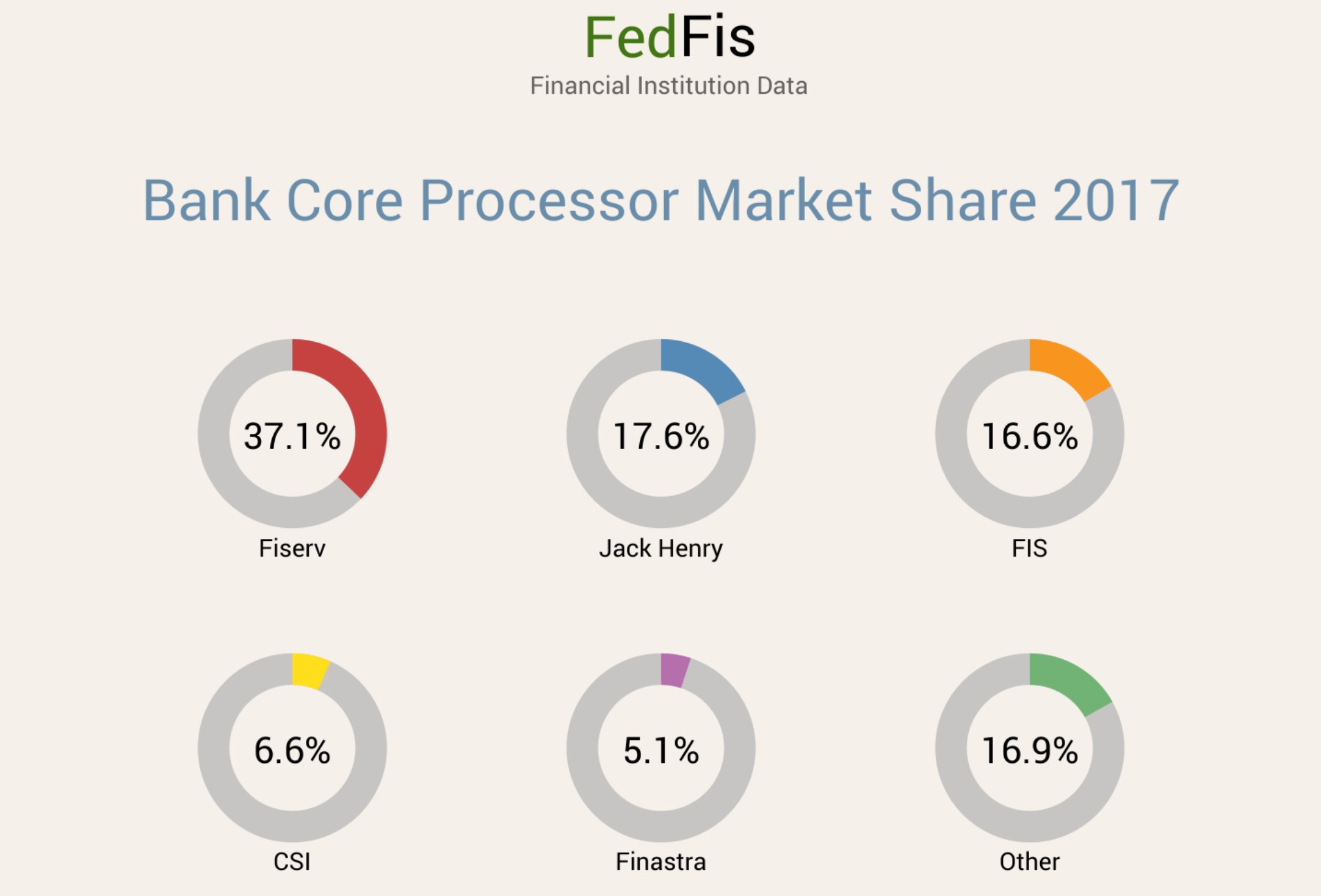

Computer Services Inc., “CSI” (CSVI)

This is the core processor stock that was just written up by Jayden Preston:

I also spent the better part of today’s Sunday Morning Memo on CSVI. You can find that memo entitled “Fear, Greed, and Boredom” here:

https://focusedcompounding.com/memos/

Since CSVI doesn’t file with the SEC, it’s not on EDGAR. For that reason, I thought I should include links to the specific pages where you can find “EDGAR-like” information on the company.

The company’s “Disclosures” page over at OTCMarkets.com has annual reports going as far back as 2006 (filed in 2007, covering the year 2006):

https://www.otcmarkets.com/stock/CSVI/disclosure

CSI always includes a “Selected Financial Data” table in the annual report that goes back a full 10 years. So, the 2006 annual report has data going back to 1996.

The company also has an investor relations page that includes financial data in other summary forms:

https://www.csiweb.com/investor-relations

I don’t know if I’ve mentioned this before, but I always read a company’s Glassdoor page as well. This is a site that includes employee reviews. CSI has a lot of reviews on its Glassdoor page. So, you might want to check it out in this case. I usually read the reviews more to get a sense of what the company actually does day-to-day, what incentives are like for lower-level employees especially those that deal with customers, etc. than because I prefer companies with higher reviews from employees or something like that.

I’ll summarize the reviews in general here by saying this company doesn’t have very high base pay, it does have benefits, it doesn’t have very high employee churn, and management cares about hitting profit targets (and probably the stock price). Employees also mentioned something that had been disclosed in a press release:

“..non-executive full-time employees with the company more than 12 months will receive a one-time $1,300 cash bonus in March. Part-time and other employees with the company less than 12 months will receive a one-time cash bonus of $650 also in March. The company also stated that all eligible employees will receive an additional one-time contribution to their retirement plan.”

This is due to the tax savings that Jayden mentioned in his article.

Anyway, this is the thread to use to ask me questions about CSI, to ask Jayden questions about CSI, to give your thoughts, etc. Please do so below.…

Read more