ServiceMaster (SERV): Terminix is a Wide Moat Serial Acquirer of Pest Control Companies That’s Well Worth Adding to Your Watchlist

by JONATHAN DANIELSON

ServiceMaster spun-off their home warranty segment, principally the American Home Shield brand, under the new corporate guise “frontdoor, inc.” back in October of 2018. This spin did not garner a lot of attention from the value investing community as both the RemainCo (SERV) and the NewCo (FTDR) were easily discernible high-quality businesses and both parts were going to be about the same size business at about $1.5 – $2 billion in revenue. In other words, not particularly fertile grounds for a mispricing and not what most event-driven value investors look for. Now that we’re about 7 months post-spin, with both entities trading at high-teens EBITDA multiples, they both appear fully valued by my eye. There was quite a bit of volatility in between, as Q4 proved to be a particularly hostile environment for spin-offs of all shapes and sizes so it was possible to pick both up at bargain prices (for the quality of the businesses) if you were paying close enough attention – not so much at today’s prices.

So Why Am I Looking?

Despite ServiceMaster and frontdoor not appearing quantitatively cheap on valuation metrics, the reason I think it’s worth studying up on both companies is fairly simple. Both, at first glance, appear to be extremely attractive companies as they each dominate their respective markets and possess especially compelling corporate-level economics. I’ll go over the multitude of reasons it appears to me ServiceMaster is an above-average business in this write-up. Furthermore, it certainly does not take neck-breaking, earth-shattering primary analysis to ascertain that we’re in the late stages of the current cycle. As such, now seems as good a time as any to be adding quality-type businesses trading at quality-type business prices in order to capture the opportunity if a broader market sell-off emerges. As such, let’s start with ServiceMaster.

Overview – The Company Has Been Around A Long, Long Time

ServiceMaster has been around since the late 1930s. Granted, this is somewhat in name only as the company has acquired and divested many businesses over the ensuing decades; although, the business has always operated in the cleaning residential services industry. The company was originally founded as a mothproofing business by Marion Wade – a minor league baseball player at the time. The company quickly switched gears and got into the carpet cleaning business in the 1930s. ServiceMaster experienced a good deal of success throughout that decade and began franchising its brand in the 1940s for residential and on-site carpet cleaning. Throughout the 1960s and 1970s – the era which the ServiceMaster brand really become a household name – ServiceMaster expanded into hospital maintenance. By the mid-1970s ServiceMaster had sold in excess of 1,000 franchise licenses in its consumer cleaning division, and the Company’s health care division had won cleaning contracts with more than 460 hospitals and was growing rapidly. By the mid-1980s with hospitals reducing their budgets to implement cost controls as well as government regulations making it a continually less appealing market to operate in, ServiceMaster’s main source of growth and earnings, the health care sector, began to suffer. This coincided with a change in management which ultimately led to a deterioration of the Company’s core tenets of management such as fiscal responsibility.

Post-1980s as the Company saw the writing on the wall with their main operations facing secular headwinds, the new Management began empire building. As the original management team eschewed financial leverage and preferred a conservatively financed enterprise, new management used leverage liberally to acquire unrelated businesses in different markets to “diversify” themselves. Many of these acquisitions made little sense as they ranged from a company that marketed office machines and financial services to doctors and dentists, to a cafeteria business serving educational facilities. This seemingly random use of shareholder capital for new acquisitions would continue into the 90s. However, one acquisition would prove to stand out from among the rest as ServiceMaster announced in November of 1986 that they had agreed to acquire the country’s second largest pest control business, Terminix International. With 165 company-owned locations in addition to 150 franchisee branches, Terminix had approximately $150 million in revenue. ServiceMaster made the acquisition for $165 million.

