Digirad (DRD): A Cheap Microcap Transitioning into a Holding Company

MEMBER WRITE-UP BY LONG SHORT VALUE

Summary

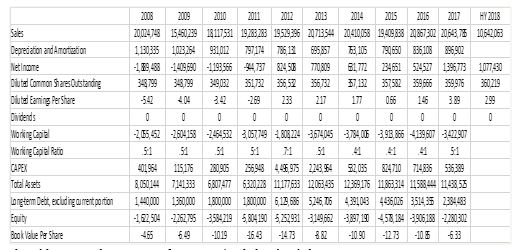

Digirad is an attractive microcap special situation investment because the valuation is extremely low, there is a high likelihood of the proposed acquisition closing, and the underlying value proposition of Holdco structure is compelling. Digirad announced on September 10th that they would be converting to a Holdco structure and acquiring ATRM, a modular homebuilder and specialty lumber company with an investment fund segment. The logic behind this structure change is to cut public company accounting, legal, management and board costs and potentially save millions of dollars that will flow to the bottom line of the joint company. I believe these savings will be real and expect a large uptick in EBITDA delivered from a combined company. Cutting costs especially the types proposed are usually an easy way to drive profitability. My valuation of the company suggests in a central case shares could yield a 100% return over the next year, and in my high case shares could yield a return of 179% over the next year (see details in the valuation section). This investment does not come without risk. Major risks include deal risk, underlying performance risk of the operating businesses, and the risk of a dividend cut.

History

To fully understand the risks and potential rewards of Digirad you really need to understand the recent history. This history is also largely the reason that this attractive opportunity exists. Digirad itself was a promising small cap healthcare imaging company a few years ago. The company completed a transformative acquisition on January 5th of 2016 by acquiring DMS Health Technologies which was poised to roughly double the revenue and EBITDA of the company. The acquisition did not end up as attractive as it was originally held out to be. Margins in the space were pressured and top line revenues struggled to grow as originally projected. On top of a lackluster DMS Health Technologies acquisition, the company lost a major servicing and sales contract with Philips Healthcare in October of 2017, which materially impacted their revenues and profitability. This eventually led to the sale of their MDSS services contract to Philips Healthcare in February of 2018 for a consideration of $8 million. This was a major hit on the underlying business and the stock price crashed from $3.50 down towards its current price of $1.35. This led to a bit of soul searching on what would be the path forward, as the remaining Digirad business was a stable cash flowing business, but lacked growth pathways. That is in part where the idea of the proposed acquisition stems.

All of the companies involved in this transaction are companies that the Chairman of the Board, Jeff Eberwein, has been involved in. This transaction seems to be Jeff’s brain child, to bring together a few businesses that he has financial stakes in into one corporate Holdco in which Jeff will be the sole capital allocator. Jeff will retain the Chairman of the board position in the …

Read more