VieMed Healthcare (VMD): A Founder Led Canadian Listed U.S. Ventilator Company Faces the Risk of Competitive Bidding for its Medicare Patients Starting in 2021

Write-up by REID HUDSON

(Geoff’s note: VieMed trades under the symbol “VMD” in Canada and over-the-counter in the U.S. under the symbol “VIEMF”. The stock is a lot more liquid in Canada than in the U.S. However, the price difference between the shares in Canada and the U.S. doesn’t always perfectly reflect the U.S. Dollar to Canadian Dollar exchange rate.)

VieMed Healthcare Inc. operates in the home health space and provides services and equipment to a variety of respiratory patients. Its main market consists of stage 4 COPD patients who are in need of non-invasive ventilation (NIV) therapy to continue living without excessive time spent in a hospital. VieMed also offers a range of sleep apnea, oxygen, and other respiratory solutions to patients. VieMed employs Respiratory Therapists (RTs) to assist patients with the set-up of machines, education, continued monitoring, and other services included in respiratory treatment. The company states that NIV treatment makes up roughly 90% of its business. VieMed is a Canadian listed company that operates in the United States. Its corporate structure consists of a Canadian parent company listed on the TSX called VieMed Healthcare Inc. This parent company is the sole owner of a Delaware incorporated U.S. subsidiary called VieMed Inc. that owns two subsidiaries of its own. The company operates through these two Louisiana based subsidiaries: one called Sleep Management, LLC and the other called Home Sleep Delivered, LLC.

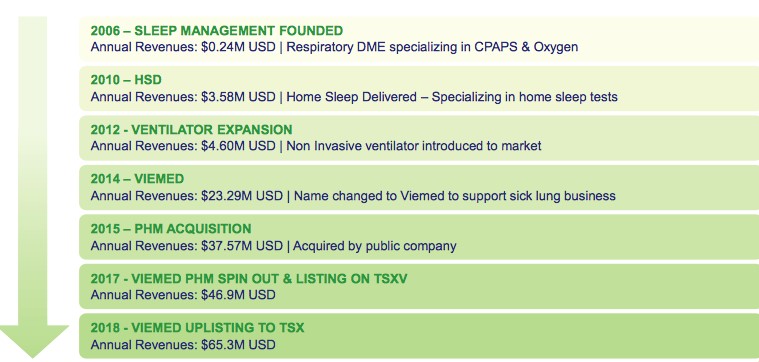

As the graphic above shows, Sleep Management was founded in 2006 by its current CEO Casey Hoyt. It got into the Non-Invasive Ventilator (NIV) market in 2012 and began to focus on COPD, changing its name to VieMed shortly thereafter. After being acquired by PHM, VieMed completed a spin-out in 2017. It was listed on the TSX Venture Exchange mainly because the company that it spun-off from was listed there.

VieMed claims that it cares for more patients with non-invasive ventilators than any other company in the United States. NIVs are non-invasive machines that are used to lessen the effort required to breath. They are primarily used by patients with late-stage COPD and neuromuscular diseases that both make it very difficult to breathe without assistance. These machines are non-invasive as opposed to invasive ventilators that require insertion through the mouth, nose, or directly to the trachea by way of a tracheostomy tube.

Since entering the NIV market, VieMed has grown revenue and active vent patients at a fantastic rate. Its revenue has grown at a CAGR 44% since 2010 and around 29% since its name change in 2014. However, this number is weighed down by a negative year in 2016, when Medicare slashed reimbursement rates for NIVs. Most recently, VieMed grew its top line number 39% in 2018 and around 50% in 2017. The number of active ventilation patients that it serves grew to about 5,905 in 2018, representing a growth rate of about 35% for the year. Active vent patients grew at almost 43% in 2017. While this growth has been impressive, what has been really impressive is the rate at which VieMed generates cash. To understand VieMed’s cash flow, you first need to understand how the company operates and how it has been fueling its growth.