The Company would continue to make more acquisitions and take on more debt to finance them straight through the end of the millennium. However, by the turn of the century the struggles the company faced as it had the unenviable task of incorporating its hodgepodge of unrelated businesses became evident. Profits fell and the stock tanked. They eventually sold themselves to a private equity firm in 2007 for $4.7 billion (12x EBITDA). ServiceMaster became public again in 2014 at ~$17/share with about 4.5 turns of EBITDA in debt (note: don’t run away yet – they’ve paid down a lot of it) and the PE firm has fully exited the position.

The Business

ServiceMaster has two main businesses:

- Terminix; which specializes in termite prevention & pest control. They provide their pest control services to both households and businesses. Additionally, about 5% of this segment’s revenue comes from selling physical pest control products. The Terminix brand represents 87% of total revenue.

- ServiceMaster Brands (previously known as Franchise Brands); which are the Company’s cleaning and restoration brands. As you can tell from the former name of this segment, these brands are ServiceMaster’s franchise brands – making up the remaining 13% of revenue.

ServiceMaster has 8,000 company-owned locations (310 of which are allocated to Terminix), 10,700 company associates, 34,000 employees under their licensed franchisees and earned 97% of revenue from within the United States. On net, I believe the evidence depicts ServiceMaster to be a company that is recession-resistant, highly cash generative, and is poised to continue growing both organically and by further consolidating their industry. But before we talk about the quality of the businesses, we have to first dissect ServiceMaster further – as there are a lot of moving parts here.

Terminix

Terminix currently serves approximately 2.8 million customers nationwide. As such, Terminix is one of the main competitors in the nation. There are three ways we can further break Terminix down. How to think about the Terminix business is by the three end markets they serve: Residential Pest Control, Commercial Pest Control, and Termite & Home Services (which also has a commercial and residential side of operations). Think of the Pest control side as the segment that deals with bedbugs, mosquitoes, cockroaches, wood-destroying ants, etc. while the Termite segment deals with, you guessed it, termites. The share of revenue is broken down as follows:

- Residential & Commercial Pest Control: 59%

- Termite and Home Services: 36%

- Other (selling products, etc.): 5%

Residential consists of serving family households and stands at 67% of the Pest segment revenue while Commercial serves businesses and brought in 33% of the Pest segment revenue in 2018. Close to 95% of Termite and Home Services revenue was earned from Residential, while the remaining minority was attributable to Commercial. Residential Termite is their flagship business as they, in the past, mainly focused on serving this sector. ServiceMaster’s historical focus on the rural market is demonstrated by the fact that they are #1 in the residential sector and #4 commercially, as determined by customer-level revenue.

The Termite segment maintains an especially robust retention rate of customers, as contracts are generally signed in excess of one year. The contracts are multi-year in nature as the Company is installing various traps and other deterrents in order to kill/exterminate wildlife. Further, an additional part of their termite services includes insulation services and crawlspace encapsulation. The annual report describes the process as “installation of a protective liquid barrier or bait stations surrounding the home.” The pricing of the Termite products is in such a way that customers pay substantially more in the first year then they do in the years following. In large part, this is because in the first year ServiceMaster has to incur substantial costs when first setting the equipment in place whereas in following years the team only has to maintain routine check-ups. Approximately 80% of the Termite Segment’s revenue came solely from these renewal-option contracts. This gives the company an incredibly stable base of recurring revenue as well as multi-year top-line revenue visibility. Despite being the flagship business, the Termite Segment, as of late, has been the sole underperforming segment. Of the three segments within Terminix, Termite is the only one which has seen declining growth rates. Gross margins for the entire segment typically run in the 45% range while EBITDA margins come to 20%.

