Protector Forsikring (OSLO: PRTOCT)

Ticker: PROTCT

Country: Norway

Stock price: 71,75 NOK

Summary of the thesis:

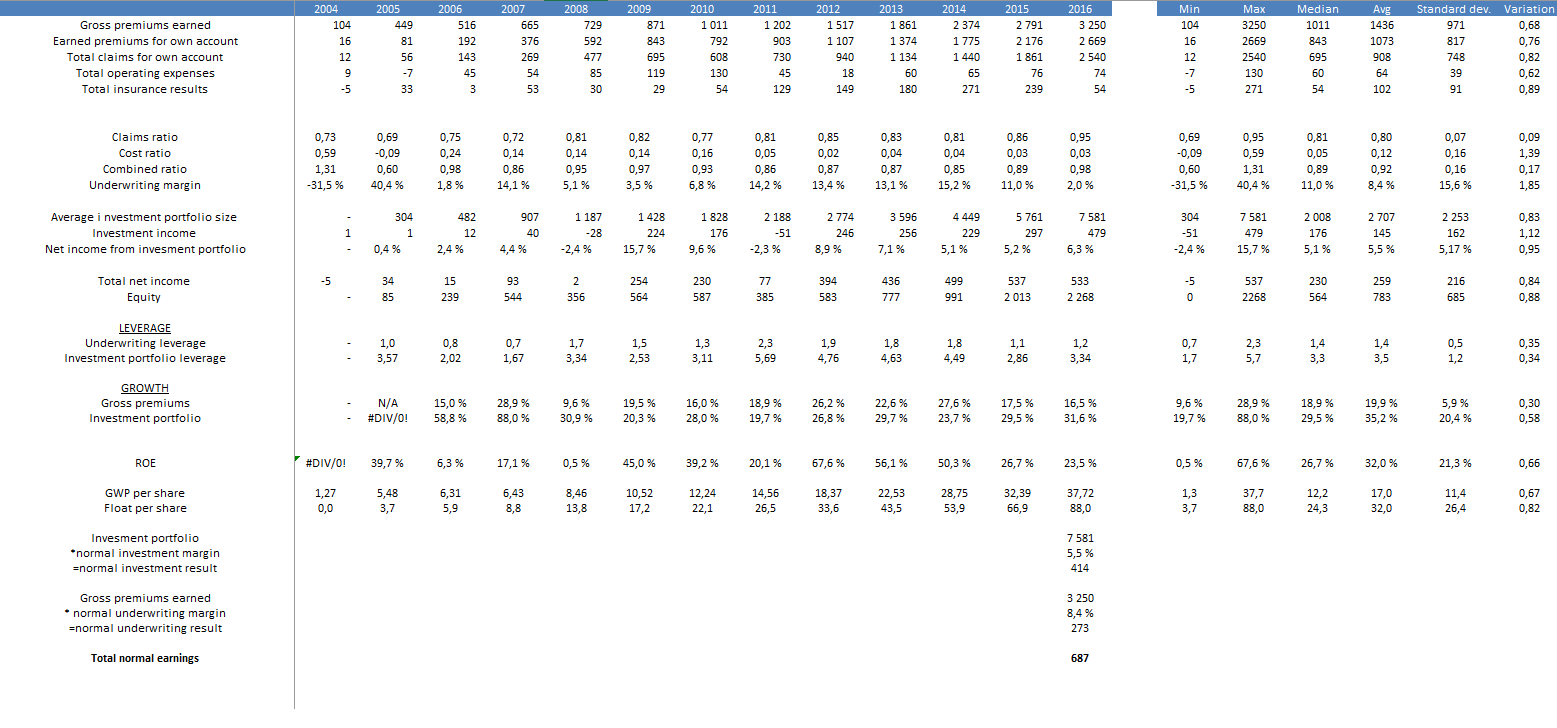

- A fast-growing Norwegian insurer with higher than industry growth in premiums. Historically it has grown premiums at 20 %, achieving 92 in combined ratio and an investment return on the float of 5,5 %.