Industry Environment

As stated above, VieMed operates in the healthcare services space, providing access to medical equipment and services. This does not mean that VieMed is a manufacturer of the equipment it owns and leases. Rather, it purchases the equipment – which ranges from NIVs, cough assist machines, oxygen tanks, percussion vests, and Positive Airway Pressure (PAP) machines – and then rents it out to its patients. VieMed also offers a range of services to go along with this equipment, such as oxygen therapy, patient monitoring, and home sleep tests. VieMed has traditionally been compensated for its services by private insurers, Medicare, and Medicaid. It has traditionally, like every other NIV provider, been paid a base reimbursement rate by Medicare for its NIV rental and services. I will get into how this is changing later in the article.

VieMed estimates that $50 billion of the U.S. annual healthcare cost is spent on COPD. According to the National Heart, Lung, and Blood Institute (NHLBI), Chronic Obstructive Pulmonary Disease (COPD) is a progressive lung disease that affects 16 million people in the U.S. The NHLBI website states that the disease is estimated to affect many more people who might not even be aware that they have it. VieMed itself estimates that 25 million people in the U.S. are suffering from COPD. Although it is commonly caused by smoking, up to 25% of people with COPD have never smoked. The NHLBI website also states that COPD is the fourth leading cause of death in the United States.

As mentioned earlier, this is a progressive breathing disease, meaning it gets worse over time. VieMed estimates that around 2.5 million Americans have stage 4 COPD, and estimates that around 50% of those (1.25 million) are candidates for the company’s therapy. VieMed states that currently less than 50,000 beneficiaries are using NIV therapy, representing less than 5% market penetration. Most of these statistics are from 2017, so the 2018 numbers may have grown.

The possible population of COPD patients is also growing every day. It is estimated that 10,000 baby boomers turn 65 every day, a demographic segment that represents 26% of the U.S. population. 65 is the age at which U.S. citizens can qualify for Medicare. The majority of COPD patients are elderly.

This is obviously a large addressable market, but what really matters is the level of competition within the market. VieMed estimates that the top ten NIV providers hold 60% of the market share. VieMed itself is the third largest supplier at 8% market share. The two largest providers are Lincare and Apria, who are both subsidiaries of larger parent companies. Both companies offer NIV treatment but do not specialize in the offering like VieMed does. They both offer a range of medical equipment and services and also operate brick and mortar locations. VieMed, on the other hand, does not own or operate any brick and mortar stores, allowing it to run an extremely capital-light operation. The two larger competitors obviously have a larger reach than VieMed, but their lack of specialization might hurt them. Although this is probably not representative, both have majority negative (and recent) online reviews by patients.

On the other end of the spectrum, VieMed competes with a variety of mom-and-pop medical equipment rental companies who don’t really have the scale to challenge VieMed nationally. As far as barriers to entry go, VieMed is operating in a highly regulated environment. One in which a company has to get licensed in every state it operates in. This process can take years, and VieMed is still working on getting licensed in the entire lower 48. Currently, it is licensed in 36 states, and is conducting business in 25. There are different requirements by Medicare for different product lines and navigating the regulatory minefield inherent in this process can be difficult. Furthermore, if a new company wants access to patients that aren’t on Medicare, it must contract with private insurance providers in each state, a feat that is not easily accomplished by a company with little scale. In the first quarter 2018 earnings call, the CEO, Casey Hoyt, stated that the then split between insurance contracts was around 75% Medicare and Medicaid combined and 25% private insurers. Finally, even though VieMed is delivering this service in the home, physicians are the ones who are actually ordering NIV therapy. Establishing relationships with the physicians and case managers in every community is an essential part of accessing new markets. A company must demonstrate the value of the new therapy it is providing for a physician or case manager to change his or her mind. A case manager usually handles all the sourcing of necessary medical equipment and further treatment for patients who are leaving the hospital but still require further care. VieMed is hiring a rapidly growing workforce of sales reps and clinical liaisons to accomplish this goal, and it has also commissioned and published a KPMG study (you can view a slide show about it here) demonstrating the benefits of its NIV therapy. VieMed hired 18 new sales reps in 2018 and now employs roughly 75 sales reps and clinical liaisons.

