How Does Warren Buffett Apply His Margin of Safety?

March 26, 2011

Someone who reads the blog sent me this email.

Geoff,

In a previous email to me you explained how Warren Buffett values a company. The text that your wrote was:

“He wants his investment to increase 15% in value. For every $1 of capital he lays out today he wants a day one return of 15 cents. That means a 15% free cash flow yield or buying a bank with an ROE of 15% at 1 times book or buying something for less than a 15% initial yield as long as it is growing.”

I understand that no problem whatsoever. However, I am just curious. How does he apply a margin of safety (for example 50%) to this fcf yield valuation? Thanks for the help.

Chad

He doesn’t.

Buffett has said that with something like Union Street Railway – bought back in the 1950s – he saw the margin of safety was that it was selling for much, much less than its net cash. For Coca-Cola the margin of safety was the confidence he had in future drinking habits around the world.

Buffett felt sure people would drink Coca-Cola in larger and larger amounts per person per day in countries where Coke had been introduced more recently than in the United States. History was on his side. Per capita consumption of Coke had been rising everywhere for years. In contrast, history was not on the side of Union Street Railway.

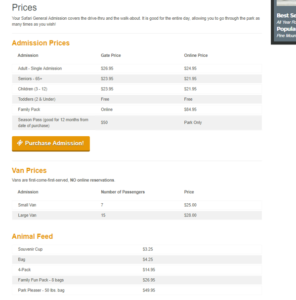

Passengers – Union Street Railway

1946: 27,002,614

1947: 26,149,937

1948: 24,224,391

1949: 21,209,982

1950: 19,823,933

1951: 18,736,420

Bad trend.

But Union Street Railway had $73 in cash and investments – not a single penny of which was needed to run the actual business. The stock traded between $25 and $42 during 1951. So, even at its high for the year, Union Street Railway’s stock was trading for more than a 40% discount to its net cash.

At its low, the company’s cash covered its stock price almost 3 times.

Union Street Railway had a big margin of safety.

But so did Coke.

Buffett believed both Union Street Railway and Coca-Cola had an adequate margin of safety when he bought them.

With Coca-Cola it came from human drinking habits. With Union Street Railway it came from the cash and investments on the balance sheet.

Buffett was as confident in Coca-Cola as in Union Street Railway.

It’s just that his margin of safety in one case was people’s buying habits and in the other case it was the cash on the balance sheet.

Buffett doesn’t apply some standard 50% margin of safety to an intrinsic value estimate.

He just looks for situations where he’s confident his investment will earn an adequate return from day one far into the future.

And he wants to pay less than the stock is worth.

But that doesn’t mean it’s necessary to do an actual intrinsic value calculation and then slap on some percentage discount to that value.

It just means seeing the …

Read more