Choose to Choose

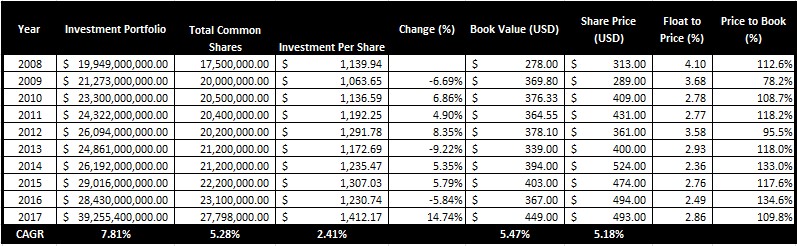

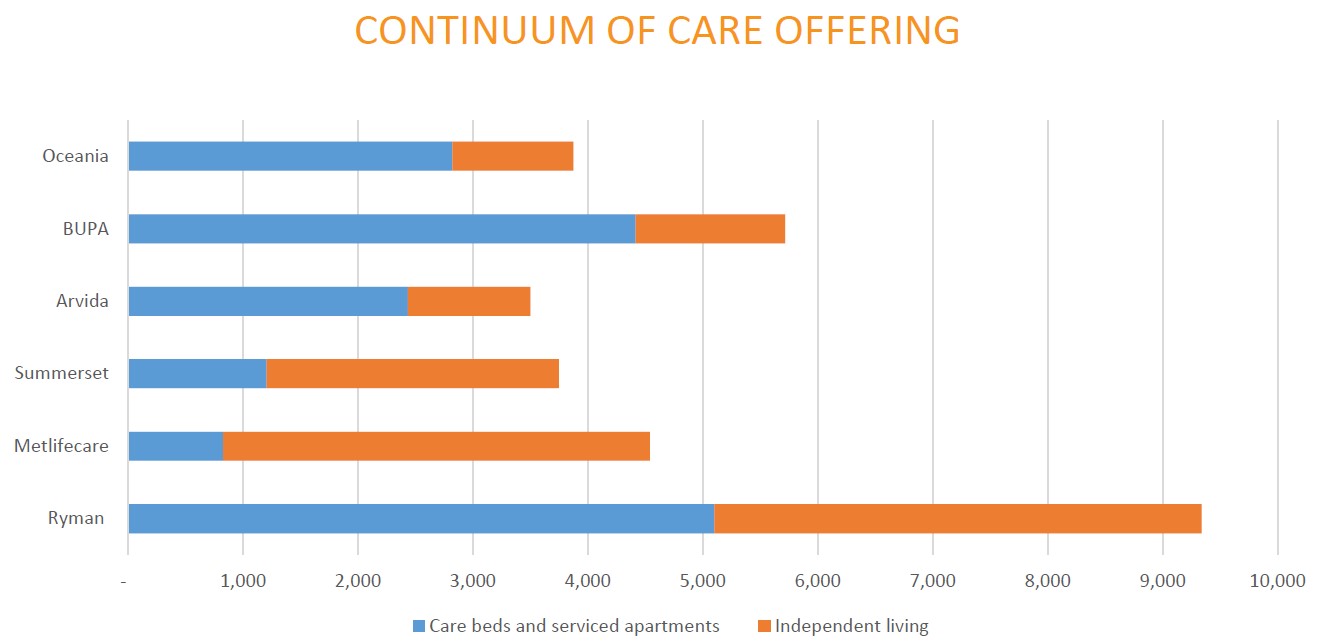

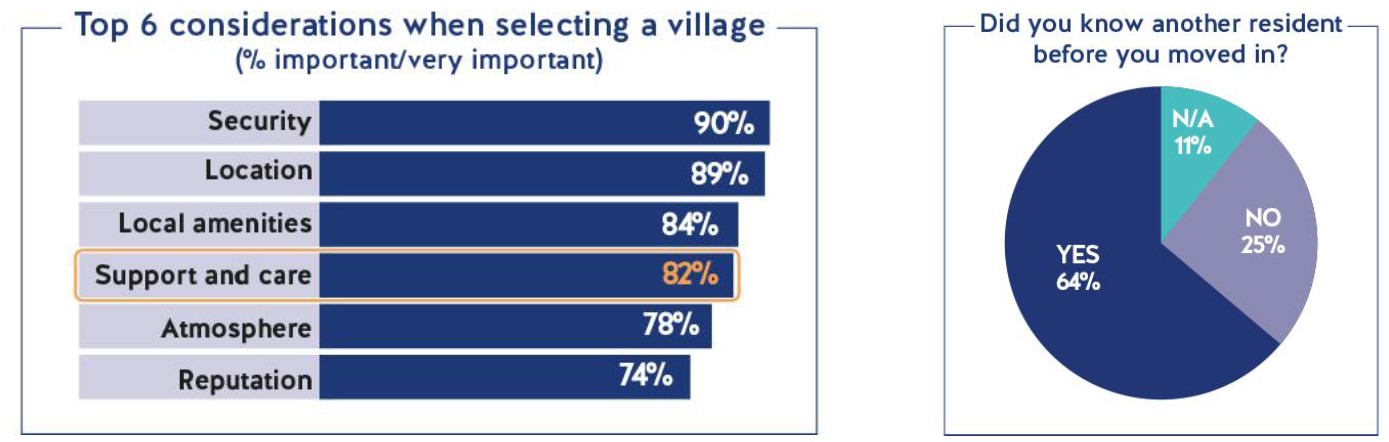

Wednesday, March 21st: Summerset by Andre Kostolany

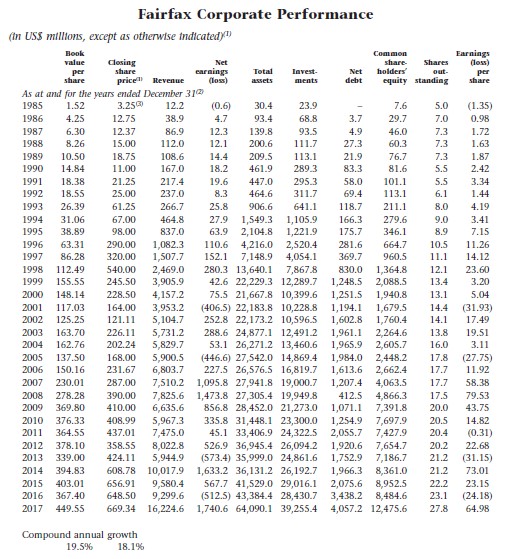

Thursday, March 22nd: Fairfax Financial by Alex Middleton

Friday, March 23rd: Keweenaw Land Association by Geoff Gannon

To Focused Compounding members:

There are two kinds of stocks out there: stocks you find and stocks that find you.

If you were on Twitter, read newspapers, or visited Bloomberg or CNBC this week – Facebook was a stock that found you. If not for the fact you’re a Focused Compounding member, Keweenaw Land Association would not have been a stock that found you this week. You’d have to go out and find it.

We can look at this objectively or subjectively. If we look at it objectively – that is, we study the stock – then we’d classify Facebook as a widely-known stock and Keweenaw as a lesser-known stock. This is usually how we talk about the situation. We separate the mega caps from the micro caps. We separate the stocks with analyst coverage, liquidity, etc. from those without all that. But, there is another – much less comforting – way of looking at the difference between Facebook and Keweenaw. If we look at it subjectively – that is, we study the stock picker – then, we’d say you’ve ordered your own, personal informational environment in such a way that you constantly hear about Facebook and rarely hear about Keweenaw. You spend a lot of time reading facts and opinions about Facebook and frequently feeling the urge to judge Facebook as a business and as a stock. Meanwhile, you don’t spend a lot of time reading facts and opinions about Keweenaw nor do you frequently feel the urge to judge Keweenaw as a business and a stock. This probably sounds wrong to you. “I didn’t organize my life that way,” you say. I never decided to think about Facebook all the time and Keweenaw rarely if at all.

No. Society made that decision for you.

As a member of a wider stock picking society, you consume a lot of information passively. It is brought to you. In fact, many of the stock ideas we have are ideas that were brought to us. Because you’re a Focused Compounding member, even Keweenaw was brought to you. There is a difference between active research and passive research. It’s the difference between conception and concurrence. If you pick up the Keweenaw annual report – never having read my write-up on the company – you’d have to conceive of a way to value it. You’d have to frame the problem of understanding the business a certain way. And then you’d have to appraise the business for yourself. But, when an idea is brought to you – and especially when it is brought to you again and again throughout the day – there is no personal, solitary act of conception. There is only the social act of concurrence or dissent. You do not have to conceive of Facebook as a stock at all. You need only read whatever bull thesis is …