Business Model

VieMed runs a very asset-light business that is currently oriented towards growth to capture a share of this massive and unmet need for NIV therapy to treat stage 4 COPD patients. As stated above, the company also offers sleep tests, PAP machines, and percussion vests, but the NIV segment is the largest part of its business. VieMed operates by hiring Respiratory Therapists (RTs) and sales reps. Its RTs are all mobile, travelling to patients’ homes instead of working at a clinic or other type of storefront presence. That is one advantage that VieMed has over its competitors. It does not own or lease patient facing infrastructure. All its remaining capital is free to be reinvested in the growth of the business.

In 2018, VieMed generated operating cash flow (OCF) of around $19.6 million on revenue of about $65.3 million, a margin of 30%. Since VieMed has been growing from a smaller revenue base over the last few years, it has had to engage in short-term leases to obtain its medical equipment like the NIVs. This was necessary to sustain the growth of the company. Today, Viemed is transitioning to immediate ownership of the vents, paid for by the increasing amount of cash the company is generating each year. In a recent investor presentation, the company stated that it has around 7,000 vents, with 97% of them being wholly owned by the company. VieMed is also using a portion of this cash flow to pay off other leases as fast as possible. VieMed claims the elimination of lease payments will improve its margins, allowing it to achieve some form of operating leverage as it grows. While gross, EBITDA, and cash flow margins are lower than they were in 2015 and 2014, they have been growing since 2016. In 2016, Medicare reimbursement rates were cut for NIVs, causing a decrease in margins that VieMed has appeared to have handled quite well since.

The quality of VieMed’s business model is demonstrated by its exceptional OCF ROIC. It generated an OCF ROIC of 51.1%, 41.6%, and 33.9% in 2018, 2017, and 2016 respectively. The primary reason for this seems to be the business model VieMed is currently utilizing. By not having to make large capital expenditures for buildings or any other infrastructure, VieMed has been able to grow at exceptional rates while also generating exceptional cash flow with the assets it does own. This all looks well and good, but you may be wondering why I am using operating cash flow in my ROIC calculation instead of free cash flow. In looking at VieMed’s cash flow statement, one can see that the company spent just over $6 million on property, plant, and equipment in 2018. When reporting its overall capital expenditures, management uses this number combined with the amount of property and equipment financed through leases, which came out to $8.4 million in 2018. The company reported just over $14 million in capex for 2018.

The interesting thing about VieMed is that its CEO, in the year-end earnings call, stated that all current capex is growth capex. VieMed is using all of its capex to buy new vents and pay off old leases. According to the CEO, there is virtually no maintenance cost of new and relatively new ventilators. He stated that the expected life of the devices is around 10 years, but can also stretch longer. Obviously, there is going to be some maintenance capex at some point in the future, but it is could be after years of generating cash flow that can be used to grow the business or buy back shares.

VieMed has achieved this growth without the aid of debt or equity issuance. It has a line of credit with Whitney Bank for $10 million at a rate that is based on the one month ICE LIBOR plus 3.00% per annum, but none of it has been used. In fact, the line of credit that it has with Whitney Bank has not been utilized at all since inception. As of December 31, 2018, VieMed has outstanding finance leases of $3.4 million and cash in the amount of $10.4 million on its balance sheet. This leaves VieMed with around $7 million of net cash.

In terms of pricing, VieMed has been reimbursed by Medicare (its largest payer) with a base fee schedule reimbursement rate that is paid to all providers of the products it offers (NIVs). This is a fee that does not differ between providers. As long as a company is licensed in that area, it is getting reimbursed at the rate at which Medicare is offering in that area. When it comes to private insurers, however, Viemed must negotiate contracts. These contracts are usually not competitive bidding contracts (which I will discuss later), but a high-touch model in which VieMed demonstrates its value to the private insurer and the two parties agree on a reimbursement rate.