ServiceMaster Brands

Very little of ServiceMaster’s value comes from this segment. As I’ve already said, this segment contributes around 13% of total revenue. The brands that make up this segment are: ServiceMaster Restore (restoration), ServiceMaster Clean (commercial cleaning), Merry Maids (residential cleaning), Furniture Medic (cabinet and furniture repair) and AmeriSpec (home inspection). All seem to do fine in their respective industries. Together, these brands brought in revenue of $244 million and EBITDA of $89 million in 2018. Despite being small and offering zero growth, this is an appealing source of earnings for the company. Revenue earned are in large part royalty fees paid to ServiceMaster by the franchisees. The dynamics of the relationship are typical: ServiceMaster provides the infrastructure and brand name while the franchisees run the actual business. This translates to recurring high-margin revenue for ServiceMaster. EBITDA margins remain resilient at the high-30s level.

Quality

“What I’ve found here is that through the downturn in the economy … basically the team was able to hold revenue constant and improve earnings and cash flow in a very challenging environment. … If we lose a customer it’s because we made a mistake. It’s not the economy. It’s not the weather. It’s that we didn’t deliver on our promise. We didn’t meet our expectation. The economy has not hurt us dramatically.” – Hank Mullany (former CEO of ServiceMaster as quoted in February 2011)

ServiceMaster is a company with meaningful pricing power

ServiceMaster is a company with meaningful pricing power

Above I’ve highlighted two extremely attractive aspects inherent with ServiceMaster’s business model. The first is that the business appears to be extremely recession resistant. Throughout the Great Financial Crisis, the Company’s revenue remained relatively flat – only decreasing <1% in 2009 from its 2008 level. In addition to the company not shrinking its top line, EBITDA only fell 5% year over year in 2009, only to get back above the 2008 level in 2010. Conceptually, this makes a lot of sense. Given the nature of the Terminix business model, it doesn’t appear to me that this would be a highly discretionary product. Coupled with extremely high retention rates (disclosed in prior years 85%+) and the corporate-level results match any reasonable intuition of the product-level economics.

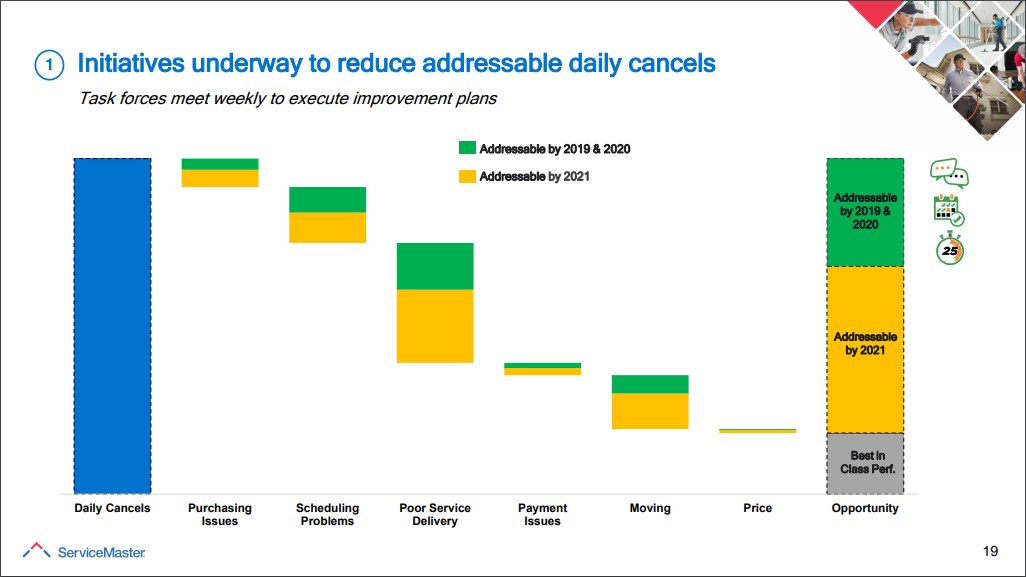

Furthermore, SERV maintains a dominant market position in an otherwise fragmented market. In an industry with >20,000 companies, Terminix captures over 21% of the market as measured by customer-level revenue. Terminix’s only true competitors at Rollins at 19% market share, Rentokil with 7%, and Ecolab maintaining a 5% position. While the case can be made that Terminix has seen stiffer competition in recent years as peers have been able to achieve higher organic growth rates, it’s important to realize just how sticky a customer is once they have chosen a pest control company. In 2018, under new management, Terminix reached out to former customers that had left them to find out why they had left. Of those who left, an incredibly small minority did so because of price (see chart above). When you add the qualitative aspects described herein with respect to both pricing power and the business being recession-resistant, you would expect to find evidence of this quantitatively in the financial statements. And that’s exactly what we do find with SERV.

