Sandridge Energy (SD): A Carl Icahn Controlled Post-Bankruptcy Oil Producer With 10-35 Years of Proved Reserves in Colorado, Oklahoma, and Kansas Trading at a Fraction of Net Asset Value

Write-up by JONATHAN DANIELSON

Sandridge Energy (SD) is an upstream oil and nat gas exploration and production company with operations primarily in the Mid-Continent and North Park Basin in Colorado. The Company is an onshore driller and owns three principle assets: Mississippi Lime, NW STACK, and the North Park Basin. The Miss Lime is a mature asset that will continue to decline in production, while the STACK and N Park assets are newer, higher growth, and more economically attractive.

I believe SD to be one of the most demonstrably mispriced and most compelling E&P play around for a multitude of reasons. SD is not a stock for a concentrated investor and extreme caution in trading the name is urged by your author.

Despite being in a tough industry, there is no reason for this valuation discrepancy and it is very unlikely to persist. SD has cleaned house with a new management team in place which has shed unproductive assets, implemented tighter cost controls and will invest future cash flows into their more productive assets.

Recent Events:

There are several factors at play as to why SD is currently trading so cheaply. For one, it’s a post-bankruptcy stock. With headquarters in Oklahoma City, Sandridge was founded by Tom Ward in 2006. Ward went on to accumulate over $10 billion from Wall Street investors and pursued strategies that entailed growing without regard to the underlying economics of the transaction in question (Empire building), leveraging the balance sheet with billions in debt, and subsequently entering Chapter 11.

SD emerged from bankruptcy in late 2016 and has seen its share price slide ever since. The reasoning reorg stocks face selling pressure is well documented in Greenblatt’s Stock Market Genius book, so i’ll be brief – as former bondholders now become equity holders there’s a mismatch in owners of the capital structure. Entities who specialize in distressed debt now find themselves owning equity, which they likely have very little interest in. Thus, selling pressure ensues.

Second, the past 5 years have been brutal for all E&P companies with the collapse in oil prices. Many of whom have subsequently filed for Chapter 11. That’s what happens when you take a commodity business notorious for cyclicality and add leverage. Upstream producer’s woes were exacerbated in the second half of last year as oil was again hammered.

Third – and most importantly – SD was on the bidding block last year as part of their “strategic review” and bids came significantly lower than what was expected. I believe many special situation-type investors owned SD last year in hopes of participating in a quick asset sale. As these hopes failed to materialize these investors likely dumped their shares in droves, as they were now stuck with a mediocre oil producer at a time when crude was crashing.

These factors have culminated in a stock that I believe is too cheap to ignore.

Overview:

Upstream Oil & Gas producers represent the epitome of high risk business models – hundreds of billions of investor’s capital have been obliterated over the years – it is truly a terrible industry. The industry is notorious for the underlying companies being saddled with inordinate amounts of debt, which when added with extreme amounts of operational risk inherent in the business model and we see why so many producers went bankrupt when oil crashed in 2016 (MPO, SDLR, and even SD itself – I could go on). As investors have seen billions of their equity whipped out over the preceding 5 years, it becomes clear why the entire industry is seemingly trading cheap – no one wants to touch these things. Additionally I believe the sector is cheap for other macro headwinds, including:

- Alternative energy. The (un)likelihood of fossil fuels facing imminent replacement is well documented. Put simply, even the most conservative estimates of future oil production forecast fossil fuels being a major source of energy for years, possibly decades, to come.

- Global Warming. This ties in with the point above but it has become politically expedient for oil companies to receive the blame for damage we all do to the environment. Thus, we have investors overlooking the entire industry as it is possible that these companies face legislation.

Being fully cognizant of the risks involved, I still think SD presents investors with a compelling opportunity. As a value investor, I feel as if I come across an E&P company everyday that’s trading at a PE of 2. However, I think there are several factors at play that make Sandridge stand out, let’s go over them.

Reason #1 – Coattailing famous investors is a strategy which is always heavily debated. Whether copycating other investor’s ideas is a prudent strategy or not is a discussion for another time. What is undoubtedly an appealing strategy is coattailing activists. When other shareholders can shake up the board and operations when you can’t is an exercise worth pursuing. And with Sandridge Energy we have none other than Carl Icahn himself representing shareholders.