While VieMed is optimistic about being licensed in every state in the lower 48, it has stated that it is more focused on growing in places that have high COPD rates and high re-admittance rates in hospitals. These are the places that need VieMed’s services the most, and expanding here also presents the most profitable opportunity for the company. Since VieMed operates using an in-home treatment model, it would make the most money in areas with a dense population of patients requiring its services. It has found places like this near its headquarters in Louisiana, for example. VieMed has stated that this has been its goal from the beginning. Operating in places with high patient density allows VieMed to service many patients at once without the added expenditures that arise when RTs have to travel long distances to reach patients, or the company has to expand to a new state or community to reach patients. Areas like this are also easier to grow in because VieMed has already established relationships with the physicians and private insurers in these areas.

Future Outlook

As VieMed continues to bring more patients, RTs, and private insurers into its system, its management has continually reiterated that they see nothing standing in the way of expansion at a rate similar to what the company has been achieving over the last few years. The company has stated that it expects to be licensed in the entire lower 48 by the next year and a half. VieMed also closed 70 new private insurance contracts in 2018. The company closed 18 new contracts in the first half of the year, but increased this number to 24 and 28 in the third and fourth quarters alone.

Two particular markets that VieMed has been explicit in stating that it may enter are the Veterans Association system and the pediatric market. The latter, VieMed would most likely have to make an acquisition to enter into. The former, however, is a market that VieMed can expand into with its current infrastructure and abilities. VieMed is much more focused on expanding into the VA market than the pediatric market. It became a certified provider to the VA during 2018, so it is past all the red tape inherent in accessing that market.

VieMed states that it has data showing that there are 500,000 patients inside the VA system that qualify for the company’s therapy. Keep in mind that the company is only currently servicing 5,905 patients total. If VieMed is able to capture even a fraction of this number it would benefit the company immensely. Management states that the VA is currently somewhat behind the rest of the medical community in adopting NIVs for COPD purposes, so growth may be slow initially. While this appears negative on the surface, it seems to also mean that there are no other NIV providers operating in the VA system. If no one is currently using NIVs for COPD treatment in the VA, then it appears that VieMed may be the only company that is going after this market. An underserved market with no competition is exactly the kind of opportunity this company should be jumping on. That being said, adoption may be harder than it appears. VieMed has said in its earnings calls that its real competitors are not the two large respiratory providers or the small mom and pops. Instead, the real hindrance on growth (the real competition) is the physicians the company has to convince to order this treatment and the case managers it has to convince to adopt the company’s treatment and equipment. If the VA system does not want to adopt this new kind of treatment, this could be tougher competition than the other companies. This task, however, should become much easier now that VieMed has published its KPMG study.

CMS Competitive Bidding

No discussion of VieMed’s future or its valuation would be complete without addressing the competitive bidding environment it will now have to enter into in 2021. Non-invasive ventilators are being placed on the list of durable medical equipment (DME) that is going to be subject to competitive bidding starting in 2021. This means that instead of getting paid the flat Medicare reimbursement rental rate for its NIVs in an area, Viemed will have to submit a bid for each area that requires it. The winner of the bid is the provider that offers the lowest price and is able, financially and operationally, to service the area being bid for. The Center for Medicare and Medicaid Services (CMS) will inspect the bidders, making sure each will be able to fulfill their contract.

Other products that Viemed provides, such as oxygen, had been subject to competitive bidding in the past, but will not be until 2021 because the program was suspended. From what I can tell, the past competitive bidding program did not work out as well as many had hoped. The particular way that the winning bid was calculated allowed for suppliers to come in and submit an ultra-low bid – forcing everyone else out of the market – but then getting to fulfill the bid at a higher price because of how the calculations worked. In this past scheme, the single payment amount (SPA) for any particular DME category was set equal to the median of the bids submitted for that particular item by bidders whose composite bids were equal to or below the pivotal bid for that product category in that geographic area. This could technically allow the winner to submit a “false” bid below what was economically feasible and then actually be reimbursed at the median price.

