A Blast from the Past: Warren Buffett’s 1977 Shareholder Letter

Whenever someone comes to me asking for advice on how to get started in investing, the first place I direct them to is reading all Warren Buffett’s Berkshire shareholder letters. It is no secret that his letters have tons of golden investing-wisdom nuggets laid upon them. I have read them many times but interestingly enough, I always take something new away from them every time I reread them. In this series, we’re going to go all the way back and start from the beginning and review all of Berkshires’ Investor letters and all the significant passages, starting with 1977; a cool 19 years before I was born.

Focus on Return on Invested Capital, instead of EPS growth

“Most companies define “record” earnings as a new high in earnings per share. Since businesses customarily add from year to year to their equity base, we find nothing particularly noteworthy in a management performance combining, say, a 10% increase in equity capital and a 5% increase in earnings per share. After all, even a totally dormant savings account will produce steadily rising interest earnings each year because of compounding. Except for special cases (for example, companies with unusual debt-equity ratios or those with important assets carried at unrealistic balance sheet values), we believe a more appropriate measure of managerial economic performance to be return on equity capital. In 1977 our operating earnings on beginning equity capital amounted to 19%, slightly better than last year and above both our own long-term average and that of American industry in aggregate. But, while our operating earnings per share were up 37% from the year before, our beginning capital was up 24%, making the gain in earnings per share considerably less impressive than it might appear at first glance. We expect difficulty in matching our 1977 rate of return during the forthcoming year. Beginning equity capital is up 23% from a year ago, and we expect the trend of insurance underwriting profit margins to turn down well before the end of the year. Nevertheless, we expect a reasonably good year and our present estimate, subject to the usual caveats regarding the frailties of forecasts, is that operating earnings will improve somewhat on a per share basis during 1978.”

Warren is talking about looking through the noise and thinking about how a business has gotten to present day. What does Warren mean by this? Well, let’s look at a disastrous investment example to illustrate.

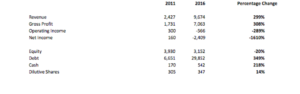

Valeant was the darling of Wall Street for quite some time, and everyone reading this blog will be familiar with what happened to them. The most alarming thing for me when I did some due-diligence on Valeant when it was in the $200’s, was their exploding debt followed by declining operating/net earnings… A true recipe for disaster. Growing revenue is good, but you want to understand how they got to where they are. The whole Valeant saga was, and still is, a case study in action. Standing from the sidelines, I have …

Read more