- A low-cost focused business model with industry leading expense ratios.

- Protector is trading at approximately 12x normal earnings, which is in line with what the Norwegian market has been priced at historically. This is cheap if the growth and the underwriting record can sustained.

- The risks involve an underwriting business with many moving parts in combination with rapid expansion in new markets. The company has experienced mispricing in its policies like worker’s compensation in Denmark causing the combined ratio to hit 98 for the fiscal year 2016. Furthermore, the investment portfolio consists of 80 % bonds which might not provide an adequate return.

Overview:

Protector is quite a new player in the Scandinavian insurance market. The company was established in 2004, and listed on the Norwegian stock exchange in 2007. It has 300 employees at offices in Oslo, Denmark, Stockholm, Helsinki and Manchester. In 2006, gross written premiums (GWP) was about 500 million NOK, while in 2016 it wrote 3,4 billion NOK in GWP. In other words, this has been a growth story.

Protector consists of three business segments:

- Selling insurance to companies

- Selling insurance to the public sector

- Ownership insurance

And as of today, 56 % of revenues comes from Norway, 24 % from Sweden, 19 % from Denmark, while others amount to 1 % of the business. It has just started expanding into the UK and Protector insures the London boroughs with Royal Borough of Kensington and Chelsea, City of Westminster and Fulham. You might have noticed the big fire in London recently, and the building Grenfell Tower was insured by Protector. The building lies in the west of Kensington and is a typical example of what kind of risks Protector takes on. At least 30 people were sent to hospital with injuries and several were wounded. This was a tragedy for the people, but most of the risks related to the fire was covered by reassurance. The UK market was chosen based on statistical analysis of the expense ratios and competitiveness of insurance markets across Europe.

The long-term financial goals of the company are the following:

- Growth rate of gross written premium: 15 %

- Combined ratio for own account: 92 %

- Return on equity: >20 %

Protector sells their insurance through insurance brokers. Historically, the focus of the company has been to sell insurance to companies in the segment from 100 thousand NOK up to 3 million NOK. In the commercial lines of business, they have 5 000 customers.

Historically, the company sprung out of ownership insurance. This is where Protector also has the strongest market presence, with more than 50 % market share in the Norwegian market. It is sold through lawyers and real estate brokers. However, today, this line of business only accounts for 524 million NOK, which equals approximately 15 % of gross written premiums.

Given Protectors business segments, the company is not directly comparable to the other Nordic insurance companies. The reason to this, is that Protector does not invest in the lucrative, yet competitive private insurance market. The CEO, Sverre Bjerkeli, has in a former interview expressed his opinion about this, saying he doesn’t care about this market.

The explanation he has given, is that the big insurance companies, like Gjensidige, IF and Tryg have strong brands and long history operating in this market. Brand is a more important factor in the private market, and it is difficult for Protector to compete in this market against a company like Gjensidige which has 200 years of history.

Because of this, Protector has chosen to focus on insuring businesses and municipalities, in the range 100 thousand NOK to 3 million NOK. The competition is less fierce in this business segment. Protector was started in 2004 and has gone to have a market share of approximately 2,7 % in the Norwegian market. The other dominating companies are Gjensidige (25,6 %), If owned by the Finnish company Sämpo (21,2 %), the Danish company Tryg (13,4 %), Sparebank 1 which is owned by a group of local banks (10,2 %) and other smaller players (26,9 %).

Durability:

Insurance is all about the managing and pricing risk of risk. If the insurance company fails in this area, the company will not be durable in the long term. The Scandinavian insurance market is a highly attractive market when it comes to underwriting. The market is consolidated and is dominated by a few big players, such as Gjensidige (Norway) Sämpo (Finland), Tryg (Denmark). This is indicated in this article by S&P, where the average ROE in the Nordic region is estimated to be between 10 % to 20 % supported by a strong underwriting margin.