The 2021 round of DME competitive bidding will, as stated above, now include non-invasive ventilators. This style of reimbursement is mainly relegated to metropolitan areas called competitive bidding areas (CBAs). There will be 130 CBAs in the 2021 round. VieMed is currently operating in 39 of those areas. The company stated in a recent investor informational conference call that about 25% of their current business is in a CBA. So, around 75% of the company’s revenues come from rural areas that won’t be affected by the next competitive bidding round. As VieMed expands, however, it will probably penetrate more of these metropolitan areas. One can assume that since VieMed’s strategy is to operate in areas with high COPD admittance rates and dense COPD patient populations, a good amount of these CBAs will be places VieMed is targeting for growth.

This new round of competitive bidding will be conducted somewhat differently than old rounds. The single payment amount will be computed based on the winning bid for lead items in each category. This means that all the products will be sorted into categories based on their similarities and will be represented in the bidding by a lead item. The price of the lead items will be multiplied by an applicable rate to determine the price of each other product in that category. It appears that the NIVs will be their own lead item, as they are listed as one of the 16 categories on the CMS website. The winning bid will be equal to the maximum bid submitted for that item by bidders whose lead item bids for the product category are equal to or below the pivotal bid for that product category in a CBA.

VieMed, like many other medical equipment providers, has long been a proponent for the exclusion of NIVs from the competitive bidding process. The company’s past method of growth didn’t involve any competitive bids or negotiations for price when it was dealing with Medicare. Each payment it received from Medicare was the base fee schedule reimbursement rate in that area. The competitive bidding process does, on its face, appear to be a negative development for the company, and it may very well be. I would like to propose, however, that some second level thinking is required in this scenario. During the bidding process, which will all take place at one time, there will be a definite winner in each area who will get all the business in that CBA. It will have to accept the rate that correlates to what it won the bid with, but there will be no other competition in that area. It has long been documented that past competitive bidding rounds drove DME providers out of business and prevented competition from coming in. This seems a little counter-intuitive since the process is supposed to increase market-based competition. However, the transition from a market from fee schedule payment amounts to competitive bidding does make that market look significantly worse to new entrants. VieMed has stated themselves that the classification of other equipment like certain types of oxygen tanks has made those markets less desirable for growth. If a company can’t just come in and start getting payed the fee scheduled reimbursement rate, but instead has to compete with competitors with scale, it might think twice about entering.

I would actually be willing to proffer that this development could make VieMed a more entrenched provider in the non-invasive ventilation market and increase barriers to entry in this market. Yes, reimbursements rates will most likely decrease in certain areas, but if VieMed is a winning bidder in a lot of areas, it may increase its volume of patients exponentially and all at one time. Think about it, in many areas VieMed may still be competing with other providers who may have been there before them. A patient may just be sticking with the local brick-and-mortar ventilation provider in the area because they always have in the past or because their case manager doesn’t know any better. Obviously, VieMed is trying to fix this with its sales team that propounds the benefits of its high-touch, in-home ventilation service that comes with an RT you can contact 24-7. This, however, does take time. But if VieMed wins a bid for an area, all the patients on Medicare in that area will switch over to VieMed immediately. You do, however, have to take into account the fact that VieMed may lose too many bids in too many areas and the fact that this process will reduce the rate at which VieMed is currently getting reimbursed at.

I don’t know how much reimbursement rates will decline as a result of this, but I can make some estimates. The CMS website discusses earlier rounds of competitive bidding and has stated that they have, at times, decrease reimbursement rates by an average of around 32%. Right now, VieMed claims that it receives roughly $950 per month in NIV reimbursements. This aligns with a ResMed report I’ve seen stating that the 2019 Medicare reimbursement rate for NIVs ranges from $934-$1,099 a month. This $950 number is equivalent to $11,400 a year in reimbursement rates per patient. A 32% reduction would drop this rate to around $7,752 per year. For a further discussion of how this will affect VieMed’s business and valuation going forward, I will discuss this under the valuation heading.

