CountPlus (CUP)

CountPlus Investment Thesis

Market data

Ticker: ASX:CUP

Price: $0.66

Net debt: ~$0m

Market cap: AU$74m

Elevator pitch

After years of poor performance, a revolving door at the C suite and ongoing restructuring charges/impairments, recent insider buying gives us confidence that CountPlus has reached an inflection point in its turnaround. Looking through the one-off charges to cash profitability and assuming no improvement in operating margins (~10% vs. peers >20%) we believe the shares are selling for a pre-tax free cash flow yield of 14%. As the turnaround begins to show up in the reported financials and the company re-instates a dividend policy, we believe the market will wake up to this emerging growth story.

Investment thesis

- New CEO who co-founded one of the best performing groups within the network, and who has a non-monetary vested interest in the success of the business due to relationships with many of the employees he mentored, is implementing a strategy he successfully employed while managing Hood Sweeney and recently acquired ~$400k of stock on market

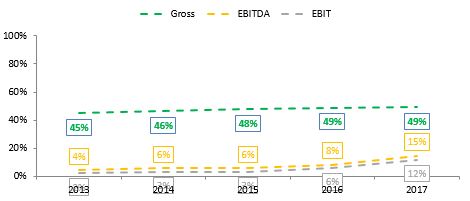

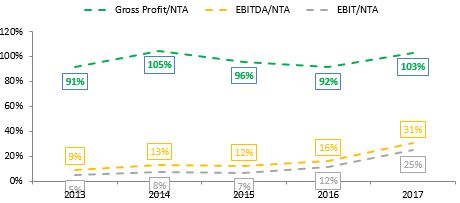

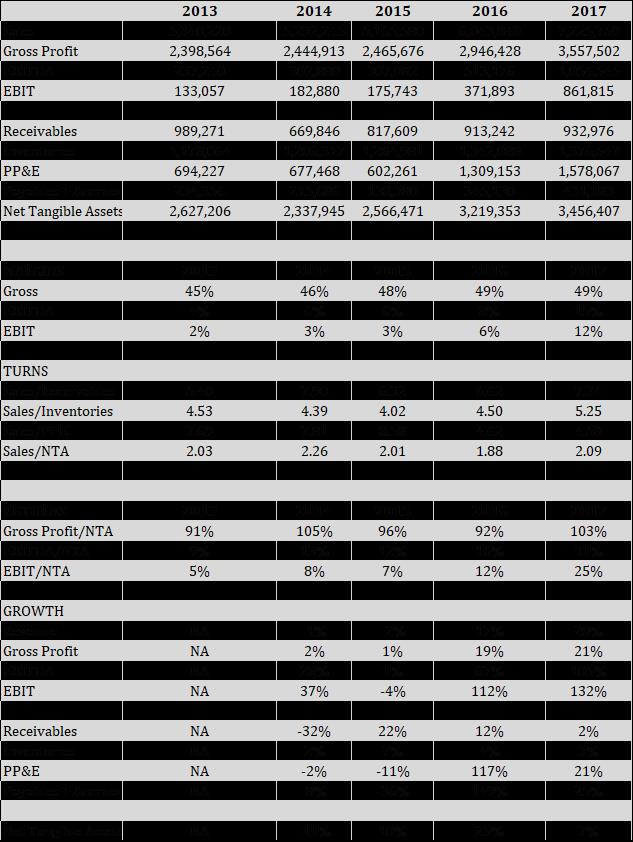

- Sticky, diversified, annuity like revenues provide downside protection. Operating margins of 10% due to a loss-making division and poor incentivisation under old model vs. peer group margins 20%+. Every 1% improvement in profitability adds $0.08 in value per share (if capitalised at 8x)

- Increased regulatory pressure on the back of a Royal Commission should drive consolidation as sub-scale firms look to partner with a well-capitalised competitor to scale fixed compliance overheads, providing an attractive backdrop in a highly fragmented industry

- Current valuation implies extremely low expectations. Assuming no improvement, it should currently be generating $10-12m in pre-tax owner earnings (14%+ earnings yield). Given the low capital requirements of the business, the majority of this cash flow can be used to pay dividends or make acquisitions. As the CEO has a track record of finding and executing value accretive acquisitions, combined with a board rich in M&A experience, and a consolidating industry backdrop, we believe CUP is in a prime position to increase value for shareholders

- The convergence of cash profits and reported financials, together with the dividend returning, should provide a hard catalyst for the Aussie small cap community to take another look at the business

History

CountPlus (CUP) was born within Count Financial (Count), one of Australia’s largest network of advisory firms. Count, which is now owned by The Commonwealth Bank of Australia (ASX:CBA) spun CUP off into its own publicly traded entity in 2010 and still retains a 36% shareholding. CUP generates revenues through a network of ~17 firms (wholly and partially owned) with a fairly even split between accounting and financial advice fees.

After an initially successful IPO, CUP began to get into trouble when Count Financial went from a stand-alone public entity, to being acquired by CBA. While this had little impact on the underlying operations of CUP member firms, because of the unique relationship between CUP and Count, CBA began making “loyalty payments” …

Read more