The insurance business in Norway has a good ecosystem, where several players can coexist. All the big players have a combined ratio below 100. This means they all receive more in insurance premiums than their total costs (claims and operating costs). You can look up a company like Gjensidige, which has had profitable underwriting margins over the last 13 years. I could not find data going further back than 2004, but since 2004 and up to 2016, Gjensidige has had an average combined ratio of 90,5. Furthermore, for the last two years, it has been 83,4 (2016) and 83, 7 (2015). This means that on average, for every 100 NOK the company receives in insurance premiums, it will be left with 9,5 NOK.

The underwriting side of the Nordic market in general is profitable. There is a tendency for humans to want to insure themselves against possible risks. Some of these risks may disappear over time, like auto accidents. In the newsletter about Progressive, Gannon and Hoang, makes a strong case for why self-driving cars are a threat to the long-term durability of car insurance. Protector is not a specific insurer like Progressive. It is more of a general insurer. In this way, the company is not – to the same extent – threatened by their products becoming obsolete. There is another form of risk in this company to the durability of the business. Protector is not a focused insurer like Progressive. Protector is a company that insures different types of risks in different countries. There are more moving parts.

The risk of the company is mostly short-tail, so they can adjust quickly and they said in their annual report from 2016 that the overall risk in the company is decreasing. The short-term business shows good profitability, but there are problems in change of ownership insurance and in the worker’s compensation in Denmark. Short-tail insurance products are for example property insurance, while long-tail primarily involve personal and liability lines of business.

The uncertainty in short-tailed lines of business Is linked to the size of the loss, while in long-tail, the risk is linked to the risk being properly priced based on experience and empirical data. Thus, it takes longer time to adjust in long-tail type of insurance. Therefore, it may take up to 10-15 years before all the claims that occurred in a calendar year are reported to the company, due to uncertainty in the causal relationship and the uncertainty in the injured party’s future work capacity.

So, what types of risk do they insure?

Let’s take home ownership insurance as an example of what type of risks Protector insures. In 2016, this part of the business was not very profitable. The same with the Danish worker’s compensation in Denmark. The home ownership market is a market where Protector has a 50 % market share. This is an insurance you buy, through your real estate broker or your lawyer when you are selling your home. Most people are selling their home to buy a new one. This is the single largest investment most people will do in their life. It makes sense to insure such a transaction. Now, in Norway more than 80 % of the people buy their own home, which places the country in the top 10-15 countries with regard to home ownership. In comparison, US ownership rates topped out about 68 % right before the financial crisis. It has steadily been declining since then, and now being 63-64 %. Ownership insurance insures the seller in this transaction. At this point it makes sense to stop to mention that Protector has made some bad press for this insurance and achieved some massive critics. However, this is from the people buying the home. The people who will face Protector in court if they complain about the home they’ve just bought. The buyers of the real estate are not the buyers of the insurance product – the seller is. The criticism comes from Protector’s hard profile in the settlements. The buyers of these insurance products, who are the sellers in the transaction of the real estate, are satisfied and most people (70-80 %) choose such insurance. It is regarded as a necessity.

To make an insurance company durable over time, it is necessary that the company has a long-term combined ratio below 100. Historically, Protector’s combined ratio has averaged 92. The biggest risk to owning Protector is that it starts mispricing its risk and starts to lose money on the insurance business. Protector is a fast-growing insurance company, taking on a lot of different insurance policies in different countries. This can lead to that the company is taking on too much too fast, as this is not a focused company on the underwriting part of the business.

It is very focused on costs, and they are also relatively focused in how they invest their investments in equities, but not necessary on what type risks they take and how they price it. This is probably the biggest concern for any investor in Protector, as fast-paced growth in combination with mispricing of risk, may be the biggest threat to the investment thesis. Compared to a company like Gjensidige, Protector comes with greater risk, but also with a higher underlying growth rate at a cheap price.

I’ve discussed this company with Geoff Gannon, and his biggest concern with North European insurance companies in general is the investment side of the business:

“My main concern with insurers generally – and this would probably apply to insurers in Northern European countries more than insurers anywhere else – is that they own a lot of bonds, some of these bonds are long-term, and these bonds do not provide an adequate return. I prefer companies like Berkshire Hathaway that basically don’t own bonds at all except to the extent they are required to (and as short-term cash, but that’s different) and insurers like Progressive which invest in very short-term bonds even if rates are very low and get by on just the underwriting profit.”