Valuation

Viemed currently trades on the U.S. OTC market as well as the TSX, and is at a price of $5.45 on the OTC market, but it has been fluctuation lately. Using its fully diluted share count, this translates to a market cap of $216 million. This leaves the company with a price operating cash flow ratio of 11x. It trades at an EV/EBITDA of just over 14x. The company doesn’t have any comparable publicly traded competitors, but on the surface, this appears way too cheap for a company growing at the rate and generating the kind of return on capital that Viemed is. The forward EBITDA and cash flow multiples for 2019 are even lower, especially if one assumes Viemed grows at a rate of anywhere from 20%-40%. If OCF grows at 20% this year, the ratio is in the single digits – definitely too low for a company that grows at the rate VieMed does and generates the ROIC VieMed does.

If you want to try to estimated VieMed’s expected maintenance capex, you can look to its medical equipment depreciation cost. This cost has been rising every year because VieMed is switching from being a lease-heavy provider to one that owns the ventilators outright. This medical equipment depreciation number has averaged 3.1% of revenues since 2014, but has been creeping up each year. Since VieMed has stated that about 97% of its vents are wholly owned, and 2018’s medical equipment depreciation cost was 4.9% of revenue, I’m going to estimated that future depreciation costs are going to be about 5% of revenue each year. This seems to be the most reliable measure of what annual maintenance capex could be each year. VieMed’s maintenance capex may be delayed for now, but the depreciation cost is a good way to see how it would be spread out over each machine’s useful life.

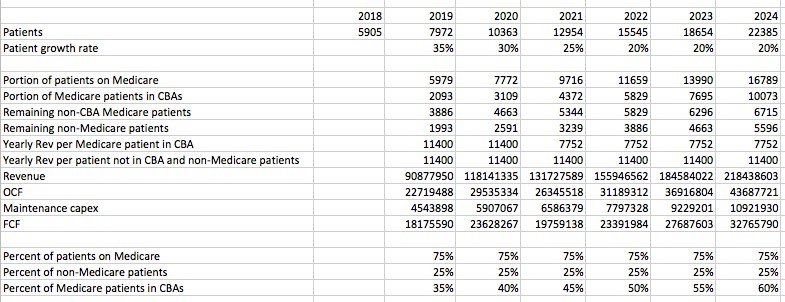

When trying to determine what kind of return you can generate from holding this stock, it is imperative to take into account not just past performance, but also future effects from things like competitive bidding. To do that I tried to model out a possible scenario. Obviously, this is just a hypothetical to see what could happen if certain assumptions are made. This is not a definite prediction of the future and should not be blindly relied upon. I mainly did this to attempt to see what kind of return can be generated in the future even with NIVs being added to the next competitive bidding round. If VieMed fails to win bids in a lot of the CBAs it is operating in then this model is useless. If Viemed wins many more or is able to expand at a faster rate or enter into the VA quicker than anticipated, then this model is also useless. This isn’t even really a model, just a sanity check on whether the company will be alright and whether I will be able to achieve a solid return with common sense assumptions applied to a possible scenario.

This is a chart of a possible scenario five years down the line. It includes assumptions such as constant maintenance capex of 5% of revenue every year. It also assumes that the OCF margin drops from to 20% after the competitive bidding starts. The average OCF margin since 2014 is 27.2%, but it dropped to 20% in 2016 when Medicare reimbursement rates were cut. VieMed did a good job of getting it back up to 30% after the rates were cut in 2016, but might not have the same luck this time. I assume it will drop again since the reimbursement rate will almost assuredly drop when competitive bidding starts, and it might take time for the wholesale price for vents to drop. VieMed may also not be able to cut its costs at a similar rate, so I just assumed a 20% OCF margin beginning in 2021, no recovery accounted for. Furthermore, the company currently has some tax loss carryforwards that will be used soon, so the application of a real tax on VieMed’s net income (not cash flow) will also probably help to keep the margin down around 20%.

Another assumption I made is that as VieMed grows, a larger portion of its Medicare patients will be located in competitive bid areas (CBAs). I figured the growth in those areas might not become a massive part of VieMed’s business initially, but it will escalate pretty quickly once competitive bidding starts. I just made a base rate assumption that the percentage of patients inside CBAs that VieMed serves grows by 5% of the total number of patients every year. The first round is for three years, so the winner of an area is the provider for those three years. In reality, this number could increase much faster after competitive bidding begins because if VieMed wins in a CBA, it will not have any more competition for the Medicare patients in that area. This is all based on the assumption that VieMed’s current split between Medicare and non-Medicare patients stays the same. One or the other could increase. I have also just kept revenue per patient at $950 a month for all non-Medicare patients and Medicare patients that are in areas that are not subject to competitive bidding.

