even after borrowing $60 million to fund the acquisition NUVR had already paid off $8 million of it by the end of 2008.

The recent acquisition of Scott-Rice Telephone Company in 2018 is another example of management making a savvy purchase. The company paid $42 million in cash and as a result took on an extra $34 million in debt to buy the company from Zayo Group (Ticker: ZAYO). For this price, NUVR is on track to add about $5-6 million in additional FCF per year to their bottom line, implying that roughly they paid 7-8x FCF for Scott-Rice, which seems a more than fair price to me based on the stability of the underlying business (this ratio was below NUVR’s at the time of purchase). In terms of customer numbers, the Scott-Rice acquisition added 16,000 new connections to NUVR’s existing 48,000 connections, with these new connections being located much closer to the major Minneapolis-Saint Paul population center.

In the spirit of thinking about the party on the other side of the trade, Zayo at the time of sale was considering moves to transform their business into a REIT and/or looking to make themselves an acquisition target. Zayo had come into possession of Scott-Rice as part of an acquisition of Electric Lightwave (another telecom company) in 2017, which was primarily targeting Lightwave’s fiber network on the West Coast. Lightwave’s Midwest presence was limited to spot service in the Minneapolis, MN and Fargo, ND regions making it less in alignment with Zayo’s core strategy. Zayo had been focusing their business around building out fiber networks, cloud solutions, and wireless connectivity and had limited interest in hanging on to a small telecom company in the Midwest. NUVR was able to capitalize on the opportunity to pick up Scott-Rice cheaply. For what it is worth, Zayo recently announced that they have agreed to be acquired by a private investment group, so it appears that their divestiture of Scott-Rice may indeed have been mutually beneficial for both parties.

In summary, I see plenty of evidence that NUVR management is long-term focused, responsible with debt, and adequate at allocating their capital, which makes me more comfortable to hold NUVR over a longer time period. It also doesn’t hurt that management has been comfortable paying a dividend since 2006 to return some cash to shareholders directly, and that the current dividend is well supported by a 30% payout ratio. I suspect that management would be willing to raise the dividend once their debt burden has been further reduced and cash begins to pile up on the balance sheet. In the last five years, the dividend distribution amount has grown over 40%.

NUVR has Some Room for Growth

NUVR has somewhat limited avenues for revenue growth and is facing a slow decline in their voice and direct phone line business, but the company is actively investing in other areas of the business that have more potential for future gains. NUVR continues to build out their fiber network, giving customers the options of paying more for higher data speeds. In particular, NUVR management is focusing on data solutions for small businesses, devoting additional capital in 2019 to building out their New Ulm and Prior Lake downtown fiber networks. NUVR also spends a lot of time talking about their value-add to customers being the ability to bundle their various services together, which can act as a vehicle for growth as customers add, say, a new fiber data connection subscription to their cable TV and landline phone package. Though it is difficult to say exactly how much of the increase in data revenue has come from the Scott-Rice acquisition, Q1 2019 revenue from data services jumped over 65% YoY from 2018. Growth in fiber business is particularly appealing, as the company reaps higher margins on this type of business, with fiber lines requiring minimal maintenance and allowing NUVR to charge more for the dramatic increase in speed and performance over cable or DSL solutions.

Although Minnesota’s population as a whole is growing at a slightly above average rate compared to other states, New Ulm itself and the surrounding areas have experienced negligible population growth over the last twenty years, so I would not count on substantial growth coming from an increase in population in the areas that NUVR services. At the very least, it is encouraging that the service area’s population has not dropped dramatically either, as has been the case in other rural areas.

NUVR does have a history of acquisitions, as mentioned earlier, so over the next five to ten years it would not be unreasonable to see management acquire additional customers by buying a telecom provider elsewhere in Minnesota. With the pace of acquisitions being relatively slow, however, I wouldn’t expect there to be another purchase soon.