Per the 2018 10-K, ServiceMaster had $5 billion in assets and $2.2 billion in equity. Now, both of these are misleading as the vast majority of ServiceMaster’s book value comes from intangibles assets like goodwill and various other intangibles. These items might be important to us if we’re trying to gage how well management has been allocating capital, but these are largely irrelevant to you and me right now.

Let’s look at Invested Capital (or Net Tangible Assets, if you will). For the first quarter of 2019 we get (in millions):

Cash: 255

Receivables: 183

Inventories: 46

PP&E: 201

Total: 685

If we subtract out current liabilities of $443 we get Invested Capital of: $242 million. Quite obviously, with a business that did $442 million in EBITDA last year and converts ~50% of that into Free Cash Flow, the precise percentage of ROIC isn’t relevant. Returns are good. If you wanted to take stated book value of $2.2 billion, then ROE is 15% (EBITDA of $442 less $91 in D&A).

Aside from these corporate-level statistics, it has become increasingly difficult to tease out customer-level economics. We know, broadly speaking, that Terminix has over 2.8 million customers. But we don’t know how that’s broken down by segment. Each segment has wildly different price points since the rate you charge a corporation will differ materially then what you can charge a household. We can also add in to the mix that Terminix has to charge each household customer differently depending several factors specific to the household. And we don’t know what the retention rate of each segment is. ServiceMaster used to disclose retention rates for all of their segments, but they’ve moved away from doing that. In an ideal world I’d like to have the disclosures to allow me to reasonably guesstimate how much in revenue each customer brings in over the life of said customer and how much it costs to get that customers. But this isn’t an ideal world and we, as outside investors, rarely have the disclosures necessary to get an exact approximation of the granular details of customer-level economics. Quite frequently there are simply too many moving parts.

Despite not directly disclosing retention rates anymore, the Company does tell us that the investments in the business over the previous years are driving customer retention rates higher. In the most recent slide deck we’re told Commercial Pest retention rates are at 3-year highs. From previous years, the Pest Control segment averaged around 80% retention rates. The Termite segment was a little higher at 85%. As I said, Management tells us those rates have been improving, yet they’ve discontinued those disclosures so let’s assume they’ve remained constant.

In attempts to triangulate customer-level economics, we can assume Terminix’s customer retention rate is no less than 80%. That seems conservative. The ultimate price the customer pays is far from a flat rate. It varies greatly depending on your geography, type of home, and obviously what type of pest control you need. Just from perusing the internet in attempts to find the average price point customers will tend to pay it appears to me the average one-time extermination fee is ~$500. For contracts the initial visit is usually $185. You can then enter contracts in which you’ll pay monthly, semi-monthly, quarterly, or yearly. Multi-year contracts exist too but are much more infrequent. The quarterly average payments range between $100 – $300. That’s quite a difference. Let’s split it down the middle and call it $200 every quarter.

Alright, so we know ~80% of Terminix’s revenue comes from the renewal contracts. Gross margins are ~40%. As I’ve said, the initial visit always has a higher cost basis for Terminix as they have to install the actual traps (or other devices at their disposal). This is why SERV experiences high incremental margins, which are in the 30%-35% range for EBITDA.

