Do Supermarket Stocks Have Long-Term Staying Power?

Read the Free Report on Village Supermarket

Following Amazon’s acquisition of Whole Foods and the big drop in supermarket stocks – especially Kroger (KR) – I’ve decided to do a series of re-posts of my analysis of the U.S. supermarket industry.

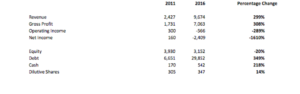

Today’s re-post is a roughly 1,300 word excerpt from the Village Supermarket (VLGEA) stock report Quan and I wrote back in 2014. This section focuses on whether or not a supermarket can be a durable investment. The full 10,000+ word report on Village – along with 26 other reports of similar depth – are now available at my new site, Focused Compounding.

Some facts have changed since this report was written. For example, Amazon’s companywide sales figure is much, much higher than it was in 2013 (the last year for which we had data when we wrote this report).

And – more relevant to the grocery industry – Amazon Fresh has gone from a $300 a year add-on to Amazon Prime to a $15 a month add-on to Amazon Prime (so 40% cheaper).

Durability (From the 2014 Report on Village Supermarket)

High Volume Supermarkets are Durable Local Market Leaders

Demand for food is stable. Most grocers do not experience meaningful changes in real sales per square foot over time. Changes in real sales numbers almost always reflect changes in local market share. There will be online competition in the grocery business. However, in Village’s home market of New Jersey, direct to your door delivery of groceries has been available for 18 years. Peapod started offering online grocery shopping in 1996. The company was later bought by Royal Ahold. Royal Ahold owns Stop & Shop. Peapod has 4 locations in Somerset, Toms River, Wanaque, and Watchung. These locations offer grocery delivery in Village’s markets. They are direct competition and have been for years. Peapod does not require a $300 annual fee like Amazon Fresh. Instead, Peapod simply adds a delivery charge. Customers also tip the driver. Since the driver normally carries the bags into the customer’s home and puts them on the kitchen counter for the customer – the tip is usually a generous one. Peapod charges $6.95 for orders over $100. The charge for orders under $100 is $9.95. The minimum order size is $60. Customers can also order online and then drive to one of the 4 Stop & Shops mentioned above (Peapod often uses the second floor of a building where the ground level is Stop & Shop’s retail store) and pick up their own order. Pick-up is free. However, a Peapod employee still collects the groceries and brings them to the customer’s car. So, a tip is still expected. Common tips are probably $5 to $10. So, the total cost of a Peapod home delivery order is probably anywhere from $12 to $20 higher than a trip to a Stop & Shop grocery store. Even a pick-up is probably $5 higher than a normal Stop & Shop visit – …

Read more