Protector differs from a lot of the big Scandinavian insurance companies in the way that their portfolio has 20 % of stocks and 80 % bonds. The investment portfolio has gradually been moving more and more towards equities. At yearend 2016, 22,1 % of Protector’s investment portfolio was in equities, up from 13, 7 % in the year before. Protector has established an in-house investment team which seems promising. As of 31st of March 2017, the investment portfolio amounted to 9,3 billion NOK. The float is growing steadily and the long-term goal of the company is to have an equity share of 20 %. The average investment result for the period 2008-2015 was 6 % and thus beating their peers.

Protector differs from a lot of the big Scandinavian insurance companies in the way that their portfolio has 20 % of stocks and 80 % bonds. The investment portfolio has gradually been moving more and more toward equities. So at yearend 2016, 22,1 % of Protector’s investment portfolio was in equities, up from 13, 7 % the year before. Protector has established an in-house investment team which is promising. As of 31st of March 2017, the investment portfolio amounted to 9,3 billion NOK. The float is growing steadily and the long-term goal of the company is to have an equity share of 20 %. The average investment result for the period 2008-2015 was 6 % and thus beating their peers.

Compared to the other Scandinavian insurance companies they also recognize themselves as the investment challenger. This also is the case as it owns some equities.

The investment philosophy of Protector is based on the following principles:

Philosophy:

- Long-term oriented approach, from 5 years to forever.

- Patience – willing to wait for great opportunities

- Concentrated portfolio of 10-20 holdings. As of March 2017 it was 16 holdings.

- Focus on continuous improvement in process

Type of investments:

- Great companies

- Strong management

- Price with an implied margin of safety

- Profitable growth

Main risks

- No indexing – returns can diverge from index

- Key people considerations

Now the investment portfolio consists of the following companies:

- Åf AB Ser. B

- AF Gruppen

- B2Holding AS

- Pandora

- Bouvet

- Compusoft

- Medistim

- Multiconsult

- Norwegian Air Shuttle

- Norwegian Finance Holding

- Olav Thon Eiendomsselskap

- XXL

- Dustin Group

- B3IT Management AB

- Hennes & Mauritz

The cost price of the portfolio is 1,3 billion NOK and the market value at 2016 year-end was close to 1,7 billion. The portfolio consists of both Swedish and Norwegian companies. Some of these are Swedish, and some are Norwegian. I won’t go through every single investment, but some of these are solid companies, with proven track-record, like Medistim, AF Gruppen and Bouvet. I’m more critical to for example Norwegian Air Shuttle, which is a low-cost airline with high leverage and B2Holding which has a short history. Hennes & Mauritz is the well-known Swedish retailer that is currently struggling. It has a solid track record, but investing in retailers might be a difficult undertaking. Especially these days. But overall, the investment team is talented and a possible investor in Protector should follow the development. Also, only if you want to learn more about investing in Scandinavian equities.

The track record since the start of the in-house management (October 2014) has been good. From October 2014 until July of 2016 the return had been 95 % versus 5,6 % for the benchmark, the OSEBX. However, this is too short a period, as one should evaluate investment performance based on rolling 5-years periods. Despite this, the investment team looks promising and this might give hope for an investment return for the total portfolio in the region of 5-6 %. It is unlikely that the equity share will increase dramatically due to capitalization concerns, thus one should expect the long-term share of the equity share to be around 20 %.

Still 77,9 % of their portfolio is invested in bonds. Long-term, the ratio will probably be something like 80 %. Their bond portfolio is another risk to the investment thesis. They are invested in medium corporate bonds and not achieving adequate yields. As of now, the average rating of the bond portfolio is BBB+, yields 3.2 % and matures in 2.8 years. A possible investor in Protector should also have an extra eye on the bond portfolio and whether they move further out in maturities of the bond portfolio. They are now achieving less than what the Fed Funds rate itself has been in the U.S in an average year.