Icahn has been a shareholder since 2017. He didn’t go activist on the company until they surprisingly announced their intention to acquire Bonanza Creek (which went directly against what management had been saying they’d do). Icahn described the deal as “massively dilutive and overpriced”. In response to Icahn and another investment firm, Fir Tree Partners, Sandridge adopted a poison pill in attempts to keep the activists off the board. In an open letter to shareholders (linked below), Icahn laid out in his words what had transpired:

“To add insult to injury, the board tried to use an unorthodox poison pill to ram through the wildly unpopular Bonanza deal. The pill broke new ground for poor corporate governance, containing purposely ambiguous provisions that would make a totalitarian dictator blush. For example, it prohibited stockholders from merely talking or meeting with one another to discuss opposition to the Bonanza transaction (but conveniently contained a provision that explicitly gave management the right to campaign in favor of the deal). It appears that the board has never heard of the First Amendment. Does anyone believe that if the incumbent directors are re-elected they will not blatantly disregard stockholders’ rights again?”

Unsurprisingly, shareholders concurred with Icahn. In 2018, he won 5 out of the 8 board seats and replaced the CEO and CFO.

Reason #2 – There are bids on the books for each one of the company’s assets that were rejected by the board as they felt the offers materially undervalued the company. The bids were:

- Miss Lime: $305 million

- NW Stack: $70 million

- North Park Basin: $100 million

Totaling $475 for a SOTP of the company. This was September of last year with oil around $55 and gas at ~$2.85. Sandridge current total market capitalization is just ~$280 million, or about 40% LESS than what private buyers offered to pay for the company not 9 months ago which was rejected by the board (read *Icahn*) as they viewed the bids grossly undervalued the company. Everyone involved – and even the board in their PR (again, linked below) – were very much surprised by how low the bids were, especially for the N Park asset, as it was less than what the company paid for it ($190 million) not 5 years prior.

Many theories are circulating around on the internet as to why the bids came in so cheaply. They range from investor apathy towards the Miss Lime asset, to the Colorado legislation not being struck down yet (it has been voted down since then), to an even more sinister speculation that Icahn intentionally sandbagged the bidding process in order to buy shares on the cheap. I’m not going to comment as to why the assets were undervalued. All I know is that the board thought they all materially undervalued the company. SD is now trading 40% below that offer price.

Reason #3 – SD has a clean balance sheet. They have no debt and $19 million in cash. Not to say that makes this company not risky – there’s enormous risk in the business model. But it’s a nice cushion that there’s not the added financial risk that crippled so many upstream producers when oil got rocked in 2016. Moreover, it gives them the financial flexibility to more acquisitions if any become available.

The Assets

Sandridge has three main assets:

Miss Lime: The Miss Lime asset is located on the Anadarko Shelf in Oklahoma and southern Kansas. It contributed 81% of total production in 2018, or 10,000 MBoe. Proved reserved at the end of 2018 were 110 MMBoe (77% where proved developed). Net Acreage is 445,189 and SD had interests in 1,739 gross producing wells – 1,057 net – with an average working interest of 61%, The R/P ratio equates to a little over 10 years. SD is not focusing on drilling more wells here as they focus on the more attractive assets cited below, so production will continue to decline into the future.

North Park Basin of Colorado: Located in central Colorado these properties contributed 8.4% of total production with 1,000 MBoe. Proved reserves totaled 49 MMBoe (12% proved developed). These properties have 123,000 gross acres with 38 net producing wells. North Park was acquired by the Company in 2015 and has significant room to grow. North Park production grew by 53% in 2018 and totaled 30% of the company’s oil production.

NW Stack: Production came in at 925 MBoe and 7.5% of total production for 2018. SD entered into an agreement with a third party in 2017 where the Counterparty is paying 90% of net drilling costs. SD receives 20% net working interest and 10% of the drilling costs. SD also operates all of the wells developed and retain full autonomy regarding the number, location, and scheduling of all wells drilled.

Future Production/Strategic Review

Taking the Company’s reserves into consideration is a must when analyzing an E&P company. An oil produce might appear cheap on a multiple of this year’s EBITDA but only have a few years left of production capacity. All told, there’s roughly 10 years of production left at the Company’s Miss Lime asset and 35 years at the N Park Basin.