So at a retention rate of 80%, the average residential customer for Terminix would look something like (assuming payments every quarter):

Year 1: $75 (Gross)

Year 2: $256 (80% retention rate at 40% Gross)

Year 3: $208

Year 4: $160

Year 5: $128

Years 6-10: $336

So for 10 years, with a Gross margin of 40% and a retention rate of 80%, the average residential pest customer gross in a gross profit of ~$1,100. We also know that Terminix turns about 22% of gross profit into free cash. So, if each customer stays with the company for 10 years, we can expect on average that they will contribute $250 worth of FCF over that time period.

Okay, that’s one side of the equation. What does it cost to get that costumer? Well, in 2017 Terminix had 2.7 million customers. In 2018 they had 2.8 million. So that’s 100,000 new customers. But there is also churn in the business. So, if we assume a churn of 20% and add the net additional customers, we get 540,000 total new customers. ServiceMaster discloses what they claim to be customer acquisition costs. Per page 62 of the 10-K,

“Customer acquisition costs, which are incremental and direct costs of obtaining a customer, are deferred and amortized over the expected customer relationship period”.

ServiceMaster discloses that the above defined costs total $77 million for 2018. So if we want to take the number they give us and apply some 5th grade level math we get:

- 540k new customers

- $77 million in related expenses

- = $142/in CAC per customer

Which means Terminix gets the amount it costs to acquire each customer back in 2 years if we’re measuring by gross profits. It might even be reasonable to assume they can achieve pay-back periods of under a year. $185 for the initial inspection is an overly conservative estimation. Also, we can add on top of that the 20% of revenue that Terminix brings in from one-time sales. These routinely cost more than $1,000.

Moving back to customer acquisition costs, ServiceMaster doesn’t explicitly state what all goes into that $77 million number. They only tell us it is the direct costs of acquiring a given customer. In addition to that, they also spent $85 million in advertising in 2018. So, if we wanted to add the two, we would get $300 million in customer acquisition costs. Even if we more than double the CAC, it doesn’t take Terminix very long to earn back everything it spent and then some.

Of course, all of the above calculations are only an approximation of what residential customers are likely to be worth to the company. Commercial customers are still 35% of the business (of the Terminix segment, anyway). And this segment is likely to continue to continue to grow as I’ll discuss later with the Copesan acquisition. Separate from that, Management has reiterated on several occasions that they intend to pursue growth in the commercial side of operations. Shareholders should welcome this development as pricing power among corporate clients appears to outstrip the already very strong pricing power the company has with its residential customers. With that said, it appears to me that doing the same CAC for Commercial customers that we just did with Residential customers would involve too many moving parts, as the company doesn’t make the necessary disclosures for us to back in to a reasonable guess. Despite that, if we are judging based on corporate-level statistics then any way you slice, customer-level economics are enticing.

A Turn Around(ish)

Despite the rather obvious attractive aspects of ServiceMaster’s business via its dominant position in its industry and its cash generative abilities, if you read the latest conference calls or the 2018 investor day, you’ll notice management is spinning this story as a turnaround of sorts. They have undergone several change ups in their management team has they’ve replaced more than a few top executives. Aside from that, management talks about improving customer experience, upgrading their leadership team, and rebuilding the fundamentals of the business. Why is that?

It’s certainly up for debate but as far as I can tell, it is largely because that they believe “short-termism” plagued the company under leadership from the PE firm. In order to juice profits with the intention of selling the company back to the public markets, the PE firm’s previous management team underinvested in the company to inflate EBITDA margins.

This led to several problems. Firstly, organic growth at Terminix has been slowing. Compared to other comps including Rollins and Ecolab which have been achieving 5%+ growth, Terminix has consistently been in the 3%+ range over the recent years. The full effects of underinvesting in the company can be seen if you look at the company’s revenue growth rate from 2014-2017 and compare it to its EBITDA margins over the same time. The results are striking – revenue growth falls from mid-4% to ~1.5% as EBITDA margins improve over 30% as they increase from 20% in 2014 to 26% in 2017.