Competitive advantage

To evaluate the competitive advantage of Protector, it makes sense to start in a completely different place. It may make more sense to show intellectual empathy with Buffett’s purchase of GEICO than to compare this company with something like Gjensidige. Gjensidige is a Norwegian insurance stalwart. Protector is not. There aren’t any comparable peers in the Nordic region.

Buffett has bought GEICO several times in his career. It can be more practical to try to show intellectual empathy with Buffett’s first purchase of GEICO. I guess the readers of Focused Compounding know the story, as it is described in the chapter “Strike One” in The Snowball by Alice Schroeder. A young Buffett takes the trip to GEICO’s office and the only one there to reply to the young, enterprising investor was Lorimer Davidson. Davidson thought he would use something like 5 minutes on the 21-year old Buffett, but instead they chatted for 4 hours. The following Monday, Buffett put a big chunk of his net worth in the stock. The reason for the purchase was the cost advantage GEICO had over its competitors. It had the lowest costs and a competitive advantage because GEICO sells its insurance directly. GEICO has always been focused on achieving the lowest possible expense ratio. Being both a low cost operator and having a direct business, the company has been taking market share over time.

Protector’s strength lies in its cost leadership. Protector’s cost has been declining over time and compared to its Norwegian competitors, the company has – by far – the lowest costs. In 2006, Protector’s cost ratio was 21,7 % while it today is 6, 8 %. In comparison, Gjensidige’s cost ratio is 14,2 %, and 14, 8 % for Tryg.

The company has a strong focus on costs and they talk a lot about their culture and being the challenger, both in underwriting, investments and costs. This is necessary, as the cost ratio is an important part of the long-term competitive advantage of Protector. However, the things Protector cover have lower expense ratios, and higher loss ratios. This involves some risk.

If Protector – over time – targets 92 % combined ratio and a 5 % cost ratio, then it needs to price the premiums in such a way that the loss on claims are about 87 % of the premiums. As Geoff pointed out in an email, this only gives the company a 15 % margin of error because 87*1.15>100. That’s not a big margin of safety.

And in the recent past, there have been risks in the business regarding the Danish worker’s compensation, which has had a strong negative effect on the underwriting results. Protector had a relatively bad year in 2016 due to the results in Denmark, where they had a combined ratio of 113,2 due to problems in the pricing of the worker’s compensation policies.

The problem is that this kind of insurance is notoriously difficult to price, because it is open to fraud and it is long-tail type of business. There is a great degree of cultural difference in this area and pricing risk across such policies poses some challenges.

In the 1978 letter to shareholders, Buffett pointed to the challenges of such an operation, in the sense that changing social concepts might be challenging to control in an insurance business. In the National Indemnity business, Berkshire experienced problems in the early years. Aggressive growth at the expense of sound risk management in insurance is a major risk.

The point with this digression, if you want, is that there might always be something in Protector’s results that will have negative effect on the business. In the early years of Berkshires insurance operations, Buffett talks about the industry chasing growth at whatever price. The whole insurance industry takes on more risks because the companies chase growth in written premiums. Then, when you after some time find out that you have mispriced some of your policies, the companies make changes. Just like Protector’s results in Denmark in 2016 related to the worker’s compensation. Then they make an adjustment in either growth prospects, combined ratio or take less risk in the investment portfolio to adjust to the loss.

This is not a focused insurer in the same way as GEICO or Progressive, so there might be a couple of revisions in the form of losses that may come every other year, which will negatively affect the earnings of the company. And it may be more difficult to be comfortable with the underwriting side of this business compared to more focused insurance companies.

However, despite this, the management is cost oriented and treat costs like fingernails; something that should be constantly cut. And Protector does not take the same risk when it comes to underwriting leverage as other companies. Historically, Protector has had an underwriting leverage of 1.4x equity.