As we’ll see later, SD is trading at a significant discount to the PV-10 which likely indicates the market thinks the Company is going to have horrible capital allocation. This likely stems from the Miss Lime asset being mediocre and has incenterated billions in shareholder capital by SD continually investing money in the property. This risk is mitigated as Icahn has now got his people on the board. This is further demonstrated on the last Conference Call, as management states:

“As summarized in our guidance, total production is estimated to decline this year by 5% to 6% due to declines we have experienced in our largest asset, the Mississippi Lime. The capital program necessary to arrest this decline and grow our production in 2019 would need to appreciably exceed our estimates of operating cash flow and we’re just not going to do that. This puts pressure on us to further reduce our cash costs below the levels achieved in 2018 and it also puts pressure on us to find new opportunities to increase our production.”

Second, as is common with a major change in a company’s board along with the CEO and CFO being booted, SD has a new strategic process. Essentially, management is aiming to cut operating costs, reinvest the cash flow from the Miss Lime asset into the N Park and NW STACK assets, and pursue accretive acquisitions if the opportunity presents itself.

All that talk is nice, but management teams always have a plan in place. So, how has the company performed?

From the most recent conference call:

“We also significantly reduced production costs by $10 million in 2018; a 10% decrease compared to 2017, and adjusted G&A by $19 million or 34% year-over-year.”

For these measures to be accomplished in only a year is certainly encouraging. I suppose it goes to show just how inept prior management was. Add to that the fact that the new management completed a divestiture that:

- Eliminated wells that were only “marginally profitable” in their Permian Basin

- Eliminated $27 million in asset retirement obligations

- Freed up the cash needed to make accretive acquisitions in their more economically favorable Mid-Continent basin

Although any turnaround is by nature risky, it seems to me the turn around is well under way. As cheap as this company is (which will be discussed next) with as pristine of a balance sheet as they possess, practically the only way the stock doesn’t work out is if the company attempts boneheaded acquisitions. This seems improbable given the board/c-suite overhaul and the fact that Icahn is now intensely involved.

Valuation

Valuing upstream producers is an extremely difficult enterprise. Typical value “multiples” are less than useless, as previously described, they can make a company look seemingly cheap, yet the company might have already consumed 80% of total reserves. Obviously, these points only mean investors must be extra cautious when operating in the space.

Further complicating the issue, most companies (retailers, distributors, etc.) increase their asset value over time. Inventories, receivables, PPE, all grow in tandem. Not upstream producers – that’d be too easy. No, with producers you have depletion. As the oil producer extracts more and more oil out of the ground their revenues increase. The other side of that is that their reserves are depleting as you only have a finite amount of oil. So as the company grows they have to continually invest more in exploration in order to continue operations. This is typically a not-so-virtuous cycle. Quite obviously, this is why capital allocation when valuing E&P companies is so pertinent.

So, blindly following a company’s multiples has indicators of value isn’t a viable valuation methodology – what’s a good one?

You could do a SOTP of the company for each segment. As noted above, even if we use the valuations presented to the board last September which they viewed undervalued the company, we get $13/share or ~55% upside from SD’s $8.21 close as of 4/18.

Another method to value E&P companies is the Net Asset Value approach. With this approach, you assume the company adds nothing to its reserves and purely value the company based on the reserves it currently has on its balance sheet. Think of it as valuing the company in a “steady state”. This to me seems to be the most conservative method.