NUVR is Cheap

The main appeal of a NUVR investment, in my mind, is the cheap share price relative to the company’s free cash flow. I’m sure a case could also be made for the value of NUVR’s assets or a strong relative valuation when the company is compared to peers, but what gets me excited is seeing the potential of receiving $14-$16 million a year in cash on an $100 million investment. What is particularly appealing is that this flow of cash seems about stable as one could expect from a public company. The company has locked in nearly $90 million over the next ten years from federal programs alone, and when you throw in the recurring nature of the company’s services revenue that does not require much in the way of capital expenditures to maintain, I would expect to see NUVR trading at a higher multiple. While I don’t anticipate much growth in NUVR’s business, I believe that some growth is possible and even without any growth NUVR is an attractive purchase at these levels.

Why Does This Opportunity Exist?

When thinking about whether to invest in a company that looks cheap, it is important to ask yourself why the opportunity exists. In other words, why is NUVR only trading at a P/FCF ratio of 7? There are a few reasons I can think of, but I think the primary reason lies in NUVR’s minuscule daily trading volume. According to Yahoo Finance, the average number of shares trading hands every day is around 3,000. I can say from experience that most days are well below that number and many days no shares are traded at all. Not only does this require a large amount of patience for a potential investor to establish a position, but I know there are some investors who would worry that they would be eaten alive by the bid/ask spread if they had to sell their shares unexpectedly. I also suspect that the lack of a clear compounding growth strategy and there being little chance of the company doubling or tripling in share price anytime soon could be potential turnoffs to some investors. I doubt that a NUVR investment will be particularly “exciting”, either to watch in the short term (many days the share price doesn’t move at all) or to talk about with others (“rural Minnesota telecom” is not a very sexy description). Finally, while I think there is limited risk of serious capital loss on a NUVR investment, I do think there is another important risk to consider that might also be responsible for the cheap valuation.

Risks

The major risk that I see for a NUVR investor is that of opportunity cost. While the company does pay a dividend over 2% and there is some room for company growth, the main source of returns on a NUVR investment will need to come from the market assigning a higher multiple to the company’s free cash flow. For all of the company’s strengths and stability that I have already mentioned in this article, the market has not historically been especially kind to NUVR. In particular, if one ignores the steep run-up in 2005 and subsequent drop in 2006, anyone who invested in the company between 2000 and 2008 wouldn’t have realized any gains in share price until 2017. That is a long time to hold a company without seeing significant returns, and it isn’t immediately clear that the market will decide to assign higher multiples to NUVR in the next few years. I would hope that the company’s 2019 and 2020 numbers will provide overwhelming evidence that NUVR is a worthy investment, but I can’t say for sure that the market will value the company the way I do.

I think it is worth mentioning that I am not overly concerned about NUVR’s debt and don’t consider it a major risk. The company has a relatively large debt burden at the moment (long-term debt is at $65 million), but with the company’s stable cash flow and history of paying down debt quickly, I believe the risk of the debt being a problem is small. By way of comparison, the last time NUVR’s debt was this high was at the start of 2008, and despite the economic difficulties of that time the company managed a net profit for the year and generated almost $3 million in FCF while paying over $4 million for the year in interest expense. With NUVR’s debt currently at about a 6% weighted average (their debt is floating rate and tied to LIBOR) and requiring principal payments of $4.6 million per year over the next five years, I believe the company is at worst in a comparable position to 2008. Thus, in my mind even if we are on the brink of another Great Recession, I would expect NUVR to be able to handle their debt obligations while still generating free cash flow.

Conclusion

In summary, the core long thesis for NUVR is relatively simple. The company has a stable business model that I can understand and its shares are trading at a level that is cheaper than I think they should be given the company’s ability to generate cash. I also trust that management will make wise capital allocations and continue to run the company with shareholders in mind. NUVR is not the type of stock that is going to double overnight, but I think the potential to receive a steady 15% cash yield is appealing enough to consider investing in the company.