The CEO, Sverre Bjerkeli, talks a lot about being the cost leader and maintaining this advantage by creating a culture that fosters internal competition. I think this is the case. He founded the company and still holds 3,7 % of the company through his Tjongsfjord Invest AS which makes him the 4th biggest shareholder in the company. In many ways, this is his painting – his lifework. He still strongly believes in the company.

And as Buffett also wrote in his 1977 letter to shareholders:

“It is comforting to be in a business where some mistakes can be made and yet a quite satisfactory overall performance can be achieved”

Quality:

The insurance business in Norway is solid and the companies, in general, operates with solid returns and solid combined ratios. Protector’s quality is in their cost advantage. The gross expense ratio has been falling from 11,2 % in 2008 to 7,5 % in 2015. Partly, the success of Protector can be explained by their efforts to attack the private business market and the public sector in the range up to 3 million NOK. The competition is less fierce in this interval and it has been easier to achieve both profitability and growth. The brokers that work with Protector are generally satisfied with the cooperation and gave the company a score of 87 out of 100 in Norway, 75 out of 100 in Sweden. The renewal rate in Norway was 86 %, down from 91 % in 2015. Protector is regarded as the preferred insurance company by brokers in Norway. So, the overall position, at least in Norway, is quite good.

This is not a direct business like with auto insurance provided by GEICO and Progressive. To build a meaningful market in new countries it is important for Progressive to gain a relationship with the insurance brokers. This is important, and for example in 2016 Protector lost their position as the quality leader in Denmark among the insurance brokers. Because of the nature of the business, Protector aims at being both the quality leader (among the insurance brokers) and the cost leader (expense ratios).

Historically, Protector has levered their investment portfolio at 3,5x the equity of the company and has achieved an investment return of 5,5%. This gives a return of 19,25 %. Similarly, the underwriting business has given an 8,4 % underwriting margin, while it has been levered at 1,4x equity. This gives a return on this part of the business of close to 11,8 %. Protector has been writing only 1,4x the equity of the company. This is less than a company like Progressive, which has had an underwriting leverage of 3x the equity base of the company. This makes sense, as Protector is not as safe as Progressive; they insure far more things, across different markets, countries and segments. Adjusting for their relative weight we get a pre-tax return on equity of the entire company of 16,25 %.

The investment portfolio is the biggest contributor to profits. Historically, the company has earned 5,5 % on its investment portfolio since 2006. The portfolio at year-end was 8,5 billion NOK. Applying the average portfolio size for 2016, you get 7,6 billion NOK. Applying the historical return to the average portfolio of 2016 gives an investment result of 414 million NOK. This is less compared to the actual investment income for 2016 which amounted to 479 million.

The average combined ratio has been 92. So, it has been able to make an 8,4 % margin on premiums over the short history of the company. Applied to gross premiums written premiums of 2016, this gives an underwriting result of 273 million NOK. The actual insurance result for 2016 was closer to 50 million NOK due to the weak results in Denmark translating to a combined ratio of 98 for the fiscal year 2016.

Taken together this gives a normal earning calculation of 687 million NOK, if you accept the assumptions. This translates to a normal EPS of 5,82. As I’m writing this, the stock price is 70 NOK per share, which gives a P/normalE of 12x. Protectors enterprise value is approximately 7,3 billion NOK, which gives a valuation of EV/normalEBIT of 10,6x.

This means that Protector is more exposed to weak results in their financial portfolio than in their underwriting business. The reason is that the multiplier is 1,4 for the underwriting business and 3,5x for the investment portfolio. A combined ratio of 105 will only amount to 7 % negative effect on the equity in a single year. The same type of investment loss, of 5 %, will have a negative impact of 17 % on the equity capital. This is also the reason why it will be difficult to increase the equity share over time, because the company can’t risk becoming insolvent. Due to the leverage of the investment portfolio, market declines will have a major effect on the results, which you may see in the results of 2008 and 2011 when the investment portfolio was down more than 2 %.