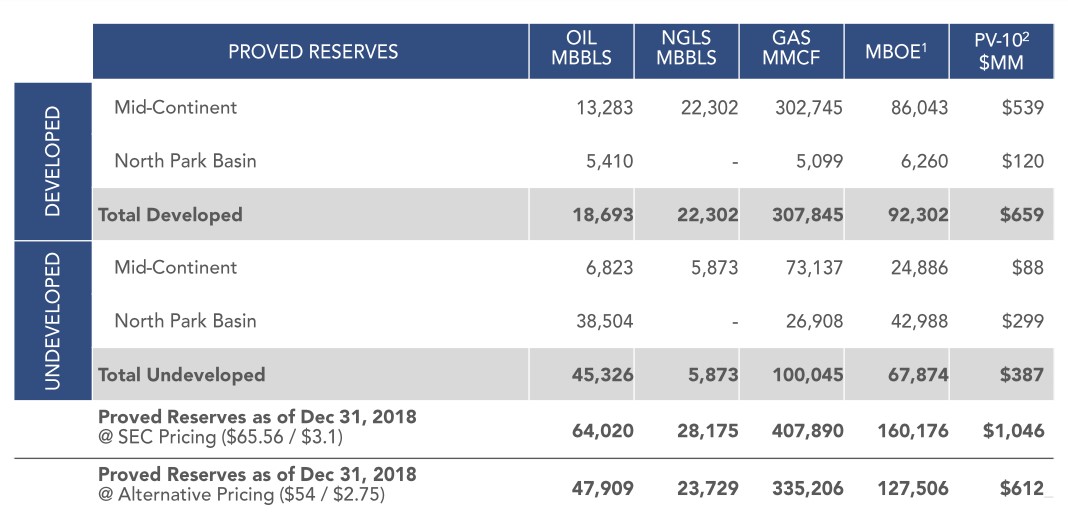

In order to comply with the SEC, all public upstream producers must file a 10-year present value (PV10) of their existing reserves every year. This is net of exploration, production, and plug/abandonment costs. The SEC requires an independent third party of “reserve engineers” to conduct this analysis (for SD 90% of reserves were calculated by third parties). This report is inherently conservative as the only reserves that are assigned value are the company’s P1 reserves.

The Society of Petroleum Engineers defines Proved (P1) reserves as:

“Quantities of petroleum which, by analysis of geological and engineering data, can be estimated with reasonable certainty to be commercially recoverable, from a given date forward, from known reservoirs and under current economic conditions, operating methods, and government regulations. Proved reserves can be categorized as developed or undeveloped.

If deterministic methods are used, the term reasonable certainty is intended to express a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate.”

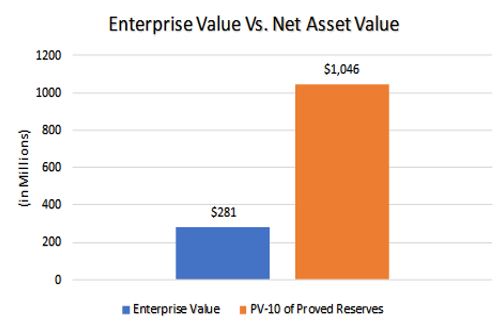

Sandridge’s disclosed PV-10 of Proved Reserves is given below:

Meaning, SD is currently trading at ~0.27x P1 SEC Pricing reserves and ~0.46x Alternative Pricing reserves. This seems excessively unwarranted even considering the market’s current apathy towards the E&P sector in general. Typically, it’s not unusual for upstream producers to trade above PV10 of P1 reserves as this is an excessively conservative valuation methodology. Even if we assume a haircut of say 35% that the market will be willing to pay for SD’s PV10, that brings us to $12/share.

Meaning, SD is currently trading at ~0.27x P1 SEC Pricing reserves and ~0.46x Alternative Pricing reserves. This seems excessively unwarranted even considering the market’s current apathy towards the E&P sector in general. Typically, it’s not unusual for upstream producers to trade above PV10 of P1 reserves as this is an excessively conservative valuation methodology. Even if we assume a haircut of say 35% that the market will be willing to pay for SD’s PV10, that brings us to $12/share.

Peers MidStates Petroleum, Apache, Bonanza Creek, Equinor, HighPoint trade at an average EV/EBITDA of 3.2, which would value SD at ~$16/share. Carl Icahn’s cost basis $17/share. I doubt he’s expecting a dead money return on his investment in Sandridge. I’m not anticipating he’ll get one either. But we don’t need him to make money for us to. Sandridge is one of the most mispriced upstream producers I’ve ever seen (and this is in an environment where the average E&P is trading at an EV/EBITDA of 3 – not exactly a demanding valuation by any means).

Upstream producers are a bad business in aggregate – there’s no disputing that. The Sandridge Miss Lime asset doesn’t have the best economics compared to peers. But neither of these need be the case for an investment in SD common stock to work out – as it is egregiously undervalued. All told, despite being in a lousy industry I think Sandridge is a wonderful stock at current valuations.

Links

Icahn’s letter:

https://carlicahn.com/open-letter-to-sandridge-energy-stockholders-3/

SD’s strategic review press release:

https://www.sec.gov/Archives/edgar/data/1349436/000119312518270365/d619103dex991.htm

EIA 2019 outlook:

https://www.eia.gov/outlooks/aeo/pdf/aeo2019.pdf

WSJ article on Icahn’s activist measures:

https://www.wsj.com/articles/icahn-set-to-win-majority-on-sandridge-board-1529420595