Since new management has taken over we’ve seen a reduction in EBITDA margins as they have returned to investing in the business – such as rolling out new contracts with their employees to retain talent as employees can opt for a compensation plan that has three tiers ranging from completely fixed to completely commission, investing in innovation centers, upgrading sales teams, etc. – and consequently a resurgence in revenue growth as top-line was up mid-5% in 2018 year over year.

With that being said, I do find it hard to call a company that hasn’t seen a decrease in top-line during the past decade a “turn-around”. Since 2010, ServiceMaster’s revenue CAGR totals a little less than 4% including acquisitions. During the same timeframe EBITDA as grown 6%+ compounded annually, increasing from $264 million to $433 million. That’s not to say the business faces no problems going forward. The Termite sector has seen some contraction in top-line growth rates has it has lost market share to competitors, but on net ServiceMaster remains a dominant player.

Capital Allocation

“There is no reason why we can’t recreate what we’ve done in North America in a global market. We are in the process of analyzing and studying every single geography” – CEO Nikhil Varty at the 2018 investor day

As cited above, ServiceMaster’s only real market as it currently stands is the United States. They earn north of 95% of revenue domestically, with the only foreign revenue coming from small franchisees in their ServiceMaster Brands segment. The small number of foreign markets these franchisees operate in are: Japan, South Korea, Southeast Asia, Central America, and the Middle East. ServiceMaster’s historic preference of domestic markets looks to be changing as the company has stated several times their intention of expanding internationally. It remains largely to be seen how the company will take on the challenge of growing internationally. All indicators point to it being done via M&A.

Speaking of M&A: From 2014-2018 ServiceMaster acquired over 75 companies. In 2019 they’ve already completed an additional 11 acquisitions. Granted, these are largely smaller sub-$100 million (usually much, much smaller) in revenue companies that operate in the same space as ServiceMaster. And this point is important to note because how SERV is approaching M&A now is different than what it was doing in the decades leading up to the turn of the century. As I’ve already pointed out ServiceMaster, at the time, appeared to be indifferent to the type of businesses they bought. They just wanted revenue. That’s not what we have seen this decade. To the contrary, they’ve even divested large pieces of their business where they saw the chance for value enhancement (frontdoor). No, what it appears they are doing is rolling up a fragmented industry. Take Copesan for example. This might not be entirely representative because it is one of the larger acquisition SERV has done of late. But management has stated that they intend to increase their exposure to the commercial side of the industry. And with the acquisition of Copesan they did just that. Copesan specializes in urban markets serving commercial clients. These are the type of acquisitions we see now with ServiceMaster. They tend be more of the “bolt-on” persuasion, where (and here’s that infamous word) “synergies” are at least feasible, as opposed to randomly acquiring companies in unrelated industries.

Aside from M&A and international expansion, SERV has long aimed at reducing net leverage to the 2.5-3 range of EBITDA. The way in which they handled the frontdoor spin-off made it so they were able to achieve that goal nicely. With the spin-off, SERV was able to transfer $1 billion in debt to the NewCo’s balance sheet. In addition to that, SERV retained a ~20% interest in the spin-off company which it would go on to monetize in 2019 and was able to reduce debt by another ~$500 million, bringing net debt from 3.7 turns of EBITDA down to 2.6x EBITDA.

Management

This wouldn’t be a proper discussion of ServiceMaster if we didn’t talk about executive turnover. First, there’s the most obvious one: in summer 2017 Rob Gillette was replaced as CEO by Nik Varty, who came over from WABCO. Since then, Mr. Varty has been extremely busy. He has replaced 6 executives by last summer, with more being announced this year (2 just this month). Corporate shakeup isn’t just happening on the executive level: over 60 of their 250 branch managers have been replaced. Clearly Varty considers SERV to be a turn around. I think a deep discussion regarding the credentials of every new senior executive is beyond the scope of this article, but it should be noted that Management is currently taking great lengths to get back the pre-buyout level of operations.

