Parks! America (PRKA): A Gem Trading at a 15% FCF Yield That Should Have 50%+ of Its Current Market Cap in Cash Within 5 Years

by ANDREW KUHN

Parks! America

Price: $0.14

Shares: 74.8m

MC: $10.4m

Cash: $3.2m

Debt: $2.4m

EV: $9.6m

Geoff and I use a checklist that we go through before investing in any company. Let’s go over it here before jumping into the actual business.

Boxes that need to be checked for us to invest:

- Overlooked: Parks! America is an illiquid microcap. The stock currently has a market cap of only $10.4m, of which only about 4% of the shares turn over every year – the average daily volume is 12,806 – multiply this by 252 trading days a year and we get an average of 3.28m shares per year that trade – divide this by the 74.8m shares outstanding and we get a yearly share turnover of a little over 4%. In comparison, Facebook’s shares turn over 177% per year and Apple’s 148%. Parks! is overlooked.

- High-Quality Business: We look for simple, predictable, free cash flow generative businesses. Parks fits this mold with solid EBIT margins and FCF generation. Their average FCF (EBITDA – Capex) margin since 2012 is 19% with a standard deviation of only 10% and a coefficient of variation of 0.49. This is a very stable business. I estimate that in 5 years the business will have more than half of its market cap in cash (assuming they continue to run the business like it is running currently).

- The Stock CAGR Works Over time:

One of the first initial checklist items we do is look at a long-term stock chart to see how the business has performed over time. We want to roll with the tide.

Compound Annual Returns

YTD: -12%

1 Yr: -11.95%

2 Yr: +18%

3 Yr: +40%

4 Yr: 46%

5 Yr: 47%

6 Yr: 29%

- Cheapness:

Current

P/E: 8x

EV/EBIT: 6x

FCF Yield: 15%

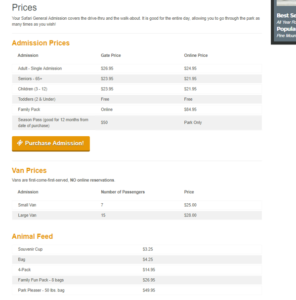

Parks! America is the perfect example of a stock that is overlooked and operates in a niche market. Since 1991, the business has owned and operated drive and walk through wild animal safaris. Combined, the company owns two parks – one in Pine Mountain, Georgia and the other in Stafford, Missouri. The Missouri park was acquired in 2008. Both parks are named Wild Animal Safari. Here are a few videos to get a visual tour from people who have vlogged the experience and uploaded it to YouTube:

https://www.youtube.com/results?search_query=wild+animal+safari+pine+mountain+ga+

Both parks combined have over 100 different species and over 900 animals. Together, the uniqueness of having a true animal safari in Georgia and Missouri with affordable admission prices makes Parks a business that people genuinely enjoy attending.

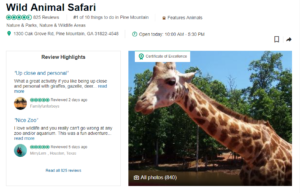

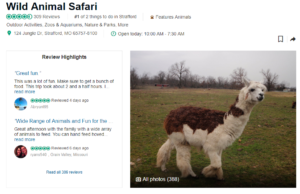

The trip advisor reviews for both parks are 4.5 stars with over 1,000 reviews.

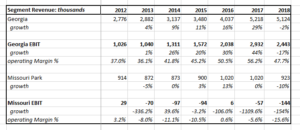

Although people seem to love both parks equally, the economics of the two could not be more different. In 2018, the Georgia park did $5.1m in revenue with a 47% EBIT margin while the Missouri park only booked $923k with a -15.6% EBIT Margin. This is not anything new as the Missouri park has pretty much been a money-pit since the acquisition in 2008. Since 2012, Parks! has made investments into the Missouri park totaling $1,433,855. A quick look at the segment financials shows they have put in more cash than they’ve been able to take out at this point.

It’s fair to ask why is the Missouri park economically unfavorable for the company, especially in comparison to the Georgia park?

Let’s walk through the two towns.