If you apply a 15x or 20x multiple on the expected FCF in 2024, then you get a pretty good return over five years. These multiples seem appropriate or too low, seeing as how VieMed will have demonstrated it can compete in competitive bidding environments by then and would still have a large addressable market ahead of it. This assumption would see VieMed serving roughly 22,000 to 23,000 patients by then. That would still be less than 2% of the addressable market as it stands today. This also doesn’t take into account any possible patients inside the VA system. I don’t know what rate the VA system reimburses at, and it is questionable if VieMed can operate inside of it. However, as stated earlier, the VA system represents an untapped market with what looks like no competition currently present.

Looking at the market VieMed is operating in and how the company has been performing, I think you could try to value the company just by assuming it captures a percentage of the total market. If the general medical community becomes more aware of the benefits from NIV for COPD patients as many are professing, adoption may advance faster than it has in the past. This may not attract many new entrants because of licensing hurdles, private insurance hurdles, and the cut-throat environment of competitive bidding. If VieMed achieves larger scale, it may be able to bid at a consistently lower price than competitors and new entrants. The company does not have to make interest payments on loans that it may have had to take out for brick-and-mortar expenditures. It does not have to pay the normal operating costs and costs of up-keep associated with brick-and-mortar infrastructure either. Also, the company can grow just by using the cash it generates. All this plays towards a thesis that VieMed can capture a meaningful portion of the NIV treatment market for late-stage COPD patients and that it deserves a high multiple.

Assuming it serves just 8% of the addressable market in five years will put it at 100,000 patients. Of course, you have to assume that the market currently being served would expand significantly from the current 50,000.

Conclusion

This risk inherent in owning VieMed is not one of balance sheet risk or really even mis-management risk. Management is aligned with roughly 12% inside ownership, and they have executed well since inception. The risks inherent in owning VieMed are more along the lines of regulatory and possibly market risk. The fact that the non-invasive ventilator is being added to the competitive bidding round starting in 2021 could be detrimental to VieMed or beneficial. Also, the non-invasive ventilator could fail to achieve meaningful adoption. This does not seem too likely considering VieMed’s and others’ claims that the treatment can reduce fatalities, private insurance costs, Medicare and Medicaid insurance costs, and extend lives. However, a new technology could come along and change this. VieMed is not a manufacturer of NIVs, so it could technically offer another product to its patients. However, the company has somewhat tied itself to this machine by purchasing its collection of them outright instead of leasing them. This may help the company, but it has tied its fate to the adoption of the non-invasive ventilator.

Going forward, VieMed is trying to achieve a dual-listing on the TSX and an actual U.S. stock exchange instead of the OTC market. This could increase the company’s multiple by allowing healthcare and U.S. focused funds to purchase the stock as well as by increasing the company’s exposure. Management also bought back shares during the stock price pullback in late 2018 and has initiated a stock-buyback program.

The company has also expressed aspirations to become a home health technology leader. It wants to, and is working right now, to collect large amounts of data on respiratory patients at home. This possible catalyst seems far-off, but one could see how, with VieMed’s possible entrenched home treatment position, it could become a large provider of in-home medical technology and deploy data collection techniques that could help it and other home health providers improve their treatment.

This is an impressive company that has flown under the radar probably because of its position as a Canadian parent company that operates only in the United States. It also was a spin-off, but one that listed on the TSX Venture Exchange instead of in the U.S. This, along with probable uncertainty surrounding competitive bidding have played a role in keeping the company’s valuation depressed. VieMed is a company that generates a great return on its capital, has grown at a high rate in the past, has a large addressable market ahead of it, and seems to operate in an industry that has substantial barriers to entry that will likely only increase with time.