Valuation

And that brings us to everyone’s favorite question: what’s this thing worth? Well, Rollins trades at 32x EBITDA (yeah, you read that right). But we know a previous investment firm bought SERV out at 12x EBITDA. “But, a 12x multiple is asinine for a company that has a 20% market share, is recession-proof and turns nearly 10% of revenue into free cash!” you say. Yeah, I agree. Rollins could be overvalued though. I’d venture to guess that it is. But given SERV’s attractive characteristics I’m willing to say it should trade at a market premium. But what’s the right multiple? There is definitely more than one reason to not want to place too high of a multiple on SERV. Organic growth has been declining (over the past 5 years, notwithstanding improvement under new management). They do acquire a lot of companies. They also claim to buy back stock. But it isn’t so clear to me that they actually do. In 2015 they launch a $300 million buyback program and have spent $150 million of it. Yet, total shares outstanding are up slightly. So, that certainly means they’ve at least been issuing the same amount of shares they’ve been buying. Whether that’s due to acquisitions or executive comp isn’t entirely relevant. But either way, your ownership in the business hasn’t increased at all which is sort of the point of buying back stock in the first place.

So, this isn’t a great company. There are flaws. But it looks to me like an above-average company. The Company did about $190 million in free cash last year. If we want to frame it that way, then I’d say for a company with the negative aspects I just listed, but is likely to grow 3%+ year over year organically over the next 5 years and is still an above-average company, they should probably trade no less than at a FCF yield of at least 3%. If they get to a Free Cash Flow yield of, say, 5% then the situation starts to get very interesting. So, on a market cap basis, that gets us in the ballpark of no less than $6 billion.

If you prefer multiples of EBITDA, then I don’t think a 15x multiple for this company is completely unjustified. With $442 in EBITDA in 2018, that also gets us to ~$6 billion on an EV basis. If you think 18x is more appropriate, that brings us to ~$7.5 billion. Even though the business has been paying down debt over the past 5 years, it still has a meaningful amount. After they divested their total remaining interest in frontdoor, net debt stands at roughly $1,034 billion. So, a fair value of SERV looks to be something close to:

- EBITDA: $442

- Fair Value Multiple: 18

- Enterprise Value: $7.5 billion

- Less debt: $1,034

- Equity Value: $6,466

- Per Share: ~$47

SERV currently trades at $7 billion on a mark cap basis and ~$8 billion on an enterprise basis. At current prices that’s about a 2.5% yield. So long as the business continues to maintain its recovery, if SERV trades down to a 5% yield I think it would be worth considering it as a position.

Key Negatives/Things to Keep an Eye On

At a ~2.5% FCF yield, it looks to me the market is pricing SERV appropriately here. Of course, if you think ServiceMaster is going to be able to achieve 5%+ growth in their top-line, with some margin expansion added in, then there could be a path to 10%+ annual returns in the stock. But I don’t really see a margin of safety there. With that, some items worth watching (or thinking more deeply about before initiating a position) are:

- New Management. It strikes me as a little odd that the Old CEO was discarded so abruptly. The reasoning appears to be slowing growth in the Terminix business, but we don’t really know. With that said, I think you obviously have to get pretty comfortable with the new management as they implement their initiatives.

- SERV’s highly acquisitive nature does add an element of risk, in my opinion. Despite the majority of these acquisitions being miniscule, there’s a fair amount of shareholder capital being spent on these deals. How they ultimately perform is vital to what the stock will return long-term.

- Customer Retention. I’m always given pause when a company stops disclosing performance metrics. Given the nature of the business, customer retention is a big one. On the same note, I think watching organic growth in the Terminix business will be key moving forward.

All told, SERV is a business that is likely to achieve GDP%+ growth in the medium term, has a universally recognized brand, and is a cash cow. It’ll be on my watchlist.