Pine Mountain, Georgia:

Population: 1,374

Avg income: $34,365

Stafford, Missouri:

Population: 2,399

Avg income: $45,906

Here’s the way I think about these two parks. When I was younger and grew up in the suburbs of Chicago, my family and I used to go to waterpark resorts quite often in the Wisconsin Dells. The “Dells” is a very popular tourist city for families who essentially wanted to get away for the weekend to kid-friendly resorts. Naturally, since the Dells is popular – a lot of tourist activities started popping up around the resorts. Mini-Golf, bumper cars, racetracks, The Upside-Down White House – you get the point. Would people go to these activities just on a regular Saturday afternoon if they were not in the area hanging out at the resorts? Most likely not.

Given that the population of Pine Mountain is only 1,374 and Stafford is 2,399, it’s obvious that both parks get traffic from their surrounding areas. If you do a Google search and read about Pine Mountain, you’ll learn about The Callaway Resort & Gardens, which has over 750,000 guests annually. This Resort is only 12 minutes away from the Georgia park.

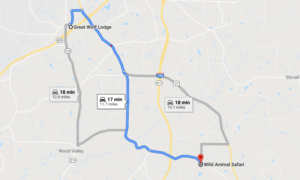

In addition to this, only 11.7 miles away from the Georgia park is a new Great Wolf Lodge that just opened up – which is a waterpark resort that should bring more tourists to the general area.

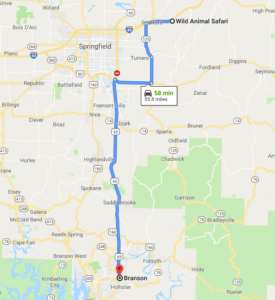

Missouri on the other hand has Branson, which is a vacation destination that is located about 55 miles away. Other than Branson, the only other popular city is Springfield, which has a population of 167k people.

The Safari in Pine Mountain is the #1 thing to do ranked by TripAdvisor when you’re visiting.

As said above, the business has been operating since 1991 and in my opinion will continue to have traffic. The business is durable. The issue with Missouri is the location of the park as opposed to kids and families being more interested in their iPads. From reading a lot of the reviews on TripAdvisor and Google, people like the uniqueness of feeding the exotic animals and being able to be in their habitat, which creates a fun family activity. I am sure ten years from now people will still enjoy attending the parks just as much as they do today. This is not a fad.

Also, the fact that the parks are an interesting attraction in a rural area only adds to the company’s moat. The Great Wolf Lodge that opened 17 minutes away will only help the company instead of hurting it by bringing more tourists to the general area that will be looking for fun activities.

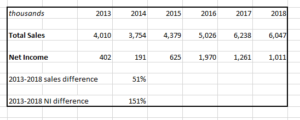

Given that the majority of the park’s expenses are fixed we should continue to see the operating leverage reflected in the financials going forward. From 2013 – 2018 sales are up 51% while earnings during this period are up 151%.

The common theme among the companies that we invest in is often the companies generate a lot of free cash and Geoff and I must think about what management will do with this cash.

Clearly, management’s acquisition of the Missouri Park has been anything but satisfactory, so, hopefully they do not make that mistake again. As of late, management has been letting the cash build on the balance sheet.

If the company continues to produce the same amount of free cash that it has historically, in 4-5 years they will have more than half of today’s market cap in cash.

Naturally, this is a concern for a lot of shareholders. James Elbaor is a shareholder whose fund Marlton Wayne, LP owns just over 5% of the shares outstanding. You can read his letters to the company here. But, basically he wants Parks! to return $1.5 million to shareholders through a special dividend or Modified Dutch Auction Tender, and announce the formation of a Special Committee of Independent Board Members to explore all strategic alternatives to maximize shareholder value. From speaking to James about this, I get the impression that he wants the company to communicate to shareholders SOME guidance on what they plan to do going forward given that the companies aging CEO (77 years old) and largest shareholder (28%) Dale Van Voorhis has a little more than a year left on his contract with the company. James has also said that other shareholders share the same concern.

It’s also interesting to note that a large shareholder, Nicholas Parks – who owns 12.06% of the company, issued this 13D on January 30, 2019:

“On January 30, 2019, Nicholas A. Parks, a long-term significant stockholder of the Issuer, entered into discussions with a private equity firm to discuss strategic options involving the Issuer’s stock. Mr. Parks wishes to continue such discussions in hopes of the following:

- To purchase additional shares of the Issuer’s outstanding stock.

- To have an active role in company decisions in order to maximize shareholder value.

