Standard Diversified (SDI / SDOIB): Get a Solid Tobacco Brand and a Solid Marijuana Brand at a 33% Discount to Their Market Value

Member Write-up by André Kostolany

Geoff’s Note: Standard Diversified also has extremely illiquid super voting shares that trade under the ticker SDOIB. SDOIB shares are sometimes available at a discount to SDI shares (for example: last week, 400 SDOIB shares changed hands at something like 30% less than the then current price of SDI). SDOIB shares have 10 times the votes of SDI shares and can be converted into SDI shares. Buying Turning Point Brands (TPB) directly is usually the most expensive way to get exposure to Turning Point Brands stock, buying SDI is often the next most expensive, and buying SDOIB is sometimes the cheapest. This is not always the case. So, make sure you always check the bid/ask prices of each of these 3 stocks against each other before deciding which of the 3 stocks to buy to get direct or “look-through” exposure to Turning Point Brands. SDI discloses it owns 51% of TPB. So, you can multiply the number of TPB shares outstanding by 0.51 and then divide that number by the combined number of SDI and SDOIB shares outstanding. This will give you the “look-through” value of SDI shares. Right now, I believe each share of SDI (or SDOIB) represents a “look-through” interest in about 0.59 shares of TPB.

Standard Diversified Opportunities (SDI) is a HoldCo that is majority owned by Standard General. SDI has three operating subsidiaries: Turning Point Brands (TPB), Standard Outdoor and Standard Pillar. At this point the majority of SDI’s value is made up of TPB. With TPB stock currently at $40 SDI’s stake in TPB is worth about $23.67 per share. Standard Outdoor is worth about $1.07 per share at cost and Pillar General about $0.78 per share. Net debt is -$0.94 cents. In total, SDI’s per share NAV is $24.58, or about a 49% premium to SDI’s stock price of $16.50. The company’s slide deck also has good details on the SOTP. Having established that the stock is cheap to its NAV, let me try to explain why I like the underlying businesses.

SDI is controlled and majority-owned by Standard General. Standard General is a special-situations investor that tends to take highly concentrated positions in off-the-run situations. Standard General owns over 86% of SDI. Adding insider stakes this becomes well over 90% of SDI’s total ownership. Before taking over SDI, Standard General owned a majority stake of 9.84MM shares in TPB, which it has placed inside SDI. Basically SDI is now Standard General’s public vehicle through which it holds TPB shares and other long-term investments for an indefinite time horizon. The following company slide does a good job of illustrating the SOTP:

TPB

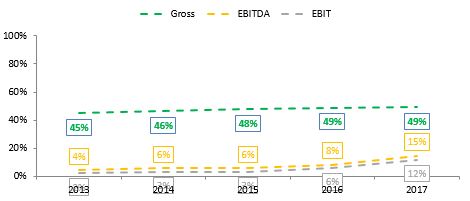

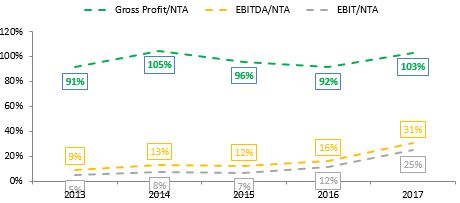

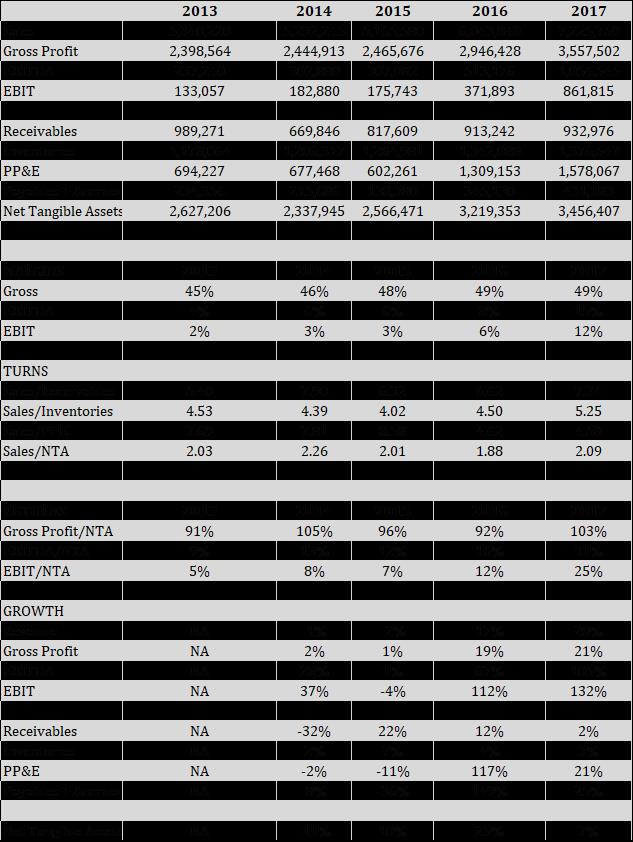

TPB is in the other tobacco products business. Their products fall into three categories: Smokeless, Smoking, and New Products. TPB’s main asset is ZigZag, which is the #1 premium cigarette paper brand with 33% market share. ZigZag has been the paper brand of choice for cigarette and pot smokers for decades now. The main thing to …

Read more