Protector is not Gjensidige when it comes to stability. Gjensidige has more than 200 years of history in the Norwegian market, and the company has been profitable every single year since 2004. But, Gjensidige is a stalwart, and Protector is a growth company, with still a very good record, despite being such a young company. In my opinion the quality of this business, growing at high double digit, can achieve a pre-tax ROE of above 16 % is attractive at such a price, if you can handle the uncertainties in the business.

Value and growth

Over time, Protector’s value will be driven by the income from the investment portfolio and from the underwriting business. Protector’s owner earnings can be calculated by using a return on sales approach, where premiums are used instead of sales. Protector targets a combined ratio of 92, which it has made historically. Since 2006 it has managed to do this 6 out of 11 years. Thus, the variation in reaching this target is higher compared to something like Progressive and can be attributed to the fast-paced growth of the company

The tax rate in Norway is currently at 27 %. On an after-tax basis, Protector is priced at something like 12x earnings. This is in line with what the Norwegian Stock Exchange has been priced at historically. Historically Norwegian Stocks have been priced at 12x net earnings, which equals 9x pre-tax earnings. This is cheap for a company that may still grow double digit for some years and has a profitable underwriting business. In my view this is better than the average Norwegian business listed on the Norwegian stock exchange.

I’ll try to value what the company will be worth to the long-term buy and hold investor.

Looking ahead 5 years, Protector should – if it manages to reach the company’s goals – achieve a normal owner earnings yield of 8 % on their premiums. Historically, Protector paid close to 30 % of their income in dividend and thus retained 70 % of earnings to achieve the underlying growth. This gives a dividend yield of 2,4 %.

Let’s assume that both premiums written and the investment portfolio grow at 15 % for the next 5 years and that Protector retains 70 % of earnings to achieve this growth at the end of 2021. Protector could be able to do this.

If this is true, Protectors gross written premiums will be doubled of what it is today and be 6,5 billion NOK in 2021. The investment portfolio will be close to 17 billion NOK. This will generate 546 million from underwriting and 935 million from the investment portfolio based on a normal earnings approach. In total, Protector may generate close to 1,5 billion NOK in pre-tax profit at the end of 2021.

This will translate into an EPS of 12,6 NOK, based on the current share count.

If we provide some more conservative approach, and say that underwriting profit will be 5 % instead of 8,4 and investment profit will be 4,5 % and growth will be closer to 10 %, the outcome will be different. This gives an EBIT-result closer to 900 million and an EPS of 7,63 NOK.

The question then becomes what should the stock trade at once it grows at its terminal growth rate, closer to something like 3-5 % a year?

Protector must retain earnings – to provide for future claims – to grow. From its history, it had to retain 70 % to grow, thus growing 3 to 5 % would translate in 1% to 1,5 % in dividend yield. This might be conservative, but anyway, let’s use these assumptions. I will compare this to the return of the S&P500, and assume it has given a long-term return of 9 %.

9 % minus the earnings yield is what Protector should trade at the end of the period.

This gives 9% minus 1,5 % equals 7,5 % and 9 % minus 1 % equals 8 %.

This gives the following calculation of P/E ratio:

1/7,5 = 13 (roughly)

1/8 = 12,5

Thus, Protector should trade at something like 12,5x to 13x earnings when Protector grows in the range of 3 to 5 %.

Applied to the above-mentioned EPS-estimates this gives a price range of 95 NOK per share to something like 164 NOK per share, depending on your assumptions. You are free to change them. In my opinion Protector – if it manages to reach all their long-term financial goals – can give the long-term investor a shot at 15 % annual returns for the next 5 years.

This might sound aggressive and too optimistic, but Protector has usually had a combined ratio below 100, and have provided acceptable investment returns.

This surely does not come without risks. This is a far riskier investment than for example Progressive, Gjensidige or any other stable insurance operator. But at the same time, it is cheap relative to their historical performance and the potential growth rate it may achieve over the next 5 years. For a more diversified portfolio, this might be an interesting bet. However, for a very concentrated portfolio, this investment may be a pass.

Disclosure: I do not own a position in any of the securities mentioned.