Geoff and I have spoken a lot about this and we could see why a private equity firm would buy Parks!. They could shut down and sell off the land/animals from the Missouri park and only run the Georgia Park going forward. The Georgia park generated around $2.4m in EBITDA in 2018. So, if a PE firm paid a 30% premium to the current enterprise value, they would pay $12.5m, or around 5 times EBITDA. (Note: PRKA’s overall EBITDA is less than the Georgia park’s EBITDA, because PRKA has corporate expenses. However, much of these expenses are probably related to being a public company that files with the SEC and having a CEO in Ohio even though the company only operates in Georgia and Missouri – that is, having an extra management layer above the head of park operations. A private equity owner would probably eliminate both these kinds of expenses.)

How I thought about valuing Parks!

If you run a reverse DCF on the company the market is pricing the stock today like the business isn’t going to grow at all.

Let’s say management just continues business as usual, and we can be conservative and model out revenue growing by 6% per year for the next 5 years, we would get revenue of $8.0m. Assuming Parks! keeps their fixed costs in line and the pretax margin is 24% (the average for the last 4 years), we’ll get a 2023 pretax income of $1.9m.

Adjust this for taxes at their blended rate of 24.5% and we get earnings of $1.5m, or .02 per share if the shares outstanding stay the same at 74.8m. Applying a 10x multiple to this (the average public companies PE is more like 15x) we would get a share price of $0.20.

What about the cash?

Let’s be conservative and say they’ll produce $1m in FCF per year for the next 5 years and just let it build up on the balance sheet.

In 2023 that’ll be a total cash balance of $5.8m (Net cash of $834k today plus $5m).

This on a per-share basis is another $0.08.

Add the two together and we get a per-share value of $0.28.

The current price is $0.14.

This could produce a 5-year IRR of 15%.

Obviously, there are many other ways that shareholders could make money.

Maybe management listens to Marlton Wayne, LP and returns cash to shareholders.

Maybe Nicholas Parks partners up with a private equity company and takes out the shareholders.

Maybe they do nothing, and cash continues to build up, which will only attract more investors.

Maybe they sell off the Missouri Park which will shoot earnings right up – in 2017 operating just the Georgia park, FCF to shareholders would have been $2.8m and $2.4m in 2018, or a 29% and 25% FCF Yield (note: again, this is park level free cash flow in the sense of EBITDA less cap-ex – that is, it ignores corporate expenses.)

In any event, I think shareholders buying today have a lot of upside with a strong margin of safety baked into today’s price.

The business should continue to do well going forward – and the stock price should follow.

What are the risks?

There’s a few that jump out. First, the company is incorporated in Nevada. Geoff generally stays away from companies incorporated in Nevada (who don’t actually do business in Nevada) because the laws are more favorable to crooks, to be blunt.

Next, their auditor is Tama, Budaj & Raab, P.C.

If you go to the PCAOB website and look at this auditor (something Geoff always does if he doesn’t recognize the name) you’ll see that this auditor only has 1 public client, who we know is Parks! and that there were some deficiencies in the performance of the auditor’s work.

“……in this audit, the auditor issued an opinion without satisfying its fundamental obligation to obtain reasonable assurance about whether the financial statements were free of material misstatement.”

Feel free to read here: https://pcaobus.org/Inspections/Reports/Documents/104-2019-021-Tama-Budaj-Raab-PC.pdf

Although I haven’t talked to James Elbaor of Marlton Wayne, LP about this, I’m assuming this is why he issued a recent 13D on July 22nd demanding to inspect books and records of the company.

https://www.sec.gov/Archives/edgar/data/1297937/000121390019013481/sc13d0719a3ex99-1marlton_pa.htm

Another risk is this statement in their 10-K:

“The Company may require additional debt and equity financing to pursue its business plan…the issuance by the Company of any additional securities would dilute the ownership of existing stockholders and may affect the price of our common stock.”

This is probably just lawyer speak that has never been removed from the 10-K. The company used to have debt. It now has cash on hand that is growing quickly. But, PRKA is still tiny by public company standards. So, it’s possible any acquisition of another park could require issuing stock.

Which brings me to the final risk here. PRKA may buy another park that turns out like Missouri did. Hopefully, they do not do this. And, if they do, hopefully they don’t issue stock to do it.

In any event, I think someone willing to buy today and hold with a 5-year mindset will have a positive outcome over time.